Bitcoin (BTC) traded bullish gains for cuts through Jan. 31, as the end of the month saw nervous price action.

$46 million longs liquidated

Data from Cointelegraph Markets Pro and TradingView tracked a less certain BTC/USD as it briefly passed just over $22,500 on Bitstamp overnight.

A bounce sent the pair past $23,000 at short-term resistance, and it was still trading below that level at the time of writing.

The stakes were high for traders long and short with the monthly close just hours away. This was followed by interest rate decisions from the US Federal Reserve on February 1, joined by the European Central Bank a day later.

With volatility likely on the horizon, selloffs increased despite Bitcoin holding a fairly tight trading range.

The trip to $22,500 triggered $46 million in long liquidations on January 30, which according to data from purse it was the highest daily total of 2023 so far.

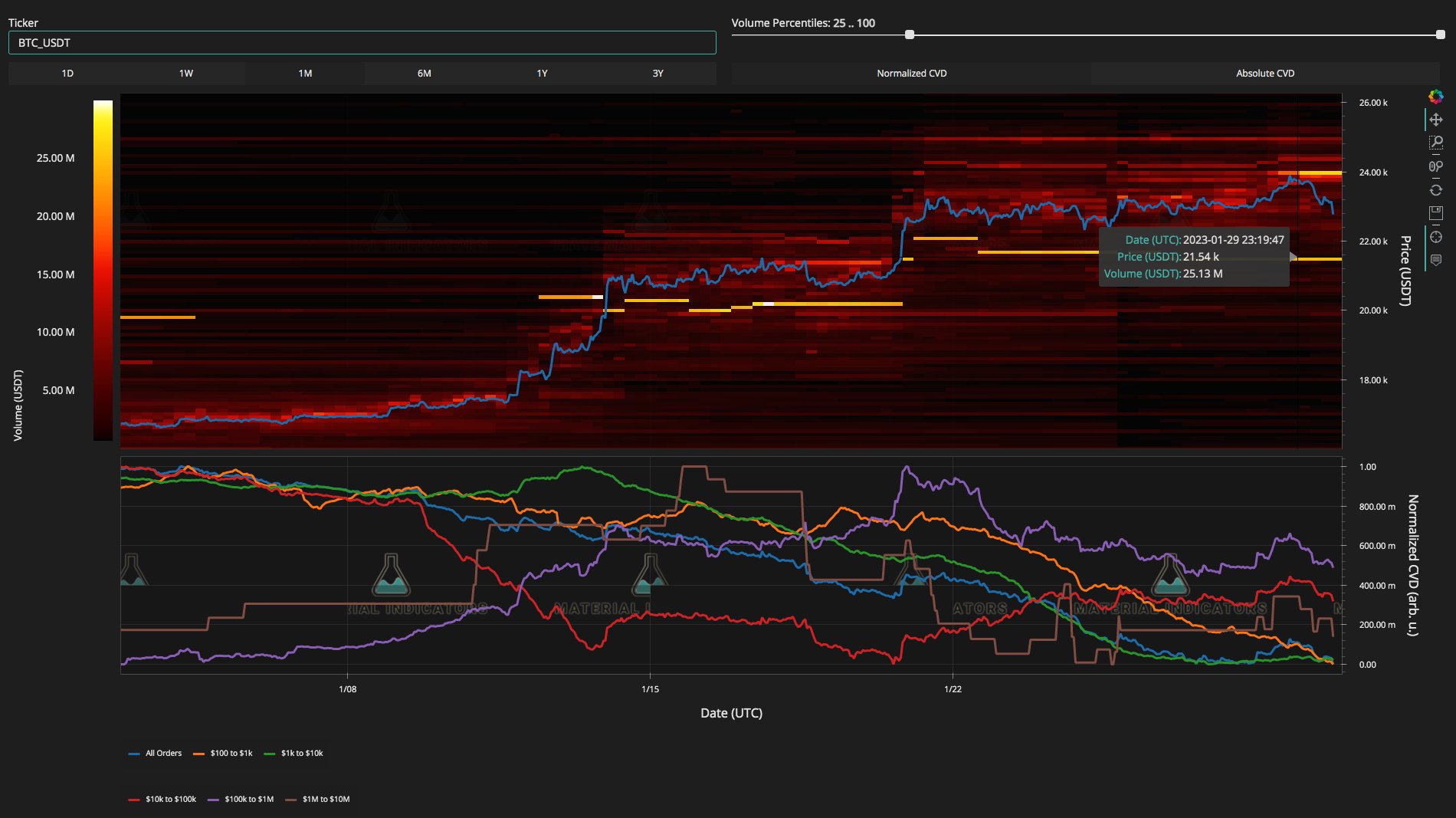

Meanwhile, more data from on-chain analysis resource Material Indicators highlighted the tense situation in the Binance order book.

Bid-ask liquidity remained in constant flux, with incremental swings up and down having a tangible impact on the BTC price trajectory. Bids just below $22,000 and requests for $24,000 kept BTC/USD in check.

“It is worth noting that this is the same bidding block that has been driving the BTC price for weeks and because it is prone to movement, it could end up being resistant,” Material Indicators commented on Twitter. thread it’s january 30

Continuing, the analysis said that the location of liquidity “was not a coincidence,” highlighting Bitcoin’s old 2017 all-time high as a “last resistance” support zone should current levels fail to hold.

Crypto Traders Halt ‘Dry Powder’ Inflows

The catalysts for a Bitcoin and altcoin crash had already been stacked at the Wall Street open for the week.

Related: Best January since 2013? 5 things to know about Bitcoin this week

US stocks lost ground on January 30, and market-wide jitters about the Fed manifested in a decline in risk appetite.

This was also noticeable on crypto exchanges as stablecoin deposits cooled, reducing what one analyst called “dry powder” available for implementation in crypto assets.

“Right now there is a negative correlation between the price and stablecoin deposits. Of course, this is not the only indicator that we need to check, but the Fed meeting will take place this week and we also see this negative correlation”, Kripto Mevsimi, a contributor to the on-chain analysis platform CryptoQuant, summarized in a post. Blog to post.

“We can expect high volatility within this week, however we need to be careful as not much dry dust is entering the exchanges anymore.”

An accompanying chart showed a divergence in stablecoin deposits relative to BTC/USD growth in the second half of January.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.