Nubank is taking its first tentative steps into the mobile networking space, as the NYSE-listed Brazilian neobank launches an eSIM (embedded SIM) service for travelers. The service will give customers access to 10GB of free roaming internet in over 40 countries without having to change their own physical SIM card or existing eSIM.

The launch comes shortly after the news. emerged for the first time that the National Telecommunications Agency of Brazil (ANATEL) had quietly given the green light to plans for Nubank to become a mobile virtual network operator (MVNO) in partnership with the wireless giant Clear. While that plan is still in the early stages and Nubank has not confirmed any of the launch details (the company also declined to comment for this article), we can now confirm that it is at least tiptoeing into the sphere of mobile networks, a growing trend within the fintech fraternity.

From neobanks to neo-OMVs

Neobanks, a new generation of financial institutions that serve as digital-native challenges to established banks, follow in the footsteps of traditional banks by offering ancillary services to target new customers, such as budgeting tools, spending data and information, and easy access to the stock market. While Neobanks have emerged In popularity, so has the MVNO (mobile virtual network operator) market, driven by the rise of eSIM, the cloud and the proliferation of third-party software that makes all-digital distribution strategies a piece of cake.

Nubank is at the intersection of these trends.

The Brazilian company, founded 10 years ago, has been booming lately: its valuation rose around 170% last year and hit an all-time high of $58 billion in March. The company went from a net loss of $9 million in 2022 to a net profit of $1 billion last yeara trend that will continue until 2024 with record income in the first quarter and Its net profit has more than doubled over the corresponding period of the previous year. Nubank also passed 100 million customers in its core markets of Brazil, Mexico and Colombia, where it operates a range of services including bank accounts, credit cards, loans, insurance, investments and now a mobile data service for travelers.

The new service is aimed at customers of Nubank Ultravioleta premium subscription launched three years ago with bundled benefits like insurance, higher credit limits, cash back, family accounts and more.

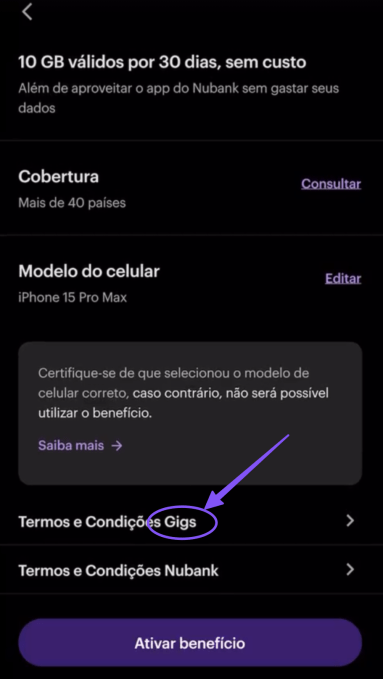

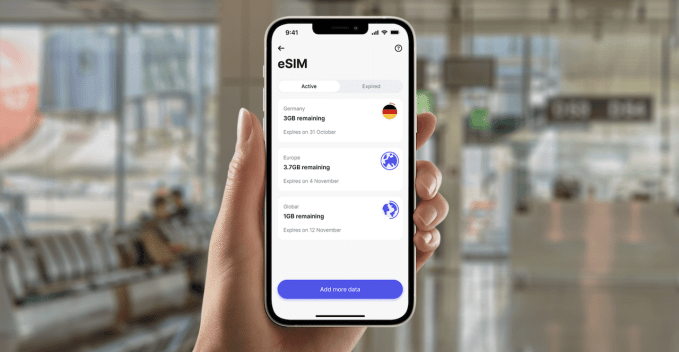

Last month, Nubank revealed that it was enter the travel sector with the imminent launch of a new “global account,” partnering with European fintech Wise to offer Ultravioleta subscribers low-cost international money transfers. As part of this, the company is now launching an eSIM service for those with compatible smartphones, with 10GB of data for travelers in the US, Latin America and Europe. The eSIM is activated through the Nubank app, with the underlying infrastructure powered by Eventsa platform that gives budding mobile network providers everything they need through a single API – basically what Stripe has been doing in finance, but for mobile plans.

