There is a longstanding debate in the world of logistics robotics. On one side are the new people, who insist that the best possible experience is one built from the ground up, with these automated systems at its core. Brownfield advocates, on the other hand, point to the time and money needed for a complete rebuild. Many companies looking to automate their warehouses simply don’t have the resources to start from scratch effectively.

Most people eventually land on some combination of these approaches. After all, no one size fits all. This morning, Nimble announces plans for his own third-way commitment. It is a method that allows companies to effectively outsource their warehousing needs through fully automated third-party logistics (3PL) factories.

Founder and CEO Simon Kalouche says Nimble’s new model wasn’t the goal when the robotic pick and pack automation company launched in 2017. “It evolved as we learned about the industry,” he tells TechCrunch. . “I’ve been to hundreds of warehouses now, and as I’ve gone to more and more, I’ve learned that everyone is automating almost every part of the warehouse, but picking is still the hardest part. Until you automate picking, you need people in the warehouse. You need to make warehouses ergonomic, safe, and OSHA compliant for people. When you automate the selection step, you remove all those restrictions.”

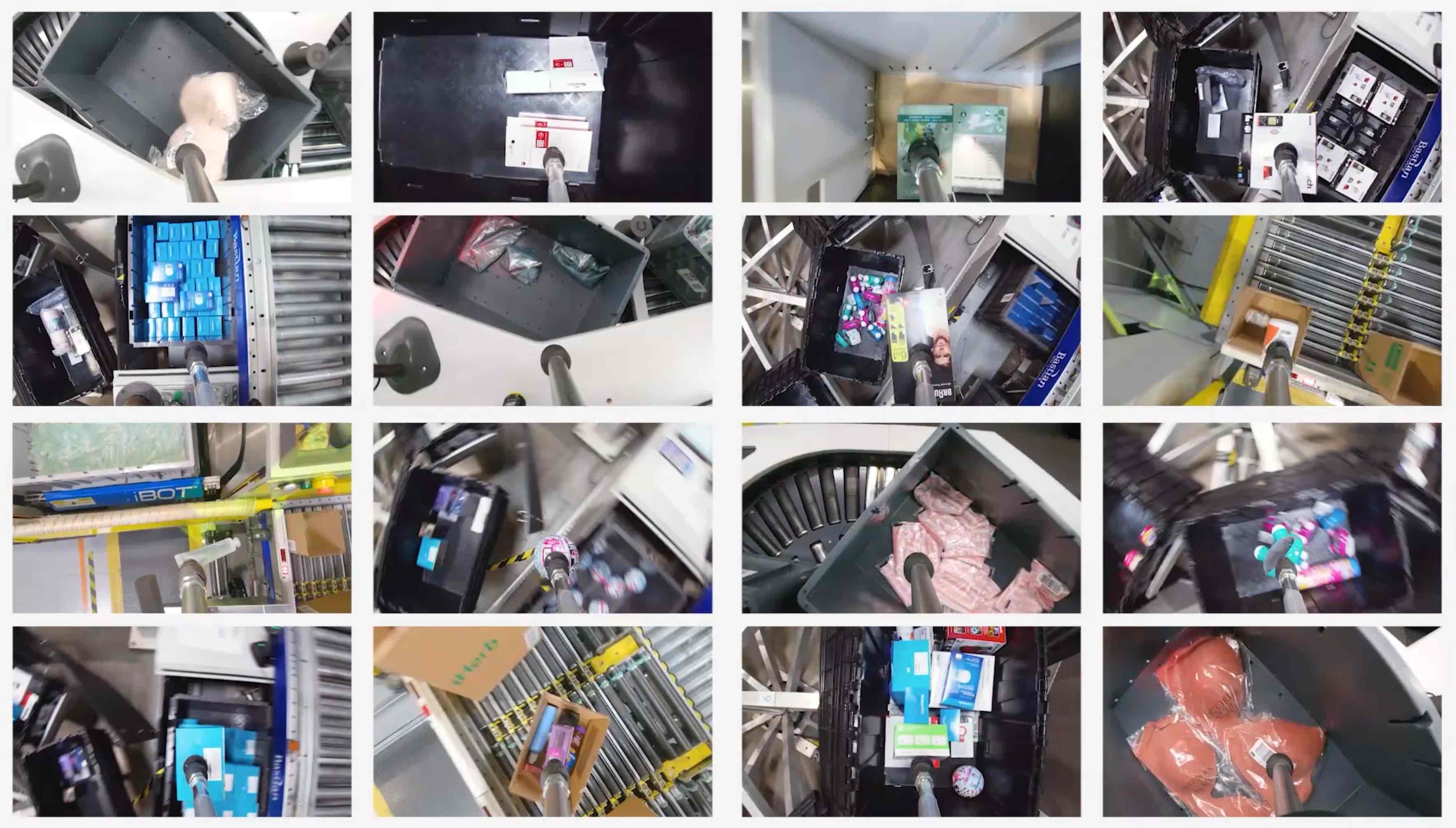

Image Credits: Agile

Kalouche says the company has already started operating its own third-party fulfillment centers, quietly opening the first about a year ago. It won’t reveal how many are currently online, just that the number is “between one and 10” and the locations are geographically dispersed across the US. In its press material, the company explains that its “intelligent robotic compliance systems will collect, pack and ship e-commerce orders while reducing warehouse size by up to 75% Nimble’s robotic warehouse network will provide brands with coverage of more than 96% of the US population in one or two days and up to 40% click-to-collect savings compared to legacy 3PL providers.”

While it’s not quite the same day, it does bring online retailers one step closer to what they want most these days, something that may help level the playing field against Amazon’s 800-pound gorilla. That’s the promise of big-time third-party warehouse automation, though Amazon has its own growing army of robots.

