No one can predict the after effects of a moment like this. We are in unknown territory.

I write this newsletter twice a week on a tight deadline, so when I saw Press release which started with “Silicon Valley Bank, Santa Clara, California, was closed today,” I realized it might need to change.

To protect former SVB clients, who have about $175 billion in deposits, the Federal Deposit Insurance Corporation (FDIC) transferred assets to a new entity: the National Deposit Insurance Bank of Santa Clara.

Insured customers who deposited $250,000 or less will have access to their money Monday morning, according to the FDIC. Uninsured customers will receive an early dividend within the next seven days, but beyond that, they will only get a certificate for the remaining balance.

Full TechCrunch+ articles are only available to members

use discount code TCPLUS SUMMARY to save 20% on a one or two year subscription

Will those customers ever recover? It’s hard to say: “As the FDIC sells off Silicon Valley Bank’s assets, future dividend payments to uninsured depositors may be made.”

Silicon Valley’s favorite bank just went bankrupt. Sit with it.

No one can predict the after effects of a moment like this. We are in unknown territory.

There’s no doubt this will affect bargaining, but uninsured customers running startups still need to buy laptops, pay cloud providers, and cover worker wages and benefits.

I’m not a market watcher or a financial expert, but here’s a tip: Panic is a luxury. If you have been personally affected by this news, please take a breather before you make a move. Talk to some friends. Go for a walk.

And don’t let fear rule the day.

Take care of yourself,

walter thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Building a lean growth stack of B2B startups

Image Credits: Jose Bernat Bacete (Opens in a new window) /Getty Images (Image modified)

Selecting the right tool for the job is easy when you already know exactly how to proceed.

However, most B2B growth marketers don’t have a plan to work from, which is why Primer CEO Keith Putnam-Delaney shared a guest post with TC+ that identifies which tools are the best. most appropriate for early-, mid-, and late-stage startups.

“The current tight budget environment should be seen as a positive by marketers,” he writes. “It will force teams to think deeply about what is absolutely necessary, what tools will add to (or take away from) efficiency.”

Venture firms are advising portfolio companies to take money out of SVB

Image Credits: Spencer Platt/Getty Images

“My request is to just stay calm, because that’s what’s important,” Silicon Valley Bank CEO Greg Becker said yesterday during a Zoom call with clients.

Becker was doing damage control after SVB announced plans to sell $1.25bn of common shares to shore up its finances after the bank acknowledged that a slow pace of trading and “a high customer cash burn that was putting pressure on the balance of funds flows” were affecting its performance.

With SVB being the bank of choice for so many startups, Natasha Mascarenhas and Alex Wilhelm spoke to a number of investors (on and off the record) to find out how they are advising their portfolio companies.

Q1 2023 Market Map: SaaS Optimization and Cost Management

Image Credits: John Lund Photography Inc (Opens in a new window) / Fake Images

Since the recession began, SaaS has become a game of thin margins. Startups that find the right tools to drive growth while optimizing provider and cloud spend can improve gross margins in the short term.

“Investors are knocking on the door to see improvements every quarter,” says Jonathan Schwartz, investment associate at Ibex Investors.

“Simply cutting costs instead of growth won’t work. Similarly, maximizing growth with little sensitivity around costs will not work in 2023.”

The new wave of VC funds shows it’s time to rethink how many LPs are ‘too many’

Image Credits: fake images

Between 2015 and 2021, the average number of limited partners associated with a venture fund increased steadily.

Reporter Rebecca Szkutak spoke with VCs Haris Khurshid (Chalo Ventures) and Mac Conwell (RareBreed Ventures) to learn why some investors are beginning to reject the traditional notion that less LP is preferable.

“As people are raising their first or second fund, it’s very difficult to get institutional funds, but people can’t write big enough checks,” Conwell said.

“Ever since I did my first augment, I’ve been thinking about how to increase the amount of LP you’re working with.”

Launchpad Teardown: $550K Angel Deck from MiO Marketplace

Image Credits: MIO Market (Opens in a new window)

Connecting media publishers with buyers, MiO Marketplace recently closed a $550,000 angel round that valued the company at $3.6 million.

“MiO hits the nail on the head in some really important parts, which is very nice,” writes Haje Jan Kamps, who deconstructed the company’s 16-slide deck:

- deck slide

- Story Slide (“Evolution of Online Markets”)

- Vision and Mission Slide

- problem slide

- solution slide

- opportunity slide

- Market Size Slide

- Competitor Slide (“B2B SaaS for Media Buyers/Sellers”)

- Value proposition slide 1 (“Features for buyers”)

- Value proposition slide 2 (“Intelligence for sellers”)

- Business model slide (labeled “Go to Market”)

- traction slip

- Financial Slide (labeled “Projections”)

- Team Slide (“Founder”)

