Expense management, at its core, is the methodical process by which a business tracks, verifies, and processes every financial expense incurred in its operations.

This encompasses the crucial tasks of

- recording expenditures.

- ensuring expenditures align with company policies.

- ensuring expenditures are approved by the right people.

- analyzing expenditures for better fiscal oversight and strategic planning.

- safeguarding a business from errors, fraud, and compliance nightmares.

In essence, it’s the art and science of making sure that every penny spent by your business not only counts but is accounted for.

Imagine a world where the Great Pyramids were built without any measurement tools, a feat of precision based purely on guesswork. Seems implausible, right? Yet, this is how many businesses still approach expense management – a critical yet often under-appreciated aspect of their operations. In today’s business environment, expense management plays a pivotal role in shaping the financial landscape of businesses, big and small.

In this blog, we’ll dive deep into the world of expense management and explore the following themes.

- need of expense management

- evolution and current state of expense management

- how to get started with expense management?

- how to create an expense policy?

- how to implement expense management?

- case studies around implementing expense management

- comparison of best expense management software

- corporate culture and expense management

- future trends in expense management

- additional resources

Need of Expense Management

Let’s face it, in the ever-evolving world of finance, managing expenses isn’t just a good idea—it’s a survival tactic. I mean, think about it. With businesses growing more complex and markets more volatile, the guy with a handle on his wallet is the one who gets to call the shots. This isn’t just about pinching pennies; it’s about strategic financial governance.

Now, you might be thinking, “We’ve got this covered with our trusty spreadsheets and quarterly audits.” But let’s not kid ourselves. The traditional methods are about as effective as a screen door on a submarine when it comes to the dynamism of today’s financial ecosystem. We need something more—something that not only tracks expenses but also gives us insights and foresight.

Let’s take a practical example. Imagine a mid-sized tech company, let’s call it ‘InnovateX’. They’re doing well, growing fast, and their product is a hit. But here’s the kicker: their financial management is stuck in the last decade. They’re using manual processes, and their expense tracking is, frankly, a mess.

Cue the entrance of a comprehensive expense management solution. With a robust system in place, InnovateX could not only keep tabs on their expenses but also leverage this data to make strategic decisions.

For instance, they find out that they’re overspending on vendor services, some of which overlap. Or, they realize that their travel expenses are through the roof because they lack a policy for booking cost-effective travel options. With these insights, InnovateX can renegotiate vendor contracts, streamline services, and implement a new travel policy.

InnovateX starts to save money, sure, but they also become more efficient, more agile, and better positioned to invest in growth opportunities. They move from playing defense with their finances to playing offense.

Let’s see how InnovateX, or any other company adopting expense management best practices and solutions is able to effectively address traditional expense management issues:

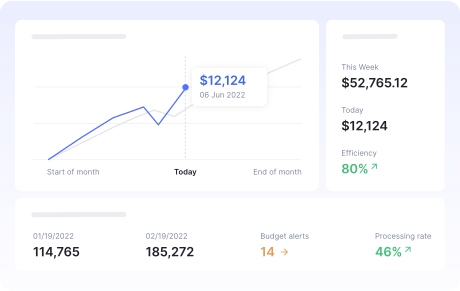

- Real-Time Data is King: In the fast-paced business world, making decisions based on last quarter’s data is like driving using your rearview mirror. Modern expense management provides real-time insights, allowing businesses to make informed decisions on the fly. InnovateX implemented a cloud-based expense management system that provided real-time reporting. This allowed their finance team to spot a sudden, unexplained increase in marketing expenses and quickly address the issue, preventing budget overrun.

- Cost Containment isn’t Optional: Effective expense management helps businesses identify and eliminate wasteful spending. By analyzing their expense data, InnovateX identified that they were overpaying for office supplies from a long-time vendor. They negotiated better rates and explored more cost-effective options, leading to significant annual savings.

- Fraud Prevention – Better Safe than Sorry: Without a robust expense management system, your business is like a house with the doors unlocked. It’s an open invitation to fraudsters. A good system can flag irregularities and prevent financial leaks. InnovateX introduced automated expense approval workflows and anomaly detection. This system flagged an unusual pattern of small, frequent purchases by an employee, uncovering a minor case of expense fraud that was swiftly dealt with.

- Regulatory Compliance – Don’t Mess with The Law: Automated expense management ensures that you’re always on the right side of the law, avoiding costly legal pitfalls. With ever-changing regulations, managing compliance manually is like juggling dynamite. InnovateX adopted an expense system that automatically updated with the latest tax and regulatory requirements, ensuring compliance and avoiding a potential hefty fine due to an overlooked tax regulation.

- Budgeting isn’t a Guessing Game: Expense management turns budgeting into a science rather than a guessing game. By analyzing spending patterns and trends, businesses can forecast more accurately and allocate resources more effectively. Utilizing historical expense data, InnovateX accurately forecasted their IT spend for the upcoming year, preventing a mid-year budget shortfall that had plagued them previously.

