Bitcoin (BTC) begins a new week in an unequivocally bullish position past $28,000.

The crypto markets continue to escalate thanks to the banking crisis, which is still raging in the United States and abroad. Where will they go next?

After a week of chaos for the macro markets and solid gains as a result, Bitcoin and altcoins are at circular levels, which some have not seen in nine months.

The 2022 bear market feels like a receding memory as old resistance levels fall and bulls try to cement newly regained support.

This week, like the previous one, there are all sorts of potential hurdles to overcome: The Federal Reserve will decide on its next interest rate changes, and new macroeconomic data will be released.

As a result, markets are likely to remain volatile, and any further unexpected events in the banking sector will only increase instability.

At the same time, the Bitcoin ecosystem itself will become stronger than ever as the fundamentals of the network hit new all-time highs.

Cointelegraph takes a look at five of the key phenomena to watch out for when it comes to BTC price action in the coming week.

Fed rate hike cycle in doubt

The macro event of the week is, without a doubt, the Fed’s March 22 decision on interest rate hikes, or the lack thereof.

The Federal Open Market Committee (FOMC) faces a stiff challenge to its current quantitative tightening (QT) policy in place for the past eighteen months.

The unfolding banking crisis has cast doubt on the Fed’s ability to keep raising interest rates, a policy that commentators say was the death knell for struggling regional banks.

However, the Fed is caught between a rock and a hard place. Raising rates would keep inflation in check but hit the economy further, possibly triggering a new wave of bank failures.

“Next week’s FOMC is setting up to be one of the most interesting in a long time, with no one really agreeing on what will happen,” engineer and trader Tree of Alpha summarized.

“Chances to lean towards 25bps, but it’s a wild card. planning to yearn <=0bps y acortar >=50 bps as game safe”.

According to CME Group FedWatch Tool, the consensus as of March 20 favored the Fed raising 25 basis points, rather than pausing hikes entirely. The week before, Goldman Sachs had predicted that rates would stall, while Nomura even predicted a rate cut.

“This week, the long-awaited March Fed rate decision comes out. Markets are currently pricing in a 62% probability of a 25bp rate hike. However, markets also see 100bps of rate cuts for December”, financial commentary resource, The Kobeissi Letter, wrote partly from the analysis of the long-term rate hike roadmap.

Kobeissi and others also asked how troubled bank stocks would react to the upcoming Wall Street open, given the latest government moves over the weekend.

These included a purchase of Credit Suisse, the European banking giant, which experienced a particularly violent reaction to the US collapse.

“Credit Suisse, $CS, was worth $10 billion a month ago and was sold for pennies on the dollar,” Kobeissi continued about UBS bank buying Credit Suisse and getting $100 billion in liquidity from the government.

“The government said that $CS had a ‘serious risk of bankruptcy.’ A shareholder vote was ignored. Regulators knew it was a matter of hours before bankruptcy. This deal was made out of desperation.”

Bitcoin Spot Price Targets $30,000

With that, it is understandable that the mood in Bitcoin and the crypto markets has improved as the week begins.

At the time of writing, BTC/USD was trading above $28,400, according to data from Cointelegraph Markets Pro and TradingView.

Already at a nine-month high, the pair managed to beat the bears during a period of consolidation last week to return to target levels not seen in nearly a year.

Chief among them is $30,000, a psychologically significant level surrounded by considerable historical liquidity. Meanwhile, to monitor resource and other material indicators, a key support level to hold is the 200-week moving average (MA).

#FireCharts shows $30 million in #BTC Bid liquidity consolidated and moved lower to defend the 200-week MA. This is a KEY LEVEL for bulls looking for full candlestick bodies above the 200 WMA to call it a bullish breakout. If the W candle closes below it, hope for a confirmation next week is lost. pic.twitter.com/0doqQWchTQ

