Did you know that processing an expense report for an overnight hotel stay can take up to 20 minutes and cost an average of $58?

According to a GBTA report, out-of-pocket costs an employee has paid expense reports contains errors or missing information, costing an additional $52 and 18 minutes to correct each.

Now consider all the hundreds of expenses and reports employees file, and imagine the resource drain it could be costing you.

Before we explore the world of expenses and reimbursements, it’s essential to understand expense claims.

What is an expense claim?

An expense claim is a formal request by an employee to be reimbursed for business expenses incurred by employees on behalf of the company.

These could be travel expenses, meals, office supplies, or any other out-of-pocket costs an employee has paid for business purposes.

The employee initiates the reimbursement request using an expense claim form or an expense report.

What qualifies as a claim?

Whether the business expense can be claimed or reimbursed depends on the following factors:

Compliance with IRS guidelines

The IRS has a simple rule about what counts as a legitimate business expense.

It has to be ordinary and necessary.

Ordinary means it's common and accepted in your field of work, while necessary means it's helpful, appropriate, or suitable for your business. This business expense does not have to be required to be considered necessary.

Adherence to the company’s expense policy

An expense reimbursement policy is a rulebook for business spending. Only expenses that adhere to this policy are considered reimbursable.

Expense category

Each company has a set of predefined expenditure categories that employees need to understand before submitting their expense claims for reimbursement.

These claims can depend on approved expense categories, such as travel expenses, office supplies, food and entertainment expenses, etc.

Remember to note the exclusions, such as personal entertainment (e.g., alcohol), penalties, etc.

Proof of expense

Every expense claim must be substantiated with proof of expense in the form of a receipt, invoice, or any other relevant document.

This proof should consider all the relevant details, such as the expense date, amount of expense, vendor/merchant details, etc.

Types of expenses that can be claimed

The common expense categories that can be claimed are:

Travel expenses

Employees on business trips must spend on airfare, hotels, rental cars, toll charges, gas, etc. These all fall under travel expenses.

Food and entertainment expenses

These include expenses like meals with potential clients or on-site employees and tickets to a networking event.

Office expenses

Operational expenses, like daily office supplies, stationery, internet bills, etc, fall under this category.

Miscellaneous expenses

While the most common categories of expenses are travel, food and entertainment, and office-related operational expenses, other costs are included under miscellaneous expenses.

These include unforeseen costs like emergency repairs or legal fees, which are not part of the regular operations but are necessary for the business.

Here is an exhaustive list of expense categories employers can use to classify employee expenses for business purposes.

Ways to generate an expense claim

Companies can allow employees to claim reimbursements for business-related expenses using different modes:

Receipts

In the most traditional expense claim process, employees who make out-of-pocket expenses save expense receipts from business-related purchases and submit these as proof. The claimant is eventually credited with an equivalent amount in their expense account.

Credit card statements

If the company provides a business credit card, expenses can be tracked directly from the card statement. Such corporate credit cards prove convenient and are often given to only certain employees, such as sales representatives and employees in leadership positions.

