resiliencea SaaS-based analytics platform that helps companies assess their climate risk and plan their transition to net-zero carbon emissions, has raised $26 million in a Series B funding round.

The increase occurs as ESG (environmental, social and [corporate] governance) startups across the spectrum have continued to raise cash during the downturn, with climate-focused companies appearing to be doing particularly well. According to Bloomberg dataVenture capital (VC) and private equity financing broke through to 539 deals in the third quarter of 2022, just a fraction less than the 547 climate-related financing deals in the previous three months.

Separately, PwC State of Climate Technology 2022 The report found that more than a quarter of every VC dollar spent in 2022 went to climate technology, totaling around $15-20 billion per quarter, a figure that is roughly comparable to the last year.

Of course, there’s a good reason why climate tech has perhaps been a little more resilient to economic headwinds than other sectors. The global climate catastrophe is somewhere near the top of the agenda in many political and business spheres, with increasing pressure on corporations to tackle their carbon emissions and do their part to counter their impact on climate change. And capturing the right kind of data and generating insights is critical to this.

“Organizations are struggling to understand and quantify how climate risk financially impacts their business and plan their path to net zero,” Rislience CEO Dr. Andrew Coburn told TechCrunch. “As we move towards a low-carbon economy, companies face near-term transition risks, such as regulatory changes and climate-related litigation; and long-term physical risks, such as floods and weather events.”

digital twins

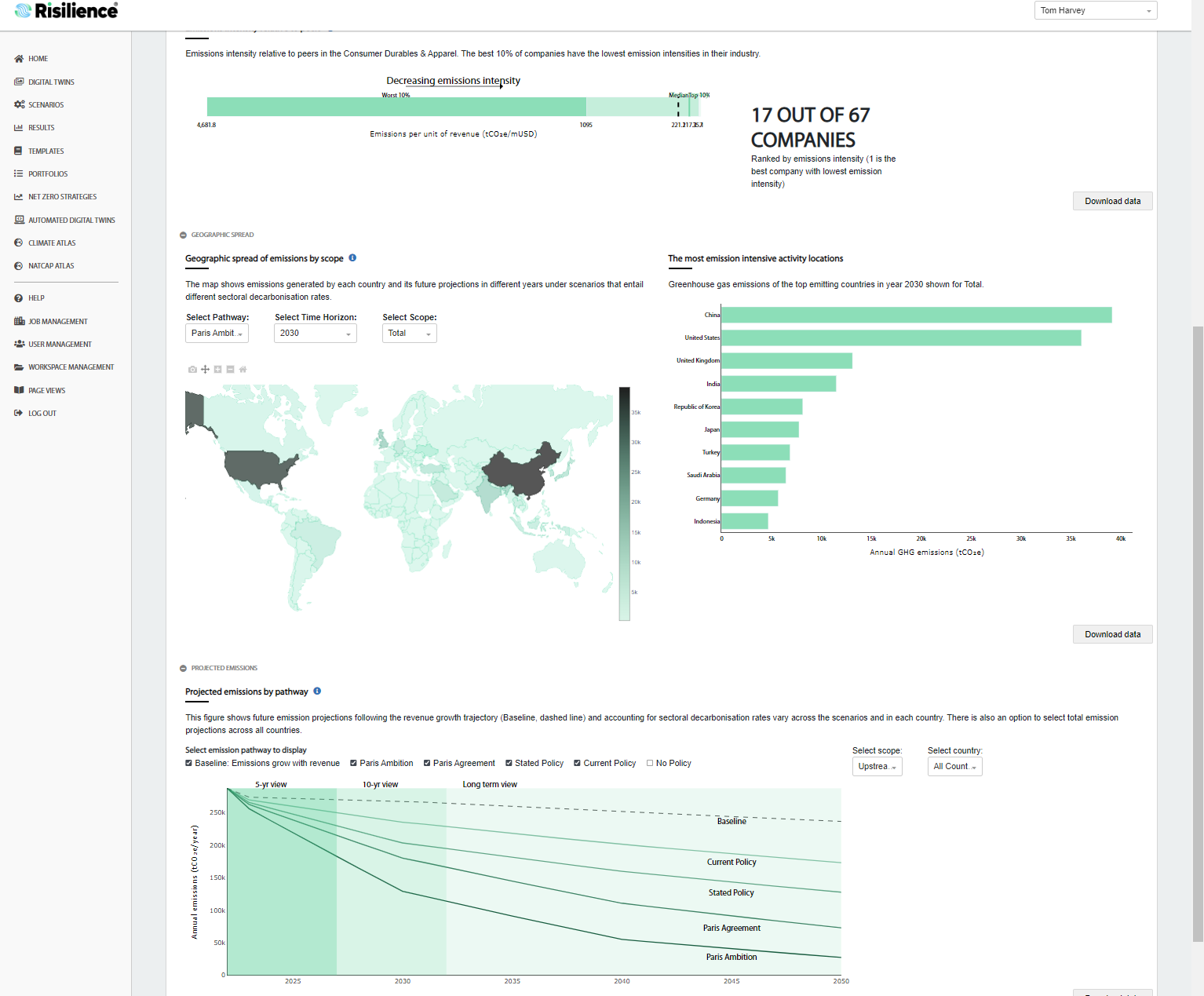

Risilience, in a nutshell, promises to enable companies to “turn data into actionable insights” and measure the (potential) impact of climate-related risks to their businesses. For example, the company has created “digital twin” technology that allows companies to connect their own internal systems and databases to visualize and “stress test” the impact of a myriad of “risks,” which in addition to weather events can include increased regulations, litigation, and even evolving customer sentiment.

By way of example, the United States Securities and Exchange Commission (SEC) has proposed new rules that would require companies to disclose any risks to their business related to climate change when filing updates for investors.

“Large organizations face many challenges when it comes to disclosing their impact on the environment,” Rislience CEO Dr. Andrew Coburn explained to TechCrunch. “With the threat of greenwashing and increasing pressure from investors, reporting needs to be very accurate, but with increasing regulatory pressure on companies to disclose this information, they need to act quickly.”

Ultimately, Risilience is about helping companies move towards low-carbon operations while minimizing the impact on profitability while enabling them to accurately report to all stakeholders.

“Another common problem is that net zero promises are made without a detailed plan for how to get there,” Coburn added. “Risilience provides the crucial information needed to form this blueprint that is updated based on the ever-changing landscape organizations face.”

resilience in action image credits: resilience

Emerged from the University of Cambridge Risk Studies Center (CCRS) in 2021, Risilience says it has already amassed a number of high-profile business clients, including Nestlé, Maersk, EasyJet, Burberry and Tesco.

Before now, Risilience had raised £6 million ($7.4 million) in a Series A round in 2021And with another $26 million in the bank, the company said it will use the fresh cash injection to fuel international growth with a particular focus on the US market.

Risilience’s Series B round was led by Quantum Innovation Fund, with the participation of Partners of IQ Capital and National Grid.