Bitcoin (BTC) enters the last week of March into uncertain territory as a strong weekly close still keeps $30,000 out of reach.

The largest cryptocurrency has sealed seven days of mostly flat performance despite some volatility in between, as the market looks for a new direction. Where could I go next?

In what was a week of more macroeconomic surprises, BTC/USD spent a lot of time reacting to the decisions of the United States Federal Reserve and the associated comments.

Next up, however, is a period of relative calm, followed by a key monthly close, which according to analysis could see the start of a new uptrend.

Bitcoin is currently up 20% in March so far, meaning the next few days will decide the strength of the ongoing recovery from multi-year lows.

Cointelegraph takes a look at five key themes to watch over the past week of what has been a volatile month.

Countdown to the monthly close of the Bitcoin price

Bitcoin managed to close out the week with a modest rise, returning to the $28,000 mark, data from Cointelegraph Markets Pro and TradingView shows

This meant that BTC/USD was largely flat compared to the previous weekend, providing impressive stability despite periods of volatility that occurred in the intervening period.

However, concerns are brewing that the market may struggle to maintain current levels.

In a reanalysis on March 27, the popular Twitter account IncomeSharks pointed to on-balance sheet volume (OBV) as a telltale sign of waning momentum.

“It’s just hard to ignore weak OBV at resistance, price at resistance, and lack of demand at these prices,” he says. commented next to a graph.

“If we go down, we get a new wave of buying demand that should push us higher. The only way to go up from here is with big news in the markets or another squeeze.”

Trader and analyst Rekt Capital agreed that a pullback would be “healthy” for Bitcoin if it entered.

“If BTC continues to struggle to break above $28,700, a healthy drop may need to occur to garner fresh buyer interest at lower levels,” he said. tweeted up to date.

“Technical data is showing some short-term weakness and a catalyst could soon come along to remove that weakness.”

Over the weekend, Rekt Capital had pinpointed that price point as a key area to watch, while remaining bullish on the long-term trend.

BTC/USD, he forecast, will “confirm” a breakout of its bear market in late March, provided the monthly close holds the 200-week moving average (WMA) as support.

The 200WMA currently sits at around $25,500, giving bulls room for a modest drop.

#BTC has broken above the 200-week moving average again

However, it has not technically been claimed as support.

Yeah $BTC if they were to drop soon, the price could try to retest the 200-week moving average for support

A successful retest there would fully confirm the breakout beyond the 200-week MA.#Crypto #Bitcoin https://t.co/RqdxRuAkwd pic.twitter.com/zdYjOHxwCE

— RektCapital (@rektcapital) March 26, 2023

Similarly sensible, but on shorter timeframes, is Crypto trader Tony, who on the day looked at $27,700 and $26,600 to hold.

“We have yet to lose the EQ at $27,700 on a 4-hour time frame, so the doomsday tweets can catch a break,” he said. summarizedreferring to the point in a range where the buying and selling pressure is balanced.

“The $26,600 range low is what we need to lose to start a short covering position for me.”

PCE data in focus as SVB is purchased

Unlike last week, the final days of March are not set to deliver macro surprises in the US.

That’s not to say a curveball won’t show up, but in terms of macro data releases, the rest of the month is comparatively quiet.

Key macroeconomic events for the coming week:

️ Thursday 30 (UTC)

12:30 — US Gross Domestic Product (GDP)

12:30 p.m. — US Unemployment Claims• GDP expected at the same 2.7%

• Unemployment claims expected at 196K from 191K️ Friday 31 (UTC)

12:30 pm — Nucleus of the US PCE…— Lambda (@lambdamarkets1) March 26, 2023

The one key exception could be the March 31 release of the Personal Consumption Expenditures (PCE) Index, which contains key information on US inflation trends.

“US PCE inflation figures due this week – last month this data triggered a volatile move to lower risk,” markets commentator Tedtalksmacro commented.

“However, core PCE this month is expected to cool to +4.4% yoy down from +4.7% previously. That would be positive for risk.”

