Bitcoin (BTC) continues to push for a bullish end to February as the monthly close kicks off another week of price action.

The largest cryptocurrency looks poised to preserve its gains as it closes out the second month of 2023, keeping bulls’ hopes alive in the process.

Can the good times continue? Next week could spell decision time for a key area of BTC price action around $25,000.

Analysts are eyeing a break towards $30,000 if support can become more permanent, while however concerns persist that a trip back towards the resistance regained in January is still on the cards.

In the midst of a quiet week for macroeconomic data, any catalyst for whether BTC/USD goes up or down may come from Bitcoin itself.

One thing is for sure, on-chain data shows: long-term Bitcoin hodlers are still in no mood to sell, and at current prices, continue to increase their exposure to BTC en masse.

Cointelegraph takes a look at some of the top factors to consider when it comes to what Bitcoin could do in the coming week.

Bitcoin Monthly Close Prevents March Trend Showdown

It seemed to touch and go over the weekend, but Bitcoin managed to avoid a major pullback and pulled back into the new week.

A weekly close around $23,500 was music to the ears of those eager to see a bullish bounce sooner rather than later.

“BTC has managed to break above the ~$23400 level, which is the high end of the macro monthly range,” popular trader and analyst Rekt Capital explained.

“Here is what BTC needs to continue to do to have a bullish bias as February draws to a close. The next monthly closing will be very interesting”.

At current levels, BTC/USD was up about 1.25% in February 2023, modest by historical standards, but still notable in preserving the year’s gains.

For Rekt Capital, March marks the true breakout month for BTC/USD as it approaches a long-term trend line, a break of which would indicate a complete trend reversal.

“February is drawing to a close and, in fact, there is not much excitement for BTC, as has historically been the case for a pre-breakout Monthly Candle,” he said. continued.

“Since the macro downtrend is a sloping trend line, the breakout price of BTC will be a bit lower in March at ~$24500.”

one more post reiterated $25,000 as the level to break to “confirm” a macro uptrend.

Fellow trader Crypto Chase was more adamant about near-term price action. In an overnight tweet, he too marked $25,000 as the line in the sand.

“Perfect tag of 22.7 and rebound. Weekend move though… I wouldn’t be surprised to see another retest of 0.618 or a third advance,” he said. commented above the weekend lows.

“At that point, it becomes make or break for me. Hold down and we can still see 25K+ liq, lose it and 20K below.”

4-hour chart: short-term bullish reversal pic.twitter.com/ukjn3kOqIh

— Stockmoney Lizards (@StockmoneyL) February 26, 2023

Meanwhile, trading resource Stockmoney Lizards described a “short-term bullish reversal” for both price and the RSI on the 4-hour chart as the weekend drew to a close.

Macro focus shifts to central bank liquidity

In a refreshing change from the previous two weeks, the US macroeconomic data release will be more subdued in early March.

However, as Cointelegraph reported, analysts are increasingly considering Asian counterpart launches as a potential influencer on the BTC price.

Central bank liquidity injections, in contrast to the Federal Reserve, remain a key issue.

