Image source: Getty Images

Invest in FTSE 100 and FTSE 250 stocks can be a great way to generate passive income. Established market positions and strong balance sheets give many of these companies the strength to pay a sustainable dividend. And right now, many of the UK's top stocks are offering impressive dividend yields.

Recent gains mean the average return on FTSE 100 shares has fallen to 3.5%. Meanwhile, the corresponding reading for FTSE 250 shares has fallen to 3.3%.

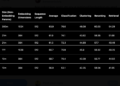

I think I can do better than this and I'm looking at the following three FTSE 250 stocks to boost my passive income. Their market-beating dividend yields and dividend growth projections can also be seen below.

| Company | Forward Dividend Yield | Expected Dividend Growth |

|---|---|---|

| NextSolar Energy Fund (LSE:NESF) | 10.9% | 1% |

| Bank of Georgia Group (LSE: BGEO) | 6.4% | twenty% |

| HICL Infrastructure (LSE:HICL) | 6.6% | 0% |

A second income of £1,600

The average return on these stocks amounts to a gigantic 8%. If the brokers' forecasts prove accurate, a lump sum of £20,000 invested equally in these shares would give me a passive income of £1,600 over the next 12 months.

I am confident that they will also provide steadily increasing dividends for years to come. Here's why I would buy them if I had extra money to invest today.

Light

Investors looking for reliable dividend income might consider the renewable energy stock NextEnergy Solar Fund. This is despite the fact that keeping solar panels running can be an expensive and profit-damaging business.

The fund can expect income to remain stable regardless of economic conditions. After all, electricity demand remains virtually unchanged even during recessions.

In addition to this, NextEnergy Solar receives subsidies from the UK government which are linked to inflation, which in turn provides additional cash flow protection.

I think the company could be a great way for investors to take advantage of the green energy revolution.

banking star

Investing in Georgia today is riskier than it has been in many years. The political crisis unfolding in the country threatens to undermine the country's bright economic prospects.

But overall, I think the risks of such turmoil are built into Bank of Georgia's very low valuation. Today, the bank trades on a forward price-to-earnings (P/E) ratio of just 3.7 times.

By also offering that near 6% dividend yield, I think Bank of Georgia offers fantastic value right now.

In my opinion, this is another FTSE 250 stock with considerable growth potential. regional rival TBC BankThe nearly 16% increase in earnings last quarter (as announced last week) illustrates this point.

Real estate giant

HICL Infrastructure invests primarily in public sector related assets. This leaves it vulnerable to changes in government policy and legal changes.

But I think it's another great way to make a reliable passive income. The contracted income it receives from its portfolio of more than 100 assets provides a steady stream of income that it can then distribute to shareholders.

HICL's focus on key infrastructure such as hospitals, schools, railways and roads provides another layer of strength. These assets continue to be in high demand at all points in the economic cycle.