As we approach the New Year, you may be interested in creating a budget for yourself or looking for a new tool to help you manage your startup or small business budget. You may be looking to switch from your current budgeting app to a better one, or maybe you're someone who has traditionally relied on spreadsheets. Although spreadsheets can be an easy way to manage and track a budget, it might be worth checking out budgeting apps to save time and effort. We've compiled two lists of apps that we think are great budgeting tools for individuals and startups.

For individuals, a good budgeting app can help you save money by creating and sticking to a monthly budget. For startups and small businesses, a good budgeting app can help you understand the financial health of your business and make informed decisions. Whichever path you choose, the best budgeting app for you will depend on your individual or business needs, so we've included a variety of apps to help you find the one that best suits your needs.

good budget

Image credits: good budget

good budget It is a good app if you are a beginner and starting to budget. It uses the envelope system, which is one of the original ways of managing money. Goodbudget helps ensure you're never caught off guard by a sudden bill or expense. Each month, you set aside money for the things you need, like food and gas. Once you've set aside money for the essentials, you can choose how to spend the rest based on what's important to you.

The app is also a great option if you share a household, as it allows you to sync your budget with someone else's. Goodbudget offers a free version and a paid version, which costs $8 per month. The free version includes everything you need to manage a budget, while the paid version gives you additional capabilities, such as email support, unlimited envelopes, and the ability to use the service on five devices instead of just two. One possible downside is that you have to manually enter your transactions into the app, since the app doesn't connect to your bank account.