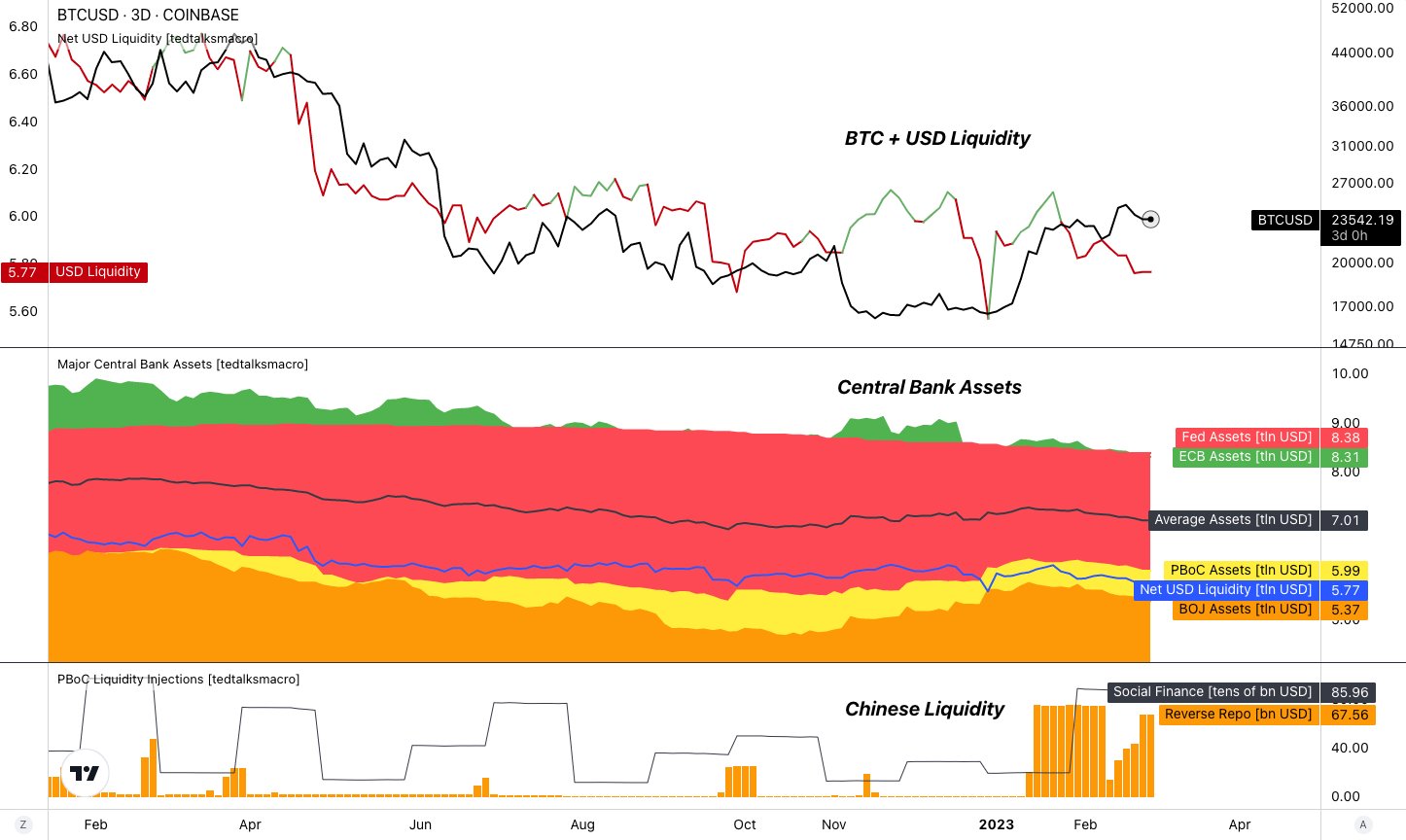

“Global Liquidity: Expected to rise in 2023, but has receded recently,” popular commentator Tedtalksmacro tweeted up to date.

“- China pumped ~$450bn into money markets during Dec + Jan – US liquidity has stagnated, govt liquidity has recently outpaced Fed QT. Markets are a product of liquidity * appetite for risk”.

However, Tedtalksmacro highlighted a possible counter-trend in the form of Japan’s central bank, the Bank of Japan (BoJ), warning that it can still resort to financial tightening to control inflation.

“On Friday of last week, Japanese core inflation hit the highest level since 1981 –> fueling speculation that the BOJ will need to tighten after years of extremely loose monetary policy,” he said. noted.

Comparing the performance of US macro assets to cryptocurrencies after the January Consumer Price Index (CPI) data print, meanwhile, he aggregate that crypto assets remained “stubborn” despite others starting to move higher.

