.toc-list { position: relative; } .toc-list { overflow: hidden; liststyle: none; } .gh-toc .is-active-link::before { background-color: var(–ghost-accent-color); /* Sets the TOC accent color based on the accent color set in Ghost Admin */ } .gl-toc__header { align-items: center; color: var(–foreground); cursor: pointer; screen: flexible; gap: 2rem; justify content: space between; filling: 1rem; width: 100%; } .gh-toc-title { font-size: 15px !important; font weight: 600! Important; letter spacing: .0075rem; line-height: 1.2; margin: 0; texttransformation: uppercase; } .gl-toc__icon { transition: transform .2s ease of input and output; } .gh-toc li { color: #404040; font-size: 14px; line-height: 1.3; bottom margin: .75rem; } .gh-toc { display: none; } .gh-toc.active { show: block; } .gl-toc__icon svg{ transition: transform 0.2s easy in and out; } .gh-toc.active + .gl-toc__header .gl-toc__icon .rotated{ transform: rotate(180 degrees); } .gl-toc__icon .rotated{ transform: rotate(180 degrees); } .gh-toc-container-sidebar{ display: none; } .gh-toc-container-content{ display: block; width: 100%; } a.toc-link{ background-image: none! Important; } .gh-toc-container-content .toc-list-item{ margin-left: 0 !important; } .gh-toc-container-content .toc-list-item::marker{ content: none; } .gh-toc-container-content .toc-list{ padding: 0 !important; margin: 0 !important; } Display only @media and (min-width: 1200px) { .gh-sidebar-wrapper{ margin: 0; position: sticky; up: 6rem; left: calc((( 100vw – 928px)/ 2 ) – 16.25rem – 60px); z-index: 3; } .gh-sidebar { align-self: flex-start; background color: transparent; flexible steering: column; gridarea: knock; maximum height: calc(100vh – 6rem); width: 16.25 rem; z-index: 3; position: sticky; top: 80px; } .gh-sidebar:before { -webkit-backdrop-filter: blur(30px); backgroundfilter:blur(30px); background-color:hsla(0, 0%, 100%, .5); edge radius: .5rem; content: “”; show: block; height: 100%; left: 0; position: absolute; top: 0; width: 100%; z-index: -1; } .gl-toc__header { cursor: default; flexible shrinkage: 0; pointerevents: none; } .gl-toc__icon { display: none; } .gh-toc { show: block; flex: 1; overflow-y: auto; } .gh-toc-container-sidebar{ display: block; } .gh-toc-container-content{ display: none; } } ))>

Automation has revolutionized the way financial teams operate, with accounts payable (AP) automation being the first step for companies looking to improve efficiency and reduce costs. Companies like Nanonets and Centime have made AP processes smarter, faster and more optimized through cutting-edge technology, while paving the way for more comprehensive financial solutions.

But while AP automation is an important step, it's only one side of the equation. To truly unlock the full potential of financial workflows, CFOs and CFOs in enterprise and mid-market organizations, especially those looking to optimize cash flow and streamline financial processes, must also focus on automating financial workflows. accounts receivable (AR). By complementing AP automation with AR automation, businesses can achieve a seamless, integrated approach to financial management that maximizes cash flow, efficiency, and strategic decision making.

The rise of AP automation

Accounts payable automation has transformed the way companies handle outbound payments. Instead of dealing with manual invoice processing, businesses can rely on solutions like Nanonets to automate tasks like:

- Optical Character Recognition (OCR) to extract invoice data.

- Automate invoice approvals to optimize workflows.

- Improved compliance and reduced risks of duplicate or late payments.

These advancements save time, reduce errors, and free up finance teams to focus on more strategic initiatives. But what about the other side of the financial equation: incoming payments?

The challenges of disconnected financial processes

When AP and AR processes operate in silos, companies often face:

- Fragmented cash flow visibilityWithout a unified view of incoming and outgoing payments, finance teams struggle to predict cash flow accurately. This makes it more difficult to plan for working capital needs.

- Inefficiencies in AR processesManual AR processes, such as sending invoices, following up with customers, and reconciling payments, slow down collections and delay cash inflows.

- Isolated data that hinders decision makingWhen AP and AR data is not integrated, financial leaders lack the complete picture needed to make strategic decisions.

By addressing these gaps through AR automation, businesses can close the gap and unlock better financial performance.

Why AR automation complements AP automation

1. Full cash flow visibility

AR Automation provides real-time insights into incoming payments, complementing AP Automation's outbound payment visibility. Together, they allow finance teams to see the full picture of their cash flow, allowing them to make more informed decisions.