- Board of Directors Slide

- contact slide

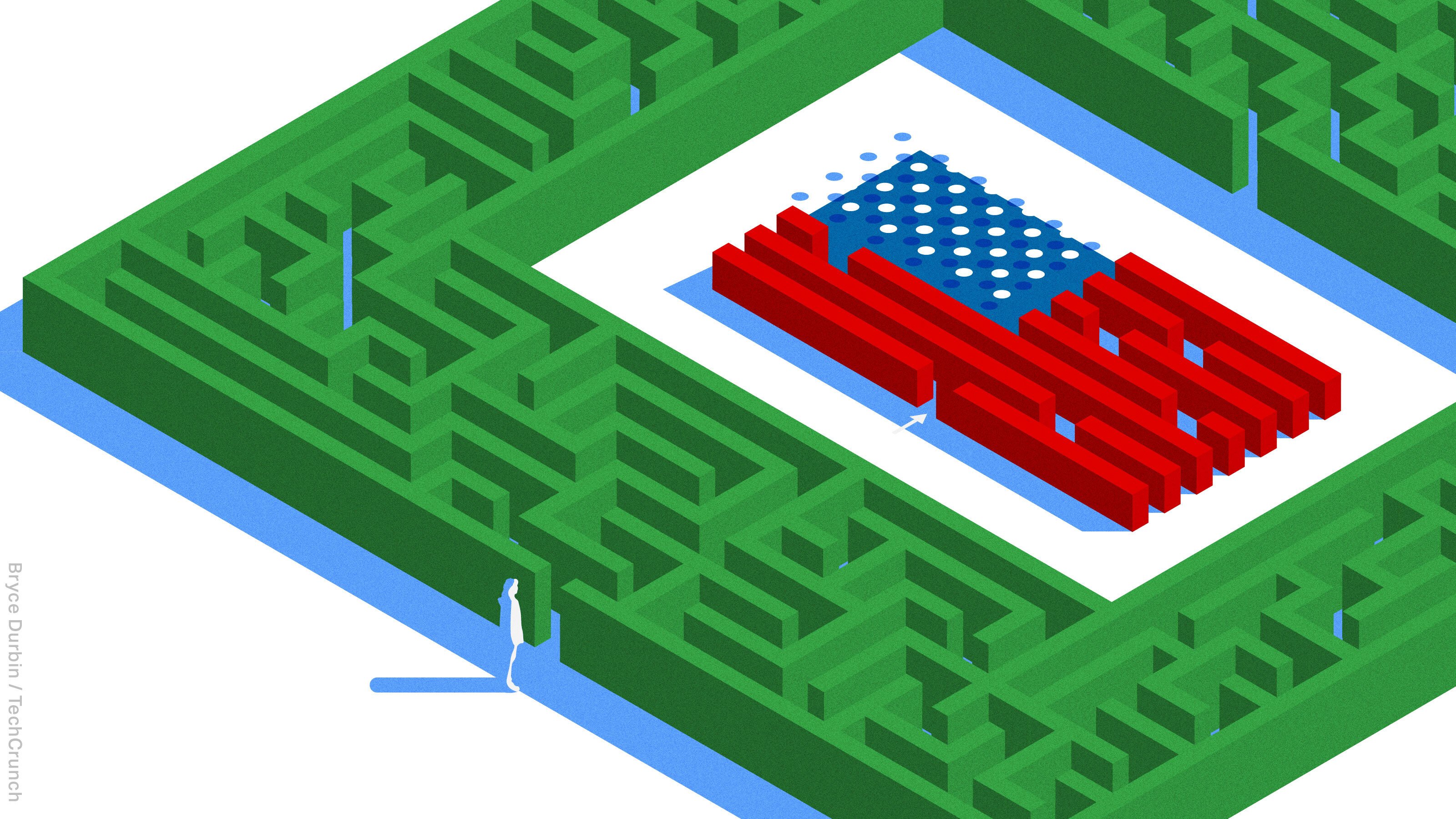

Dear Sophie: Extraordinary preparation for last minute H-1B, O-1A and EB-1A credentials

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

How many people will employers register in the H-1B lottery this year? Will there be fewer because of all the layoffs?

Is it still possible to include additional candidates before the deadline next week?

— Fast-paced founder

Dear Sophie,

Can I enhance my portfolio of achievements to establish my qualifications for an O-1A Extraordinary Ability Visa and then a self-applied EB-1A Green Card if I am in the US but do not yet have a work permit?

— Serious and exceptional

7 investors reveal what’s hot in fintech in Q1 2023

money coins in a heap

How are fintech investors adapting during this downturn and how are they advising founders on their portfolios?

Mary Ann Azevedo interviewed seven venture capitalists to ask how (or if) any have changed their thesis to accommodate current macroeconomic trends and learn more about the types of opportunities they’re looking for right now:

- Charles Birnbaum, Partner, Bessemer Venture Partners

- Aunkur Arya, Partner, Menlo Ventures

- Ansaf Kareem, Venture Partner, Lightspeed Venture Partners

- Emmalyn Shaw, Managing Partner, Flourish Ventures

- Michael Sidgmore, Partner and Co-Founder, Broadhaven Ventures

- Ruth Foxe Blader, Partner, Anthemis

- Miguel Armaza, Co-Founder and General Partner, Gilgamesh Ventures

NEWSLETTER

NEWSLETTER