Month-end closing is a widely accepted accounting standard that aims to maintain an accurate set of financial records and detect errors/fraud. It involves recording, reviewing and reconciling records at the end of each month.

The month-end reconciliation is the most important part of the month-end closing process. It is a crucial step to ensure the preparation of an accurate set of financial statements for financial reporting, planning and tax compliance.

Closings can be quite stressful as the general turnaround time is <1 week, while you only have 2-3 days to reconcile all your accounts. This can be simplified by preparing a checklist, applying best practices, and automating tasks using reconciliation software. Read to learn more:

Month-end account reconciliation

Reconciliation is the process of matching the company's general ledger with payments and deposits recorded on documents such as bank statements, credit card statements, or invoices. Each transaction in the general ledger is reviewed and compared to a corresponding transaction in the actual bank statement.

If the balance on both statements matches and all transactions are posted, we can consider the statement reconciled. Once reconciled, an account is marked as “closed” for the month, indicating that we no longer need to make any changes to the records before the end date. However, the balances generally do not match; They have to be adjusted due to accounting errors, banking errors and refunds. This is how you can perform the monthly reconciliation.

How to do the monthly account reconciliation?

The key steps for monthly reconciliation are:

- Reconciliation tool: The first step is to decide how you will do your reconciliation process. Reconciliation can be done through Excel, ERP such as QuickBooks or reconciliation software. While Excel is a simple and free option, it can be quite cumbersome if you are dealing with a large volume of transactions. You can read more about how to choose the right option for you in the next section!

- Data collection: You need to collect your financial documents like general ledger, balance sheet, bank statements, invoices, receipts, etc. This depends on the type of work your company does.

- Pareo: To compare transactions manually, sort transactions by account, transaction type (deposits first, then payments), and date. Now find the corresponding type on your bank statement and mark them as reconciled or “not found”.

- Prepare the reconciliation statement: Prepare a bank reconciliation statementst that accounts for pending transactions. You would need to adjust your bank and general ledger due to:

- Accounting errors: Missed records of transactions and discrepancies in figures must be adjusted in the general ledger. A common example is that bank charges, such as fees or accrued interest, do not appear in the records.

- Banking errors: Checks or ACH transfers post on dates other than the processing date. This may cause a discrepancy in dates. There could also be errors on the bank statement that need to be corrected.

- Refunds: Bank transactions may be refunded or your deposits may be withheld due to disputes. This should be posted to your general ledger.

Once you finish your reconciliation, you can submit your record and statement for review.

How long does month-end reconciliation take?

The time needed depends on your team, process, volume, tools, document type and complexity. The average monthly closing time is 6.4 days, according to the CFO.com survey. Note: This includes reviewing and creating the report in the required format; You can expect to have a reconciled statement in 2-3 days.