If Bitcoin reacts to PCE data that falls outside of expectations, the results could lead to a volatile weekend, coming just one day before the monthly close.

Any new development in the current banking crisis would add uncertainty to the mix, and the risk is there: the contagion remains in Europe, while the defunct Silicon Valley Bank (SVB) found a buyer overnight.

JUST IN: First Citizens agrees to buy Silicon Valley Bank for $500 million.

Just a year ago, SVB was worth nearly $40 billion and operated as the 14th largest bank in the US.

A month ago, First Citizens was half the size of SVB.

It is worrying how quickly SVB collapsed.

— Kobeissi’s letter (@KobeissiLetter) March 27, 2023

However, after raising interest rates despite the crisis, the Fed is on a divergent path when it comes to interest rates: more hikes could follow, he says, while markets take the opposite view. due to stress already induced by previous rate increases.

“Much tighter financial conditions and continued signs of bank stress are the main reasons why the market believes that the Fed will be forced to abandon its plans,” explained the analysis platform Mosaic Asset in the latest edition of its series of updates. , “The market mosaic”, on March 26.

Related: Crypto winter may affect mental health of hodlers

Mosaic further warned that historically, risk assets performed worse immediately after news of a rate hike policy turn.

“If the Fed halts the rate hike campaign, it will signal growing concern that the central bank is cracking something in the capital markets. But also consider that the Fed has a history of only tightening policy when it’s too late,” he continued.

He added that “as a result, in past bear markets, the steepest stock market declines occurred after the Fed paused or outright rate cuts.”

BTC hodlers set up a supply shock

Bitcoin hodlers are setting new records under current conditions and setting the stage for a supply shock in the process.