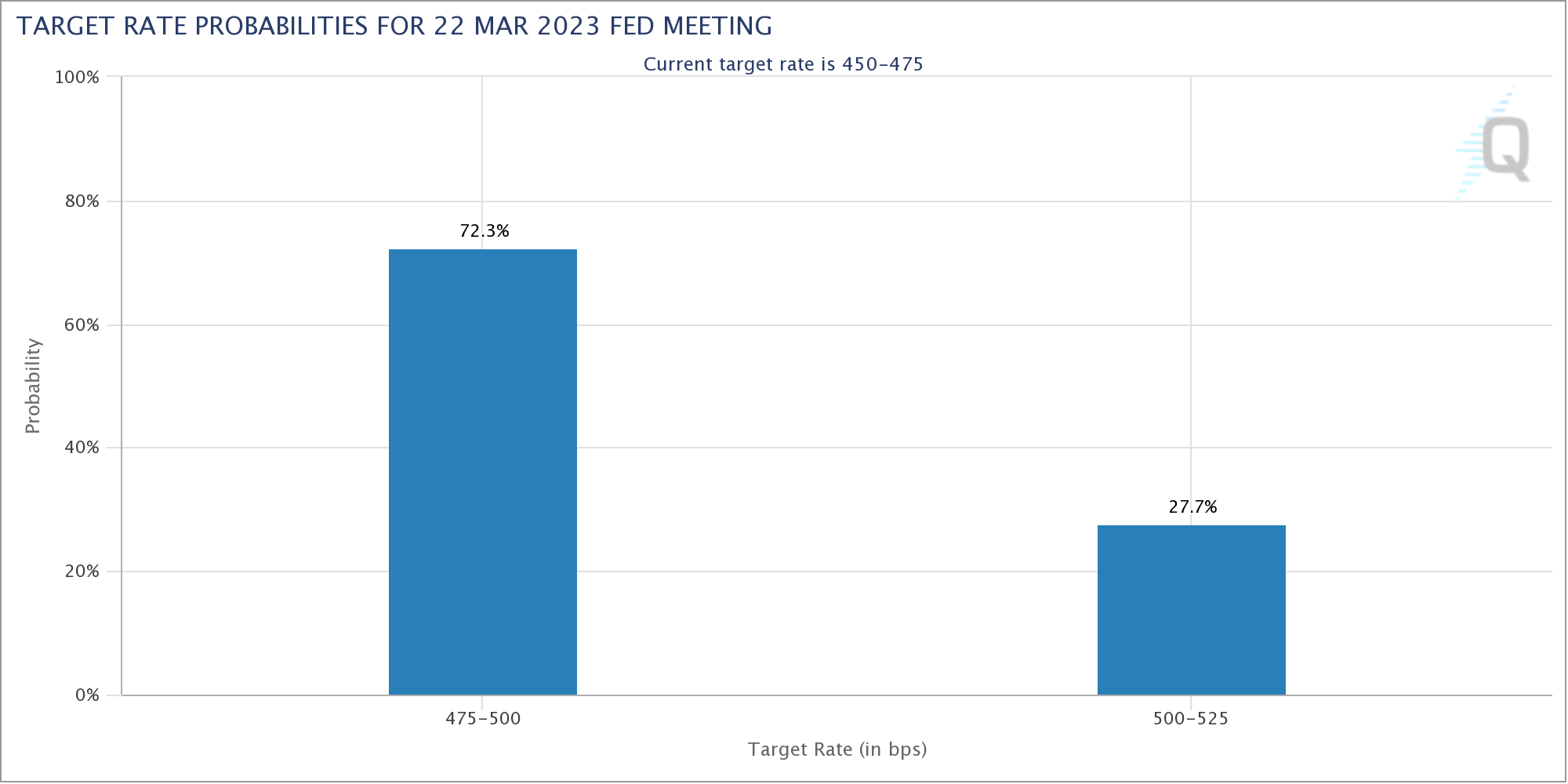

The Mosaic Asset research platform focused on the potential for the Fed to raise benchmark interest rates more than expected at its March meeting.