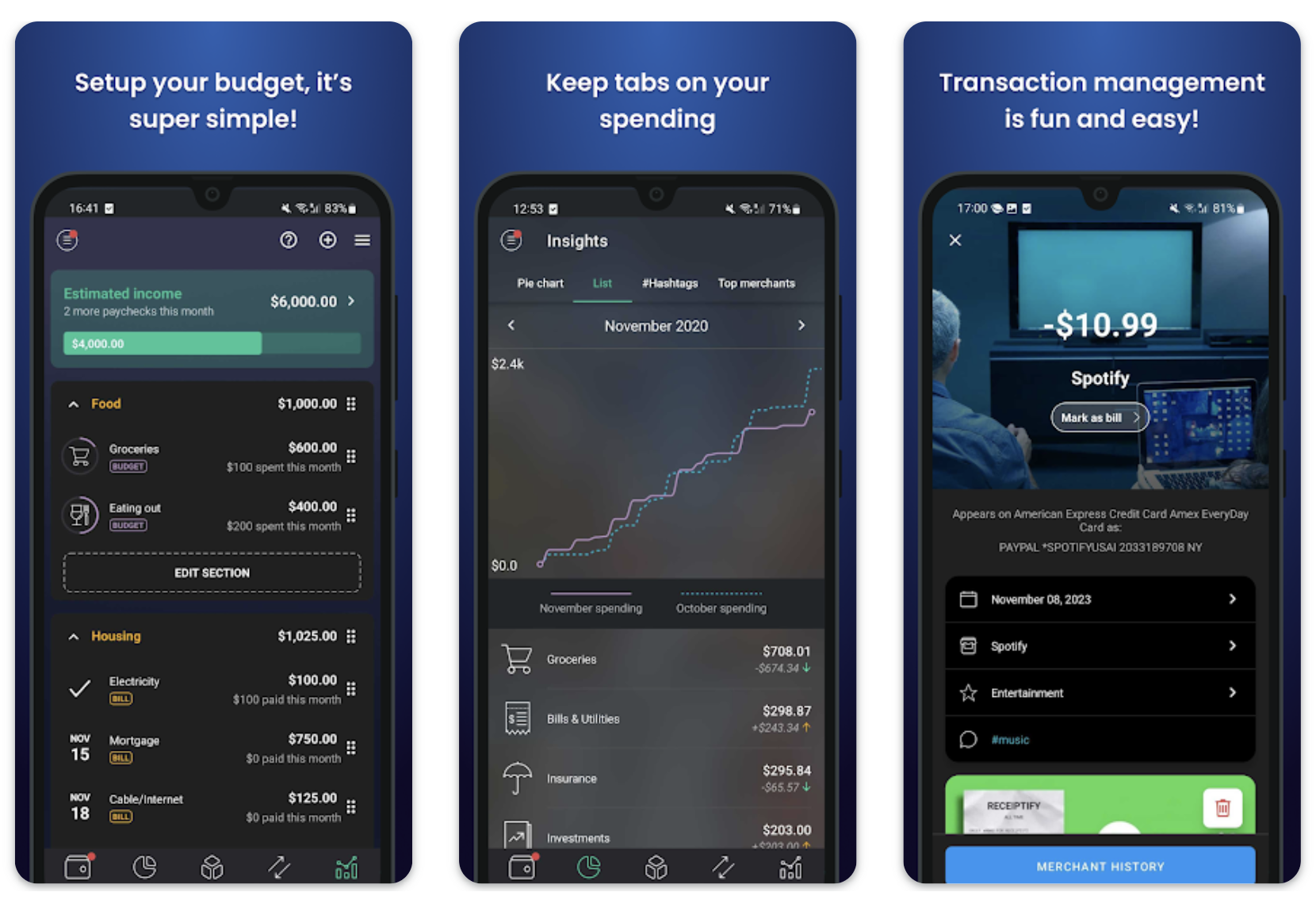

pocketguard

Image credits: pocketguard

If your main goal is to track your expenses, pocketguard could be the best app for you. PocketGuard shows you how much spending money you have after you set aside enough for your bills, goals, and needs. The application shows you a pie chart so you can see which expenses consume the most money. You can set spending limits in the app to ensure you don't spend beyond your means.

PocketGuard links your banks, credit cards, loans, and investments in one place to help you keep track of your account balances, your net worth, and more. There's a limited free version of the app and a paid version, which costs $8 per month and unlocks features like the ability to create your own spending categories, set up a debt payment plan, attach receipts, export transaction data, and more.