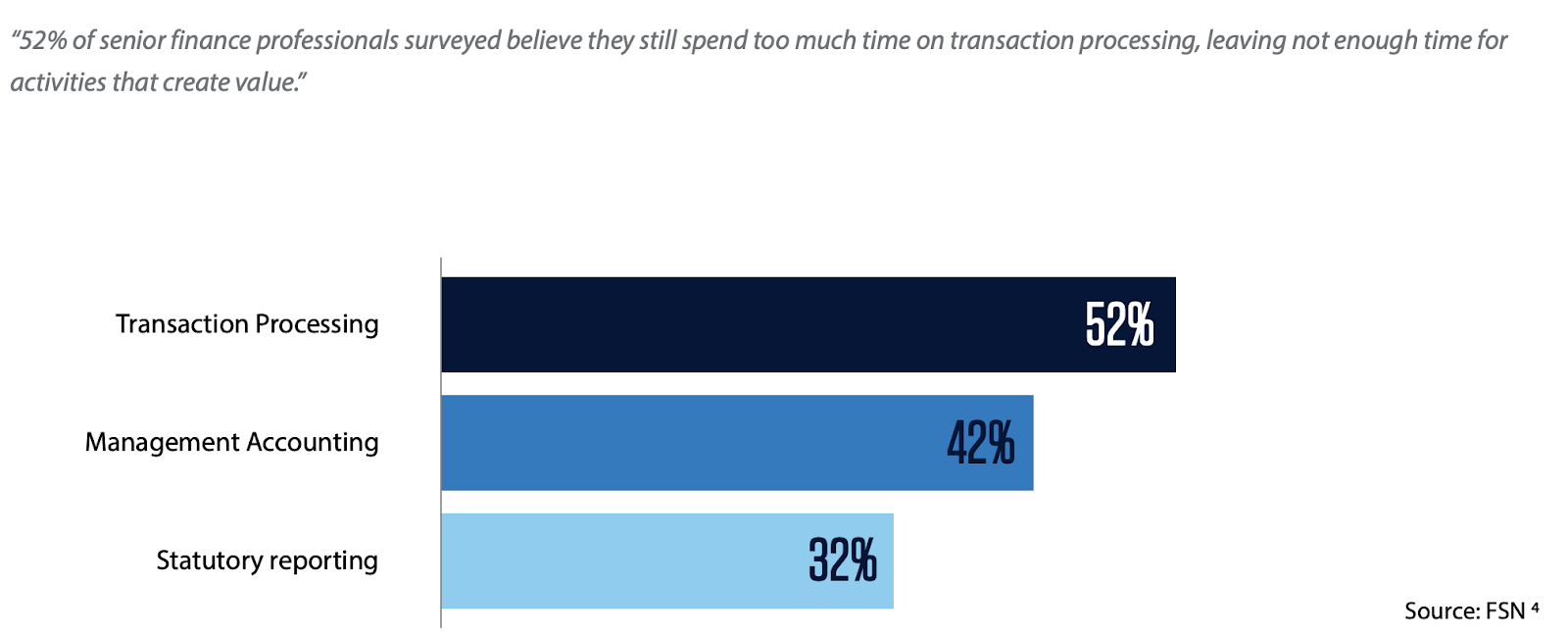

The main cause of the delay is that most of the process is still done manually, which wastes too much time for employees.

This can be easily reduced by using ai automation to save your team time and costs. Let's see how you can speed up this process:

How to simplify month-end reconciliation?

If you are still doing manual processing, here are some tips that can speed up the process:

- Mark payments and deposits: Periodically record all incoming and outgoing transactions with details such as transaction ID, date, amount and party. Waiting until the end of the month to enter data can cost you a lot of time. Tools like Nanonetworks Automatically extract relevant data from your email or ERP and categorize it.

- Frequent reconciliation: Monthly reconciliations are part of an old process where businesses had to wait until the end of the month to receive their bank statements in the mail. With online statements, you can perform the reconciliation process daily or weekly. Nanonetworks Allow instant reconciliation to save you a daily headache.

- Excel Formulas and Template: If you prefer to use Excel, using formulas will help you quickly reconcile your statement. You can see this free bank reconciliation template.

Automate monthly reconciliation:

Reconciling manually in Excel is not feasible if you have a high volume of transactions or work with a small team. It adds more stress and causes you to miss important details or deadlines. Automation software like Nanonets can help revolutionize your reconciliation; here is how:

Automate fraud detection, bank reconciliations, or accounting processes with a custom workflow out of the box.

- All in one app: Automatically sync data from your existing apps like QuickBooks, Xero, Gmail, or your bank's website. This will allow you to consolidate all your financial statements and processes under one roof. Resulting in greater transparency for you and your team.

- Save time: With Nanonets, reconciliation can be done weekly, daily, or even instantly. This helps your team save time from manual work and allows your finance team to produce better reports and insights.

- Save costs: Match your transactions through Gen-ai and implement your business logic using code-free workflows to detect any irregularities. This will help quickly detect any errors or fraud and help protect your business.

- Simplify compliance: Teams can often face the challenge of preparing GAAP financials in time for reporting. You can configure rules to make adjustments to the application through workflow blocks.

If you want to automate your month-end reconciliation process, schedule a demo call with our experts to automate your workflows using Nanonets.

NEWSLETTER

NEWSLETTER