Ethereum’s native token Ether (ETH) could grow 35% against Bitcoin (BTC) this year to hit 0.1 BTC for the first time since 2018 as it forms a classic bullish continuation pattern.

Ethereum Price Must First Break Key Resistance

Called the ascending triangle, the pattern forms when the price fluctuates within a range defined by the support of the rising trend line and the resistance of the horizontal trend line. It usually resolves after the price breaks in the direction of its previous trend.

On a weekly chart, the ETH/BTC pair has been painting an ascending pattern since May 2021. The Ethereum token envisions a break above the pattern’s horizontal trendline resistance near 0.0776 BTC. Breaking this level could cause the price to go as high as the maximum height of the triangle.

In other words, the ETH/BTC pair could reach the next major resistance level at 0.1 BTC in 2023, or 35% of current price levels.

However, it is important to mention that ETH/BTC has attempted to break above the triangle resistance trend line eight times since May 2021. The attempts included two major breakouts in November 2021 and September 2022, in which the pair rallied. 14% and 9%. respectively.

Both rallies faded within the 0.082 to 0.085 BTC area, followed by extreme price corrections that took ETH/BTC back into the triangle range. Given this multi-year hurdle, the pair could face stiff resistance within the 0.082 to 0.085 BTC range, even if it breaks above the triangle.

Such a move would risk collapsing ETH towards the triangle support, which coincides with its 50-week exponential moving average (50-week EMA), represented by the red line on the above chart, near 0.070 BTC, almost a 6 % less than the current one. price levels

ETH “deflation” narrative

Ether’s bullish setup against Bitcoin looks like ETH’s dominance has doubled against other crypto assets in recent years.

Notably, ETH’s market capitalization increased to almost 20.5% of the total crypto market valuation in January 2023, from approximately 10% in December 2020, when the Ethereum network began its transition from proof-of-work (PoW) to proof-of-stake (PoS) with the launch of a dedicated stake smart contract.

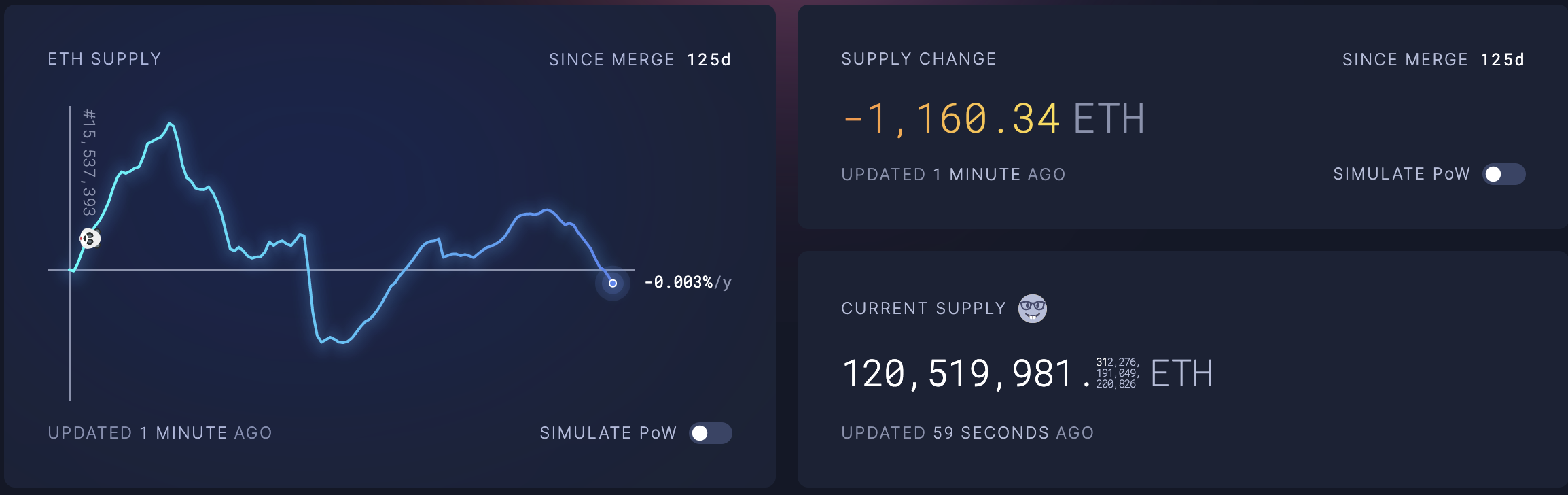

Becoming a PoS blockchain has brought two key changes to the Ethereum economy. First, users temporarily lock a portion of their Ether holdings in the Ethereum PoS smart contract to gain performance. And second, the Ethereum network has started burning some transaction fees.

Related: Ethereum ‘shark’ accumulation, Shanghai hard fork put $2K ETH price on the line

Both changes have had a deflationary impact on the overall supply. As a result, the Ethereum network now regularly produces fewer Ether tokens than are taken out of circulation, theoretically making ETH a “deflationary” asset.

The ETH/BTC price has grown nearly 250% since December 2020, despite still being roughly 50% below its all-time highs seen in 2017.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.