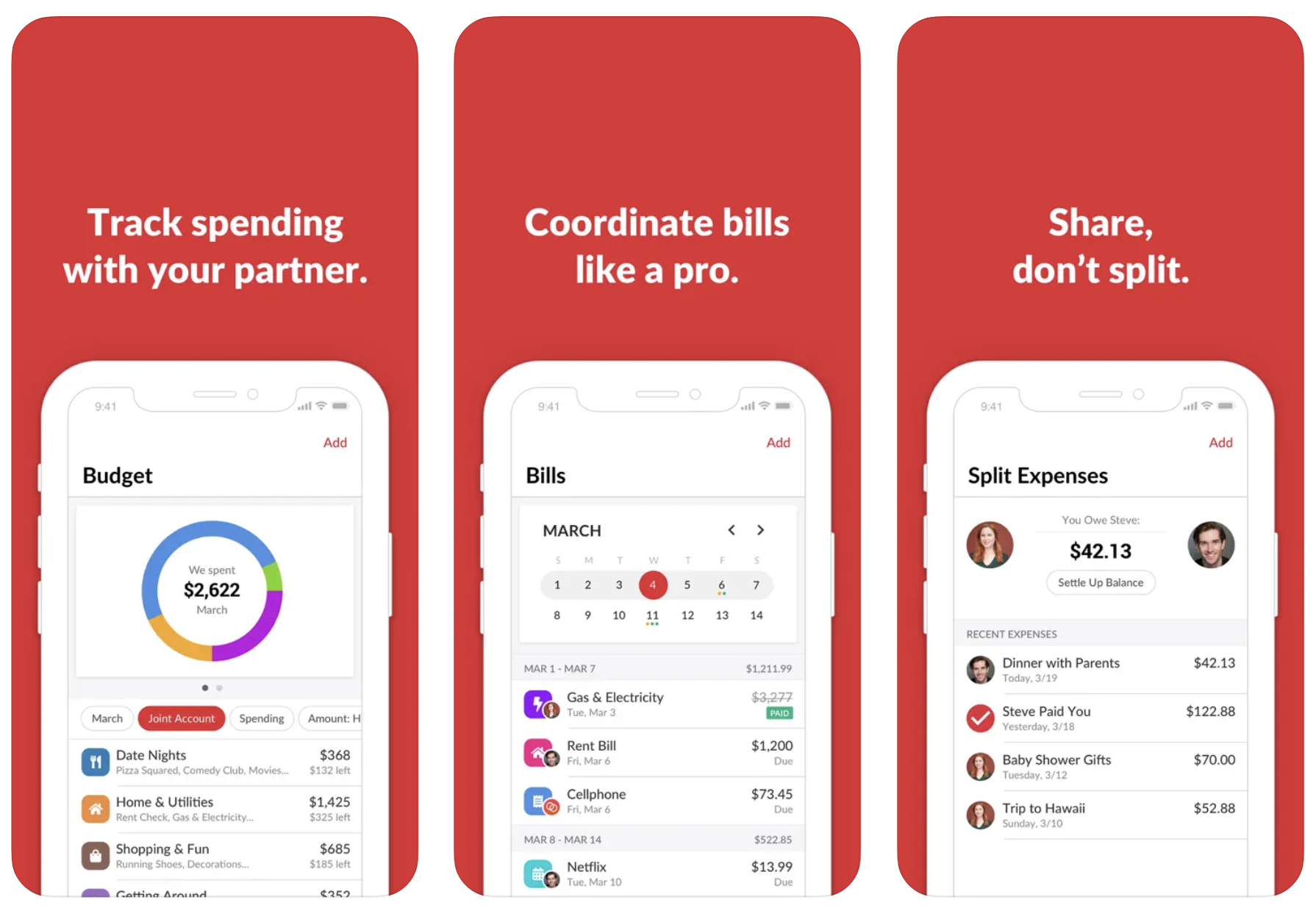

honeydue

Image credits: honeydue

honeydue It is a good budgeting app if you want to plan and manage your finances with your partner. The app syncs with your and your partner's bank accounts. Honeydue allows you to manage your money together while tracking your spending and communicating about bills. You can chat with your partner on the app and decide if one person will cover the bill or if the two of you will split it equally.

The app also offers your own joint bank account. Honeydue is free to use, making it a good option for couples who don't want to pay a monthly subscription. One downside is that there is no desktop version of the app, so if you like managing your finances on a larger screen, Honeydue may not be the best option for you.

