Image source: Getty Images

Supermarket actions like Sainsbury’s (LSE:SBRY) experienced monumental declines in 2022 due to the cost of living crisis. Nonetheless, the stock is now up 40% from its low point, and even reported a positive set of third-quarter results. With a decent dividend yield of 5%, you might be tempted to buy the stock.

christmas cheer

Sainsbury’s released its latest Q3 update yesterday. There was an improvement in underlying sales growth, but it’s important to note that the numbers do not take into account the impact of double-digit inflation in grocery stores.

| Metrics | Q3 2023 | Q3 2022 |

|---|---|---|

| Grocery | 5.6% | 12.5% |

| General merchandise | 4.6% | -6.9% |

| Comparable sales (for example, fuel) | 5.9% | -4.5% |

| Comparable sales (including fuel) | 6.8% | 0.6% |

However, CEO Simon Roberts remained optimistic. He updated the FTSE 100 the company’s outlook, and now expects pre-tax profit to hit the top end of its guidance of £630m to £690m. He even raised the company’s free cash flow guidance to £600m for FY23.

Sainsbury’s results aren’t flashy by any means, but this update showed many encouraging signs that the company is beginning to establish a unique position with consumers. In fact, it outperformed many of its biggest competitors on many fronts.

seeing the difference

Its £550m investment to broaden its Aldi price match range and delay price increases after the rest of the market has proven beneficial. As a result, the average sales price of its top 100 products is the lowest in the industry. As a result, customer satisfaction reached an all-time high in the third quarter.

So it’s no surprise that Sainsbury’s has done so well over the Christmas period. Additionally, the board mentioned that it is seeing fewer sales at other supermarkets. And despite declines in grocery volumes, it still managed to outperform TescoAsda and Morrisons in the quarter.

This shows that their investments are paying off, and Kantar’s latest grocery market share data backs this up. Since bottoming out in September, Sainsbury’s has staged a strong recovery, taking market share away from the likes of Asda and Morrisons.

Choose the best action

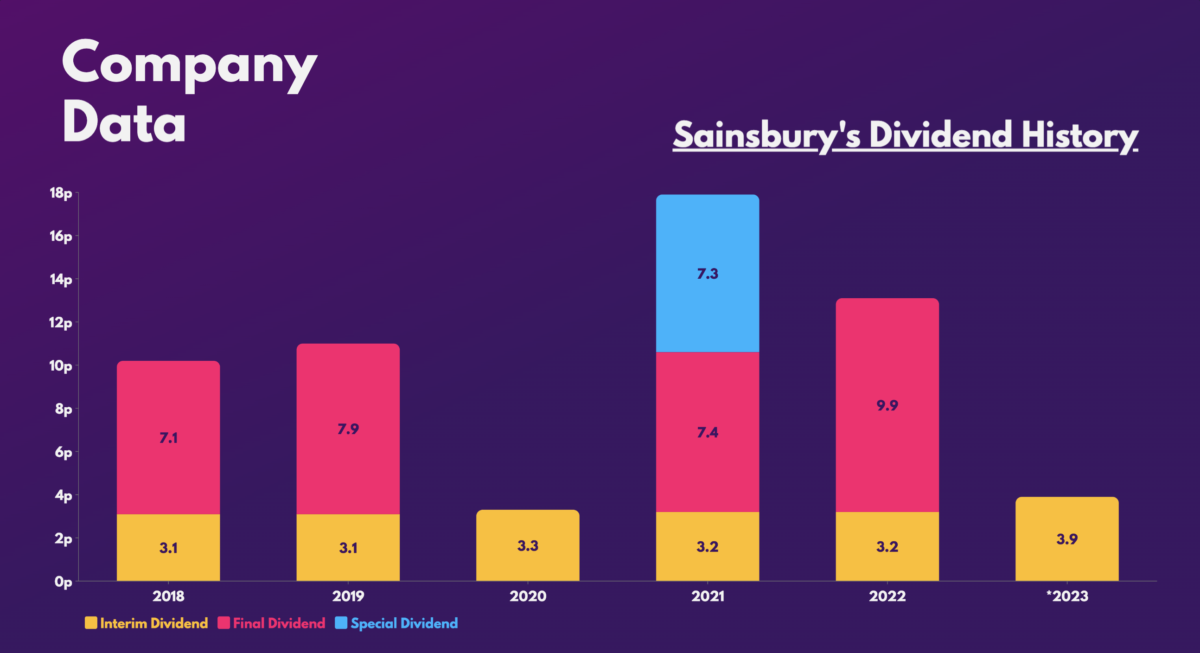

So is Sainsbury’s stock worth buying? Well, your 5% dividend yield is well covered at 1.9 times. As such, the group dividends could help me generate passive income, given the strong history of paying steady and increasing dividends.

