Climate change is increasing the risk, rate and cost of sewer system failures. Flooding is becoming more common, causing backups that often overwhelm wastewater treatment systems. Compounding the problem is that American infrastructure is woefully outdated; the epa Dear All that nearly $700 billion in investments are needed to simply maintain existing wastewater, stormwater, and other clean water pipelines over the next 20 years.

Matthew Rosenthal and Billy Gilmartin, both coming from the wastewater treatment industry, saw an opportunity to help solve the problem with technology, at least in a small way. Five years ago, the couple co-founded SewerAIthat leverages ai to automate the types of data capture and defect labeling that make up a sewer inspection.

“Most of the infrastructure was built after World War II and is reaching the end of its useful life, leading to more frequent failures and higher costs,” Rosenthal told TechCrunch. “SewerAI revolutionizes underground infrastructure inspection and management with its ai-powered software-as-a-service platform.”

SewerAI started as a side project of Rosenthal; He had started taking online courses on ai after co-launching two wastewater analysis and services companies. While experimenting with artificial intelligence models to predict sewer defects in inspection videos, Rosenthal enlisted the help of Gilmartin, who at the time worked at a sewer inspection company.

Today, SewerAI, whose customers span municipalities, utilities, and private contractors, sells cloud-based, ai-powered subscription products designed to streamline field inspections and data management of sewer infrastructure. .

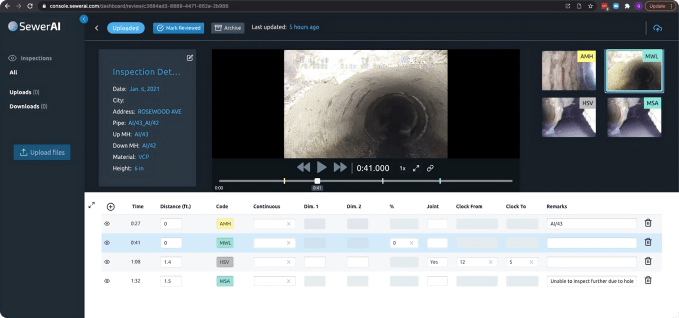

One of those products, Pioneer, allows field inspectors to upload inspection data to the cloud and tag problems, data that project managers can use to plan pipeline repairs. Another tool, AutoCode, automatically labels pipeline and manhole inspections, creating 3D models of infrastructure from video captured with a GoPro or other camera.

“Traditional ones offer on-premise or truck-based software that has seen very little innovation in the last 20 years,” Rosenthal said. “SewerAI technology increases results by enabling more inspections per day at a lower cost.”

SewerAI is not alone in the nascent market for ai-assisted pipeline inspection. The company's rivals include Subterra, which maps, analyzes and forecasts pipeline problems; Clear Object, which offers software that analyzes images of pipeline inspections for damage; and Pallon, which develops algorithms to detect possible problems inside sewers from still images.

What sets SewerAI apart, Rosenthal says, is the quality of its data, specifically the quality of its model training data. Rosenthal says SewerAI has images of inspections of 135 million feet of pipe performed by municipalities and independent contractors. While it's just a fraction of the 6.8 billion feet of sewer pipe in the U.S., it's a large enough data set to train competitive ai for defect detection, Rosenthal says.

“Our products streamline field inspections and data management, allowing customers to proactively manage infrastructure rather than react to emergencies,” Rosenthal said.

SewerAI's sales pitch won over investors like Innovius Capital, who, along with others, invested $15 million in SewerAI's most recent fundraising round. With a total of $25 million raised by SewerAI, the cash will go toward market expansion, ai model training, recruiting, and expanding SewerAI's product portfolio beyond inspection tools.

“SewerAI continues to grow and we are seeing an acceleration in demand for our platform as we enable people to do more with existing budgets, which has led us to close our first seven-figure contracts,” Rosenthal said.

NEWSLETTER

NEWSLETTER