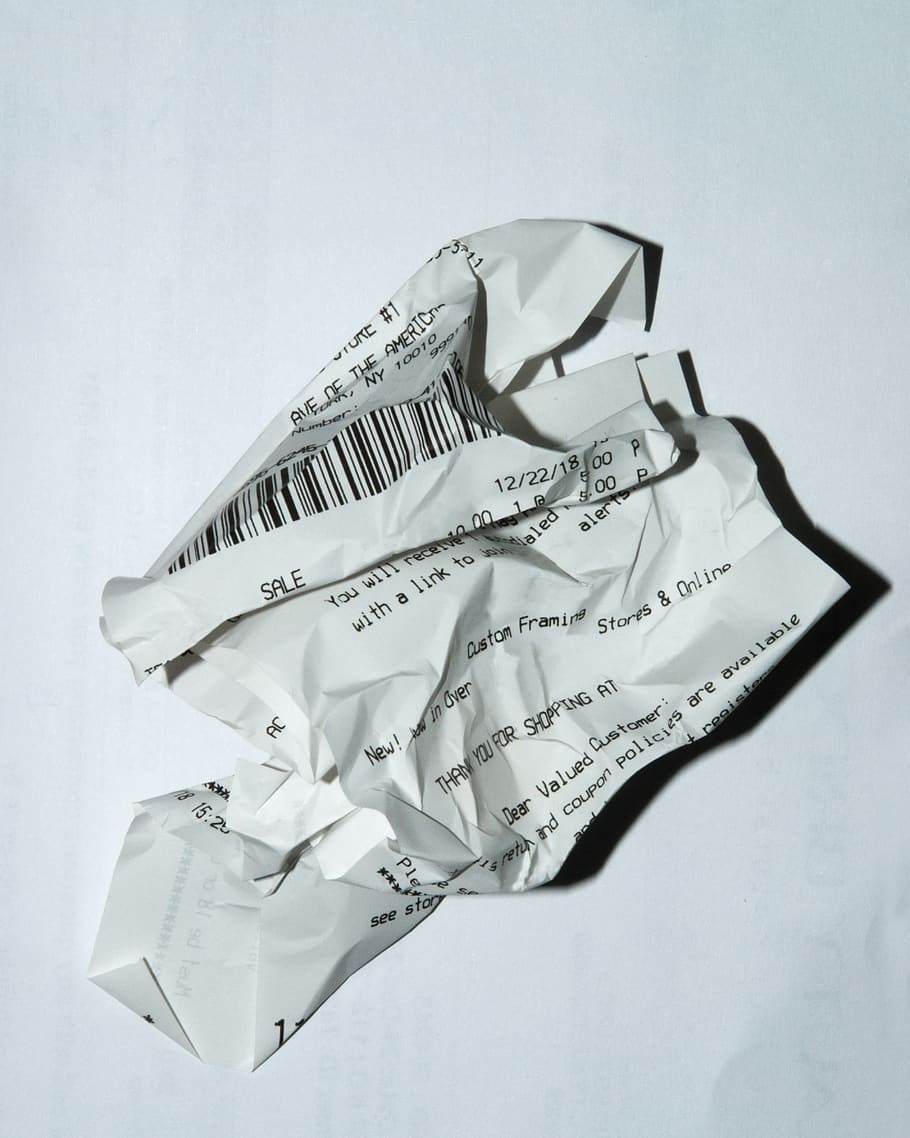

- Manual Work is time-consuming and error-prone: An efficient expense management system simplifies processes, reduces manual tasks, and keeps your team focused on what they do best, not on filling out expense reports. InnovateX used the OCR-based mobile app offered by their expense management software for expense reporting which captures data directly from receipts and populates the same in the expense management system. This reduced the time employees spent on expense reports, boosting morale and reducing errors.

- Strategic Decision Making: Information is power. By providing detailed insights into where and how money is being spent, expense management systems empower businesses to make strategic decisions that drive growth and efficiency. InnovateX’s leadership used expense data to decide to shift a portion of their advertising budget from traditional media to digital channels, resulting in a higher ROI as indicated by the sales and marketing expense analysis.

- Visibility Leads to Accountability: When employees know that expenses are being monitored and analyzed, it leads to more responsible spending. This isn’t about micromanagement; it’s about creating a culture of accountability. InnovateX noted a cultural shift with employees became more mindful of their spending, leading to a reduction in non-essential expenses, like excessive business lunches.

- Scalability – Grow Without the Growing Pains: A solid expense management system can grow with your business, ensuring financial management doesn’t become a bottleneck. As InnovateX opened a new office in another country, the system was already able to handle multi-currency expenses and different tax regimes.

- The Bottom Line – It’s All About the Greenbacks: At the end of the day, it’s about the bottom line. Effective expense management directly contributes to profitability. InnovateX’s focused approach to expense management led to a 15% reduction in travel costs, directly boosting their profitability.

Thus, applying expense management in your business leads to tangible benefits, enhancing operational efficiency, compliance, and ultimately contributing to the company’s financial health.

Evolution and Current State

The journey of expense management is a tale of evolution, mirroring the broader story of business development. From the days of ledger books and piles of paper receipts to the modern era of software solutions, expense management has undergone a transformative journey. In the last decade, the advent of ai and cloud computing has revolutionized this field. Gone are the days of laborious manual entry; today, a receipt can travel from a pocket to a digital ledger in mere seconds.

The expense management market is a market buzzing with activity, ripe with innovation, and growing faster than a Silicon Valley startup on steroids. According to a recent report, the global expense management software market is projected to grow significantly in the next five years, driven by a surge in demand for automated and integrated financial solutions.

Companies like Nanonets, SAP Concur, Expensify, and Coupa are leading the charge, transforming the landscape with cutting-edge solutions that make expense management seem like a walk in the park. Their contributions range from ai-driven analytics to seamless integrations with accounting systems, reshaping how businesses handle their expenses.

But what’s truly fascinating is the widespread adoption of these solutions. From the sprawling conglomerates to the bustling startups, businesses across industries are jumping on the expense management bandwagon. This isn’t a trend limited to the finance or tech sectors; it’s a cross-industrial movement. Retailers, manufacturers, healthcare providers – you name it, they’re all recognizing the need for efficient expense management solutions.

Challenges in Expense Management

Businesses looking to implement expense management in a traditional manual workflow immediately face a boatload of challenges. Let’s look at the challenges most commonly faced by a business looking to implement expense management.

- Manual data leads to errors and wastes valuable time & human resources. A mountain of receipts, hours spent in manual data entry, and the inevitable human error that creeps in – It’s a recipe for financial disaster.

- Then there’s the behemoth of policy compliance. Ensuring adherence to both corporate policies and regulatory mandates is like walking a tightrope. One slip, and you’re in a world of compliance chaos. This is where many businesses stumble, struggling to keep up with ever-changing regulations and internal policies.

- And let’s not forget about integration issues. In a world where your expense management system needs to talk to your accounting software, your ERP system, and maybe even your CRM, integration is key. But achieving seamless integration is often easier said than done. Businesses frequently grapple with making their systems work in harmony, often leading to data silos and operational inefficiencies.

- Manual Approvals are inefficient and directly lead to late fined payments and operational inefficiencies. Approvers are often unaware of the context of the expenses which need to be approved, and cumbersome approval workflows lead to delays. Human intervention in approvals can lead to missed deadlines, fines, and increased administrative burdens, making automation a more efficient alternative for streamlining workflows and ensuring timely transactions.

- Ensuring seamless payments to vendors, employees, and suppliers can be challenging. Delayed or incorrect payments can lead to strained relationships, financial penalties, and tarnished business reputation. Moreover, for businesses operating internationally, managing expenses in multiple currencies can be intricate. Handling exchange rates, compliance with foreign regulations, and reconciling multicurrency transactions require specialized tools and expertise.

- Dealing with multiple vendors for expense management software, payment processing, and other related services can be complex. Coordinating and managing these relationships effectively can be a challenge in itself.

- As businesses grow, their expense management needs may scale. Ensuring that the chosen expense management solution can scale to accommodate increased transaction volumes, additional employees, and expanding operations is essential for long-term success.

- Managing and storing digital receipts, invoices, and other expense-related documents can become overwhelming. Maintaining a thorough and easily accessible audit trail is essential for compliance and transparency. This includes recording all changes and approvals related to expenses and having proper documentation readily available for audits.

- Generating meaningful insights from expense data is essential for informed decision-making. Setting up robust reporting and analytics capabilities, understanding the data, and translating it into actionable intelligence can be complex, particularly for businesses with large volumes of expense data.