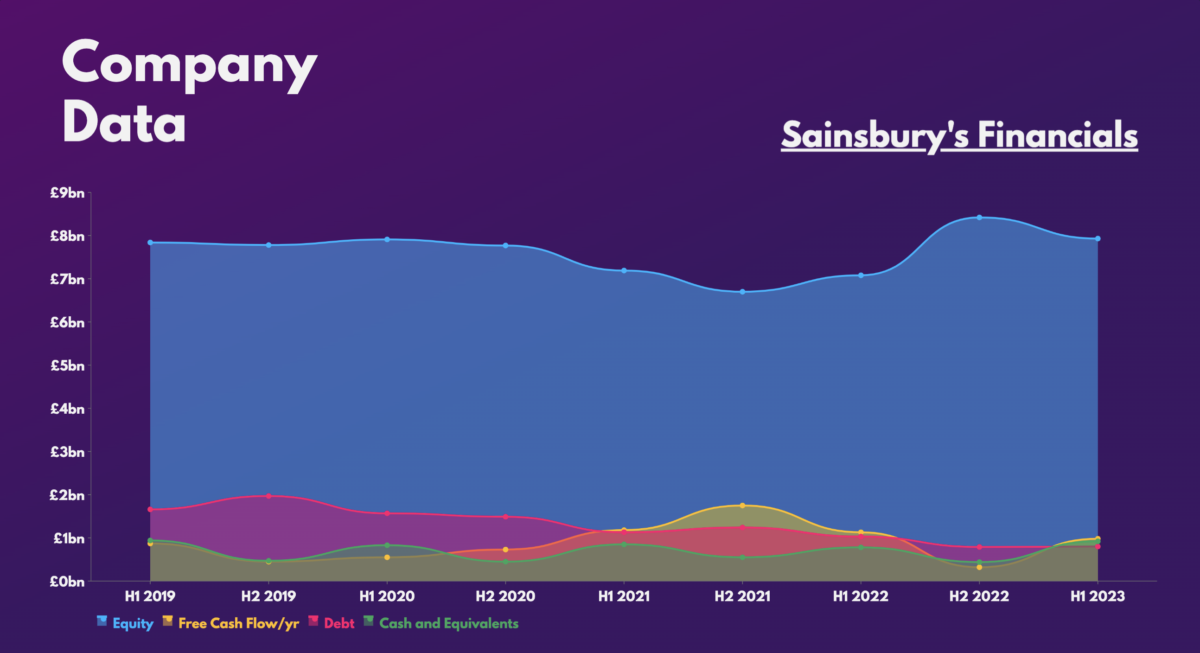

Also, its strong debt-to-equity levels, declining debt, and steady free cash flow are definitely positives. That said, I’m wary of their slim 1-2% profit margins. Management’s move to raise prices later than the rest of the industry allowed it to capture market share. But this also prevents Sainsbury’s from expanding its margins.

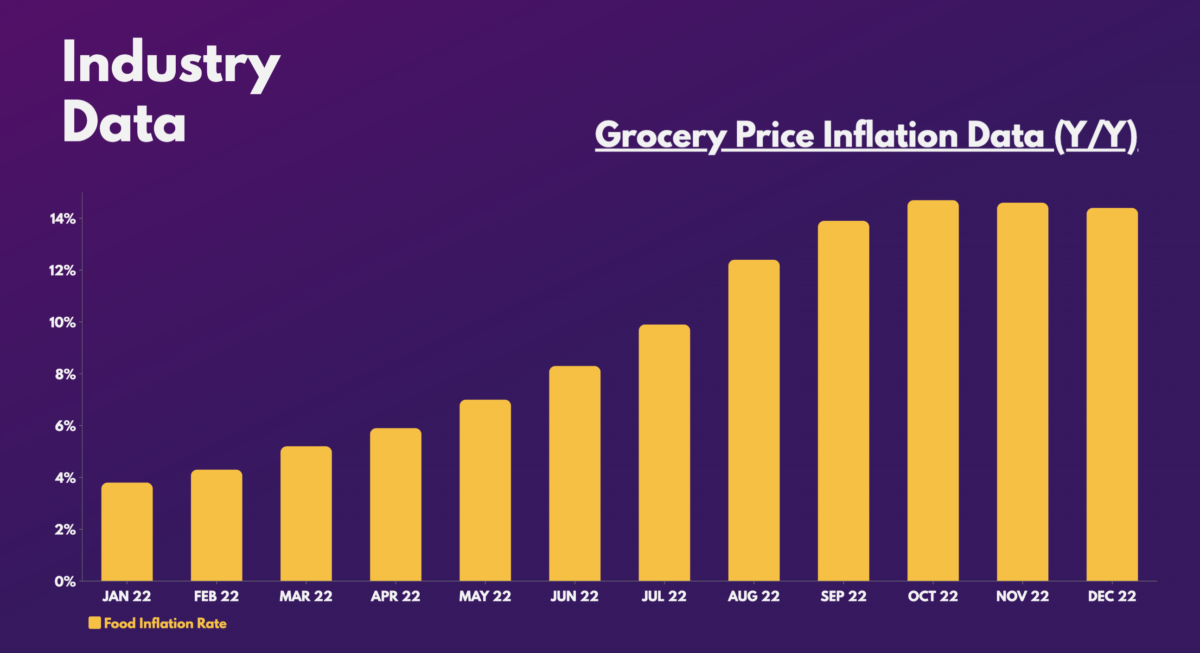

I am confident that the Sainsbury’s share price will see a further rise in the short term. Food inflation is finally starting to trend down, and declines in energy and commodity prices have yet to materialize. Still, I don’t see how Sainsbury’s shares can grow exponentially in the long run. The conglomerate’s e-commerce businesses are growing, but not enough to substantially increase its results.

The stock’s valuation multiples certainly indicate fair value at these prices, and its track record of consistent dividend payments is definitely worth an investment.

| Metrics | valuation multiples |

|---|---|

| Price-Earnings Ratio (P/E) | 10.0 |

| Price-Sales Ratio (P/S) | 0.2 |

| Price-to-book (P/B) ratio | 0.7 |

| Price to earnings growth (PEG) ratio | 0.1 |

However, there are other UK stocks with better growth potential, higher dividends and better margins, such as glencore Y taylor wimpey. I am more inclined to invest in those names than in Sainsbury shares. After all, JP Morgan it has an ‘underweight’ rating on the stock with a £2.13 price target.