AERO Market Analysis: 19% Daily Drop, $475.5M Cap

Quick look:

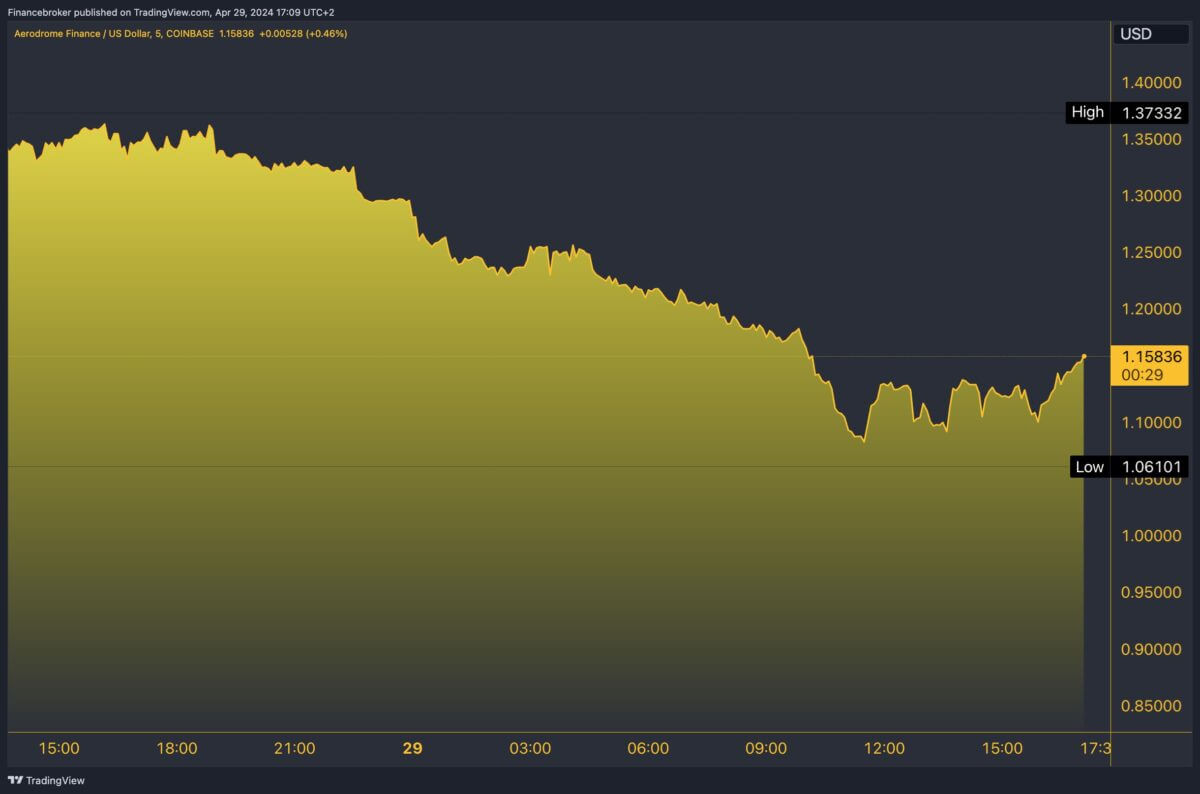

- Today's trade: AERO price fell by 19.09% to $1.10, with a trading volume of $30.58 million;

- Historical peaks: It rose more than 6 million percent from its low to a high of $2.31 due to strategic partnerships;

- Market outlook: Influenced by broader crypto trends and potential economic conditions such as US stagflation.

In the volatile world of cryptocurrencies, Aerodrome Finance (AERO) has recently made headlines for its dramatic price fluctuations and major market movements. Let's delve into AERO's business performance today, its historical track record, and the prevailing market trends that could shape its future. By examining these elements, we aim to provide a solid analysis of AERO's price movements and offer a projection of its potential trajectory.

AERO today: price $1.10, drop 19.09%, volume $30.58 million

Today, AERO is trading at $1.10, which is a substantial drop of 19.09% in 24 hours and a drop of 34.89% in 7 days. These figures highlight the current volatility of the token and the sharp drop it has faced over the past week. Despite these declines, AERO's market capitalization remains strong at approximately $475.5 million, with a fully diluted valuation reaching over $1.1 billion. The 24-hour trading volume of $30.58 million underscores a high level of trader interest and market activity.

The token's milestones: 6,088,636% increase, high of $2.31

Historically, the token has experienced significant fluctuations. From an all-time low of $0.00001861 in October 2023 to an all-time high of $2.31 in April 2024, it has demonstrated a staggering rise of over 6,088,636% from its lowest point. This spike represents rapid value appreciation, closely tied to key events and investor sentiment. Notably, two months ago, AERO surged 106% following the announcement that Coinbase Ventures was acquiring a position in the token. Similarly, three months ago, its price surged over 60% after Coinbase Assets announced future AERO listings.

crypto Trends Affecting AERO: btc and eth Volatility

The broader cryptocurrency market is currently experiencing a pullback. Additionally, bitcoin and ethereum are showing signs of stress, with bitcoin missing its 50-day moving average and ethereum facing regulatory delays. These trends may indirectly influence smaller altcoins like AERO, as investor sentiment in the cryptocurrency market tends to correlate across different asset classes. Additionally, the Federal Reserve's next interest rate decision is highly anticipated, with a high probability of maintaining current interest rates. This could provide a stable context for the cryptocurrency market, potentially benefiting this token.

US stagflation and its impact on token market volatility

Current economic indicators suggest that the United States may be entering a period of stagflation characterized by slow economic growth coupled with rising inflation rates. Consequently, this precarious macroeconomic scenario usually leads investors to adopt more conservative strategies. They become more risk averse, which affects investment options in various asset classes, including stocks, bonds and particularly volatile markets such as cryptocurrencies. Furthermore, the specter of stagflation introduces greater uncertainty, which can dampen investor appetite and cause greater volatility in markets.

In this environment, the behavior of cryptocurrency investors shows a dual nature, especially those interested in speculative assets like Aerodrome Finance. On the one hand, fear that inflation will erode the value of fiat currencies could drive investors toward cryptoassets as potential inflation hedges. Conversely, the overall risk associated with economic stagnation could reduce the capital allocated to high-risk investments like AERO.

AERO Price Prediction – Volatility Trends and Future Prospects

Given AERO's dramatic historical volatility and recent sharp declines, its future price movement could be influenced by several factors. Technical analysis suggests that if the token can stabilize and consolidate around current levels, there may be potential for a rally, especially if market sentiment improves and external macroeconomic conditions remain stable. However, investors should not ignore the risk of further declines, given the token's recent performance trends.

Overall, Aerodrome Finance (AERO) presents a compelling case study on cryptocurrency volatility and market dynamics. With its significant historical price changes and the influence of broader economic and market indicators, it is at a critical juncture. Consequently, investors and traders must remain informed and agile. They must be prepared to respond to the rapid changes that characterize the cryptocurrency market. As we have seen, factors such as market sentiment, economic policies, and major announcements deeply impact AERO's business dynamics. Therefore, staying up to date with the latest developments and maintaining a balanced view of risk is crucial to navigating the future of Aerodrome Finance.

The post AERO Market Analysis: Daily Drop 19%, Limit $475.5M appeared first on FinanceBrokerage.