Technological Innovations in Expense Management

Automation and ai have come to our rescue. Let’s explore how these cutting-edge advancements are revolutionizing expense management.

Automation: The New Workhorse of Financial Management

Welcome to the era of automation, where expense reports create themselves, submissions are a breeze, and approvals don’t require a Herculean effort. Automation in expense management is like having a financial wizard by your side, one that works 24/7 without a coffee break. It’s transformed the monotonous chore of expense report creation into a streamlined, error-free process. Now, employees snap a photo of their receipts, and voila, the data magically finds its way into reports. Approvals that used to take days now happen in real-time, ensuring a smooth cash flow and happy employees. This isn’t just about saving time; it’s about redefining efficiency.

Mobile and Cloud Solutions: Expense Management at Your Fingertips

Finally, let’s talk about the unsung heroes: mobile and cloud solutions. In a world where business happens everywhere, why should expense management be chained to a desk? Cloud-based platforms mean that financial data is always at your fingertips, secure and up-to-date. And with mobile apps, expenses can be managed on the go – from the backseat of a cab or the departure lounge of an airport. This mobility and flexibility aren’t just conveniences; they’re necessities in a world that never stops moving.

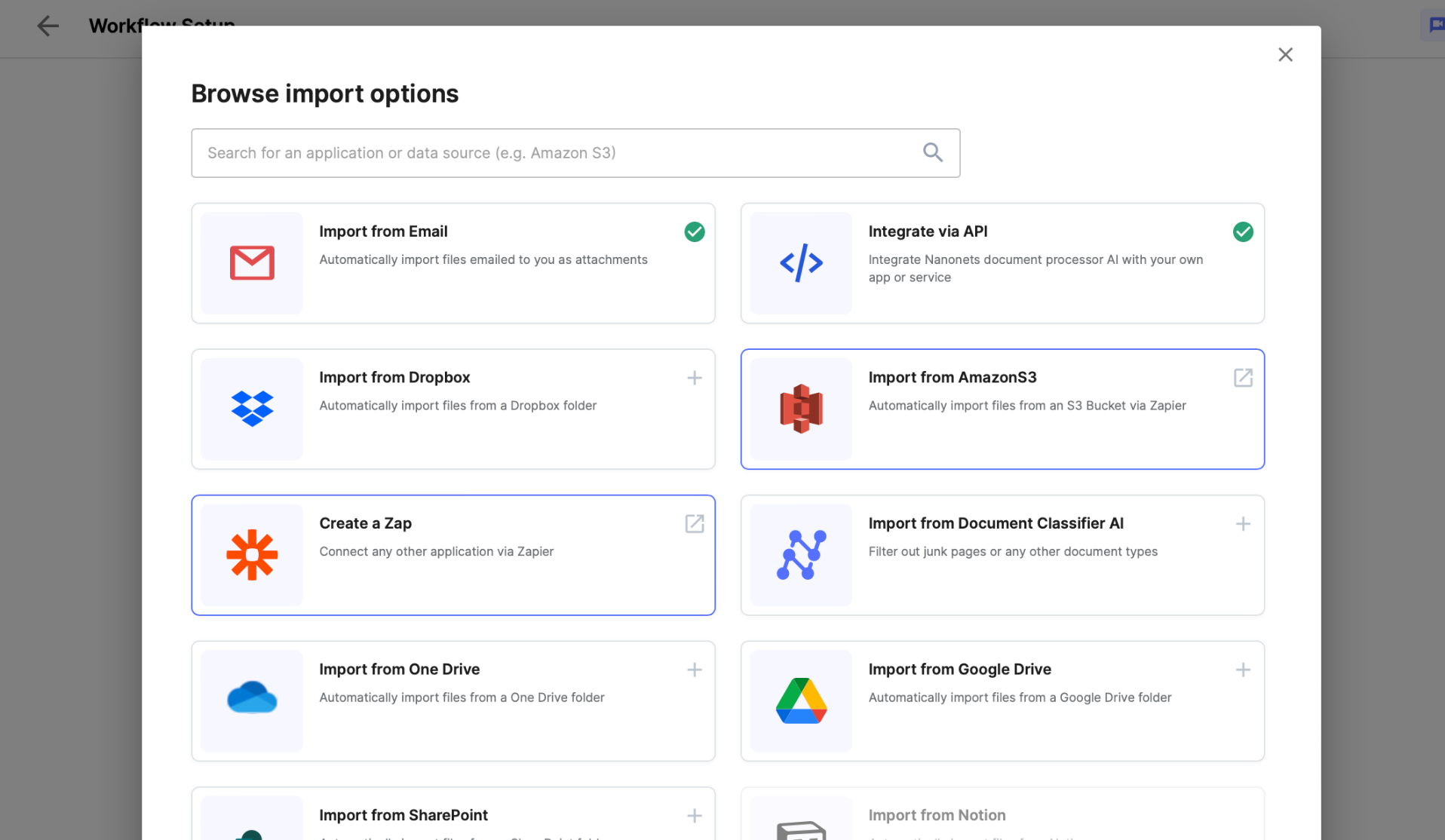

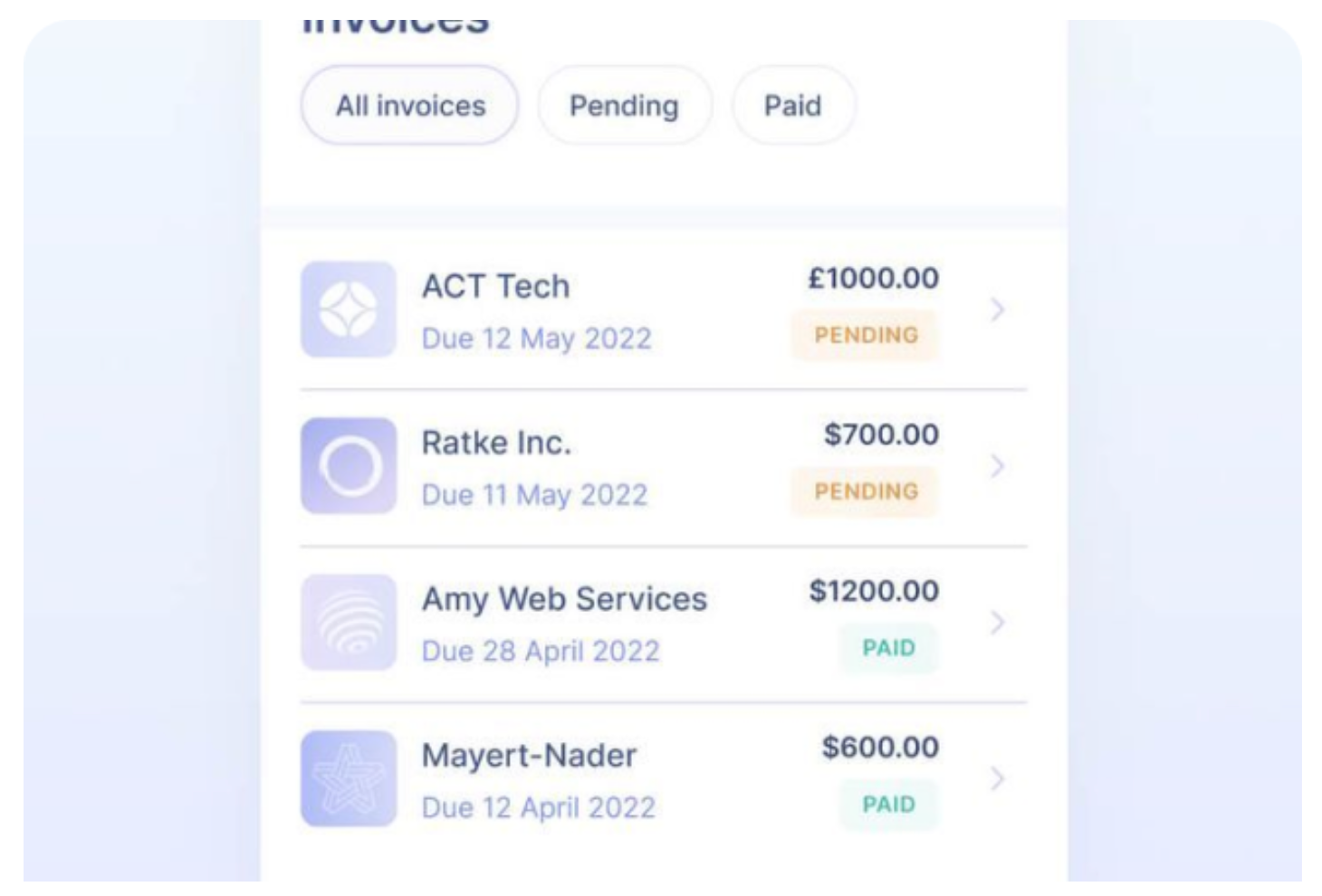

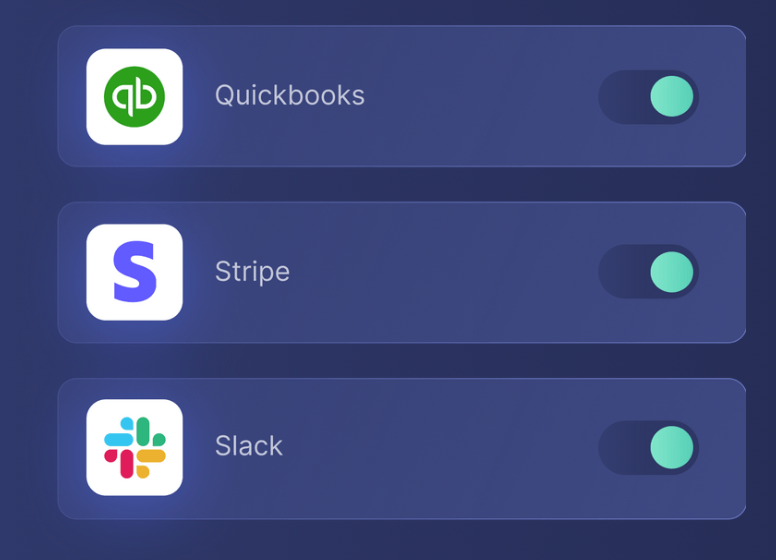

Integrations: Your apps can now talk to each other

Integrations are essential tools that make expense management even more efficient. They connect your apps and ensure real-time data sync between your applications and databases. Just to list a few, you can now –

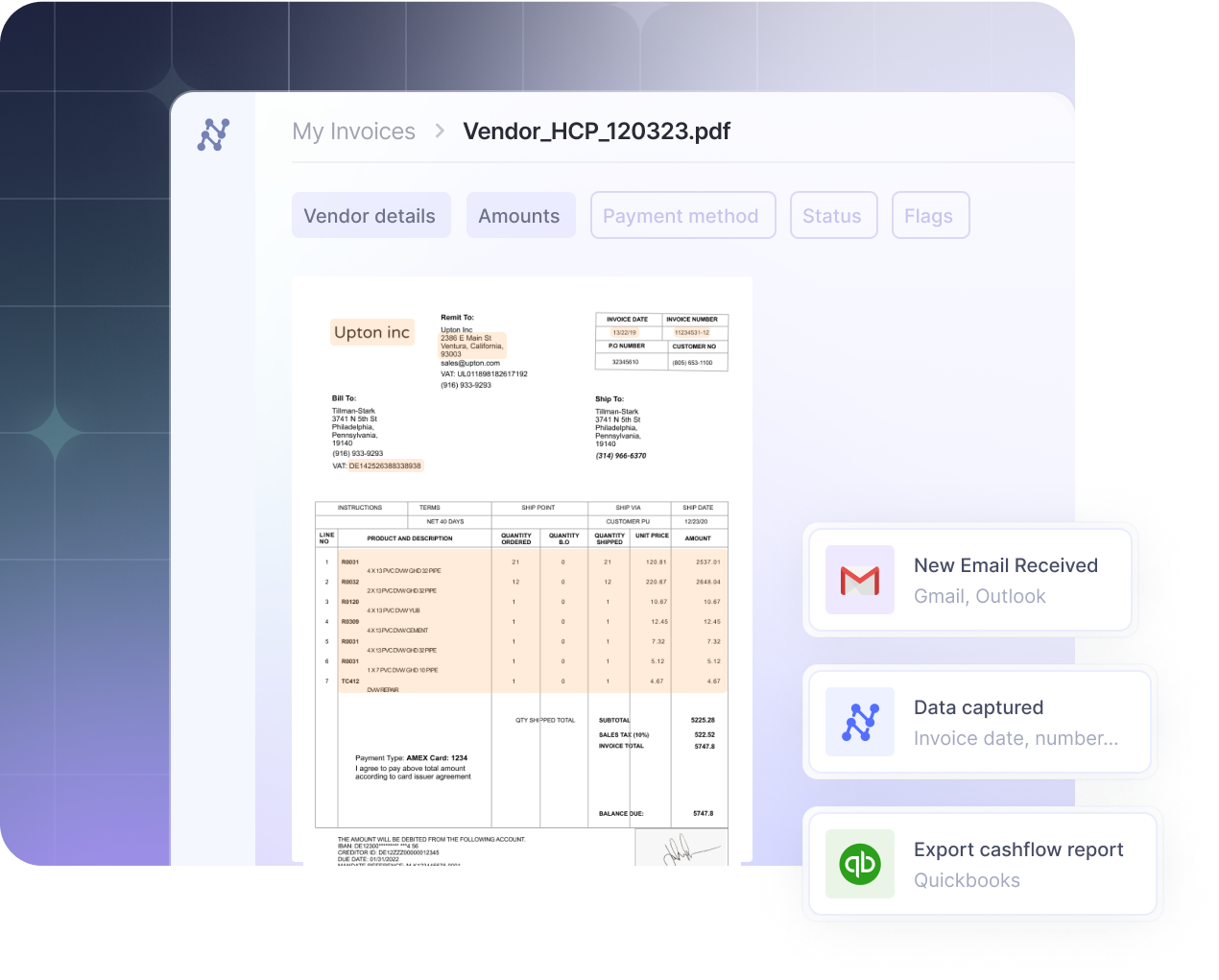

- Link your Emails and other apps to your expense management system for seamless ingestion of expense bills, invoces and receipts. An OCR-based system can directly extract data from your expense documents and ingest the data in structured format.