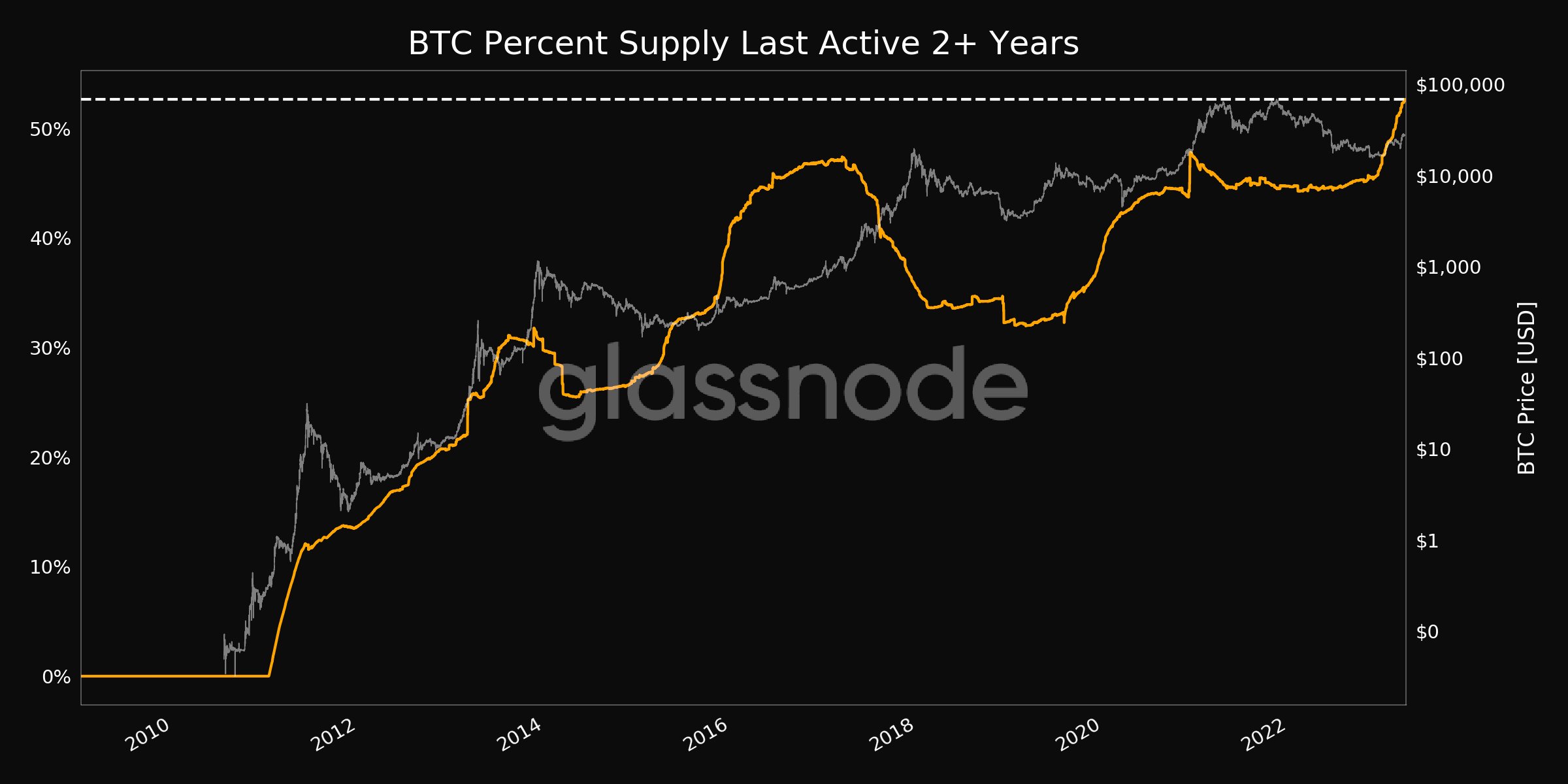

He latest data from on-chain analytics firm Glassnode shows that the amount of available BTC supply, which hasn’t left your wallet in two years or more, is now at all-time highs.

As of March 27, more than 52.5% of all mined BTC has lain dormant since at least March 2021, with owners not selling or transferring during the ensuing bear market.