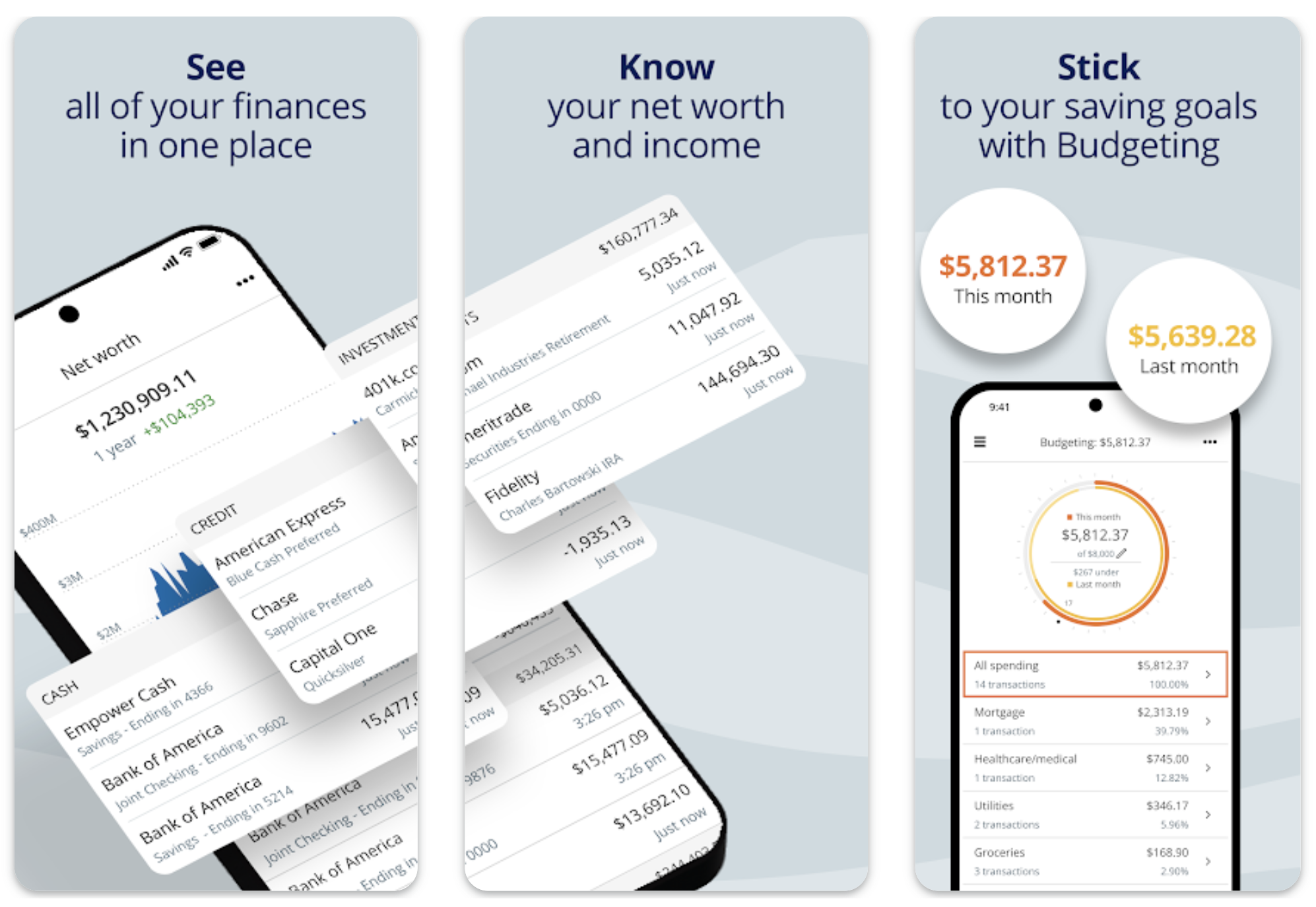

Authorize

Image credits: Authorize

Authorize It's a good app if you want a tool for both budgeting and investing. The app allows you to keep track of all your accounts, including your bank and credit cards, IRAs, 401(k), mortgages, and loans in one place. You can plan for your retirement, monitor your investments, and discover hidden fees. Empower has a money tracking dashboard that allows you to track your spending by categories.

The service is free to use and is designed to help you manage your daily finances while also helping you plan for the future. However, if your main goal is to budget your expenses, Empower may not be the best option for you. You may be better off choosing a different app on this list because Empower's budgeting tools are not as advanced as some of the others.

