Nvidia and Amazon Web Services, Amazon's lucrative cloud arm, have a lot in common. To begin with, his main businesses arose from a happy accident. For AWS, he realized he could sell the internal services (storage, compute, and memory) that he had built in-house. For Nvidia, it was the fact that the GPU, created for gaming, was also suitable ai-chips/?redirectURL=https%3A%2F%2Fwww.wired.com%2Fstory%2Fnvidia-ai-chips%2F” target=”_blank” rel=”noopener”>to process ai workloads.

That ultimately led to explosive revenue growth in recent quarters. Nvidia's revenue has grown by triple digits, going from $7.1 billion in the first quarter of 2024 to $22.1 billion in the fourth quarter of 2024. It's a pretty surprising trajectory, although the vast majority of that growth came in the company's data center business.

While Amazon has never experienced that kind of intense growth, it has consistently been a huge revenue driver for the e-commerce giant, and both companies have experienced first-to-market advantage. However, over the years, Microsoft and Google have joined the market creating the big three cloud providers, and other chip makers are expected to start gaining significant market share as well, even as revenues continue to grow. in the next years. several years.

It is clear that both companies were in the right place at the right time. When web and mobile applications began to emerge around 2010, the cloud provided on-demand resources. Enterprises soon began to see the value of moving workloads or building applications to the cloud, rather than running their own data centers. Similarly, the takeoff of ai in the last decade, and large language models more recently, coincided with the explosion in the use of GPUs to process these workloads.

Over the years, AWS has become a tremendously profitable business, currently with a run rate approaching $100 billion, a business that even apart from Amazon would be a highly successful company. But AWS's growth has begun to slow, even as Nvidia's takes off. It's partly the law of large numbers, something that will eventually affect Nvidia as well.

The question is whether Nvidia can sustain that growth to become a long-term revenue powerhouse like AWS has been for Amazon. If the GPU market starts to shrink, Nvidia has other businesses, but as this chart shows, they are much smaller revenue generators that are growing much more slowly than the current GPU data center business.

Image credits: NVIDIA

The short-term financial outlook

As the chart above points out, Nvida's revenue growth has been astronomical in recent quarters. And according to Nvidia and Wall Street analysts, this will continue.

In his recent earnings report Covering the fourth quarter of its fiscal 2024 (the three months ending January 31, 2024), Nvidia told its investors that it anticipates revenue of $24 billion in its current quarter (first quarter of FY25 ). Compared to the first quarter of last year, Nvidia expects to record growth of around 234%.

It's just not a figure we often see in mature public companies. However, given the company's huge revenue growth in recent quarters, its growth rate is expected to slow. From a 22% revenue increase between the third and fourth quarters of its recently concluded fiscal year, Nvidia anticipates a more modest 8.6% growth rate from the final quarter of its fiscal 2024 to the first quarter of its year. fiscal 2025. Certainly, in a year- Comparing throughout the year and without looking back to just three months, Nvidia's growth rate is still incredible for the current period. But there are other growth declines on the horizon.

For example, analysts expect Nvidia to generate revenue of $110.5 billion in its current fiscal year, up just over 81% from the previous year's results. That's dramatically lower than the 126% gain it posted in its recently concluded fiscal 2024.

To which we ask: So what? For at least the next few quarters, Nvidia is expected to continue growing its revenue past the $100 billion annual run rate mark, impressive for a company that in the prior-year period today posted total revenue of just $7. .19 billion.

In short, analysts, and to a more modest degree Nvidia, see huge periods of growth ahead for the company, even if some of the surprising revenue growth numbers will slow this calendar year. It is not clear what will happen in a slightly longer period of time.

Momentum ahead

It looks like ai could be the gift that keeps on giving to Nvidia for years to come, even as more competition begins to emerge from AMD, Intel, and other chipmakers. Like AWS, Nvidia will eventually face tougher competition, but right now it controls so much of the market that it can afford to give up some.

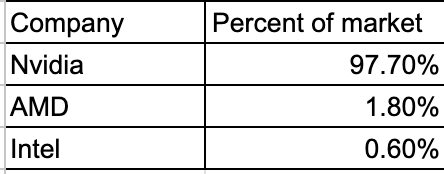

If we look at it only at the chip level, not at the board level or other adjacencies, IDC shows that Nvidia is firmly in control:

Image credits: IDC

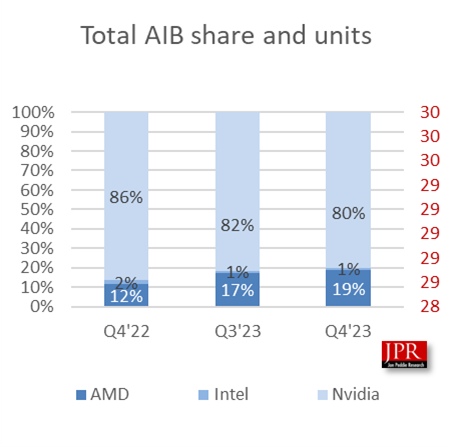

If you look at the board level with these market share figures from Jon Peddie Research (JPR), a company that tracks the GPU market, while Nvidia still dominates, AMD is getting stronger:

Image credits: Research by Jon Peddie

C Robert Dow, an analyst at JPR, says some of these fluctuations have to do with the timing of new products being introduced. “AMD gains percentage points here and there depending on market cycles (when new cards are introduced) and inventory levels, but Nvidia has been in a dominant position for years, and that will continue,” Dow told TechCrunch.

Shane Rau, an IDC analyst who follows the silicon market, also expects the dominance to continue, even as trends shift and change. “There are trends and countertrends, the markets Nvidia participates in are large and growing, and the growth will continue, at least for another five years,” Rau said.

Part of the reason is that Nvidia is selling more than just the chip itself. “They will sell you boards, systems, software, services and time on one of their own supercomputers. So any of those markets are big and growing and Nvidia is attached to all of them,” he stated.

But not everyone sees Nvidia as an unstoppable force. David Linthicum, author and longtime cloud consultant, says GPUs aren't always needed, and businesses are starting to realize that. “They say they need GPUs. I look at it, do some back-of-the-envelope calculations, and they don't need it. The CPUs are perfectly fine,” he said.

As this happens, he believes Nvidia will begin to slow down and the competition will lose its position in the market. “I think we will see Nvidia become a weaker player in the coming years. And we are going to see that because too many substitutes are being built.”

Rau says other vendors will also benefit as companies expand ai use cases with Nvidia products. “What I think we will see in the future are growing markets that will create tailwinds for Nvidia. But then there will be other companies that will also follow those tailwinds and that will particularly benefit from ai.”

It is also possible that some disruptive force could come into play and that would be a positive outcome to prevent a company from becoming too dominant. “You almost expect disruption because that's how markets and capitalism work best, right? Someone gets an early lead, other suppliers follow, and the market grows. You get established players, who eventually get disrupted by a better way of doing the same thing within their market or within adjacent markets that are intersecting with yours,” Rau said.

In fact, we're starting to see that happen at Amazon as Microsoft gains traction through its relationship with OpenAI and Amazon is forced to play catch-up when it comes to ai. Whatever happens with Nvidia in the long term, right now it's firmly in the driver's seat, making money hand over fist, dominating a growing market, and making almost everything go its way. But that doesn't mean it will always be this way or that there won't be more competitive pressure in the future.

NEWSLETTER

NEWSLETTER