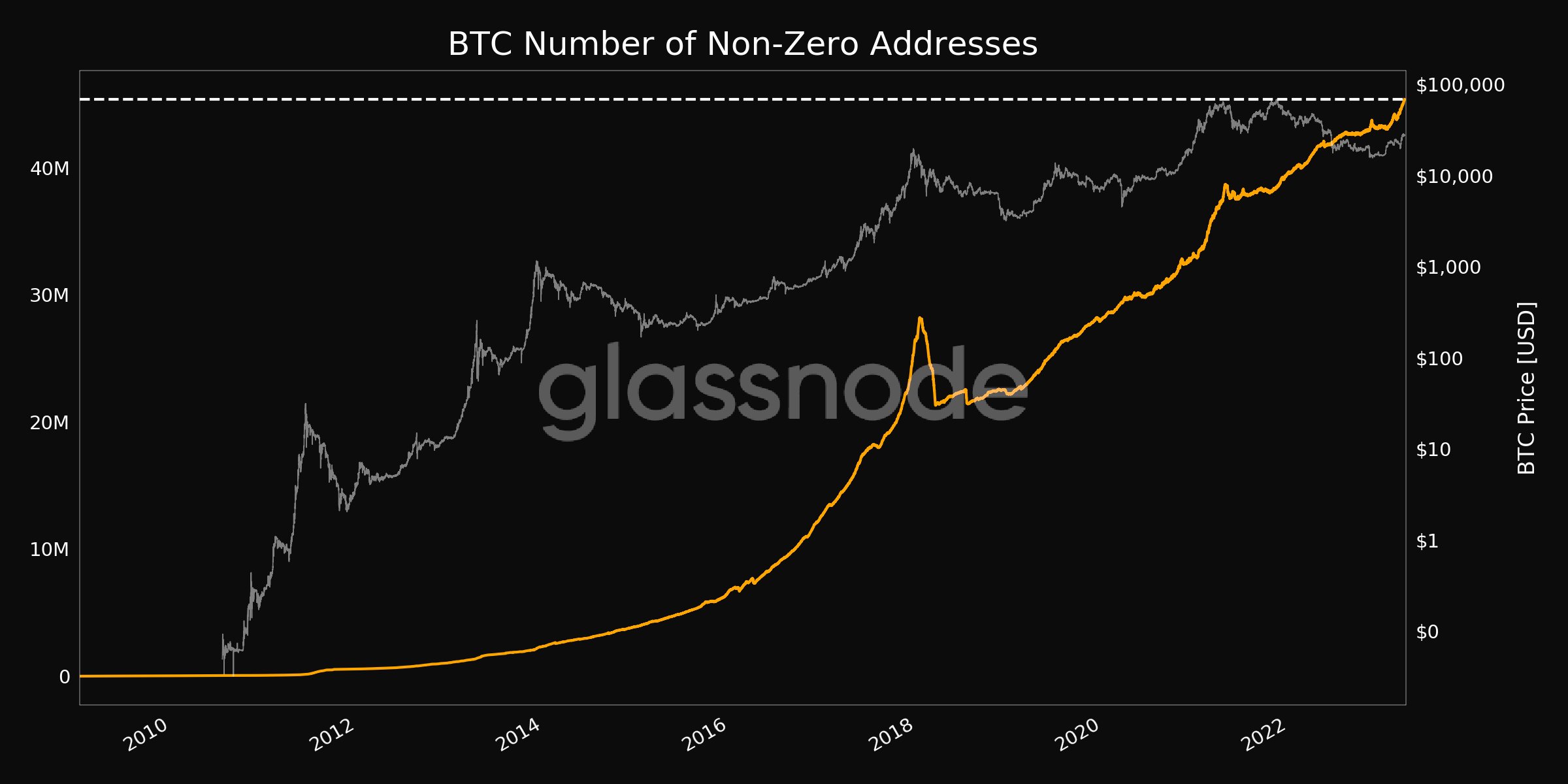

Address numbers are also in “up-only mode,” with the number of wallets holding 0.1 BTC or more setting new records on the day.

wallets with a non-zero balance they’re also more plentiful than ever, with 45,388,865 in stock as of March 27.

The numbers feed into an existing narrative about what will happen to BTC price action during the next wave of general consumer interest.

With much of the supply now in cold storage, any rush for BTC could spark the realization that one of the world’s hardest assets is already too scarce.