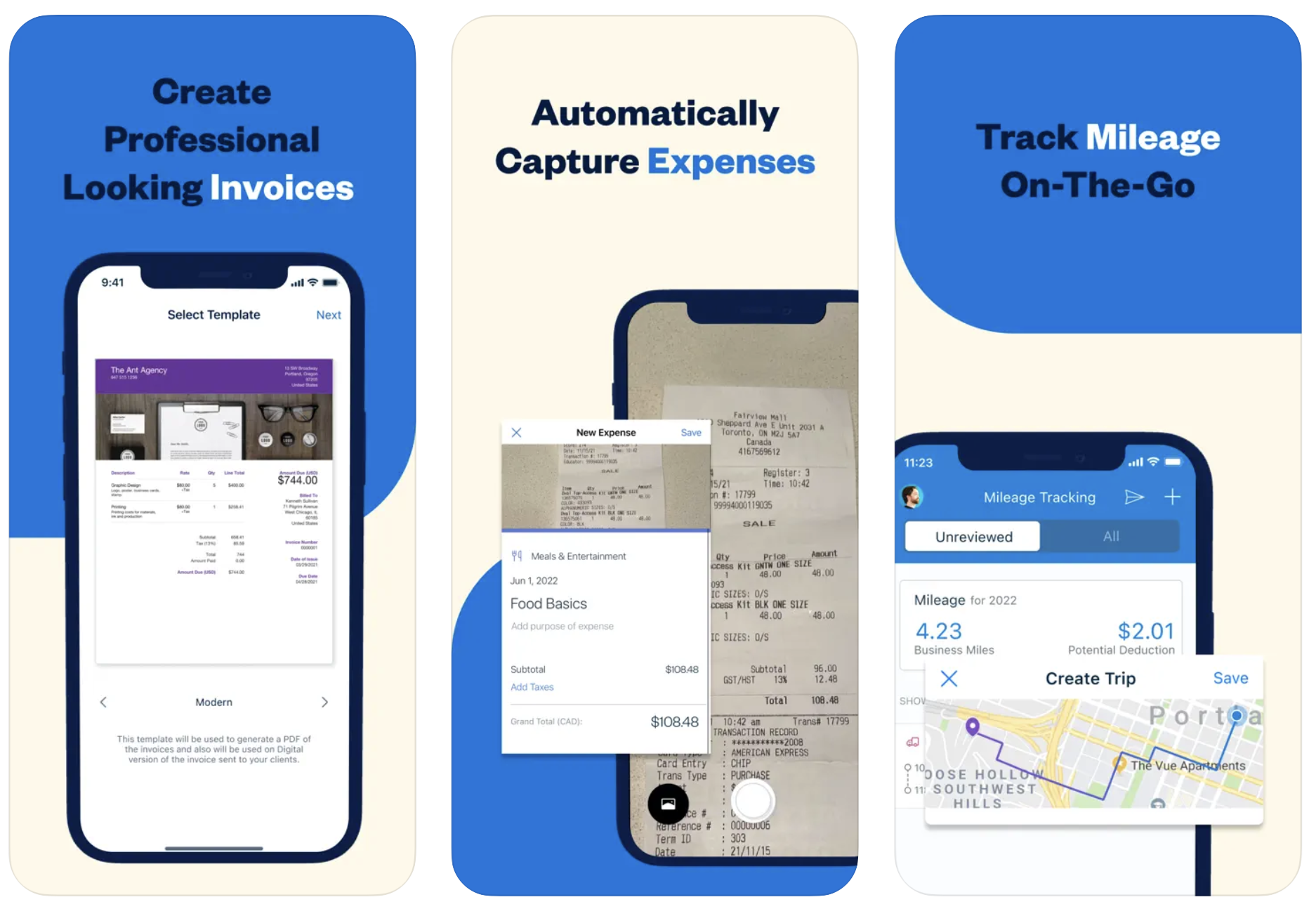

cool books

Image credits: cool books

cool books is a simple tool that can help startups and small businesses create a budget and stick to it. The service connects to your bank account or credit card to track your spending. FreshBooks has tools for invoicing, time tracking, accounting, payments, and more. It allows you to take photos of receipts, forward email receipts to your account, and import expenses from your bank account.

The service has tools for businesses at all stages, from freelancers to companies with multiple employees. FreshBooks allows your team, clients, and contractors to collaborate and share files and updates in one place. It can also integrate with over 100 apps, including Dropbox, HubSpot, GSuite, Stripe, and more. FreshBooks has four pricing tiers, and commercial ones start at $30 per month.