— Material indicators (@MI_Algos) March 19, 2023

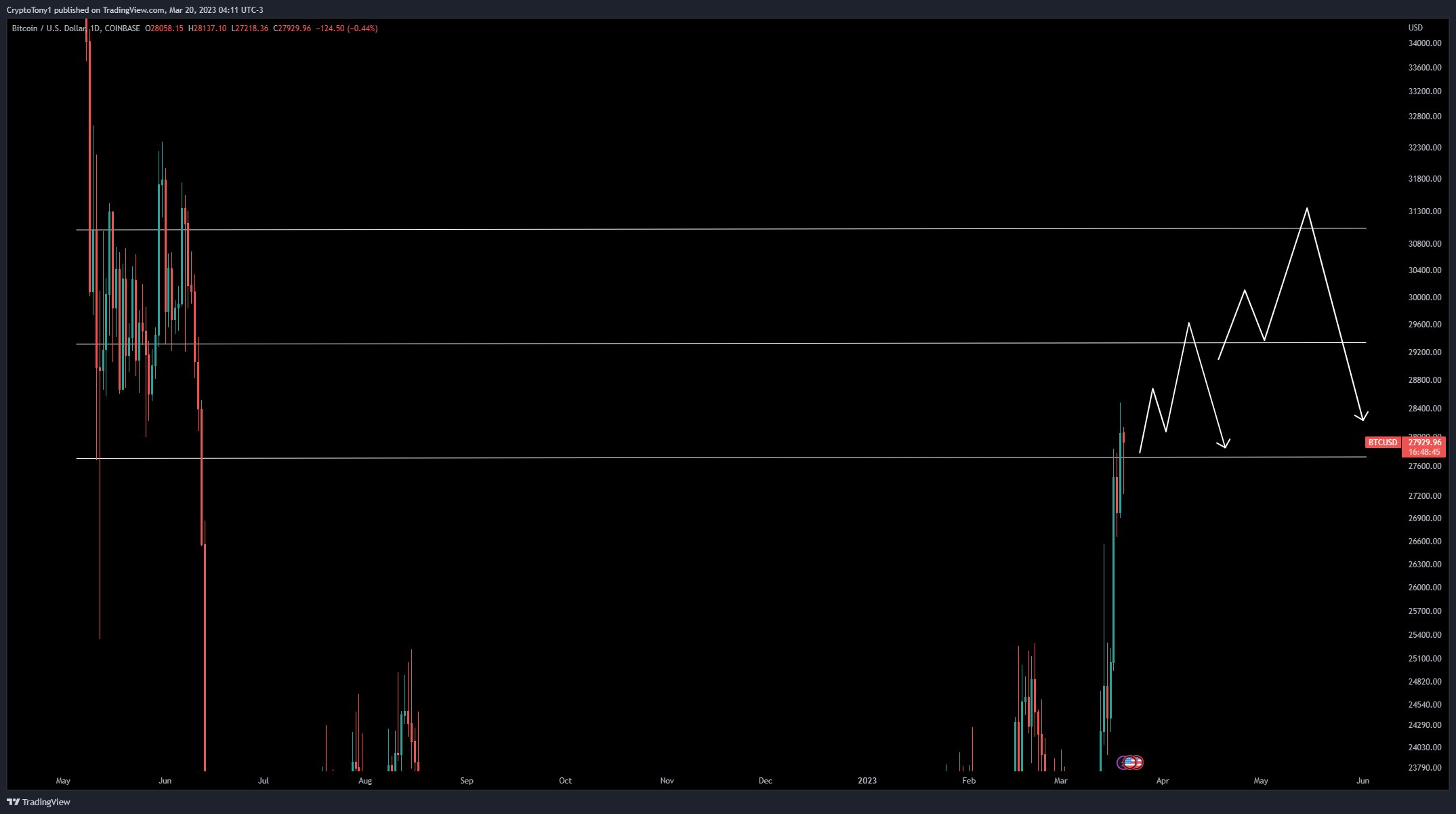

Popular Crypto trader Tony focused on $27,700 to support the bullish case and the potential for a run to $30,000.

“$27,700 ensured that we are now in the next range between $27,700 – $31,000. Using $27,700 as a level that the bulls need to hold to sustain a move to the $30,000 level,” she said. tweeted.

“Interesting week for sure. My stop loss on my main long remains at $25,500.”

Meanwhile, in a new analysis, Crypto trader Chase highlighted $28,500 as a potential short entry, while also being viewed as a “somewhat likely” bullish case where selling is only triggered above $33,000.

Please note that I am not giving up on the idea of 28.5K~ shorts. These may still present a great opportunity around the FOMC this Wednesday. At the moment, however, I cannot imagine an immediate local cap,” she explained.

“I think a rejection could happen there and I will continue to look at the trade, but for those trying to short 28.5K back to 12K they may end up getting stuck in that 33K liquidity pool.”

Analyst announces the end of the bear market

However, to some looking at the long-term picture, Bitcoin has already emerged from a bear market since the fall from its all-time highs and the start of Federal Reserve tightening in late 2021.

The weekly close came in just above $28,000, making it the highest for Bitcoin since early June 2022.

For trader, analyst and podcaster Scott Melker, known as “The Wolf of All Streets,” this has clear implications.

“The bear market is officially over,” he said. proclaimed based on weekly chart data.

“$BTC reached its first highest high ($25,212) since the all-time high. That confirms a new uptrend. The price may still go lower, but that would be a new trend, not a continuation of the previous bear market. Congratulations to all.”

Melker linked to a similar post from August 2019, just after BTC/USD broke above $13,000 in a comeback from the pit of its previous bear market.

Equally bullish on weekly time frames is trader and analyst Rekt Capital, who continues to watch a breakdown of Bitcoin’s “macro bearish trend.”

Mission accomplished#BTC finally challenges the macro downtrend again and breaks out of the macro range and breaks the macro downtrend$BTC #Crypto #Bitcoin pic.twitter.com/m90xhW3QM6

— RektCapital (@rektcapital) March 19, 2023

In quarterly terms, Rekt Capital is supervision a “bullish engulfing” event in the making, something that has triggered significant upside itself in the past.