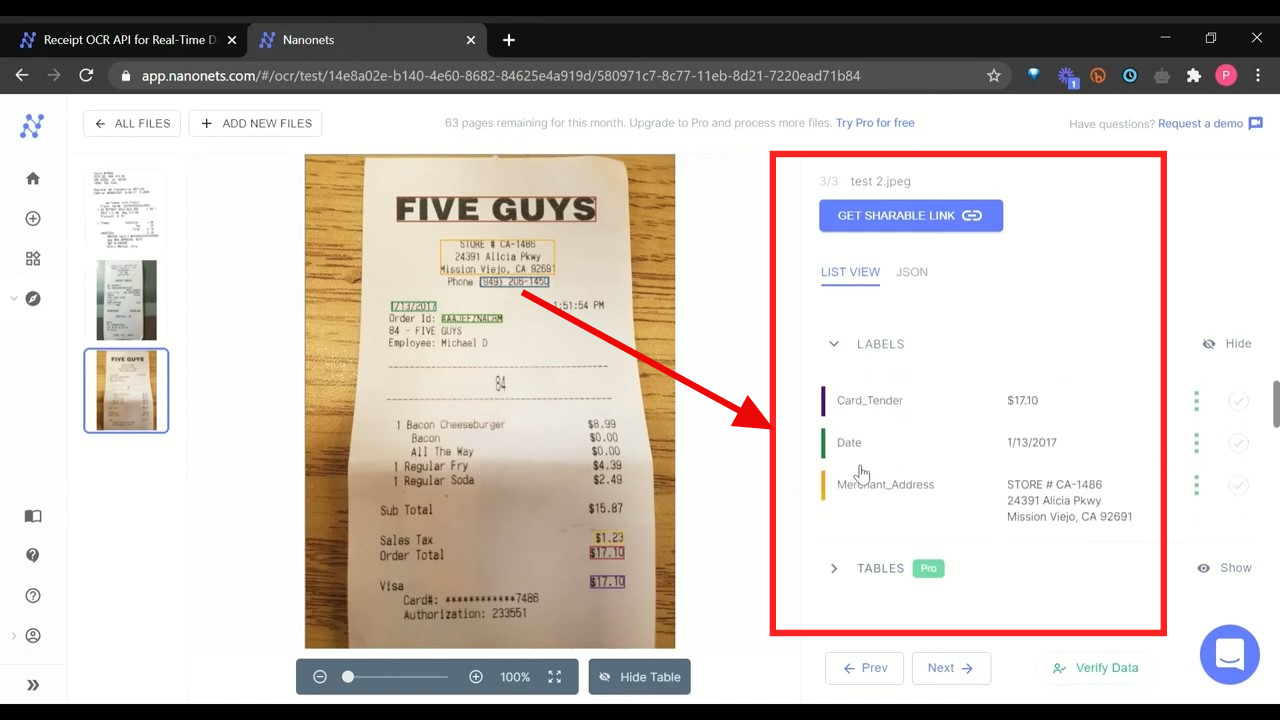

OCR-enabled mobile apps

Many businesses now use OCR-enabled expense management apps that allow employees to snap a picture of their receipt and submit it instantly.

Per diem allowances

In some cases, businesses may provide a per diem daily allowance for employees to cover their meals and commuting expenses. Any spending beyond this allowance would need to be claimed separately.

All the above methods have pros and cons, and the best choice often depends on the size and needs of your business.

Expense claim process

The expense claim process can look different for different companies. Typically, it involves the following steps:

Expense incurrence

An employee incurs an expense. It could be an out-of-pocket expense for which the employee needs to save the invoice or proof of purchase.

Generating an expense claim

Smaller companies usually ask employees to use an employee expense claim form for reimbursement.

Enterprises typically use an expense management system that allows employees to generate periodic expense reports and submit them for approval.

Getting approval

Once the expense claim form/expense report is submitted, the manager approves or denies the claim, depending on its legitimacy. Only the reimbursable expenses are sent to the finance department for further processing.

Finance verification

Once the manager approves the employee expense claim, it is further sent to the finance team for verification.

Reimbursement

Once the expense claim is verified and approved by all necessary stakeholders, the finance department initiates the reimbursement depending on the mode of payment as per the company’s expense reimbursement policy.

Bookkeeping and documentation

The finance team also ensures the data entry of all such expenses and keeps track of all such expense reports. All such reports, along with proofs, are recorded.

Challenges in the expense claim process

Time-consuming manual data entry

The tedious and lengthy data entry process is a big challenge for companies that follow the traditional expense claim process.

Employees waste precious time locating and manually entering details of each purchase, which often leads to many inaccuracies.

Tracking proofs of purchase

During business travel, employees are forced to save paper receipts. Many misplaced receipts can hinder bookkeeping. Without such proof, employees cannot claim reimbursements, which leads to a poor employee experience.

Sometimes, employees intentionally inflate costs by submitting erroneous or duplicate receipts. Without proper checks in place, expense tracking can become costly for companies.

No real-time spend analytics

Traditional manual expense claim processes do not accurately give real-time visibility of employee spend. As a result, finance teams cannot monitor spending patterns and optimize costs at the right time.

Lack of workflow automation

A smooth expense claim process requires quick approvals. Without delegation and workflow automation, employees and managers get stuck in endless loops of email trails and follow-ups, leading to long reimbursement cycles.

Policy non-compliance

Adherence to expense policy is crucial for effective spend management. Without compliance checks, instances of expense and payment fraud increase.

