Introduction

When diving into the world of accounting, reconciling accounts becomes a routine but crucial task, especially when bank or credit card statements arrive. After careful adjustments, achieving that zero balance feels like a triumph, marking the completion of your reconciliation process in QuickBooks Online. However, the dynamic nature of the business means that changes or oversights can occur, requiring a review of previously reconciled accounts. The question arises: Can you undo a reconciliation in QuickBooks Online? The answer is a Yeah.

It is possible to undo a reconciliation in QuickBooks Online, providing a lifeline for correcting errors or updating transactions. For accountants with the necessary permissions, undoing a complete reconciliation is simple. However, business owners or non-accounting users can individually adjust the reconciliation status of transactions, ensuring accuracy and compliance.

QuickBooks Online stands out as an easy-to-use accounting software, with nearly 29 million users in the US and designed for the needs of small and medium-sized businesses. From generating invoices and tracking expenses to managing cash flow, it is designed to optimize financial operations. Despite their reliability, human error can lead to discrepancies that require corrections, such as undoing reconciliations. This guide is intended to walk you through the process of undoing a reconciliation in QuickBooks Online, ensuring that your financial records remain accurate and reflect your current financial status.

Are you looking for reconciliation software?

Verify Nanogrid Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

Integrate nanonetworks

Reconcile financial statements in minutes

Why is reconciliation needed in QuickBooks Online?

Reconciliation in QuickBooks Online is an essential process for businesses looking to maintain accurate and consistent financial records. It involves comparing your general ledger with bank statements to verify the accuracy and completeness of your accounts before declaring them ready for month-end closing. The need for reconciliation cannot be stressed enough as it plays a critical role in identifying discrepancies that could require a comprehensive review or even a complete redo of the reconciliation process.

Performing reconciliations in QuickBooks Online becomes particularly critical under certain circumstances, requiring adjustments to previously reconciled transactions. These scenarios include:

- Transactions pending settlement: QuickBooks Online's bank feed feature helps automate transaction checks during reconciliation. However, incorrect filter settings can cause premature reconciliation of transactions still awaiting bank authorization, which could lead to discrepancies in the future.

- Data entry errors: Erroneous entries, such as duplicating transactions or incorrectly recording supplier details, can throw your books out of alignment. While minor details can be changed without affecting the overall reconciliation, correcting the date or other critical information often requires undoing and redoing the reconciliation to ensure complete accuracy.

- Categorization errors– QuickBooks Online may incorrectly suggest classifying certain transactions as transfers, resulting in them being posted to an inappropriate account. To rectify such errors, it is necessary to undo the reconciliation, eliminate the erroneous transfer, and correctly reclassify the transaction.

Understanding when and why to undo a reconciliation in QuickBooks Online underscores the importance of this feature in keeping your financial records accurate, highlighting its role in the broader context of financial management and reporting.

How to Undo Reconciliation in QuickBooks Online

Within QuickBooks Online, reconciliation is a critical process that ensures the accuracy and consistency of your financial records with your bank statements. This verification step is essential to close your accounts each month with confidence. However, there may be cases where you discover the need to revert a completed reconciliation due to changes or errors identified after the reconciliation. The flexibility to undo reconciliation in QuickBooks Online accommodates such adjustments, ensuring that your financial data continues to reflect your true financial situation.

It may be necessary to undo a reconciliation in several scenarios, including uncleared transactions that were reconciled prematurely, data entry errors that resulted in duplicate transactions, or categorization errors where transactions were recorded incorrectly. Each of these cases alters the accuracy of your financial records and requires correction through the undo and redo reconciliation process.

QuickBooks Online offers two avenues to address reconciliation discrepancies:

- accounting assistance: For comprehensive period adjustments, leveraging QuickBooks Online Accountant allows a qualified accountant to undo entire reconciliation periods efficiently. This option is ideal for general fixes that require professional supervision.

- Individual transaction settings: Users can manually adjust the reconciliation status of individual transactions, a feature that allows for specific corrections without the need for accountant intervention. This step-by-step process involves accessing the Chart of Accounts, filtering transaction views, and modifying the reconciliation status of the affected entries.

