A bank extract is data extracted from bank statements or other financial documents.

The use of bank extracts allows organizations to quickly and easily extract important information such as account details, transaction history, and financial status from a range of financial documents. This facilitates verification of customer profiles, streamlining the onboarding process, approving loans and mortgages, assessing borrower risk, etc.

While bank extracts were obtained manually in the past, most companies are resorting to software to automate this tedious process.

PDF → Excel

Convert PDF bank statements to Excel

A bank extract may be obtained from various financial documents, some of the most common include:

- Bank statements: Bank statements are the most common sources of bank extract. These are official documents issued by a bank that provide detailed information on a customer’s account transactions and balances. Bank extraction software can be used to extract relevant information such as account details, transaction history, and financial status from bank statements.

- Credit reports: Financial data may also be extracted from credit reports that provide information on a person’s credit history, including their credit score, outstanding loans, and payment history. Bank extraction software can be used to extract this information and use it for loan approvals and risk assessments.

- Tax returns: Bank extraction software can be used to extract income and employment details from tax returns for customer onboarding and loan approvals.

- Payroll documents: These documents provide information on an employee’s salary and deductions. Bank extraction software can use this information to verify the employment and income status of the customer.

- Other financial documents: Other financial documents such as invoices, receipts, bills, and other proof of income documents can also be used as sources of financial information that can be extracted and stored for various purposes.

The difference between bank statement and bank extract

A bank statement and a bank extract are two different things, although they are related.

A bank statement is an official document issued by a bank, which provides detailed information on a customer’s account transactions and balances. It typically includes information such as deposit and withdrawal transactions, account balances, and any fees or charges. Bank statements are usually issued on a monthly or quarterly basis and are used by customers to track their account activity and ensure that all transactions are accurate.

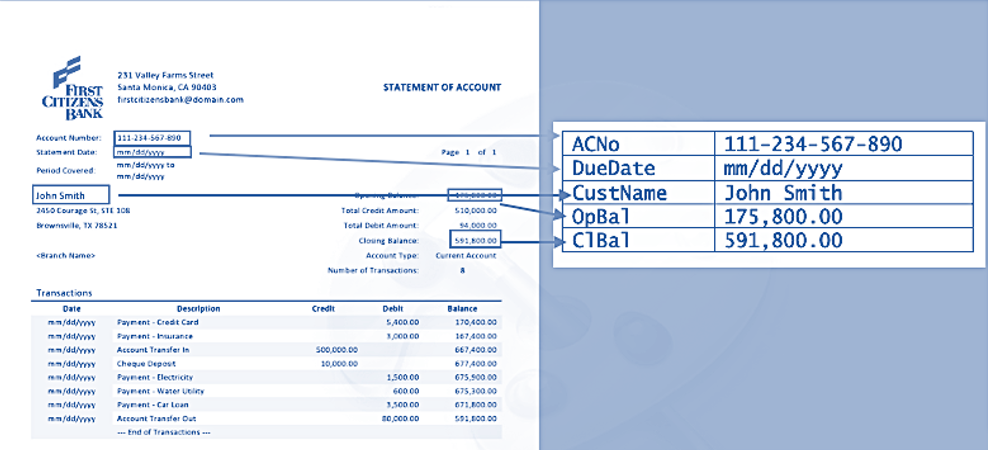

A bank extract, on the other hand, is the set of pertinent data that is extracted not only from a bank statement but also from other financial documents, often using bank extraction software. This software scans through the bank statement and other financial documents and pulls out relevant information such as account details, transaction history, and financial status of the customer. These data are then organized and presented in a structured format, making it easier for organizations to analyze and use the information for various purposes, such as customer onboarding, loan approvals and risk assessment.

Businesses of all types are increasingly benefitting from the process of extracting financial data from bank statements. The bank extract data can be used for a variety of purposes, such as financial analysis, reconciliation, and strategic planning. For example, retailers and e-commerce businesses can use bank extract to track sales and identify trends, while financial institutions can use it to detect fraudulent transactions. Additionally, businesses in the banking and finance industry can use bank extract to improve their customer service, by providing real-time information about account balances and transactions. Specific business sectors that use bank extracts to a large extent include,

- Banking: The banking sector is perhaps the largest user of bank extract software Banks use bank extraction software to efficiently process and analyze customer applications, verify their financial information, and make informed decisions about customer onboarding and loan approvals.