Ensuring such policy compliance is difficult and often leads to auditory challenges when companies follow manual, paper-based expense claim processes.

10 steps to simplify the expense claim process

Leaky expense claim processes can be a slow, silent killer for your company finances. Here are some ways you can streamline your claim process.

Build a company expense policy

A company expense policy is the rulebook of expense reimbursements and is a must for a smooth claim process.

Establish clear guidelines and mention the eligibility for reimbursement requests in the policy. Ensure this policy is periodically revisited and updated to align with tax regulations and your employees’ needs.

Communicate this policy effectively to your employees through emails, employee onboarding processes, training sessions, and announcements. This will minimize potential and future disputes and save everyone time.

Categorize your employee expenses

Categorize all your business expenses clearly in your company expense policy and guidelines.

Earlier, we saw the four broad categories of expenses: travel, food and entertainment, office expenses, and miscellaneous expenses.

Read more about how to categorize business expenses.

Digitize and organize receipts

Employees must organize and track receipts and proofs of expenses for a hassle-free expense claim.

Digitization of this process using receipt scanner apps or expense management tools with OCR-based functionalities can reduce employees' workload. This also ensures proper documentation and minimizes the risk of losing receipts.

Opt for paperless expense reporting

Employees submit paper-based expense claim forms with physical bills and receipts in the traditional expense claim process.

Move away from paper-based processes to digital-based reporting or advanced expense reporting tools and streamline your expense reporting process.

Analyze employee spending patterns

Regularly analyze your employees’ spending patterns. Many cost-optimization opportunities lie hidden and often go unnoticed as companies ignore employee expenditures.

By reviewing expense data using analytical tools, CFOs can improve budgeting and gain a bird' s-eye view of missed savings. Analyzing this data is critical to setting the right benchmarks and goals.

Have robust authorization and approval workflows

Set strict deadlines for expense approvals depending on the authorization required. These ensure a seamless and timely reimbursement process for employees.

Well-defined approval workflows also ensure no fraudulent claims pass through the cracks. Cover all grounds by considering all approvers based not only on teams, grades, and amounts but also on deviations and exceptions.

This can be easily set up using workflow automation tools that give real-time updates and reminders.

Enforce quick reimbursements

Ensure quick and timely reimbursements for your employees by allowing different modes of payments and reimbursements.

While some employers provide up-front per diem allowances for travel meals, others choose to reimburse employees at a later date. Regardless of the mode of payment, timely reimbursements are essential for a smooth claim process.

Tax compliance

Stay updated with IRS guidelines and other regional tax regulations and legal requirements. Companies often face penalties for failing to comply with regulations related to employee expense claims.

Opt for expense management tools

Leveraging modern expense management tools can be a game changer for your organization. They can improve your business efficiency and accuracy and your bottom line.

Think faster reimbursements, accurate financial records, 100% tax, and policy compliance!

These tools can automate different processes, such as data capture, expense reporting, approval workflows, reimbursements, etc.

When and how to automate your expense claim process

Each business has unique needs and requirements. A small business might only need an OCR tool to capture receipt data. The rest could be managed using a spreadsheet.

A mid-sized company might need a more comprehensive solution. One that handles everything from data capture to approval workflows to integration with accounting software.

Make sure you understand your requirements clearly before you think about automation.

Here’s a quick rundown of the steps you can follow to automate your expense claim process:

1. Identify your needs

Determine what you want to achieve with automation — faster processing times, reduced errors, better compliance, or all three.

Also, consider factors such as:

- The size of your company

- Your expense policy

- The volume of expense claims you handle

- The technical capabilities of your team

- Your budget

- Hurdles in the existing workflow

2. Evaluate available solutions

Research the market for available expense management solutions. Look for features that align with your needs:

- OCR for data capture and processing

- Rule-based approvals for faster processing

- ai-powered anomaly flagging

- Self-learning algorithms for categorizing expenses

- Integration with your accounting software

- On-the-go expense submission

- Customizable approval workflows

- Compliance checks and alerts

- Detailed reporting and analytics

3. Choose an expense management solution and implement it

When choosing a solution, consider user-friendliness, training required, scalability, security measures, cost, and customer support.