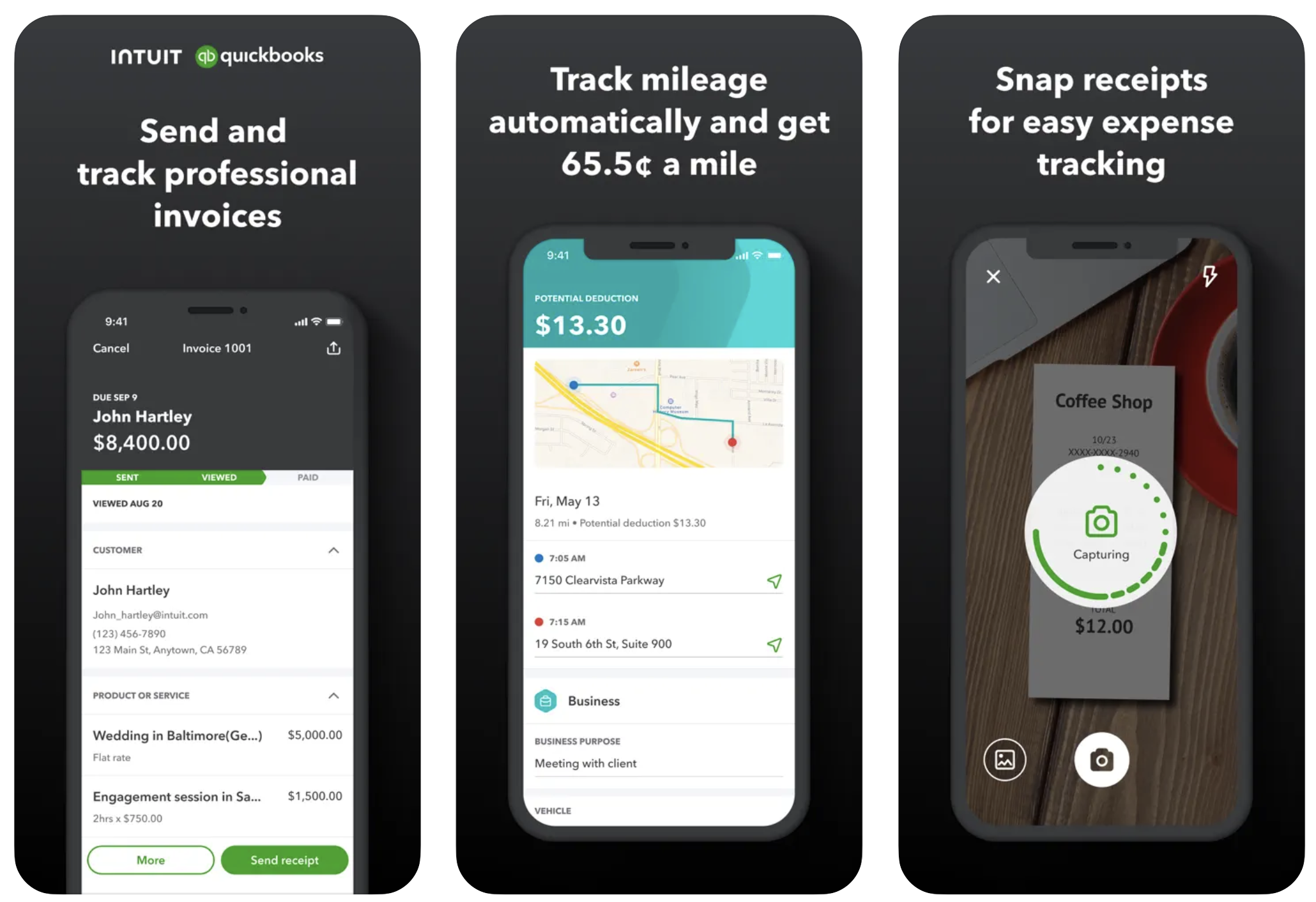

quick books

Image credits: quick books

quick books is a simple service that helps you get a complete overview of your business finances by tracking your business expenses, income, profitability, taxes, and more. The service helps you not only budget, but also manage the accounting tasks associated with your startup or business. You can see earnings at a glance, pay your team, manage your money, accept payments, and track and manage your time.

The service features an easy-to-navigate dashboard that allows you to easily understand the financial health of your business. QuickBooks also offers tax preparation features and gives you the ability to consult with experts to help you prepare for tax time. QuickBooks has three pricing tiers starting at $30 per month.

