Introduction: Elon Musk tells BBC that Twitter is roughly breaking even

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Elon Musk has revealed Twitter is “roughly breaking even”, saying advertisers are returning after many quit following his takeover of the social media site.

In an interview with the BBC, on Twitter Spaces, Musk also said the criticism he’s faced recently has been “rough”.

Asked if he had any regrets after buying Twitter for $44bn last year, Musk said the pain level of Twitter has been “extremely high”, and that owning the company hasn’t been “some sort of party”.

Musk said:

So, it’s been really quite a stressful situation, for the last several months. Not an easy one.

He said that “of course” many mistakes had been made along the way, but argued that “all’s well that ends well”.

As Musk put it:

I feel like we’re headed to a good place. We’re roughly break-even, I think we’re trending towards being cashflow positive very soon, literally in a matter of months.

The advertisers are returning.

Musk, who cut almost half of Twitter’s workforce last autumn, said cutting the workforce had not been easy.

He said the company has made improvements to its recommended tweets, following feedback after Twitter made its recommendation algorithm open source.

Overall I think the trend is very good.

Elon Musk, boss of Twitter and CEO of Tesla and SpaceX, gives an interview to the BBC.

The billionaire admits he only bought Twitter because he had to, and describes running the firm as “quite painful” and “a rollercoaster”.https://t.co/zj6h1L9q4M pic.twitter.com/u0tXrbZSEI

— BBC Breakfast (@BBCBreakfast) April 12, 2023

Musk also opened up about why, in February, he had tweeted that he wouldn’t wish the pain of running Twitter on anyone.

Musk said he had been “under constant attack”, which hurt as he doesn’t have “a stone-cold heart”.

If you’re under constant criticism and attack, and that gets fed to you non-stop, including through Twitter, it’s rough.

But it’s important to get negative feedback, he added. Musk says he doesn’t turn off replies, and doesn’t block anyone on Twitter either.

So I get a lot of negative feedback.

Also coming up today

Investors are awaiting the latest US inflation data today, which may show that the cost of living squeeze eased last month.

The US consumer prices index is expected to have risen by 5.2% in the year to March, down from 6% in February. A sharp fall could encourage the US Federal Reserve to end its interest rate increases, which would be welcomed by traders.

The IMF will release its Fiscal Monitor, assessing public finances at countries around the world, today, after yesterday predicting the UK’s economy will shrink this year.

The agenda

-

Noon: US weekly mortgage applications

-

1pm BST: IMF publishes its Fiscal Monitor

-

1.30pm BST: US inflation report released

-

2pm BST: Bank of England governor Andrew Bailey speaks on ‘The shifting risk landscape’ at the Institute of International Finance in Washington DC

-

3pm BST: Bank of Canada’s interest rate decision

-

7pm BST: Federal Reserve’s FOMC releases minutes of its last meeting

Key events

Meanwhile in the US, demand for mortgages rose last week as the cost of borrowing eased.

Mortgage applications increased 5.3% last week, according to data from the Mortgage Bankers Association. This was driven by an 8% rise in applications to purchase a home, while refinancing requests flat.

The increase in demand came as the average interest rates on fixed-term loans fell, as the US jobs market slowed – which could encourage the US Federal Reserve to slow its interest rate increases.

Mike Fratantoni, MBA’s chief economist, explains:

“Incoming data last week showed that the job market is beginning to slow, which led to the 30-year fixed rate decreasing to 6.30 percent – the lowest level in two months.

“Prospective homebuyers this year have been quite sensitive to any drop in mortgage rates, and that played out last week with purchase applications increasing by 8 percent.

Thousands of UK households have a decision to make ahead of a bumper remortgaging deadline, Bloomberg UK reports today.

Borrowers have a dilemma – whether to lock in a pricier fixed-rate deal or bet on a Bank of England rate cut.

Bloomberg explains:

As many as 56,220 two-year fixed-rate mortgages are due to expire in September, according to data from industry body UK Finance. That’s on the back of a flurry of sales in September 2021 when homebuyers were racing to complete deals before a stamp duty holiday ended.

Mortgage holders can typically secure new deals up to six months before their fixed-rate loans expire. Since January, as many as 71,100 households have been shopping for deals ahead of another crowded deadline in June, tied to a separate sales rush in 2021.

More here: Britain’s Remortgaging Pain Is Only Getting Started

UK Base Rate is currently 4.25%, and the markets expect the Bank of England to raise it again to 4.5% in May… and keep it there until at least the end of the year.

Holidaymakers have been warned to look out for fraudsters advertising bogus travel deals and exploiting passport delays, PA Media reports.

The Chartered Trading Standards Institute (CTSI) warned that scammers were using increasingly sophisticated and convincing methods to dupe potential travellers into paying for non-existent holidays and services.

