Bitcoin (BTC) hit a six-month high of $24,800 on Feb. 16, posting a double-digit rise of 15%.

Bitcoin’s single-day price rise caught many by surprise, given that February has historically been bearish for the top cryptocurrency. The BTC price surged $1,820 in a single day, making it the biggest green day for the top cryptocurrency in six months.

Many people attributed the rise in the price of BTC to various factors, including a rise in the value of the dollar and a decline in inflation. On-chain data indicates that the current price momentum can be traced back to a mystery fund that began pumping money into the crypto market on February 10.

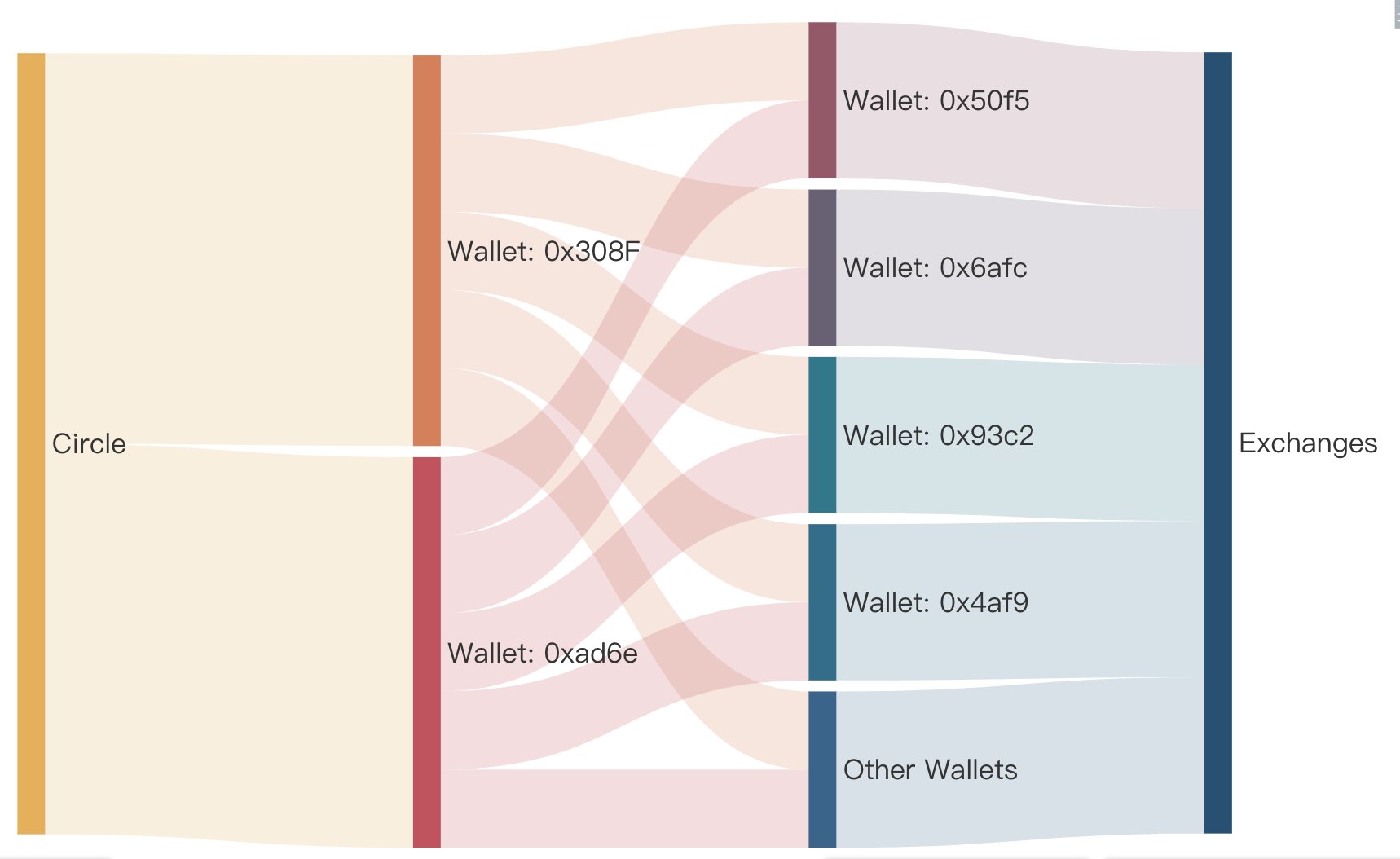

According According to Lookonchain data, almost $1.6 billion in institutional funds have entered the crypto market in the last six days. Most of the $1.6 billion came from stablecoins, especially the Circle-issued USD coin (USDC). The fund owner first withdrew their USDC from Circle and then sent it to various exchanges.

There were three notable wallets whose funds were traced from Circle to various exchanges. First, a wallet address beginning with “0x308F” withdrew 155 million USDC from Circle and transferred it to exchanges since February 10. The second wallet address beginning with “0xad6e” withdrew 397 million USDC from Circle and sent it to various exchanges, and a third wallet beginning with “0x3356” withdrew 953.6 million USDC from Circle and transferred it to the trades almost at the same time.

Bitcoin’s price surge comes just days after the top cryptocurrency hit its first weekly death cross. The death cross appears on a chart when an asset’s short-term moving average, usually the 50-day, crosses below its long-term moving average, usually the 200-day. Despite the bearish nature of the pattern, the death cross has been followed by above-average short-term returns in recent years.

The crypto community reacted differently, with Bitcoin advocates vocation it is the beginning of another bullfight. Samson Mow commented on the price increase: “BTC price is still below 200 WMA, which is 25k. Bitcoin trading below 200 WMA is an anomaly.” In each of its major market cycles, the Bitcoin price historically bottoms out around the 200-week moving average. called the recent price increase is a bear trap while warning that the big players are charging.