- Link your expense system with accounting software like QuickBooks or Xero for seamless data flow and error reduction.

- Streamline reimbursement by integrating with HR and payroll software for a smoother process.

- Integrate with project tools like Trello to allocate expenses accurately to specific projects.

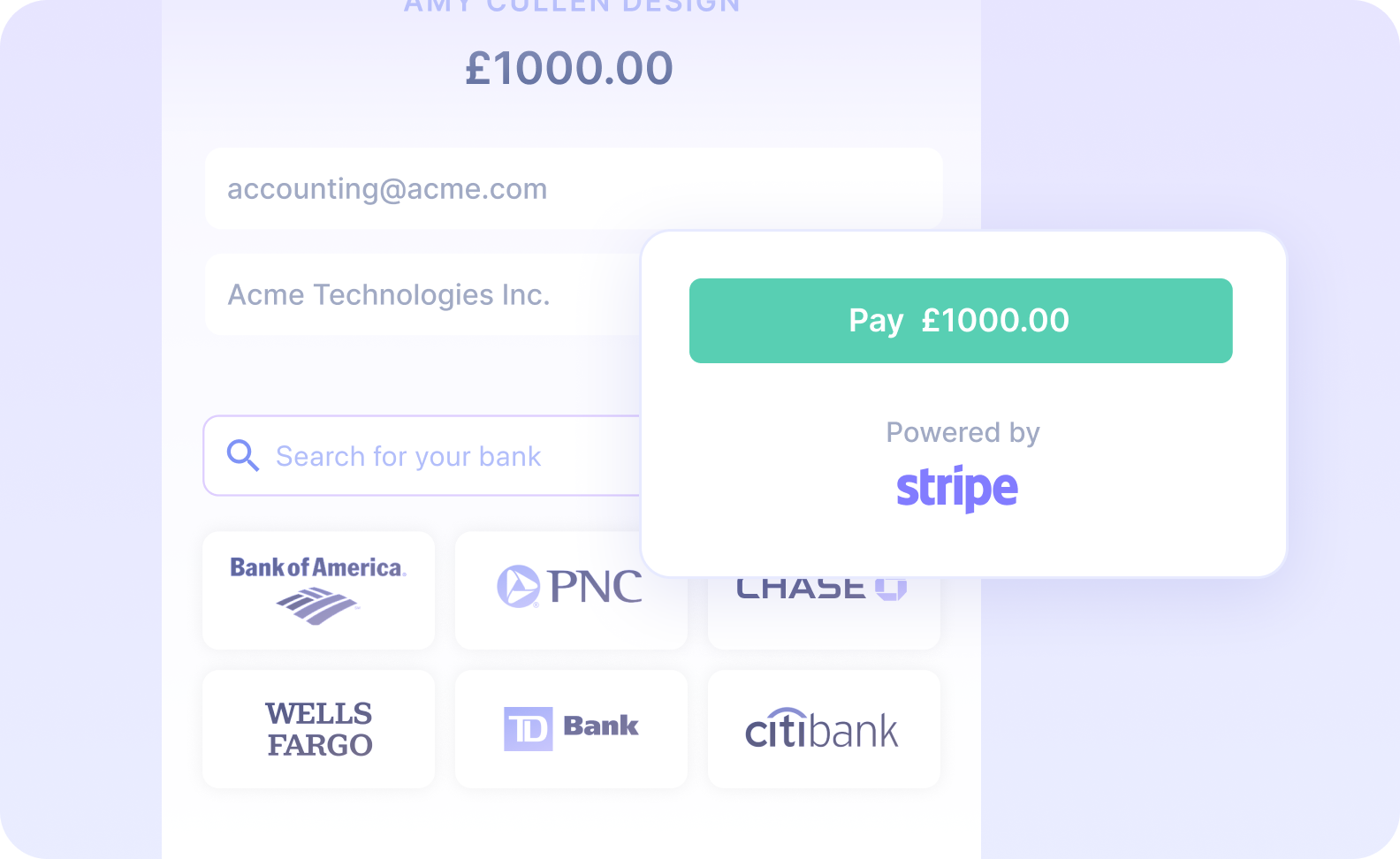

Seamless Payments: Direct payments that are faster, cost-effective & secure

Payments can now directly be made through your expense management software. These systems now provide vast functionalities to make payments seamless –

- You can choose from ACH transfer, credit cards, wires and wallet payments globally. Use an automated payment schedule – or pay on your own terms.

- Some platforms like Nanonets offer global, multicurrency payments with no extra fees.

- You can integrate seamlessly with your existing bank account and start sending payments in minutes, and even set up your vendor accounts right in the platform – so all you need to do is click ‘Pay’.

<h6 id="ai-driven-data-analytics-the-brain-behind-the-operations”>ai-driven Data Analytics: The Brain Behind the Operations

These aren’t just buzzwords; they’re the backbone of modern expense management. ai dives into the sea of financial data, analyzing spending patterns, and fishing out insights that would make even the most seasoned accountant raise an eyebrow. These algorithms detect anomalies, flag potential fraud, and even learn to predict future spending trends.

Best Practices

Let’s discuss how to get started thinking about and implementing expense management for your business.

Strategic Expense Tracking

At the heart of effective expense management is the principle of meticulous tracking. Every penny spent needs to be accounted for, not just for compliance, but to gain valuable insights into spending patterns. This level of detail helps in budgeting and forecasting, and in identifying areas for cost savings.