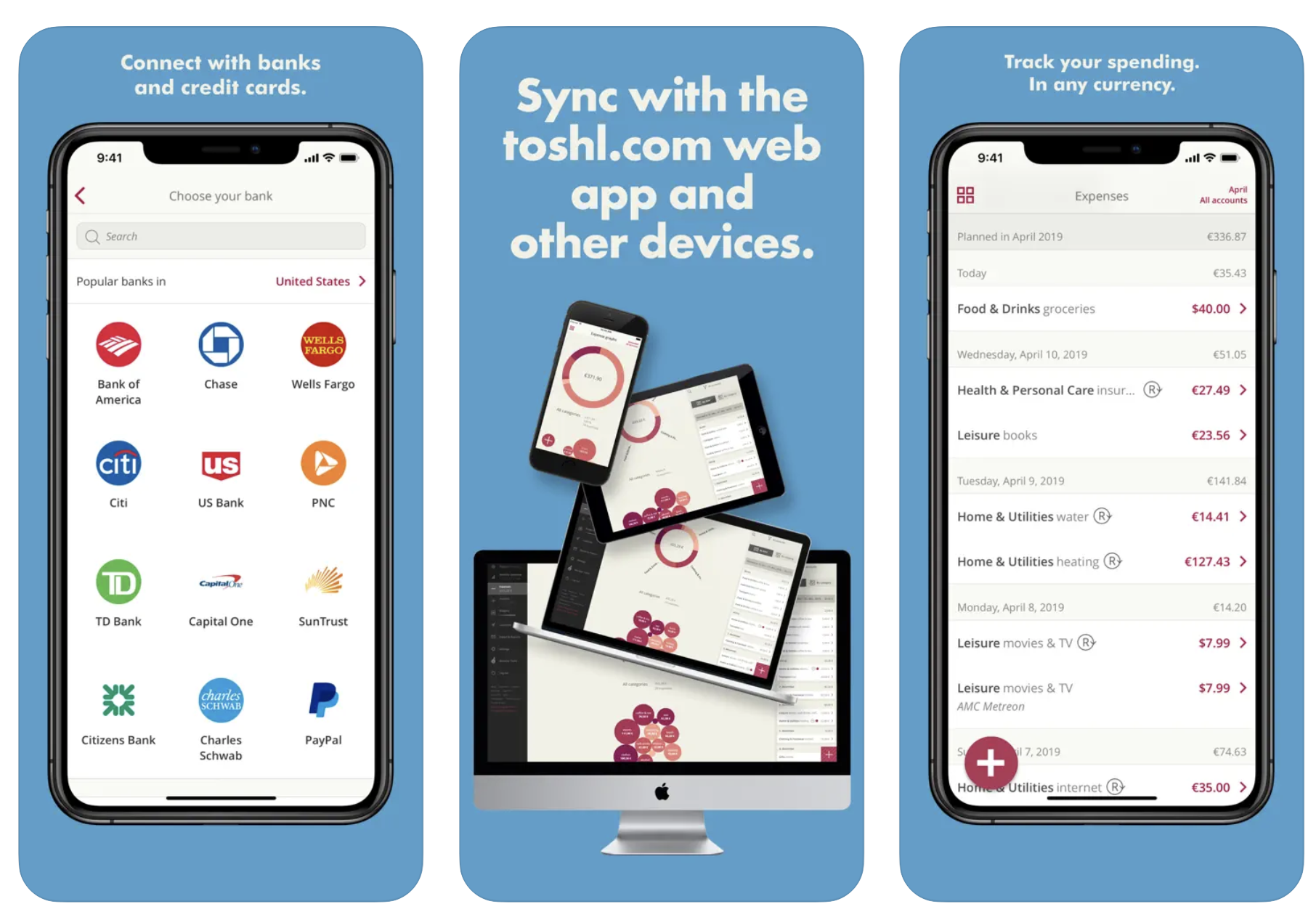

Stone

Image credits: Stone

If you want a simple yet effective and reasonably priced budgeting tool, Stone may be the app for you. Although marketed as a personal budgeting app, Toshl can be a good tool for startups looking to understand and manage their finances for a fraction of the cost of budgeting apps marketed toward small businesses.

Toshl features an intuitive, easy-to-use experience that allows you to create a budget and track expenses. If you want to budget for something in particular, you can set the budget to track only expenses with particular categories, tags, or financial accounts. Budgets can be set monthly, weekly, daily, or for a custom period of your choosing. The service has a free version and a paid version that costs $4.99 per month.