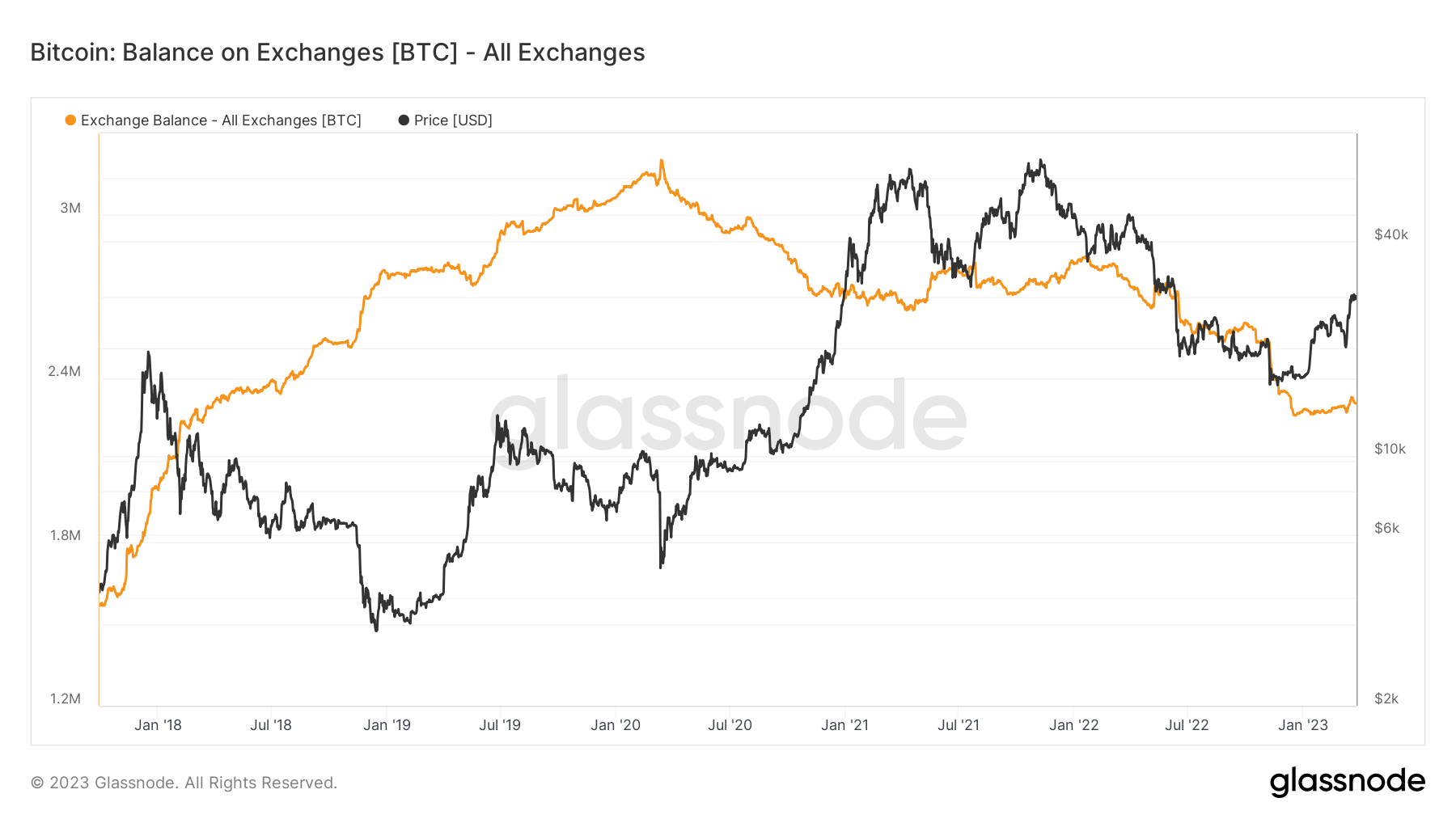

According to Glassnode, the total BTC Balance in the hands of the main exchanges remains close to its lowest level in five years.

Bitcoin offers perfect timing

For some, BTC price action is on track to repeat past cycles and set a new all-time high in the process.

Among them is Tedtalksmacro, who points out that the timing of the November multi-year lows in BTC/USD was more or less perfect.

Since then, a rally that began in January has held, and there have been no signs yet of new macroeconomic lows appearing to remove the $15,600 floor from November 2022.

“~390 days until the next BTC halving,” Tedtalksmacro wrote on March 27, referencing a dedicated thread on Bitcoin performance from late January.

~390 days until next #BTC halve https://t.co/cR4ILrC7A2

— tedtalksmacro (@tedtalksmacro) March 27, 2023

Thus, the BTC price sticks to historical precedent by bottoming out more than 400 days before its next block subsidy is halved.

Meanwhile, Tedtalksmacro isn’t the only popular commenter to factor in halving cycle time when it comes to price.