These included “entirely fabricated” social media ads featuring attractive pictures of holiday cottages and hotels accompanied by “too good to be true” prices.

By the time holidaymakers realised that the pictures and prices were fake, scammers had taken their money and disappeared, the CTSI warned.

In many cases scammers told their victims to pay by cash, via bank transfer or through services such as Western Union, which were difficult to trace and non-refundable.

Often victims did not realise they had been scammed until they arrived at the airport to find their flight reservation did not exist, or at a hotel to discover there was no record of their booking.

FTSE 100 hits one-month high

Britain’s blue-chip share index has risen to a one-month high this morning.

The FTSE 100 has gained 0.6% or 46 points to 7,831, the highest since 10th March – the day in which Silicon Valley Bank collapsed.

It’s on track for its fourth daily rise in a row, and the 10th in the last 11 sessions.

The upcoming US inflation figures are the key thing dominating the agenda today, says Russ Mould, investment director at AJ Bell.

Mould explains:

Markets have recently taken the view that the Fed needs to ensure stability in the financial system following the banking crisis. That means easing back on rate hikes which could topple the economy,” says

“However, the reason why rates have been going up so fast over the past 12 months is down to rising inflation, so today’s update on the cost of living in March will still matter to the Fed and its monetary policy. The consensus forecast is a 5.6% rise in core inflation year-on-year, up slightly on February’s 5.5% reading.

British homes sales recovered to within a whisker of pre-pandemic levels in March, data from property website Rightmove shows.

According to Rightmove, the number of sales agreed between sellers and buyers returned to pre-pandemic level last month, for the first time since September.

Sales were just 1% lower last month than in March 2019 as borrowing costs edged down from their leap after the September ‘mini-budget’.

That suggests the housing market is recovering from the turmoil last autumn.

Rightmove’s property expert Tim Bannister said:

“The market is remaining surprisingly robust given the economic headwinds that have affected movers over the last six months.

While the market is by no means at the exceptional level it has been over the last couple of years, it is a positive sign for agents that sales at a national level are being agreed at the same rate as the last more normal market of 2019, though there are regional differences across Great Britain.

European stock markets are rallying this morning, as investors put last month’s banking crisis behind them.

In Paris, the CAC 40 index of leading French shares has hit a record high, despite the ongoing protests against president Macron’s pension changes.

Shares are picking up ahead of the next US inflation report, due at 1.30pm UK time.

Pierre Veyret, technical analyst at ActivTrades, says:

Investor appetite for risk continues to rise, pushing the STOXX-50 index towards a new annual high and the French CAC-40 to a new historical summit, mostly led by energy, utilities, real estate and luxury shares.

Traders remain remarkably positive despite recession worries, inflation fears and the prospect of dented corporate profits for the next earning season starting on Friday.

Il CAC40 borsa di Parigi spacca nuovi record! Ricordiamoci che l’inflazione è un grande contributore del rialzo delle borse.. questo potrebbe essere un segno l’aumento salariale spinge al rialzo le stime degli utili. pic.twitter.com/61SAV9uhmO

— Menthor Q Italia (@menthorqitalia) April 12, 2023

Germany’s DAX has gained 0.3%, on track to close at a one-year high.

Video: Elon Musk interview

Demand for cinema trips picked up last year as pandemic restrictions were lifted, boutique operator Everyman Media Group reports this morning

Everyman, which runs 38 venues across the UK, told shareholders today that its revenues swelled to £78.8m in 2022, up from £49m in 2021, with admissions rising to 3.4m from 2m.

It made an operating profit of £402,000 for the year, up from a £2.2m operating loss in 2021.

The cinema industry had been hit by a drought of blockbusters last year, before the Christmas release of mega-sequels to Avatar and Black Panther.

But Alex Scrimgeour, CEO of Everyman Media Group PLC, insists 2022 saw “a return to business as usual”.

Everyman opened cinemas in Edinburgh and Egham in 2022, and are planning new openings in Durham, Salisbury, Northallerton, Plymouth, Marlow and Bury St Edmunds in the second half of 2023.

Scrimgeour says:

Supported by an increasingly strong pipeline of new releases, commitment to the theatrical window from studios and new investment from streamers in films for theatrical release, we view our prospects with increasing confidence.

Moving through 2023 and beyond, the Everyman proposition feels as relevant as ever.”

Retail spending figures this week showed that people are cutting back on nights out, spending less in restaurants but more on streaming and pay TV subscriptions.

The chief of Holiday Inn owner InterContinental Hotels Group has warned that the UK stock market is “not a very attractive place” for listed companies, at a time when several companies are favouring New York over the City of London.