- Finance: Financial institutions such as investment banks, hedge funds, and private equity firms use bank extracts to assess the financial health of potential investments and make informed decisions.

- Insurance: Insurance companies use bank extracts to assess the risk of insuring a customer and to calculate premiums.

- Lending: Lending institutions such as microfinance companies and pawnshops use bank extracts to assess the creditworthiness of potential borrowers and make informed lending decisions.

- E-commerce: e-commerce companies use bank extracts to assess the creditworthiness of their customers and to detect and prevent fraud.

- Credit bureaus: Credit bureaus use bank extracts to calculate credit scores and provide credit information to financial institutions, landlords, and employers.

- Government: Government agencies use bank extracts to detect fraud, assess taxes, and comply with regulatory requirements.

- Accounting & Auditing firms: they use bank extracts to reconcile financial statements, detect fraud, and ensure compliance with accounting standards.

- Healthcare: healthcare providers and insurance companies use bank extracts to verify insurance coverage and to process claims.

- Real Estate: Real estate agents and mortgage lenders use bank extracts to assess the creditworthiness of potential buyers and to make informed decisions about property purchases.

Bank extracts are important to the various activities in a business because they provide a streamlined and efficient way to gather and analyze financial data. This data can be used to gain valuable insights into customer behavior, identify potential fraud, and improve overall operational efficiency.

Furthermore, automating the process of extracting data from financial documents can help reduce errors and save time and resources, allowing companies to focus on more strategic tasks. Additionally, by using advanced analytics on the extracted data, businesses can gain a better understanding of their customers, identify new business opportunities, and develop more effective marketing and sales strategies.

Some specific end uses of bank extracts are:

- Customer onboarding: Bank extraction software can be used to extract relevant information such as account details, transaction history, and financial status from bank statements and other financial documents, which can be used to verify customer profiles and streamline the onboarding process.

- Loan approvals: The data extracted from bank statements and other financial documents can be used to assess a customer’s creditworthiness and make informed decisions about loan approvals.

- Risk assessment: By identifying patterns and trends in customer transactions, bank extracts can help financial institutions identify and mitigate potential risks.

- Compliance: The extraction of data from financial documents can aid in compliance with regulatory requirements and Anti-Money Laundering (AML).

- Fraud detection: Bank extracts can be used to detect fraudulent activities by identifying abnormal transactions or patterns of activities that deviate from a customer’s normal behavior.

- Credit scoring: Bank extracts can be used to calculate credit scores by analyzing the transaction history and account balances of a customer.

- Business Intelligence: Bank extracts are used to gain insights and make data-driven decisions by using the extracted data to identify patterns, trends, and key metrics that can help the organization to make strategic decisions.

- Marketing: Bank extracts can be used to identify customer segments, target marketing campaigns, and measure the effectiveness of these campaigns.

- Customer service: By extracting data from financial documents, bank extracts can be used to improve customer service by identifying customer needs, preferences, and behavior.

Bank extract automation can significantly streamline the process of managing financial data.

By automating the extraction of information from bank statements, individuals and businesses can save time and reduce errors that can occur from manual data entry. This can be especially helpful for those who have a large number of transactions to track or for those who need to monitor multiple bank accounts.

Another benefit of bank extract automation is the ability to quickly and easily create financial reports. This can be helpful for businesses that need to keep track of expenses, generate invoices or reconcile accounts. Additionally, by having access to accurate and up-to-date financial information, individuals and businesses can make more informed decisions about their finances.

Software tools can help in getting a bank extract by using a combination of optical character recognition (OCR) technology, machine learning algorithms and natural language processing (NLP) techniques.