The process to undo the reconciliation involves:

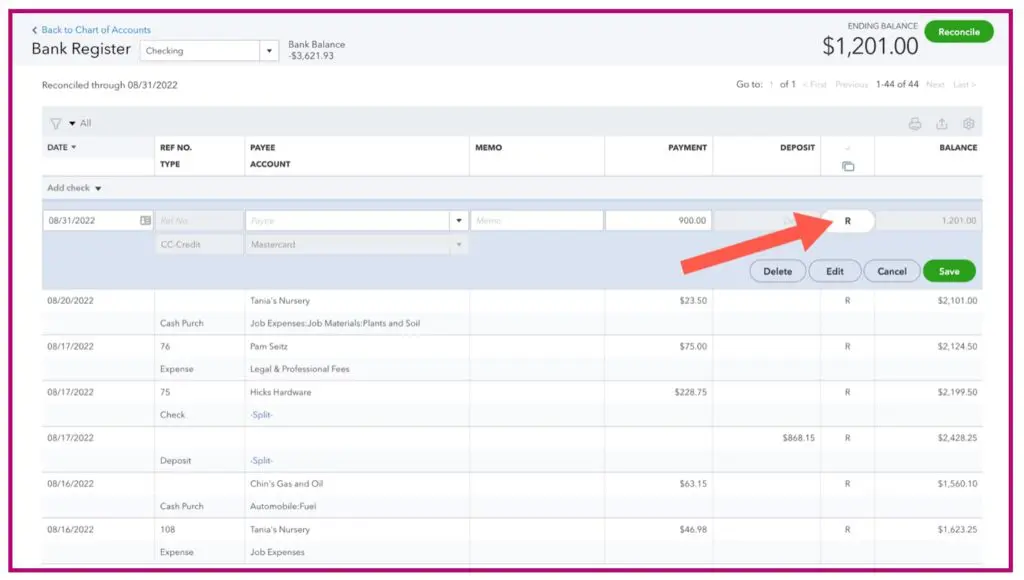

- Navigating to the Accounting menu to access the Chart of Accounts.

- Select the account in question and view the record.

- Filter the record to facilitate navigation and identify reconciled transactions marked with an “R”.

- Modify the reconciliation status by deselecting the “R”, effectively removing the transaction from the reconciliation list.

- Save changes to update the account reconciliation status.

This corrective action, while necessary, underscores the importance of thoroughness in the initial reconciliation process. It serves as a reminder of the critical role reconciliation plays in maintaining the integrity of your financial records. Whether correcting a singular transaction or performing a more substantial review with the help of an accounting professional, QuickBooks Online makes it easy to make the necessary adjustments to ensure your financial reports remain accurate and reliable.

Common reconciliation mistakes to avoid

Ensuring that financial records are accurate and reflect actual transactions is a critical skill for business owners. However, the process is not without difficulties. Common errors can disrupt the integrity of your financial data, emphasizing the need for regular and careful reconciliation. Below are key points that highlight the importance of this process and common mistakes to avoid:

- Frequent reconciliation: Regular reconciliation is crucial to maintaining a clear and accurate view of your company's finances. Neglecting this task increases the risk of errors accumulating over time, making it difficult to rectify discrepancies later.

- Correct posting of transactions: A common error is the reversal of entries, where credits are posted as debits and vice versa. These errors can cause material inaccuracies in your financial statements.

- Avoid duplicate payments: Duplicate payments to vendors may occur, particularly with changes in team members or insufficient invoice processing protocols. This not only affects your financial statements but also affects your cash flow.

Given these challenges, it is recommended to perform reconciliation tasks with a solid understanding of accounting fundamentals to avoid potential discrepancies. Engaging with a professional, such as a certified QuickBooks ProAdvisor, can provide the guidance needed to effectively navigate online reconciliation. This support can streamline the reconciliation process, ensuring your accounts remain accurate and up-to-date, thereby laying a solid foundation for reliable financial management and reporting.

Integrate nanonetworks

Reconcile financial statements in minutes

Conclusion

In conclusion, the reconciliation process within QuickBooks Online is an indispensable practice for companies seeking to maintain accurate and transparent financial records. While the task may seem daunting at first, understanding common mistakes and how to avoid them can significantly speed up the process. Regular reconciliation ensures a true reflection of your financial situation, assisting in strategic decision making and protecting against potential financial discrepancies.

Errors such as missed reconciliations, incorrect postings, and duplicate payments can not only distort your financial narrative but can also cause complications in financial reporting and tax preparation. Therefore, a disciplined approach to reconciliation, along with a keen eye for detail, is essential. For those who may find the process challenging, leveraging the expertise of a certified QuickBooks ProAdvisor can provide not only valuable information and assistance, but also peace of mind.

Ultimately, the goal of reconciliation in QuickBooks Online is to ensure that every transaction is accounted for accurately, providing a solid foundation for the financial health of your business. By prioritizing this critical aspect of financial management, businesses can avoid common mistakes, optimize their accounting processes, and focus on growth and development with confidence. Remember, in the world of business finance, precision is not just a virtue—it's a necessity.

NEWSLETTER

NEWSLETTER