Keith Barr, chief executive of IHG, has told the Financial Times that the authorities to get on the “front foot” to arrest further decline.

While Barr stressed that “there’s no clamouring” for a switch in listing from shareholders, he argues the FTSE needs to tempt back investment from pension and insurance funds to improve liquidity and ease governance rules compared with the US.

Several shareholders in the group, which has been listed in London since it demerged from pubs business Mitchells & Butlers two decades ago, asked at an investor roadshow last month whether it had any plans to switch its primary listing to the US, IHG chief executive Keith Barr told the Financial Times.

The group has a secondary listing in New York. “When we listed, there was probably no reason to even think about listing in the US for our primary listing because the FTSE was the FTSE and it was incredibly liquid . . . but things have changed,” said Barr.

The chief of InterContinental Hotels, which owns Holiday Inn, told the FT that several shareholders have asked if the group has plans to switch its primary listing to the US https://t.co/cIUDHagtMx

— Financial Times (@FinancialTimes) April 12, 2023

Last month, building materials group CRH said it plans to move its primary stock market listing to the US from London.

The Cambridge-based chip designer Arm is pursuing a US-only listing this year too.

The deeper pool of capital in the US is attractive to groups looking for growth.

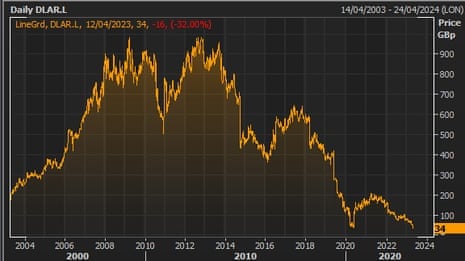

Banknote maker De La Rue issues profits warning as demand for cash falls

Shares in banknote maker De La Rue have tumbled to a record low this morning, after it issued a profits warning due to a drop in demand for cash.

De La Rue told shareholders that its full year adjusted operating profits, for the 12 months to 25 March, are likely to be a mid-single digit percentage below market expectations.

It told shareholders that demand for banknotes was at the lowest in at least two decades, following the move to cashless payments, saying:

The downturn in Currency, impacting both De La Rue and the wider industry, is causing a significant degree of uncertainty in terms of outlook for FY24.

The demand for banknotes has been at the lowest levels for over 20 years, resulting in a low order book going into FY24.

Shares in De La Rue have plunged 32% to 34p.

Victoria Scholar, head of investment at interactive investor, says De La Rue needs ‘drastic change’ after some tough years:

The British currency and passport maker has been suffering from weak demand for banknotes which is languishing at a 20-year low.

Activist investor Crystal Amber Funds recently said the group’s turnaround plan announced three years ago is failing ‘by every measure’ and the company is ‘failing to control’ various fees paid out. The activist has also been trying to remove Kev Loosemore as chairman but he survived a vote in December.

In recent years, De La Rue has struggled with the lost contract to print blue British passports, increased costs, supply chain woes and a structural decline in demand for physical cash amid the rise of contactless payments and digital banking.

Shares in De La Rue have plunged today, bringing its one-year loss to over 65% and its 5-year loss to nearly 92%. Drastic change is needed in order for De La Rue to convince shareholders of a rosier outlook.”

Twitter’s role is to be a realtime “immediate source of truth that you can count on”, Elon Musk said, and one that gets more accurate with time as people comment on particular things.

“If Twitter is the best source of truth, we will succeed”, Musk told the BBC. But “if we are not the best source of truth, we will fail”.

Musk says he wouldn’t take $44bn for Twitter if someone came in and offered his purchase price today. But he then indicated that it depends on who it was.

Musk said:

If I was confident that they would rigorously pursue the truth then I guess I would be glad to hand it off to someone else.

Musk, the world’s second richest man, insisted “I don’t care about the money, really”.

But he did seem briefly flummoxed at the suggestion that, if money wasn’t actually important, he could hand Twitter to someone else who could do a good job of running it.

Many advertisers paused work with Twitter over concerns about Musk’s approach to content and moderation, after his takeover last autumn.

But Musk insists that advertising has picked up again, telling the BBC:

“I think almost all of them [who left] have either come back or said they were going to come back. There’s very few exceptions.

“Depending on how things go, if current trends continue, we could be… cash flow positive this quarter if things keep going well.”

Elon Musk also revealed that he sometimes sleeps in the Twitter office, using a couch in a library “that no one goes to”.

And in a curious moment in the interview, he insisted that his dog Floki, a Shiba Inu, was the CEO of the social media company.

Musk said:

I’m not the CEO of Twitter. My dog is the CEO of Twitter.

Last December, Twitter users voted that Musk should stand down, and in February Musk joked that Floki was now running things.

Musk, who agreed to step down in December after a nonscientific Twitter poll declared he should, said he had abided by that pledge.