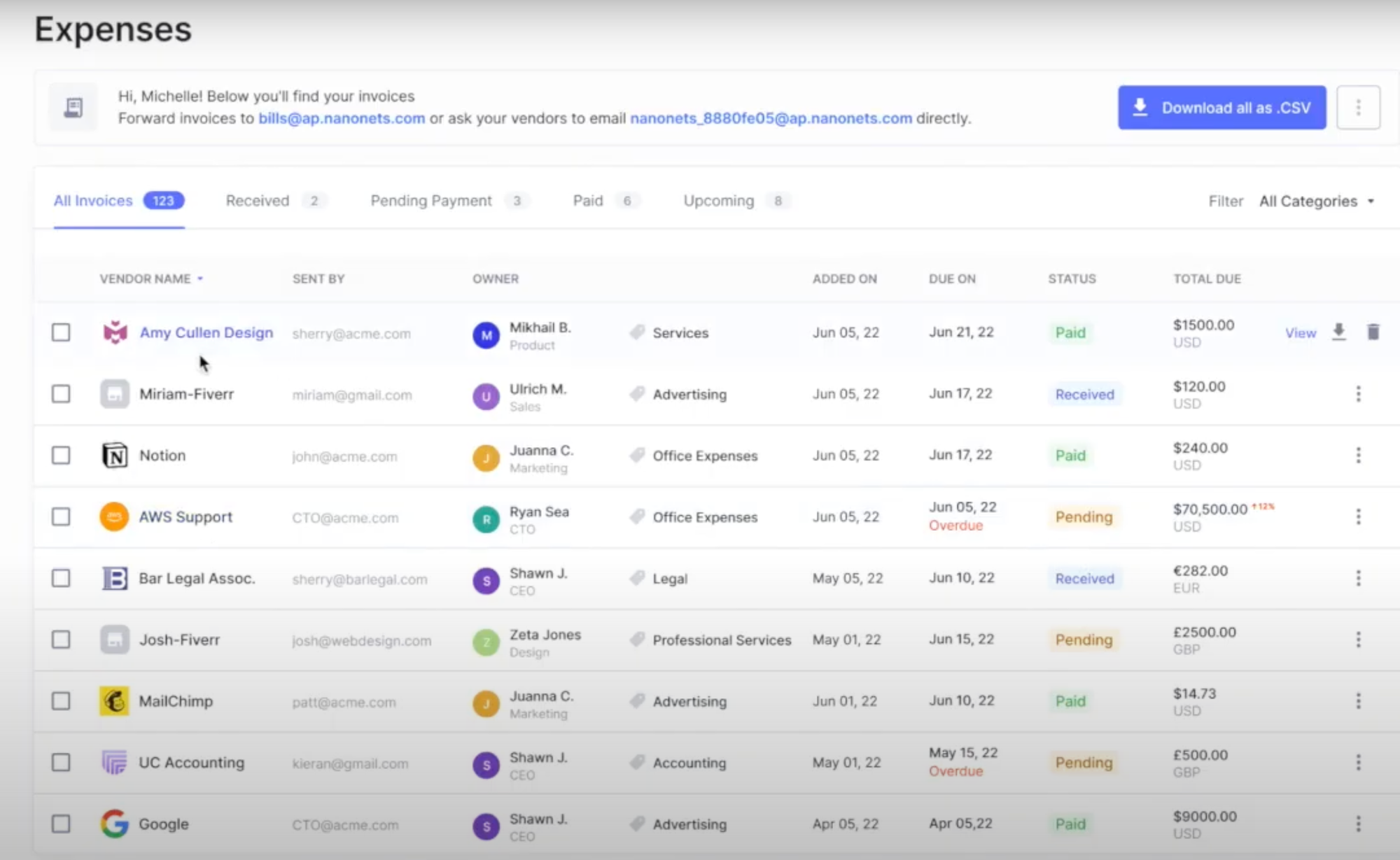

Modern tools and software have revolutionized this aspect of expense management. Platforms like Nanonets offer streamlined processes for capturing and categorizing expenses, making it easier than ever to maintain comprehensive records.

Regular Audits and Reviews

Another pillar of best practice in expense management is the regular conduct of audits and reviews. This is where the financial rubber meets the road. Audits aren’t just about compliance; they are about ensuring the integrity of financial reporting.

The best practice here involves setting a regular schedule for audits, using a mix of internal and external resources to ensure objectivity. The goal is to identify any discrepancies, potential fraud, or inefficiencies. This continual scrutiny not only safeguards against financial mismanagement but also reinforces a culture of accountability.

<h4 id="leveraging-technology“>Leveraging technology

We’re in an age where technology is an ally in almost every business function, and expense management is no exception. ai, machine learning, and automation are not just buzzwords; they are tools that can drastically simplify and enhance the efficiency of expense reporting and approval processes.

These technologies can automate mundane tasks, flag anomalies, and even predict future spending patterns, allowing for more strategic financial planning. The adoption of such tools is no longer a luxury but a necessity for businesses looking to stay competitive and financially sound.

Ensuring Policy Alignment

Finally, the linchpin of effective expense management is ensuring that all practices align with company policy. It’s not enough to have a well-written policy; it must be a living document that is reflected in every expense transaction.

Here, technology plays a critical role in enforcing compliance. With the right tools, violations of policy can be flagged in real-time, approvals can be streamlined, and exceptions can be managed more effectively. This alignment ensures that the company’s financial strategy is consistently applied across all levels, leading to more cohesive and effective financial management.

Expense Management Policy

Now that we have a adequate grasp on the expense management landscape, the next step is to create an expense policy.

A well-crafted expense policy serves as a navigational chart, guiding employees through the often murky waters of business spending, while ensuring the company’s financial ship stays on course.

Let’s see how to create one.

The role of an expense policy extends beyond mere rules; it’s about setting the tone for how a company handles its finances. A good policy strikes a delicate balance between flexibility and control. It needs to be flexible enough to accommodate the varied needs of a dynamic business environment, yet stringent enough to safeguard the company against unnecessary expenditures and potential fraud.

Key Elements of an Effective Policy

Every effective expense policy should have certain non-negotiable elements:

- Clear Definitions: What constitutes an ‘expense’? This might seem elementary, but ambiguity leads to confusion. Define clearly what employees can and cannot claim as business expenses.

- Spending Limits: Set clear limits. This could vary by role, department, or type of expense. It’s about creating boundaries within which employees can operate autonomously.

