TO court presentation in the case of the US Department of Justice against Google for its alleged monopoly in the search market has revealed some notable data about the state of competition in the search market, including the internal workings, revenues and, in in some cases, the starting prices of potential users. be competitors of Google, such as Duck Duck to win and Neeva, the latter which sold to Snowflake last year after moving to the company.

Google's proposed “Fact Facts” presentation documents the history of search competition, including Google's beginnings, its innovations, the competitive landscape, Google's search ads business, distribution agreements, and more.

Of particular interest to us were the parts that reference web search startups, such as DuckDuckGo and Neeva, and their business developments.

The presentation reveals some details that we already knew about DuckDuckGo; for example, that it has been profitable since 2014 and that its source of Operating income currently is search advertising.that is, search ads provided by Microsoft in the US. However, Google's proposal also attempts to paint a picture of a startup that did not invest in search innovation, but instead focused on returning investment to its shareholders.

As the filing states, DuckDuckGo raised $10 million in 2018, but “most of that money was distributed to DuckDuckGo shareholders,” rather than being used to improve its search engine. When DuckDuckGo raised funding again in 2020, a $100 million round, a percentage of that amount was returned to shareholders again. (The exact percentage was redacted). When shareholders sold shares to various venture capital firms, those funds were not used to improve the search engine, the document argues. But this also contradicts this point: a third of DuckDuckGo's 50 employees in 2018 were working, for example, to improve the search engine.

Image credits: Duck Duck to win

Still, the document notes that, despite DuckDuckGo's profitability, it had not created its own “comprehensive web index” for organic search results, hardly a point in Google's favor. Additionally, when asked if Apple would consider making DuckDuckGo the default in the Safari browser, Apple's senior vice president of services Eddy Cue responded: “No, we didn't… that's not a good option for the clients”. Oh!

DuckDuckGo's business scope is also included. The filing notes that the startup estimated that its search engine was being used by 100 million people worldwide as of 2021. The search engine receives only about 2.5% of general search queries in the US. .US, despite estimates that 10% of people in the US claim to be users. This, DuckDuckGo management explained, is due to the fact that people often use their search engine for some, but not all, of their search queries.

In Europe, DuckDuckGo received just 0.6% of search queries on mobile devices, as of August 2023, even after the introduction of Android's “choice screen”, where it is offered as an option. In total, its share of search queries in Europe ranged between 0.5% and 2.5% in 2023, depending on the country.

Image credit: DuckDuckGo

By presenting these findings, Google hopes to demonstrate that people choose its search engine because it is better and more innovative, not because of its monopolistic share.

It also dismisses DuckDuckGo's approach to privacy as one of its failures, stating that the approach leads to “significant trade-offs for search quality” by not using data such as search sessions, a login experience, and more. If anything, though, these details and others included in the presentation show how difficult it is for a competitor to build a search business that rivals Google's.

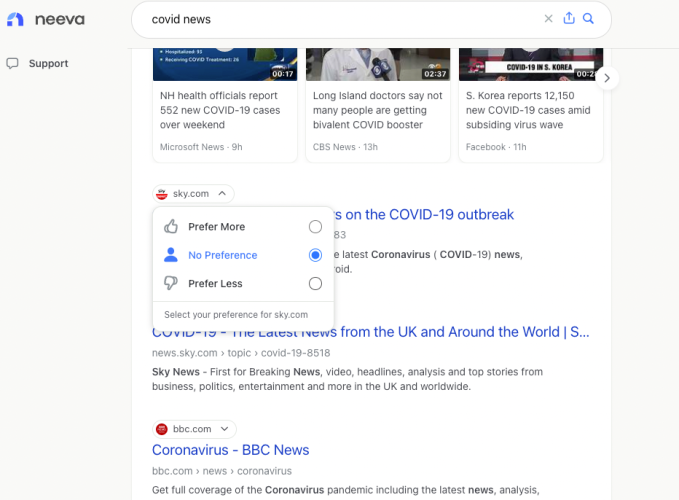

Another startup that serves as an example of that problem is Neeva, the search engine founded in 2019 by former Google employees Sridhar Ramaswamy and Vivek Raghunathan. Neeva originally seemed promising, not only because of its premise, but also because of its founding team. CEO Ramaswamy worked at Google from 2003 to 2018 and held senior positions reporting to the CEO and managing Google's advertising, commerce, search infrastructure and privacy teams, the court document reminds us.

