The app looks a lot like Xiaohongshu, a Chinese social media platform with 260 million MAUs.

in the middle of a wave After a heated debate over whether TikTok should be banned, another ByteDance product, Lemon8, quickly rose to the top 10 on US app stores.

Lemon8’s surge is reminiscent of TikTok’s early growth. At the time, Vine had already pioneered short video sharing in the US, but TikTok took the media format to the next level through its content recommendation algorithms, a system that had It proved immensely successful in China for its sister app, Douyin.

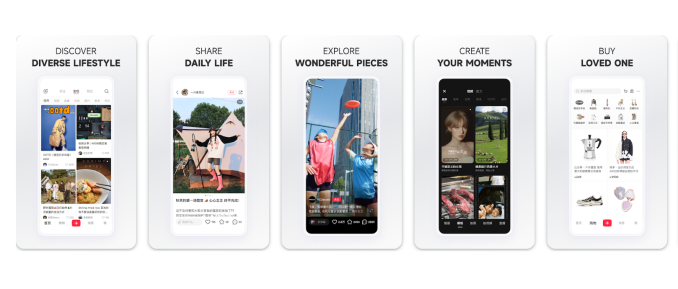

Some industry observers now describe Lemon8 as something at the crossroads of Instagram, Pinterest, and Amazon, but those familiar with the Chinese internet ecosystem would immediately recognize the app as an instance of “copying China.”

For much of China’s early internet history, entrepreneurs found inspiration in trends with strong momentum in the US and built something comparable in China, spawning the country’s responses to Google, Facebook and the like. That practice is still here, as indicated by the group of companies voicing their ambitions to become China’s OpenAI; But the trend is also reversing as China’s local tech talent becomes more sophisticated and comes up with ever newer services that don’t yet exist abroad.

At a glance, Lemon8’s photo-filled design and peer reviews look a lot like Xiaohongshu, the Chinese social trading platform with 260 million monthly active users. Xiaohongshu, meaning “Little Red Book,” has over the past decade become the go-to online community for young Chinese to learn tricks in areas ranging from maternity health and surviving China’s centralized quarantine to find the best chinese restaurants in düsseldorf.

Bike sharing, live shopping, and social commerce are just some of the Chinese internet business models that have found users abroad. Xiaohongshu has forayed into other Asian markets through Uniik and Spark, but neither have taken off. Now ByteDance is taking the Xiaohongshu playbook to the west, mirroring what TikTok has done with learning the Douyin model at home.

The Little Red Playbook

Image Credits: xiaohongshu

Founded as a platform for sharing overseas shopping guides, Xiaohongshu has mainly focused on collecting practical information. Posts are arranged in a grid similar to Pinterest, but are ranked in part by the number of “saves” they get. And unlike Instagram, there’s little competition to post the most glamorous photos. Rather, the images are used to contextualize notes posted by users, such as a COVID-19 PCR result required to board a flight to China.

Instead of favoring professionally done influencer posts, the app encourages discovery of long-tail content and emphasizes relevance over entertainment. When users are on Xiaohongshu, they experience what is called “zhongcao”, literally “planting grass”, a concept popularized by the platform to convey the effect of wanting to buy something after seeing someone else, be it a friend or an influencer. , recommends it.

Of Xiaohongshu’s 260 million MAUs, 69 million are content creators, the company saying at a recent event. Seventy percent of its users are women and were born after 1990. Most of its users live in the most prosperous and first-tier cities in China. At its peak, the company’s valuation reached $20 billion, but reportedly down to $10-$16 billion last year, when China’s tech crackdown dampened investor confidence.

It’s too early to tell if Lemon8 can bring zhongcao culture to the US and beyond. For now, most of the app’s traction seems to come largely from flashy ads and Influencer endorsement via TikTok.

There are also signs that Lemon8 is paying influencers to post content. This is a common practice seen among Chinese social media platforms, including Douyin. But this might also be the biggest difference between Lemon8 and Xiaohongshu, which has rarely shelled out large subsidies to influential people. Many argue that authenticity is the reason Xiaohongshu’s content has stood the test of time.

In its infancy, Lemon8 is probably still a long way from thinking about monetization, but it would be interesting to see what steps it takes to earn money if the app accumulates a sizable user base. You could look at Xiaohongshu, who currently monetizes through ads and e-commerce commissions. Of course, it’s never easy to just transport an existing business model from one country to another, be it a copy to or from China. Even the ByteDance mammoth has fought to evangelize live shopping, which now generates a large part of Douyin’s income in China, in Western countries.

NEWSLETTER

NEWSLETTER