Owna Mexico-based employee wellness company, has secured $30 million in new funding as it continues to build out its rewards and gamified features, including saving or completing financial education courses, while improving retention for employers.

The company’s co-founder and CEO, Nima Pourshasb, told TechCrunch that 80% of Mexicans live paycheck to paycheck with no savings, while a third often need to borrow to cover basic and recurring expenses.

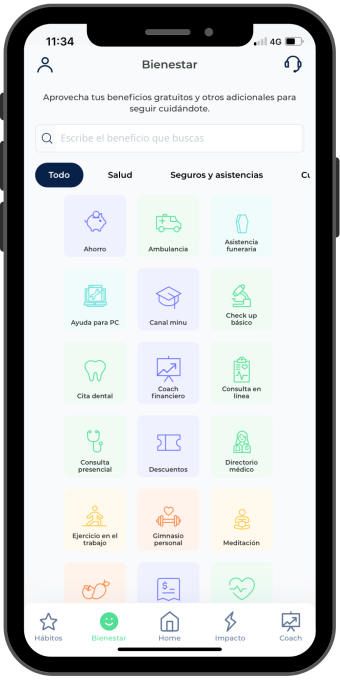

Minu Employee Wellness and Financial Apps Image Credits: Own

“The pandemic was a big part of the more humanistic approach to taking care of employees,” Pourshasb said. “We saw a market movement towards employee wellness and the use of technology to improve quality of life – the financial, physical and mental health of employees.”

He also explained that Mexican regulations helped: The country passed a law, known as name 35that forces companies to monitor the stress of their employees and have mechanisms to help them.

“The main source of stress is usually financial, so it has been a big boost,” Pourshasb added.

The new capital is a combination of $10 million in a bridge round from Coppel Capital, Besant Capital and Enea Capital, as well as existing investors FinTech Collective, QED and Salkantay, and $20 million of debt from Accial Capital. In total, Minu raised $50 million.

Pourshasb declined to disclose Minu’s valuation, but did say that with the new funds, the company has 22-month autonomy.

In 2021, my colleague Mary Ann Azevedo profiled Minu when it raised $14 million in Series A funding. Back then, the pay-on-demand company, founded by Pourshasb, Rafael Niell, and Paolo Rizzi, was working with 100 enterprise clients and only had a product, Wage Access, which offers instant access to employee wages for a flat $2 withdrawal. rate.

Almost two years later, Minu has more than 300 business clients, such as Grupo Modelo, Coppel and Cinemex, and its revenues grew more than five times between 2021 and 2022.

Also new is a SaaS subscription model where half of its revenue is now generated, paid for by employees, so it’s free for employees to take advantage of now 30+ benefits including health and mental health access to through telemedicine, insurance discounts, financial services. education, bill pay and virtual fitness classes.

In addition, Minu has a new credit union as a service that allows employers to offer savings starting at 8% for fully liquid deposits and fast, cheap loans. That compares to the 400% APR for a loan at a traditional Mexican bank.

Employees who consume financial education or fitness and mediation content can earn rewards such as higher savings percentages and life insurance dollar amounts.

In the meantime, the company intends to use the new capital to continue customer distribution and continued development of its employee wellness platform to include more modules for HR and CFOs. Minu will continue its focus in Mexico, expanding to Monterrey, Guadalajara and Yucatán.

“Mexico is where we see great opportunities,” Pourshasb said. “The greatest opportunity for us is to continue expanding geographically within Mexico with companies of all sizes, continuing to take advantage of the great inertia and positioning that we have in the market.”

NEWSLETTER

NEWSLETTER