“I did stand down,” he said. “I keep telling you I’m not the CEO of Twitter, my dog is the CEO of Twitter.” https://t.co/jauvu0YLKh

— The Washington Post (@washingtonpost) April 12, 2023

Musk also said the legacy verified blue ticks on Twitter will be removed by next week (as part of his push to persuade users to pay for Twitter Blue).

He criticised media groups who said they won’t pay for blue ticks, arguing:

“It’s a small amount of money, so I don’t know what their problem is.

Musk on BBC & Blue Tick

Finally, Elon Musk granted an interview to the BBC. Musk was asked about media like the New York Times losing blue tick verification because they refused on principle to pay for it.

“It’s a small amount of money, so I don’t know what their problem is,”… https://t.co/oPKVZr9jXS— Pervaiz Alam (@pervaizalam) April 12, 2023

Several celebrities and media organisations have said they will not pay for a subscription, amid concerns that fake accounts or parody accounts will find it easier to impersonate them.

During the interview, Musk defended the sacking of around three quarters of Twitter’s staff after his takeover last year.

He said Twitter would have gone bankrupt if he hadn’t cut costs immediately, claiming the company had ‘four months to live’.

This is not a caring/uncaring situation. If the whole ship sinks then nobody’s got a job.

Twitter has about 1,500 employees now, Musk said, a sharp decline from “just under 8,000 staff members” before the takeover.

Musk also said Twitter will update the BBC’s “government-funded media” tag after the broadcaster objected to the label.

The BBC contacted Twitter last week after the designation was attached to the main @BBC account.

In an interview with the BBC on Tuesday, Mr Musk said he has the “utmost respect” for the organisation, adding:

“We want (the tag) as truthful and accurate as possible – we’re adjusting the label to (the BBC being) publicly funded – we’ll try to be accurate.”

More here:

Introduction: Elon Musk tells BBC that Twitter is roughly breaking even

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Elon Musk has revealed Twitter is “roughly breaking even”, saying advertisers are returning after many quit following his takeover of the social media site.

In an interview with the BBC, on Twitter Spaces, Musk also said the criticism he’s faced recently has been “rough”.

Asked if he had any regrets after buying Twitter for $44bn last year, Musk said the pain level of Twitter has been “extremely high”, and that owning the company hasn’t been “some sort of party”.

Musk said:

So, it’s been really quite a stressful situation, for the last several months. Not an easy one.

He said that “of course” many mistakes had been made along the way, but argued that “all’s well that ends well”.

As Musk put it:

I feel like we’re headed to a good place. We’re roughly break-even, I think we’re trending towards being cashflow positive very soon, literally in a matter of months.

The advertisers are returning.

Musk, who cut almost half of Twitter’s workforce last autumn, said cutting the workforce had not been easy.

He said the company has made improvements to its recommended tweets, following feedback after Twitter made its recommendation algorithm open source.

Overall I think the trend is very good.

Elon Musk, boss of Twitter and CEO of Tesla and SpaceX, gives an interview to the BBC.

The billionaire admits he only bought Twitter because he had to, and describes running the firm as “quite painful” and “a rollercoaster”.https://t.co/zj6h1L9q4M pic.twitter.com/u0tXrbZSEI

— BBC Breakfast (@BBCBreakfast) April 12, 2023

Musk also opened up about why, in February, he had tweeted that he wouldn’t wish the pain of running Twitter on anyone.

Musk said he had been “under constant attack”, which hurt as he doesn’t have “a stone-cold heart”.

If you’re under constant criticism and attack, and that gets fed to you non-stop, including through Twitter, it’s rough.

But it’s important to get negative feedback, he added. Musk says he doesn’t turn off replies, and doesn’t block anyone on Twitter either.

So I get a lot of negative feedback.

Also coming up today

Investors are awaiting the latest US inflation data today, which may show that the cost of living squeeze eased last month.

The US consumer prices index is expected to have risen by 5.2% in the year to March, down from 6% in February. A sharp fall could encourage the US Federal Reserve to end its interest rate increases, which would be welcomed by traders.

The IMF will release its Fiscal Monitor, assessing public finances at countries around the world, today, after yesterday predicting the UK’s economy will shrink this year.

The agenda

-

Noon: US weekly mortgage applications

-

1pm BST: IMF publishes its Fiscal Monitor

-

1.30pm BST: US inflation report released

-

2pm BST: Bank of England governor Andrew Bailey speaks on ‘The shifting risk landscape’ at the Institute of International Finance in Washington DC

-

3pm BST: Bank of Canada’s interest rate decision

-

7pm BST: Federal Reserve’s FOMC releases minutes of its last meeting

NEWSLETTER

NEWSLETTER