Gigs is backed by companies like Gradient Ventures, Google's early-stage venture capital arm, and Uber CEO Dara Khosrowshahi.

“Combining mobile plans represents a powerful lever for neobanks to convert irregular users into paying monthly subscribers, encourage upgrades to premium features, and create an ecosystem where banking acts as a hub for multiple value-added services,” he said. the co-founder and CEO of Gigs. Hermann Frank he told TechCrunch.

The launch of Nubank echoes moves elsewhere in the fintech fray. In February, Revolut – a $25 billion UK Neobank launched a similar eSIM service for premium subscribers. And last year, the Indian neobank Zolve also aggregated mobile networks to its arsenal of services so that immigrants can not only have their banks set up before arriving in the US, but also have a Mobile service ready to go on arrival too.

This highlights the synergies between financial services and mobile communications: both are essential to how people function today, but both traditionally face similar obstacles, particularly for those arriving in a country for the first time. We have seen operators launching banking services as T-Mobile has done in the US with T-Mobile Moneywhile traditional banks have also gone in the opposite direction, as demonstrated by Banco Inter of Brazil and Standard bank in South Africa both have launched their own MVNO services.

“Our banking interaction today already focuses on our mobile number, whether for banking operations or for security checks.” Allan T. Rasmussen, a consultant, analyst and MVNO specialist in the telecommunications industry explained to TechCrunch. “Mobile operators are entering the banking business, trying to become banks themselves, and traditional banks and fintechs are doing the same by becoming MVNOs.”

But neobanks, in particular, are synergistic with MVNOs: both are “virtual,” and technology plays an important role in their respective offerings, often with only online support and account access. They are also marketed with lower overhead costs, which gives them greater agility and the ability to offer lower prices than traditional ones. And as we've seen with Revolut and now Nubank, eSIM is driving this cross-pollination even further, as they fight for shared minds, revenues and access to customer data and touchpoints.

“To be successful as an MVNO, you need a distribution channel; that is the first test of your proposal to an operator.” James Graygeneral director of telecommunications industry consulting gray stone strategy, he told TechCrunch. “Banks already have this in commercial banking or through websites and apps. However, the recent move by Revolut (and I suspect other neobanks in the future) is interesting because they are not traditional organisations. Their whole mission is to challenge the status quo and they are doing it very successfully in banking, so why not a merger of banking and telecoms? “They have the channels and the brand appeal.”

MVN… right?

One small drawback: neobanks are not really positioning themselves as MVNOs with their new eSIM travel services. A Revolut spokesperson told TechCrunch in February: “Revolut will not become an MVNO but has partnered with 1Global “which brings together many MVNOs and roaming access agreements on a single network to create a global footprint of the best operators.”

MVNOs are standalone mobile services built on top of operators' infrastructure, and there are many different mobile virtual network enablers (MVNE) and aggregators (MVNA) (such as 1Global) that help companies launch mobile networks, taking care of SIM provisioning , billing and so on. as. Although Revolut does not offer voice or SMS, nor does it assign a phone number, it still relies on the operator's infrastructure through an MVNE to offer a own-brand mobile data service, which sounds a lot like Revolut becoming a MVNO.

But calling itself an MVNO could require additional regulatory oversight. Although banks are already strictly regulated as financial institutions, being classified as telecommunications companies would likely trigger greater regulatory obligations. This is something we are seeing right now in the US, with the Federal Communications Commission (FCC). trying to determine whether connected cars should be classified as MVNOsfollowing a technology/fcc-car-apps-stalking.html”>New York Times report about how abusive partners use connected cars to track their victims.

While Nubank is preparing to launch an MVNO service in Brazil, its travel eSIM service is easier to bring to market due to its partnership with Gigs, as that partner takes on all the regulatory compliance complexities that come with the territory.

“Telecommunications is a highly regulated industry in every country, and a key part of Gigs' end-to-end value proposition is that we abstract away all the regulatory complexity for our customers,” Frank said. “To do this, Gigs almost always acts as the authorized registered operator, meaning the burden of compliance falls on Gigs and not our customers. “This allows our customers to launch their own mobile service, without legally becoming providers in a regulated industry.”

NEWSLETTER

NEWSLETTER