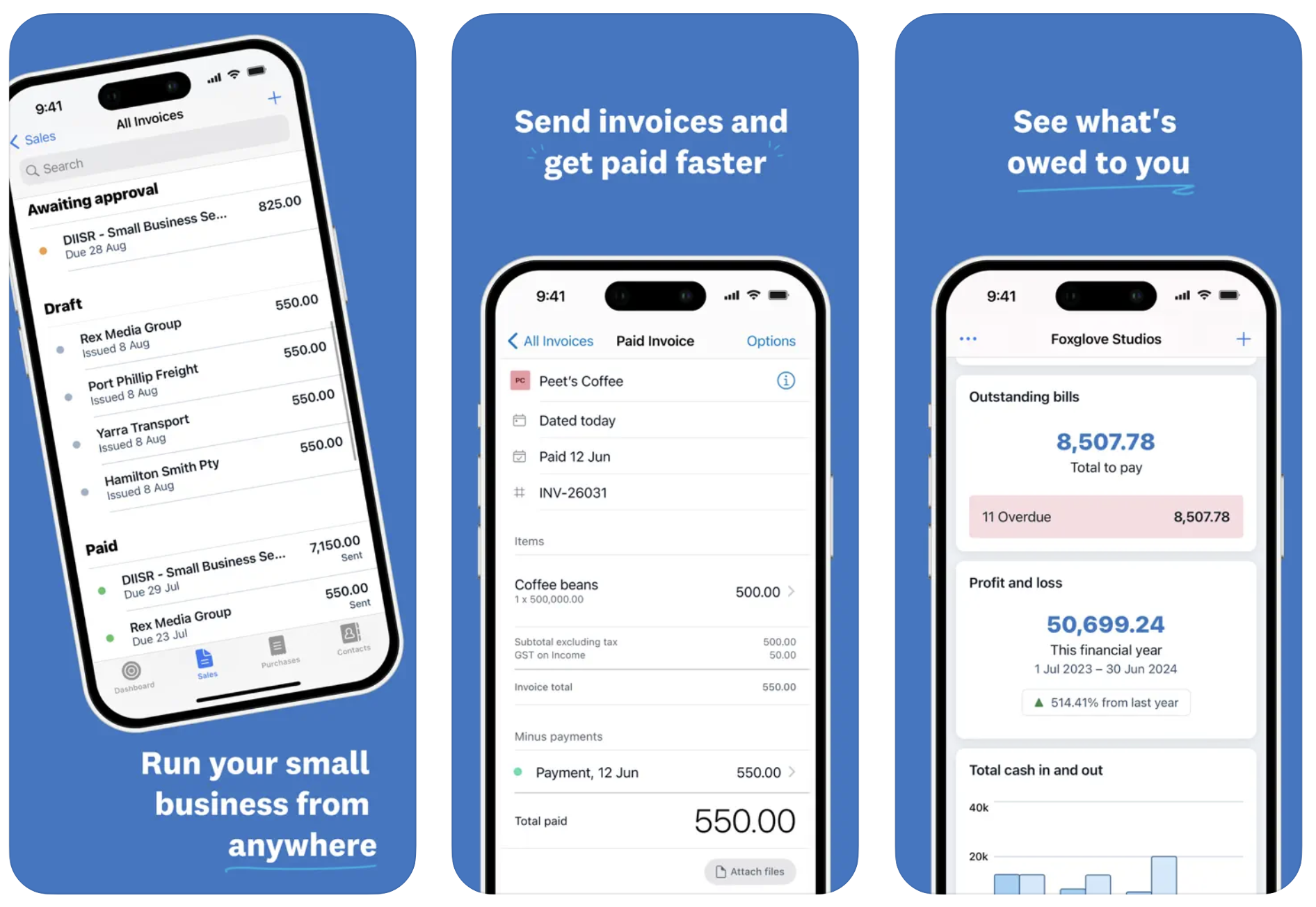

xero

Image credits: xero

xero It is a good budgeting and finance tool for businesses and startups that are ready to grow. The Service Budget Manager worksheet allows you to create an overall budget for each of your tracking categories. There are also other tools that allow you to see short-term cash flow and snapshots of the business.

You can use Xero to send invoices and quotes, pay invoices, track projects, manage expenses, accept payments, and more. Xero is designed to help small businesses make decisions through trend analysis and simple reporting. In addition to financial features, Xero includes features that help with inventory and project management. The service offers three paid tiers, starting at $15 per month.