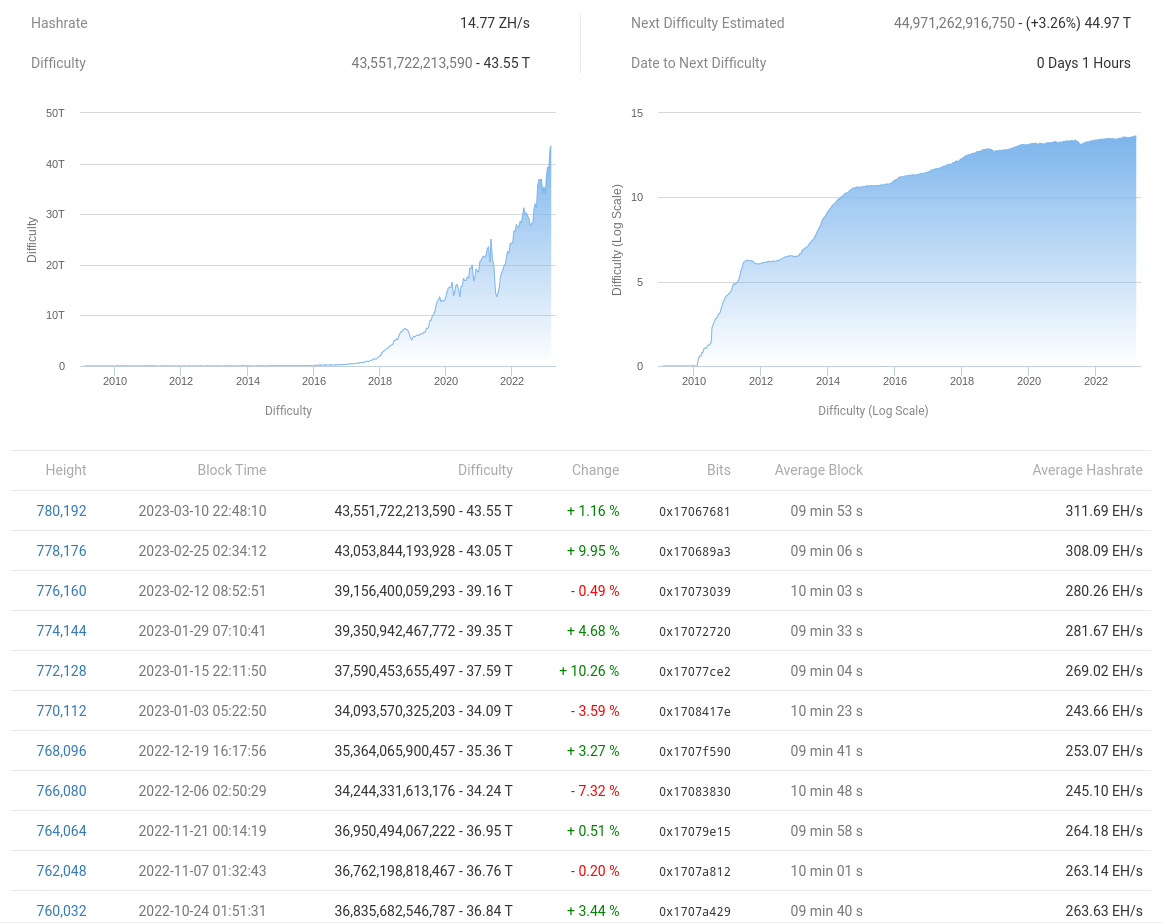

New all-time highs due to Bitcoin difficulty

In a classic move, the fundamentals of the Bitcoin network refuse to give up on their journey to the moon.

The latest estimates of BTC.com and MiningPoolStats shows that both hash rate and difficulty are in “only up” mode this month.

The difficulty is expected to adjust upwards by 3.26% in the coming days, to almost 45 trillion.

The hash rate reached a local peak on March 13, but is now trending higher once again as miners respond to the latest price action.

Bitcoin Hash Rate Coincidentally Hits New All-Time Highs Week After Week pic.twitter.com/bYIpO0puvs

— Will Clemente (@WClementeIII) March 18, 2023

Among the miners, however, a divergence is taking place. On a rolling 30-day basis, miners’ BTC balances continue to decline, according to data from the on-chain analytics firm. glass node.

Biggest greed since Bitcoin price was $69,000

There may still be reason to fear the current bullish rise in Bitcoin and cryptocurrencies in general.

Related: Bitcoin Levels to Watch as BTC Price Sees Highest Weekly Close in 9 Months

A look at the sentiment data suggests that most of the market is becoming overconfident that the good times will continue.

He Crypto Fear and Greed Indexwhich uses a basket of factors to produce a normalized sentiment score for cryptocurrencies, is now at 66/100, firmly in its “greed” zone and its highest level since November 2021.

His warnings are being corroborated by users of social networks. TO survey from research firm Santiment, which garnered nearly 15,000 responses, shows that most believe BTC/USD will break above $30,000 as the next big crypto market event.

“Crowd optimism is doubling the optimism of the top 2 cryptocurrency assets,” Santiment commented about the results

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.