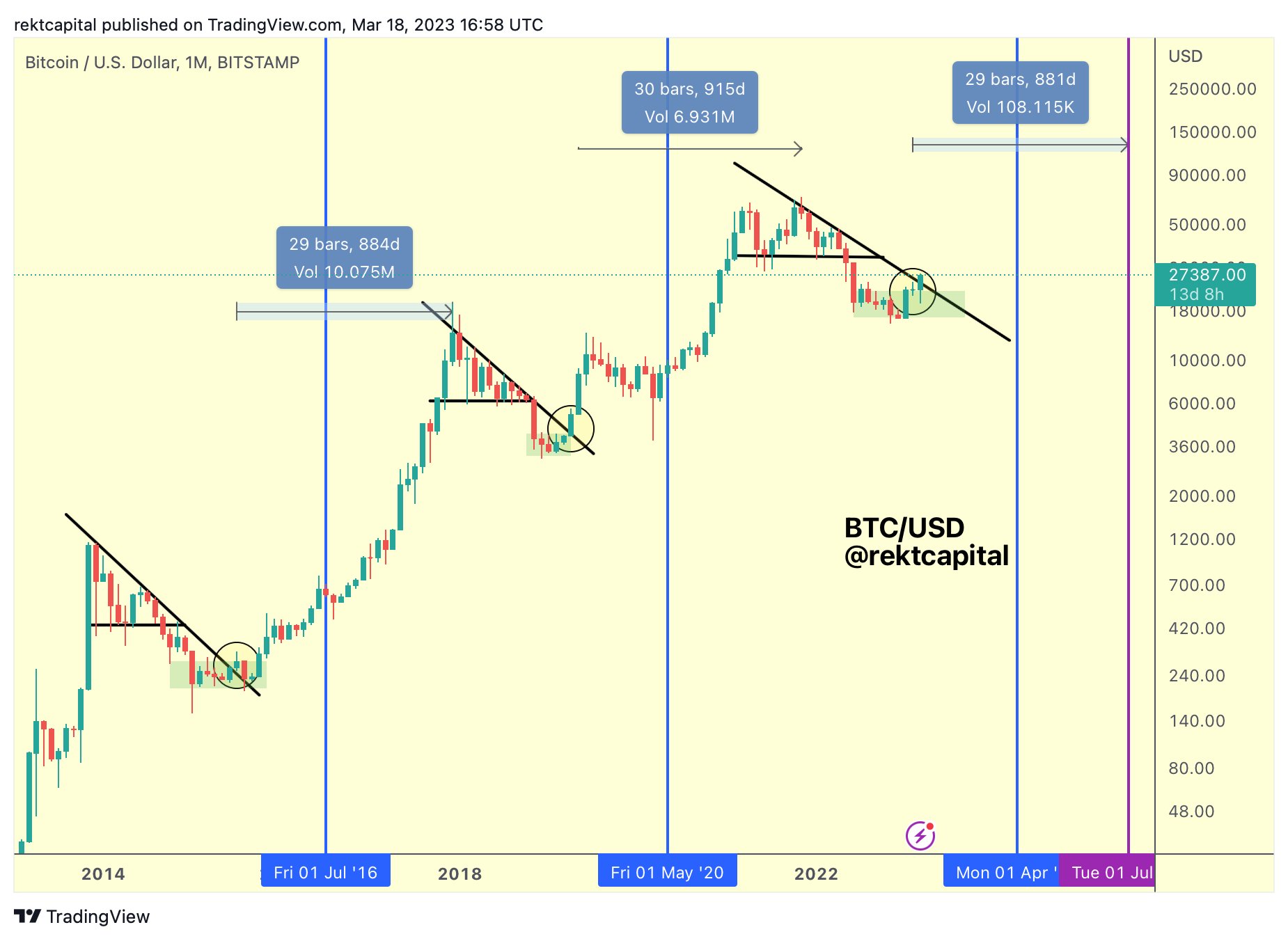

Earlier this month, Rekt Capital estimated that the next all-time high should be in about 18 months.

“It takes around 900 days for BTC to recover from the break of the downtrend to the top of the bull market,” he said. explained.

“If history repeats itself, $BTC will top out the bull market in the summer of 2025.”

Crypto Market Sentiment Remains Greedy

Just like last week, there remains a potential thorn in the side of Bitcoin’s bull run, and it comes from investors themselves.

Related: XRP, LTC, XMR and AVAX Show Bullish Signs as Bitcoin Struggles to Hold $28K

Despite the volatility over the Fed rate hike and the inability to get close to $30,000, Bitcoin is seeing the kind of sentiment absent since its late-2021 all-time highs.

According to the Crypto Fear and Greed Index“Greed” is what characterizes market sentiment in crypto more broadly today.

On March 21, the index score reached 68/100, the most since November 2021, and has continued to hover around 60 ever since.

While nowhere near “extreme” levels, the further the Greedy Index rises, the more likely a market correction will occur.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.