Narrow down your options. Request a demo or a trial period. This will give you hands-on experience with the software and help you determine whether it suits your business.

Once you've found the right solution, you can implement the solution in your organization. This may involve:

- Train your employees

- Defining the eligible expenses, approvers, approval limits, and workflows

- Setting up the roles and system to comply with your expense policy and regulations

- Integrating it with your existing systems (accounting, payroll, HR, etc.)

4. Monitor and optimize the performance

Check the accuracy of data capture, approval times, and reimbursement times.

Find out how often manual intervention is needed and whether the system correctly flags anomalies. Update the roles and rules as necessary.

Also, keep a track of user feedback.

Are your employees finding the system easy to use? Are they able to submit their expenses and get reimbursed quickly? You can use their feedback to make improvements.

Also, monitor the system's impact on your bottom line. Are you saving time and money? Is the tool helping you control costs and reduce fraud?

How Nanonets can help automate your expense claim process

Expense claim processing gets a lot easier with Nanonets. You can automate the expense claim process, from receipt capture to expense approvals and payment processing.

Here is a quick overview of how Nanonets can help:

1. Automate data capture

Employees can upload their receipts in bulk, and all the information is automatically extracted and categorized. There is no need to worry about formatting or manual data entry errors.

2. Centralize expense management

All expense claims are stored in one place, making tracking, managing, paying, and auditing easy. You can easily export the parsed data as CSV or Excel files for further analysis or reporting.

3. Work with an intelligent model

Our expense claim processing model learns from your actions over time. This helps improve the accuracy of data extraction and categorization, making the process more efficient over time.

4. Customize the workflows

You can set up approval workflows that align with your company's policies, ensuring that all expense claims undergo the necessary checks and balances before approval.

5. Automatically flag anomalies

Identify unusual expense claims based on historical data and flag them for review. This helps prevent fraud and maintain compliance with company policies.

6. Integrate with existing systems

Seamlessly integrate with finance, accounting, and other tools like Google Drive, Zapier, Xero, Sage, Gmail, QuickBooks, and more. Forget about endless data migration and enjoy a smooth transition.

7. Access real-time analytics

Get insights into your spending patterns, identify trends, and make data-driven decisions. Monitor your expense claims in real-time and take prompt action when necessary.

8. Ensure compliance

With built-in compliance checks and alerts, you can ensure that all expense claims adhere to your company's policies and regulations. Maintaining an audit trail becomes effortless, and you can avoid any potential legal issues.

Final thoughts

Managing expense claims is vital to any business. However, it is easy to lose track of expenses, especially when you’re chasing growth and expansion.

The good news is that automating the expense claim process helps. It not only saves you time and money but also keeps your operations running smoothly.

It reduces manual errors, ensures compliance, improves budgeting accuracy, and provides a clear view of your company's spending. This isn't just about cost control — it's about making intelligent, informed business decisions.

Nanonets can support you in this journey by providing an intelligent, reliable, secure, and efficient solution for expense claim processing. Our platform is designed to adapt to your business needs, making the shift to automated expense management smooth and painless.

Schedule a demo with Nanonets today and let us help you streamline your expense management.

Frequently Asked Questions (FAQs)

Q. What are expense claims examples?

A. Travel expenses (airfare, meals, overnight hotels, cabs, etc), office expenses, gas and mileage, networking expenses, meals, and entertainment expenses are some of the expense claim examples.

Q. What do you need for an expense claim?

A. Typically, you need an expense claim form to generate an expense claim. This form captures the details of all expenses, such as the date of expense, amount, vendor/merchant details, and the purpose of the expense. You must also attach all necessary documents, like receipts and invoices, as proof of costs.

In some companies, you can use expense reports instead to generate a reimbursement request.

Q. What is expense claim management?

A. Expense claim management is the end-to-end process of expense capture, expense claim generation, approval, verification, and reimbursing the employees for these expenses.

Q. Can I deduct unreimbursed employee expenses?

A. According to the IRS guidelines, only a select group of workers can deduct unreimbursed employee expenses. This group includes Armed Forces reservists, qualified performing artists, educators, fee-basis state or local government officials, or employees with impairment-related work expenses.

They must use Form 2106 to calculate and report such deductible unreimbursed expenses.

NEWSLETTER

NEWSLETTER