Machine Learning algorithms analyze the content of digitized financial documents and use pattern recognition techniques to locate specific data points such as account numbers, transaction amounts and dates, and other relevant information. The algorithms can also be trained to understand the context of the data and extract more contextually relevant information. Once the relevant data is extracted, the machine learning algorithm can validate the data using pre-defined rules and standards to make sure that the extracted data is accurate and complete. This process can be automated and can help to improve the speed, accuracy, and efficiency of data extraction from financial documents.

Many bank extract tools also feature algorithms for validation. The software validates the extracted data using pre-defined rules and standards to make sure that the extracted data is accurate and complete.

After the extraction and validation process, many bank extract software can generate reports or export the data in a specific format that can be used for further analysis and decision-making.

Companies in the financial services industry have recognized the potential benefits of AI and automation, with the banking industry expected to be among the top spenders on automation solutions by 2024, as reported by IDC. Additionally, a majority of finance leaders, at around 80%, have either already implemented or are planning to implement some kind of automation, as per Gartner’s report. Bank extract automation can increase revenues through personalized services, lower costs through improved efficiency and reduced errors, and reveal new opportunities through enhanced data processing and analysis.

The increasing use of bank extract automation in the financial sector is driven by its several advantages including,

- Efficiency: Automated bank extraction software can process large volumes of financial data quickly and accurately, reducing the need for manual data entry and analysis. This can save organizations time and resources, and help to speed up the customer onboarding process and loan approvals.

- Accuracy: Bank extraction software is designed to be highly accurate, with built-in algorithms that can identify, extract and validate key data points from financial documents. This can help to reduce errors and ensure the integrity of the extracted data.

- Compliance: Bank extraction software can aid in compliance with regulatory requirements and Anti-Money Laundering (AML) by extracting and analyzing financial data to detect any suspicious activity.

- Cost-effectiveness: Using bank extraction software can reduce the need for manual labor, thus reducing cost of labor and increasing operational efficiency.

- Scalability: Bank extraction software can process large volumes of data, making it a scalable solution for organizations with high volume of applications.

- Better Decision Making: The data extracted by bank extraction software can be used to identify patterns and trends in customer transactions, which can help financial institutions identify and mitigate potential risks, improve loan approvals and make data-driven decisions.

Nanonets is an advanced OCR tool that can significantly improve the process of extracting data from bank statements. It allows for easy conversion of bank statements into multiple formats like CSV, Excel, & JSON. This can be especially useful for companies that need to regularly process large amounts of financial data.

One of the key features of Nanonets is its AI-powered backend that facilitates the recognition of text, data, tables, graphs, and other elements within financial documents. This allows for the extraction of only the relevant information, which can be stored in the desired format. This feature can greatly enhance the efficiency and accuracy of data extraction, as it eliminates the need for manual data entry, which can be time-consuming and prone to errors.

Nanonets offers a wide range of benefits when it comes to converting bank statements into digital formats. One of the key advantages of this platform is its flexibility. Nanonets’ deep learning algorithms can handle a variety of data constraints, including handwritten text, multiple languages, low-resolution images, and images with new or cursive fonts, among others. This allows organizations to easily convert a wide range of bank statements into digital formats.

Another advantage of using Nanonets is its customizability. The platform allows organizations to use proprietary or custom data to train OCR models, which helps meet specific business requirements. This is particularly useful for organizations that have accounts with multiple banks, as each bank may have different statement formats.

Using Nanonets, organizations can easily re-train existing models with new data, allowing them to quickly adapt to unforeseen changes. This can be particularly useful when dealing with changing bank document formats or new data capture requirements.

Nanonets is also capable of working with non-English or multiple languages, making it an ideal solution for multinational operators who work across national borders. Additionally, it has a user-friendly interface, batch processing of multiple documents and seamless 2-way integration with multiple accounting software, making it easy to use.

Takeaway

Bank extracts play a critical role in the financial sector, providing important information for organizations to analyze the credit profiles of consumers. Automated data extraction software enables banks to efficiently record and assess customer account transactions while reducing the risk of errors associated with manual data entry. By using this technology, companies can also detect fraudulent statements and eliminate duplicate transactions during accounting. In effect, bank extracts and automated data extraction technology are vital tools for ensuring the accuracy and integrity of financial data.

NEWSLETTER

NEWSLETTER