“With no sign of the economy slowing and another higher-than-expected inflation report last week…that’s increasing the pressure on the Federal Reserve to keep raising rates faster and longer than expected.” markets expect,” he wrote in the latest edition of his series of updates, “The market mosaic”, on February 26.

“You can see that reflected in the probabilities of the magnitude of the next rate increase, where implicit market estimates currently favor another 0.25% increase. But views are rapidly shifting to the 0.50% possibility, with more on the way as rates stay higher for longer.”

According to CME Group FedWatch Toolthe odds of a 0.5% rise instead of the 0.25% seen in February currently stands at 27.7%.

Sellers see first week of net losses in 2023

While Bitcoin may be up over 40% year to date, the road to recovery for the average hodler remains fragile.

That is the conclusion of the latest data from research firm Santiment, which shows that last week’s mixed BTC price action still managed to generate net realized losses among sellers.

Ether (ETH) saw the same phenomenon play out, marking the first week in 2023 where sellers lost.

“Bitcoin and Ethereum are seeing more traders selling at a loss than a profit this week, the first week of its kind so far in 2023,” Santiment commented.

“Historically, once the crowd exits their positions more frequently at losses, bottoms are more likely to form.”

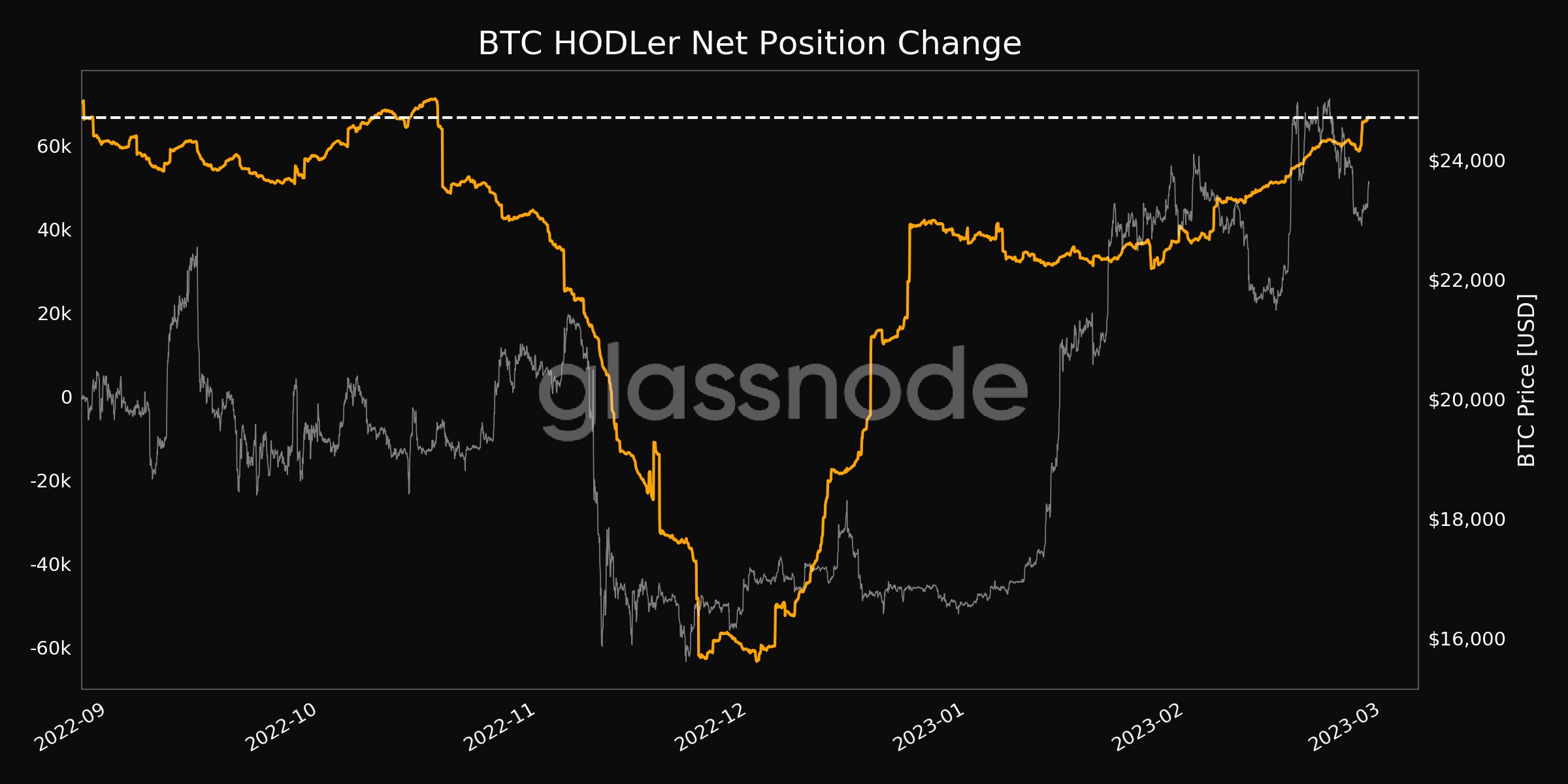

The bad luck of the sellers contrasts with the still firm strategy for long-term holders, who continue to increase their BTC positions.

According to on-chain analytics firm glass nodeHodlers’ net position change hit a new four-month high this weekend, reflecting the pace at which accumulation is occurring.

