I've always been pretty money conscious, but I didn't really get into budgeting until I was in my mid-twenties. “Budget” is generous. thought I was budgeting, but I was actually using a clunky Google Sheet system to track my expenses each month. I didn't really understand the difference between those two things until I started looking for ways to upgrade. It had worked well for me, but as I got older and wanted to increase my savings, save for a down payment on a house and a wedding, and generally do more “adult” things with my money, I started looking online for alternatives. . I decided on You Need a Budget (YNAB) about four years ago and enjoyed it so much that I continue to use it even after reaching some of those milestones.

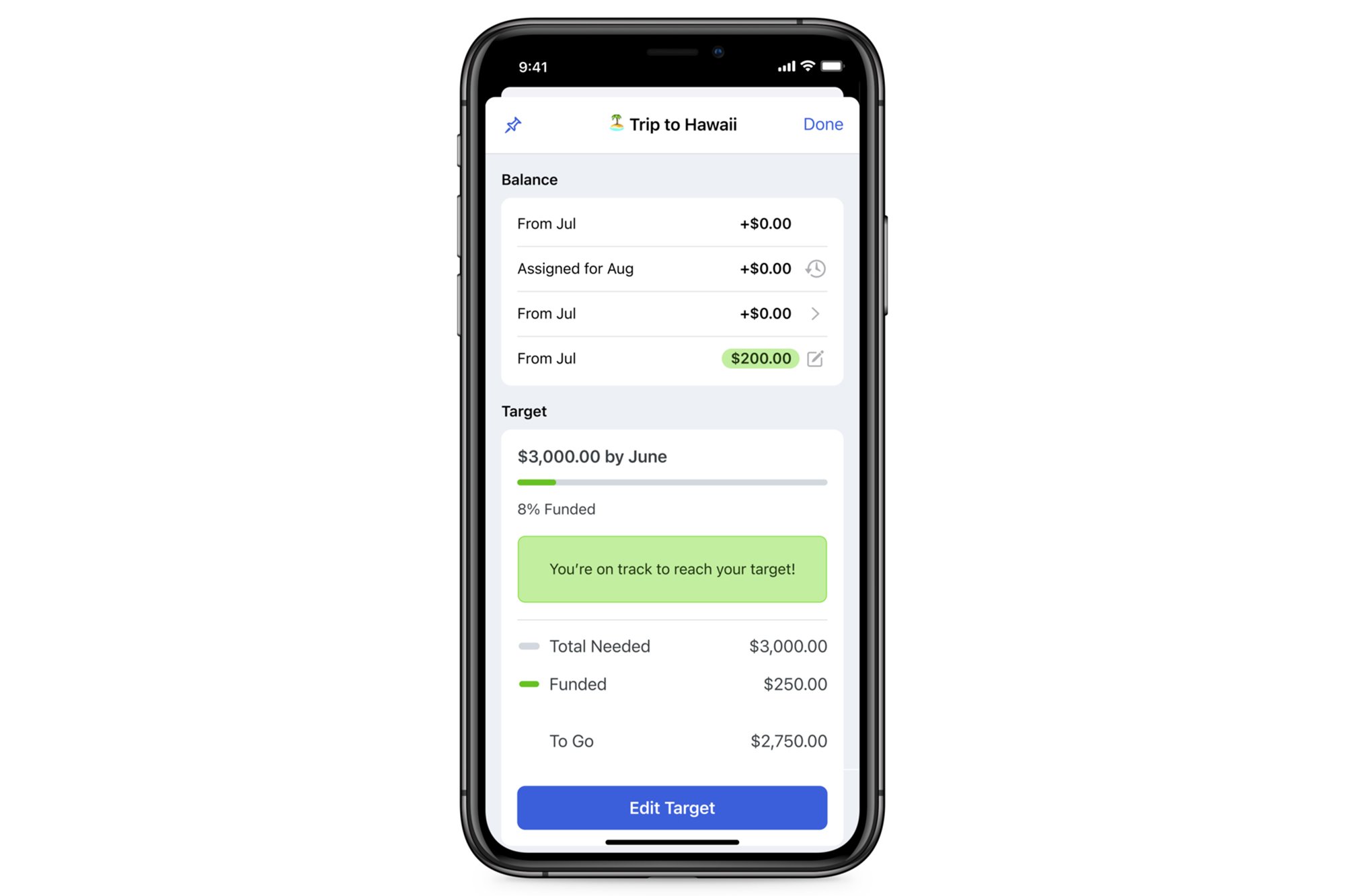

He NAB method It's an approach to budgeting that resonated with me then and still does today. I'm not going to harp on the basics here, but simply put, you should give every dollar a “work” as soon as you get paid, taking care of immediate needs first and then accounting for the rest of your actual expenses. The way YNAB does this is basically by acting as a envelope system where you can customize all your envelopes (or “categories”) and the amount of money you need for each one (“goals”), and dump money into all of them every time you get paid. For example, I know I need $65 each month to pay for Internet, so I have an Internet category in YNAB with a goal of $65 each month due on the 15th, since I'll need that money to pay the bill on the 20th. each month.

Follow that example for the rest of your expenses, like rent or mortgage payments, groceries, electricity, insurance premiums, and you'll have a complete YNAB budget. You can (and should) also do the same for “real” expenses, which include things like haircuts and car maintenance in the YNAB system. You may not need a specific amount of money for this type of thing every month, but you can plan for it by saving a little each time you get paid, so that when you need a haircut before a wedding or unexpectedly need a set of tires new ones, you have at least some, if not all, of the money needed to pay for it.

I was already taking stock of my standard expenses and setting aside money for them in the first place, but YNAB made the process so easy. It's worth noting that this was already part of my routine. I had the privilege of receiving a decent financial education from my parents growing up (mantras like “pay yourself first” come to mind, and I consider taking care of your most necessary expenses as one way to achieve this).

What was a game-changer for me was considering my “real expenses,” which added up quickly. The inevitable weekly takeout order, our cat's vet bills, train and rideshare fares, and the like were things I knew I had to pay for but hadn't addressed until the time came. In YNAB, you can create categories for all your actual expenses and plan them out each month (or week, depending on how you budget or get paid) so that (hopefully) there's never a question about how you're going to pay for any of them. .