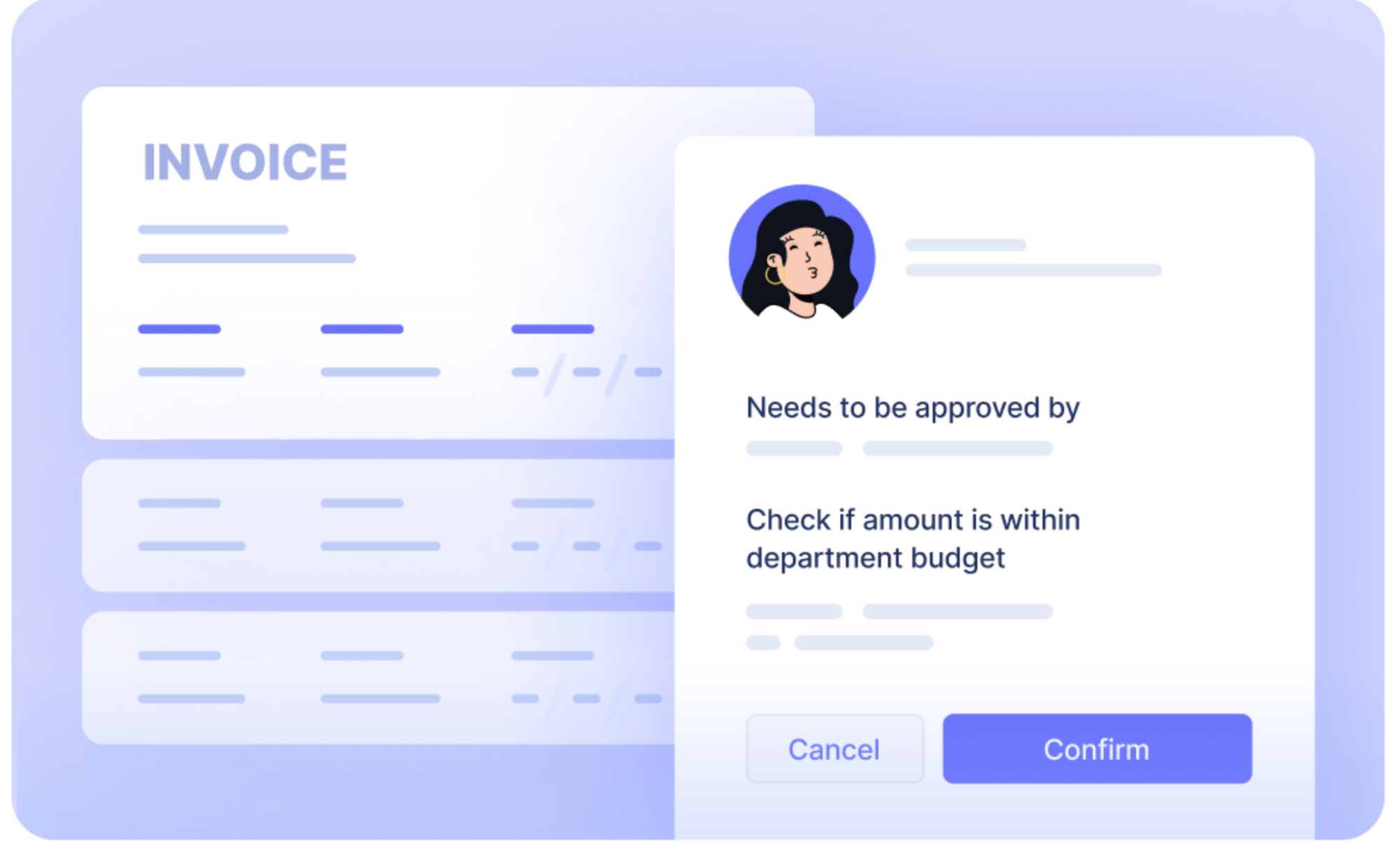

- Approval Processes: Establish who authorizes expenses and the workflow for approval. This helps in maintaining a checks and balances system.

- Receipt and Documentation Requirements: Specify the documentation needed to substantiate expenses.

Customization to Business Needs

One size does not fit all in expense policy creation. A startup with a handful of employees might need a more straightforward policy compared to a multinational corporation. For example, a tech startup might allocate more towards software subscriptions, while a manufacturing firm might focus on travel and client entertainment expenses. Tailoring your policy to the specific needs and culture of your business is crucial for its effectiveness and adoption.

Transparency and Accessibility

A policy locked away in a filing cabinet or buried in an employee handbook is as good as non-existent. Make your expense policy easily accessible – publish it on your intranet, include it in onboarding materials, or even integrate it into your expense management software.

Updating and Evolving Policies

The only constant in business is change. As your company grows, as new technologies emerge, and as the business environment evolves, so too should your expense policy. Regular reviews and updates ensure that your policy stays relevant and effective. This could mean adapting to new tax laws, accommodating emerging expense categories like remote work setups, or integrating new technology solutions.

Promoting a Culture of Compliance

Culture is the ecosystem in which policies either thrive or wither. Creating a culture that values compliance starts at the top. When management leads by example, it sets a precedent. Regularly discussing the importance of expense management in team meetings, celebrating examples of good compliance, and openly discussing challenges can help foster an environment where compliance is valued.

Monitoring and Feedback

Continuous monitoring isn’t about playing ‘big brother’; it’s about providing ongoing support and ensuring the system works as intended. Utilizing technology for monitoring can make this task less daunting. Expense management software with real-time alerts and analytics can help identify patterns that may indicate non-compliance or areas where additional training might be needed.

Feedback loops are equally important. Encouraging employees to provide feedback on the expense management process can uncover insights into potential improvements or areas of confusion.

Addressing Non-compliance

When non-compliance occurs, it’s crucial to address it constructively. The goal is to correct behavior, not to punish. Understanding the root cause is key – is it a lack of understanding, a flaw in the policy, or something else? Tailoring the response to the reason behind the non-compliance can turn these situations into learning opportunities, ultimately strengthening the compliance framework.

Expense Policy Example

Let’s consider a hypothetical company, “TechWave Solutions,” a mid-sized technology firm specializing in cloud-based services, with around 300 employees. TechWave is experiencing rapid growth and needs to revamp its expense policy to keep up with its evolving needs. Let’s see through how they might go about crafting and exercising their expense policy.

1. Clear Definitions:

- Expense Definition: Expenses at TechWave include any cost incurred for business purposes. This includes

- travel

- client entertainment

- software subscriptions

- office supplies

- Non-Expense Items: Personal expenses, fines for traffic violations while on business trips, or any costs not directly related to business operations.

2. Spending Limits:

- Travel: Limited to $200 per day for accommodation, $50 for meals, and $300 for flight tickets (economy class).

- Client Entertainment: Maximum of $100 per person per event.

- Software Subscriptions: Up to $500 annually per employee for professional development-related subscriptions.

- Office Supplies: Not exceeding $50 per month per employee.

3. Approval Processes:

- Expenses up to $100: Direct manager approval.

- Expenses between $100-$500: Department head approval.

- Expenses over $500: Require CFO approval.

- Approval workflow is integrated into the company’s expense management software for tracking and record-keeping.

4. Receipt and Documentation Requirements:

- All expenses must be accompanied by a receipt.

- For online subscriptions, e-receipts or invoice copies are required.

- Travel expenses require a detailed itinerary.

5. Customization to Business Needs:

- Given TechWave’s focus on technology, a higher budget is allocated for software and online tools.

- Moderate limits reflect the need for some client engagement but also budget control.