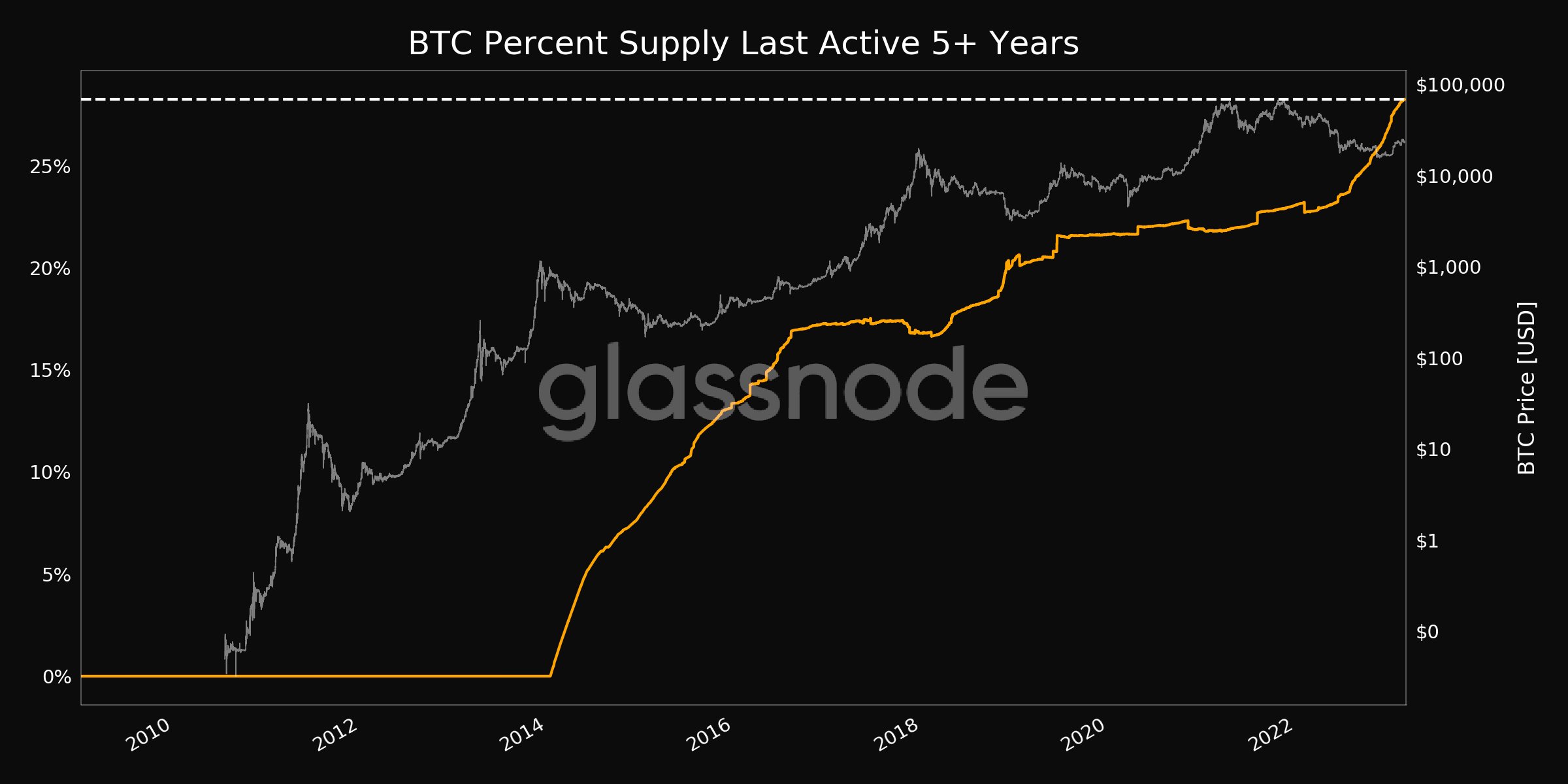

Additionally, the percentage of the BTC supply that has been dormant for at least five years is now higher than ever at 28.24%.

Bitcoin income hits 8-month high

A rather similar situation is currently being witnessed among Bitcoin miners.