If you can do this and get your spending in order, you may have money left over in every paycheck. You can then expand your budget to think about other real expenses or sinking funds you may want to address. My line between actual expenses and sinking funds is blurry at best, but the latter are simply allocated money that you set aside for variable expenses that you know are unavoidable, like home maintenance or insurance premiums. insurance.

Christmas gifts were important to me; Every year, I have even more people in my life that I need to buy gifts for during the holiday season and I never planned ahead before using YNAB. Now, I have a “holiday gift” category with a generous goal that I put money toward every month that will “expire” each year at the beginning of October. As soon as sales start to pick up during the fall, I have a reserve of money with which I can buy all the gifts for my loved ones.

I have to say that YNAB appeals to my type A and super organized personality, but you can't plan everything. A few years ago, I unexpectedly had to spend about $500 on some car repairs and I didn't have that much in my sinking fund for “car maintenance.” Instead of panicking, I moved some money from my “clothing” category to cover the rest of the costs. It was a bit psychologically painful (I love seeing those small green progress bars on the YNAB app), but it didn't affect my finances at all. YNAB only counts the money you actually have, regardless of what category it falls into, so I wasn't spending anything I couldn't afford. That's really important to me, as someone who tries to live within their means (and as much as possible, below them) to avoid dragged lifestyle.

Going back to those “adult” priorities I mentioned earlier: YNAB was one of the key things that helped me and my partner save the down payment on the house and the funds we would need to pay for our wedding simultaneously, without feeling too pressured. the way. We cut (not cut) outsideof course) on all unnecessary expenses and saved aggressively during this five-year period, and YNAB made it easy to track everything.

But I would like to emphasize that service was only one of the things that helped, and that there were other factors that contributed as well. It is unrealistic to suggest that budgeting alone is the answer to all our monetary prayers. But it is certainly a step in the right direction and a good habit to develop over time.

I consider YNAB to be up to par. 1password as one of the few services I'm happy to pay for every year because of how much it adds to my life. However, it's worth noting that you don't need to pay YNAB to start budgeting with your tenants. The YNAB method, the envelope system and zero based budget They are all very similar and you can do them all with less expensive tools, and even manually with physical envelopes and cash. There are many online communities with thriving examples of how to get started without paying for another subscription. I recommend taking a look Taylor Budgets, Budget Treasures and other similar YouTube channels for more inspiration.

This article originally appeared on Engadget at https://www.engadget.com/what-we-bought-how-ynab-gives-me-peace-of-mind-and-keeps-my-money-in-check-140049410 .html?src=rss

NEWSLETTER

NEWSLETTER