Solutions like Penny Provide dashboards that integrate AP and AR data, giving finance teams a 360-degree view of financial health. This transparency is essential for companies seeking to remain agile and competitive.

2. Simplified financial processes

AR automation reduces the time and effort required for tasks such as billing, collections, and reconciliation. When combined with accounts payable automation, the result is a completely streamlined financial process that reduces manual effort, minimizes errors, and improves efficiency.

For example, Centime's AR automation capabilities include client-level workflows and automated collections, which speed up cash receipts while ensuring accuracy. By integrating AP and AR automation, businesses can optimize resources and focus on strategic growth initiatives.

3. Improved working capital management

Efficient AP and AR processes work hand in hand to optimize working capital. By automating AR, businesses can reduce days sales outstanding (DSO), accelerate cash inflows, and improve liquidity. This complements accounts payable automation, which helps businesses take advantage of early payment discounts and better manage outgoing cash.

The combination of AP and AR automation allows businesses to maintain healthier cash flow, reduce dependence on external financing, and drive growth.

The case for a holistic automation strategy

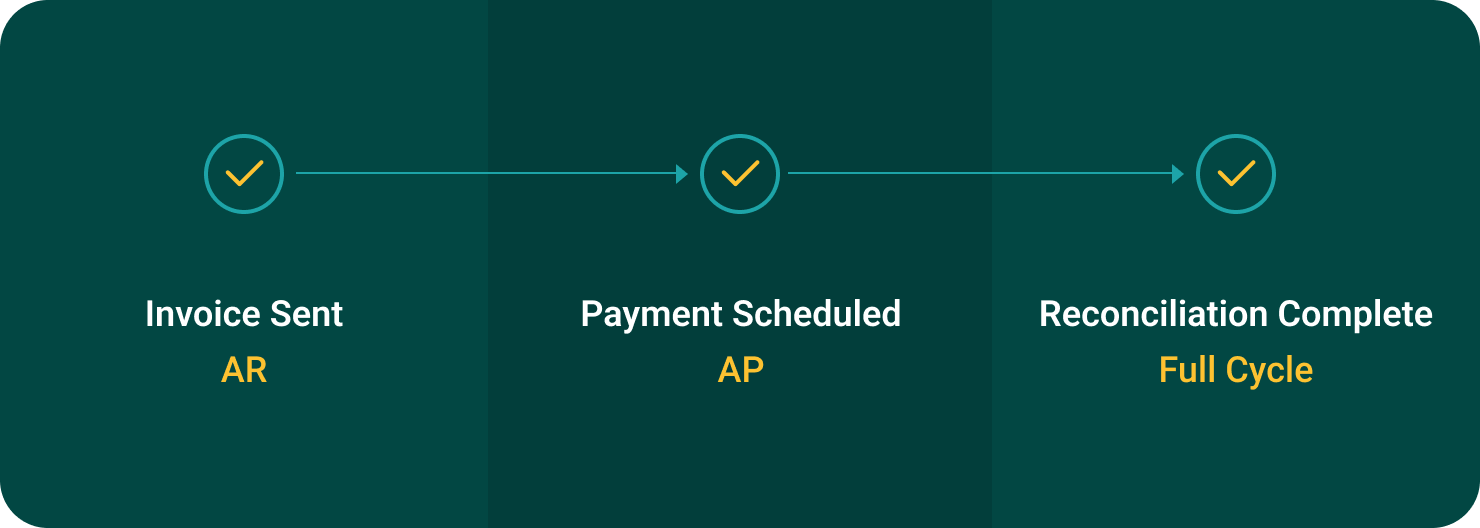

AP + AR Integration = Strategic Advantage

Companies that integrate AP and AR automation gain a significant competitive advantage. With streamlined processes, greater cash flow visibility, and reduced inefficiencies, finance teams can operate more strategically and focus on long-term growth.

Nanonets + Centime: a winning pair

For companies already using Nanonets for AP automation, adding AR automation from a complete solution like Centime is the next logical step. Together, these solutions create a cohesive financial system that ensures no part of your cash flow is left unmanaged.

Conclusion

Accounts payable automation is a critical first step toward financial transformation, but it is not the end of the journey. To unlock the full cycle of financial automation, companies must also focus on AR. By automating both AP and AR, businesses can achieve seamless financial processes, better cash flow management, and a strategic advantage in today's competitive market.

If your company has optimized AP, it's time to think about AR. The next step towards full financial integration is already here. Are you ready to give it?

NEWSLETTER

NEWSLETTER