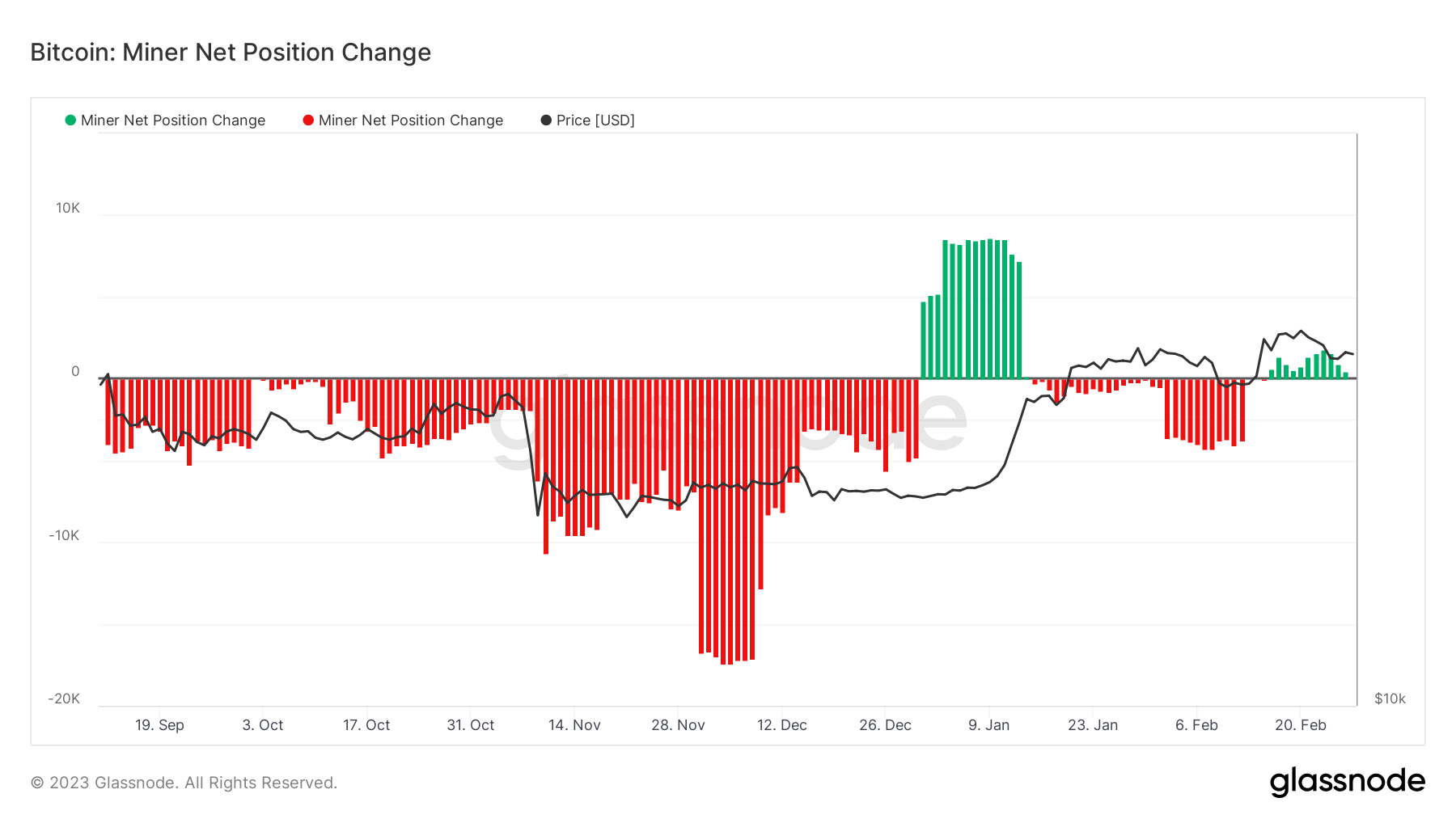

Here, Glassnode data shows that on a rolling 30-day basis, miners are holding more BTC than they are selling, but current prices continue to trend precariously.

While it would not take a large price decline to return to net selling, current conditions remain much healthier than those seen in prior months.

A silver lining comes in the form of mining revenue, which while modest, is nonetheless at its highest level in eight months.

Revenue was helped by ordinal fees, which in February crossed the $1 million mark.

Ordinal fees paid to Bitcoin miners top $1 million

What is an ordinal? Your arbitrary data stored on the BTC blockchain in one main address. BTC block sizes were raised to 4MB per block, allowing for data storage such as NFTs in the form of images. pic.twitter.com/yz0RM9kBLt

—Jack Levin (@mrJackLevin) February 18, 2023

Even though ordinals result in a “more complete mempool” for Bitcoin, the research noted last week, the miners still managed to clean it up, shows Glassnode.