With the team's deep technical knowledge and experience, they came up with a plan to offer consumers an ad-free alternative to Google by generating revenue through subscriptions. By 2022, Neeva said it had amassed more than 600,000 users, but most were not paying customers at that time.

How to deprioritize search results: Neeva

The court filing offers a few more details about Neeva's progression, highlighting funding from major venture capital firms such as Sequoia Capital and Greylock Ventures, in addition to Ramaswamy's own personal investment. The company believed it could compete successfully in search quality in the US and select other markets with only a 2.5% share of overall queries, Ramaswamy had testified during the trial.

The startup began offering results through Microsoft's Bing while developing its own search infrastructure. In 2022, it was using its own techniques to rank web results and was believed to be comparable to Google and better than Bing thanks to the use of machine learning, natural language processing, and other techniques.

To develop and train its machine learning models, it licensed anonymous information in the form of commercially available data sets. Google couldn't claim that Neeva wasn't innovating here. The startup launched a generative ai feature, Neeva ai, last year, which is similar to what Google is now testing with its Generative Search Experience (SGE) in that it also answers some queries directly on results pages. search using ai.

As a result, Neeva was able to attract some users. The filing notes that at its peak, it had “several million unique users per month,” Ramaswamy had said. Unfortunately, its inability to compete with free search ultimately caused the startup to close its consumer business, go corporate, and ultimately abandon Snowflake as it was unable to attract the venture capital funding needed to continue scaling its business.

“My co-founder, Vivek, and I reluctantly came to the conclusion that we couldn't build a business fast enough to be able to continue raising capital to support the growth of the product and the team,” Ramaswamy testified. “Earlier this year, in May (2023), we actually started talks about possible acquisitions in March, but earlier this year, in May, we closed the consumer search engine, refunded the money that customers had paid us and we were acquired by Snowflake, which is an enterprise data company,” he said.

Neeva was generating less than $1 million in subscription revenue at the time and was growing, but it was still a small part of the search market, the document also tells us.

The startup passed on Snowflake for approximately $184.4 million in cash, more than double the amount that had been invested, according to the filing. This figure is slightly higher than previous reports that had put the figure at 150 million dollars.

Although not a startup, the document also addresses the loss of Yahoo's (TechCrunch's parent company) search business, noting that it stopped crawling the web after a 2009 deal with Microsoft for algorithmic search and paid search ads. This partnership allowed Yahoo to reduce its investment in search and focus on other more popular products, such as Yahoo Finance, Yahoo Sports, Yahoo News and Yahoo Mail. (We should note that much of the Yahoo section is redacted.) He adds that Mozilla also had a deal with Yahoo, but abandoned it due to search quality.

With few viable competitors in the search market, Google tries to argue that it competes with other products, such as dedicated mobile applications and websites that offer some specialized type of search, such as Yelp, Airbnb, Amazon, Expedia, Booking. .com, Hotels.com and others. It also aims to compete with ai, such as ChatGPT, and social networks, such as Facebook, Instagram, Pinterest and TikTok (the last three, especially among younger users).

For example, Google vice president of search Liz Reid said in 2021 that “63% of daily TikTok users ages 18 to 24 reported using TikTok as a search engine in the last week.”

It remains to be seen whether or not the court will be swayed by Google's argument that it is not a monopoly on search and, more broadly, search advertising, which is a big part of this case. Google is clearly the winner in the search market, but it's not for a lack of competitors trying to get in, as these examples show. However, the trial had already revealed that Google used its significant resources to maintain its position in the search market, for example by paying Apple $18 billion to be the default search on iPhones. Meanwhile, apple considered buying Bing from Microsoft in 2020 and also had considered making DuckDuckGo the default engine in Safaribefore rejecting the idea of continuing to collect checks from Google.