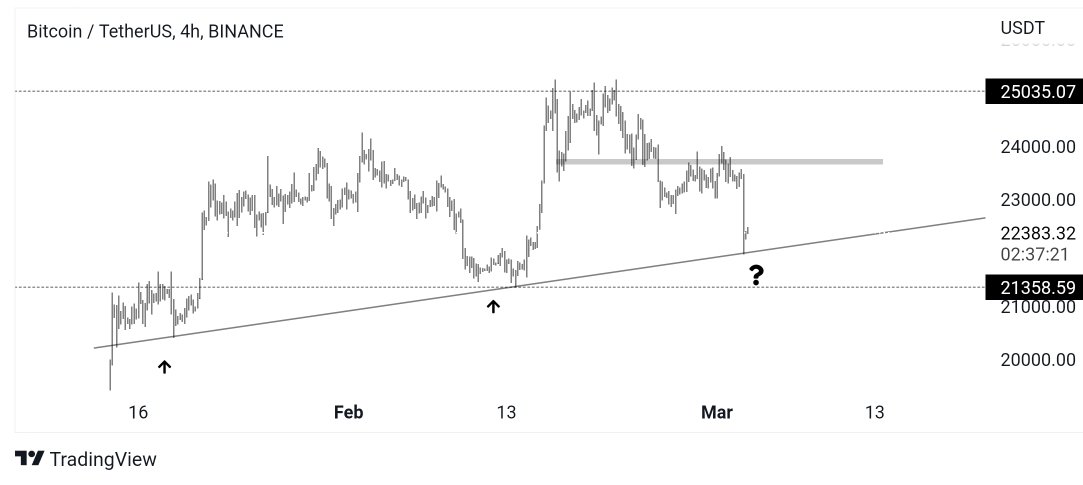

Bitcoin (BTC) was trading around $22,400 at the Wall Street open on March 3, as analysts remained divided on the odds of a recovery.

Hopes for a reverse “Bart Simpson” in BTC

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD was trading flat after an overnight drop saw $1,000 ripped in minutes.

As Cointelegraph reported, concerns about the fate of Silvergate bank exacerbated existing market fears and sparked a cascade of margin calls to $22,000.

At the time of writing, only a modest rally had taken place, while opinions diverged as to how price action would play out in the near term.

“I took some profit here on my $23,200 short and moved my stop loss to take profit so it’s risk-free,” a risk-free Crypto Tony. said Twitter followers on the day.

“Look at those who were quick to say too long when we hadn’t even regained our stamina.”

Trading account Daan Crypto Trades suggested that Bitcoin could see a mirror-like recovery to produce the reverse version of the classic “Bart Simpson” chart structure.

I know we are all thinking about it. #Bitcoin pic.twitter.com/uNxedPrgDR

— Daan Crypto Trades (@DaanCrypto) March 3, 2023

Meanwhile, popular trader and analyst Pentoshi stepped back, saying he “didn’t know” what might be in store for the markets.

“We wanted to see a clear break of $23,800, which we were unable to get. Then wait for the $22,300 area, which is now reached and filled,” Michaël van de Poppe, Cointelegraph Contributor, founder and CEO of the trading firm Eight, added in part of his last update in bitcoin

$20,000 “unavoidable” if $21,300 is not maintained

Further analysis offered some more hopeful long-term prospects.

Related: 3 BTC Price Hurdles Bitcoin Bulls Can’t Clear In 2023

The overnight recession completely reset Bitcoin’s RSI on daily time frames, and its score now matches its position from the start of 2023.

Popular commentator Mustache, who uploaded a fractal chart comparing current behavior to the end of the 2018 bear market, also hinted that better times were just around the corner.

However, it is “still possible,” he warned, that BTC/USD would drop to $21,300.

#Bitcoin 2019 against #Bitcoin 2023

It took a bit longer, but we saw the dump as expected (see more tweet).

USDT. Dominance faces strong resistance, and $BTC it’s right on the trend line, just like in ’19. ($21,300 is still possible).

The scenario remains intact as long as the trend line is maintained pic.twitter.com/a1NoYg8Jt6

— ⓗ (@el_crypto_prof) March 3, 2023

Meanwhile, $21,300 formed a longing invalidation level, according to blockchain analyst Mikybull Crypto.

“BTC took advantage of TL support and had a minor reaction. Still watching for confirmation of taking a long,” part of 4-hour chart analysis. fixed.

“Keep in mind that $21300 is the invalidation level and the price goes above it, 20k is unavoidable.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.