The advantage of Nimble is the prevalence of autonomous systems. Kalouche points out that he still hasn’t achieved a fully shutdown factory. “There are still manual operations,” he says. “Our goal is to work towards the dark warehouse. We’re still working towards it, but we’re not there yet. But picking is an automated function.”

There are, of course, broader implications for American factories moving in the direction of top-down automation. Kalouche cites Amazon recent report that its pool of human workers is drying up, and many warehouse managers have similarly complained about hiring difficulties in the shadow of the pandemic. But there is a real difference between partial and full automation when it comes to the job market.

Image Credits: Agile

The decentralized nature of the fulfillment center goes a long way toward speeding up delivery by bringing products closer to customers. Kalouche says the company is taking a controlled and deliberate approach to the number of warehouses. The ultimate goal is to work with a wide range of different business sizes, from businesses to Etsy sellers (his own hypothesis was Shopify merchants, but I prefer alliteration), and the ability to serve multiple customers in a single factory should help. .

Meanwhile, Nimble is targeting mid-market retailers, though it won’t reveal the names of any of those customers. Again, let’s say somewhere between Walmart and your cousin’s eBay store. Nimble will continue to support existing customers, but the launch of this robotic fulfillment finds it a major departure from its previous model of modernizing existing warehouses.

The startup’s growth is being fueled, in part, by a $65 million Series B led by Cedar Pine that also includes DNS Capital, GSR Ventures and Breyer Capital. That follows a $50 million Series A almost exactly too many years ago, bringing his total funding to around $110 million. Nimble isn’t ready to talk valuation yet.

“As e-commerce and warehouse automation continue to exhibit incredible growth, we were drawn to AgileCedar Pines’ industry-leading AI robotics technology and 3PL compliance capabilities,” Cedar Pines’ Stephen Weiss said in a statement related to the news. “Our robust due diligence process demonstrated that Agile has a clear technological advantage over the incumbents and has an extraordinary opportunity to be the next generation leader in the industry.”

As with its warehouse growth, Nimble is taking a measured approach to growing its workforce of approximately 100 people. “We are being cautious,” says Kalouche. “We’re not trying to triple the headcount in the next year, but we are hiring.”

NEWSLETTER

NEWSLETTER