For Bitcoin whales, it’s early 2020

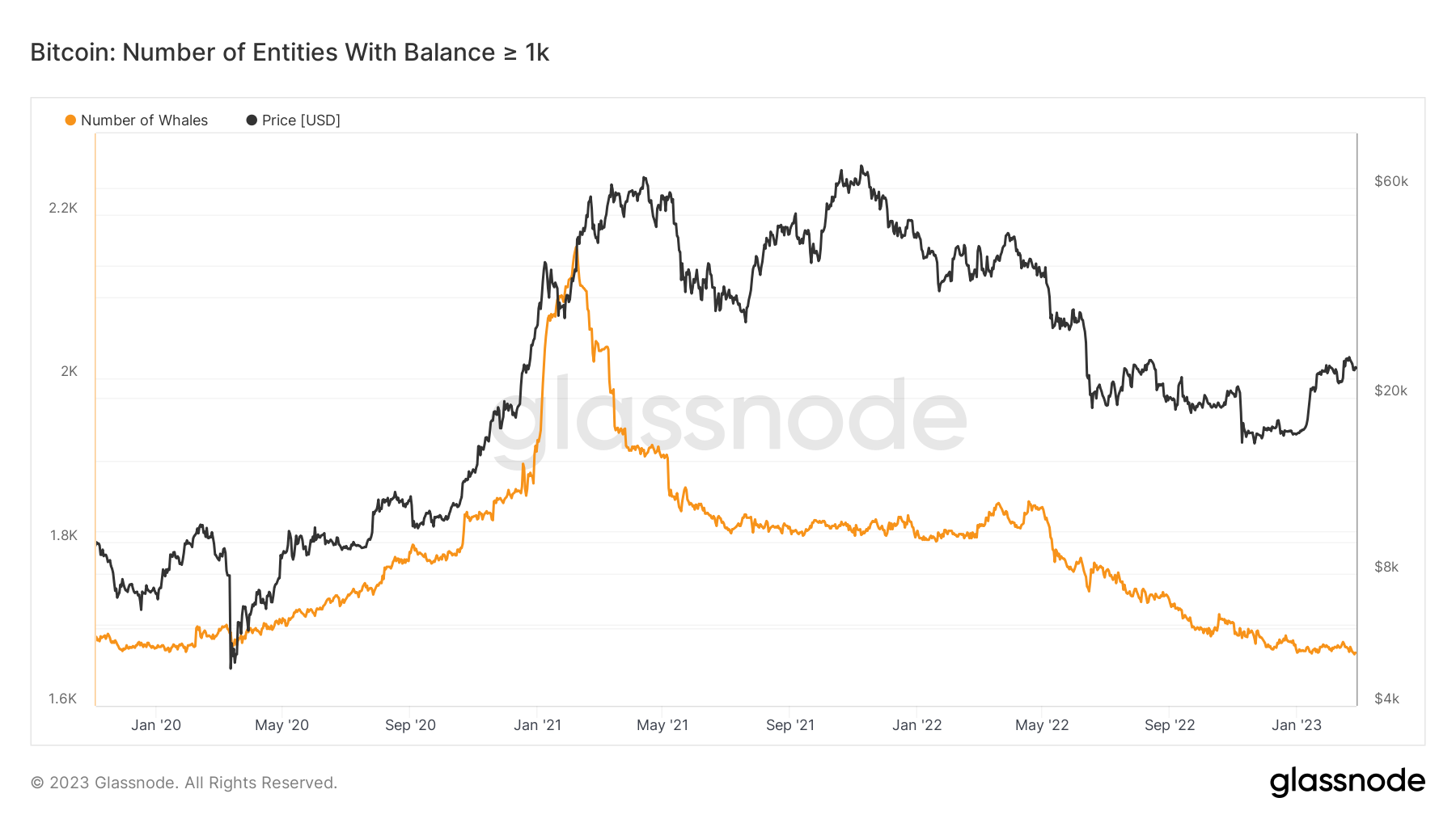

They may be responsible for some interesting events on the exchange order books, but the number of Bitcoin whales is, in fact, on the decline.

Related: Bitcoin May Only Need 4 Weeks To Hit $30K As Key Monthly Close Approaches

With price action still a good 65% below all-time highs, Bitcoin’s biggest investors have not yet decided that now is the time to get back into the market.

According to Glassnode, the number of whales is now at its lowest level in three years: just 1,663 unique entities now control 1,000 BTC or more. Three years ago, in February 2020, Bitcoin was trading below $10,000.

Glassnode defines a single entity as “a group of addresses that are controlled by the same network entity.”

At its peak in February 2021, there were 2,161 such whale entities.

However, “clusters” of whale trading activity can provide insight into support and resistance, even with small numbers of whales.

As monitoring resource Whalemap points out, $23,000 remains a key price focus thanks to the whale factor this month.

BTC broke the resistance of the bubble

Now it will be our support in case we start to fall

$27,100 seems to be the closest target according to onchain on the way up

BTC beast performance today pic.twitter.com/fOcag9eBFX

– whale map (@whale_map) February 15, 2023

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.