6. Transparency and Accessibility:

- The expense policy is published on the company intranet, included in onboarding materials, and integrated into TechWave’s expense management software dashboard.

7. Updating and Evolving Policies:

- Bi-annual reviews to adjust limits and categories as per market rates and company growth.

- With a shift towards remote work, many employees have started working from different locations, leading to a rise in home office setup requests. The HR department reports a 30% increase in remote workers. Employees have requested support for home office setups, including ergonomic chairs and upgraded internet plans, which were not previously covered. This leads to the addition of a new expense category –

- Allocation of up to $500 per employee for a one-time home office setup. This includes ergonomic furniture and necessary technology upgrades.

- An additional $30 per month for enhanced internet plans for remote workers.

- The updated policy is communicated through an all-hands meeting, email newsletters, and updated on the intranet and expense management software.

- The finance team monitors the impact of these changes on the overall expense budget and reports back in the next bi-annual review.

8. Promoting a Culture of Compliance:

- Few discussions in meetings about expense management and compliance.

- Acknowledging and rewarding compliance through internal newsletters and meetings.

9. Monitoring and Feedback:

- TechWave Solutions had been using a basic expense management system. However, as the company grew, the CFO, Alex Morgan, noticed several issues:

- Duplicate Claims: Employees occasionally submitted the same expense twice due to lack of proper tracking.

- Potential Fraud: A few instances of suspicious expenses were flagged but couldn’t be immediately verified.

- Late Payment Fines: Some expenses were being reported too late, leading to missed early payment discounts and incurring late payment fines.

- To address these issues, TechWave Solutions integrated a new feature in their expense management software that provided real-time alerts and analytics. Here’s how it transformed their process:

- Duplicate Claims Prevention: The software now automatically flags duplicate entries. For instance, if an employee tries to submit a hotel bill that matches a previous entry’s date and amount, the system alerts them and the finance team.

- Fraud Detection: Unusual spending patterns trigger alerts. For example, if an employee who rarely travels suddenly submits high travel expenses, the system flags it for review.

- Timely Expense Reporting: The software sends reminders for expense submission deadlines. This helped in reducing late payment fines significantly. For instance, a reminder is sent two days before the end of the month to submit all expenses, ensuring timely processing and payment.

- Quarterly surveys for employees to provide feedback on the expense management process.

- Employees reported that the process of submitting receipts was cumbersome. In response, TechWave upgraded their employee management system to allow easy photo uploads of receipts through a mobile app, greatly speeding up the process and improving compliance.

- The Finance team reported inefficiencies and errors in the manual data entry process of reading receipts and feeding data into the expense software. An OCR integration was added to the expense management software resulting in 90% reduction in corresponding manual work along with data extraction accuracy exceeding 99%.

10. Addressing Non-compliance:

Six months after implementing the new expense policy, TechWave Solutions observes a pattern of non-compliance concerning travel expenses. Several employees have been exceeding the set limit of $200 per day for accommodation during business trips. The finance team reports this trend to the management.

- The CFO initiates a review of recent business trips. The team discovers that in several instances, the only available hotels in the business districts were priced above the company’s set limit, leading to policy violations.

- Management holds discussions with the employees who exceeded the limits. The employees explain that attending meetings in central business areas necessitates staying nearby, but the cost of such accommodations often exceeds the company’s limit.

- The management team, acknowledging the practical challenge, decides to adjust the policy. The new accommodation limit is set to $300 per day in cities with higher living costs, while retaining the $200 limit for other locations.

- This change is communicated to all employees, emphasizing the importance of choosing cost-effective options within the new limits. Tips on early booking, choosing economical hotels, and understanding the new tiered accommodation limits are provided.

- The expense management software is updated to reflect the new limits and to prompt employees for justification when exceeding these limits in specific cities.

Thus, TechWave Solutions’ new evolving expense policy, tailored to its specific business needs and culture, provides a structured and clear framework for managing expenses. This approach not only ensures financial control but also fosters a culture of responsibility and transparency within the organization. Regular updates and feedback mechanisms ensure the policy remains relevant and effective, adapting to the dynamic business environment.

Implementing Expense Management

In the world of expense management, we’ve moved from the Stone Age to the Space Age – and some companies are still using stone tools.

Let’s take a look at how expense management is implemented in a manual process, and compare it with an automated expense management system like Nanonets.

The Stone Age: Manual Expense Management

1. Expense Incurrence: Here we are, in the trenches. Employees rack up expenses – travel, meals, you name it. They cling to receipts like precious artifacts, which, let’s face it, often end up as washed-out hieroglyphics from a laundry expedition.

2. The Paper Trail: Employees embark on the arduous journey of manually logging expenses. Think spreadsheets, crumpled receipts, and the occasional coffee stain. It’s a painstaking process, riddled with human error and about as efficient as a one-legged race.

3. The Monthly Marathon: Once a month, a ritual occurs – the compiling of these spreadsheets into something resembling an expense report. It’s akin to assembling a jigsaw puzzle, but half the pieces are missing.

4. The Gatekeeper’s Gauntlet: Managers then step into the gladiator arena, armed only with their wits, to battle the dragons of policy compliance and reasonability. This process often involves more back-and-forth than a ping-pong match.

5. The Audit Abyss: Occasionally, the finance team dons their detective hats to audit these reports. It’s a game of chance, really, where anomalies are as easily overlooked as a needle in a haystack.

6. The Waiting Game: Once approved, employees enter the purgatory of reimbursement waiting times. It’s a limbo where time stands still and morale often takes a hit.

7. The Data Dungeon: Data entry – the bane of the finance team’s existence. Manually inputting data into accounting systems is as thrilling as watching paint dry.

8. Insights? More Like Hindsight: Periodic reports are generated, offering insights that are often as timely as yesterday’s newspaper.

The Space Age: Automated Expense Management

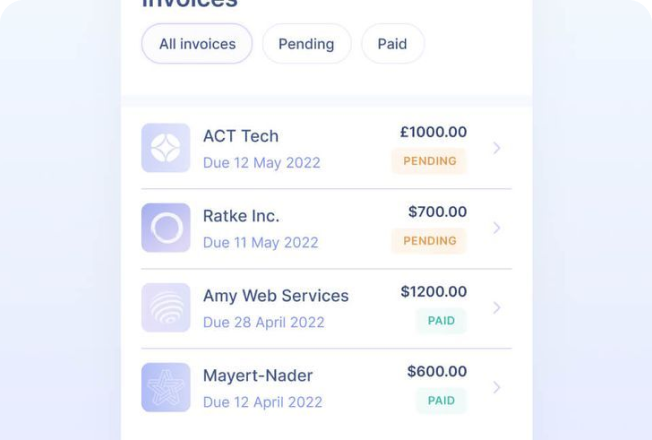

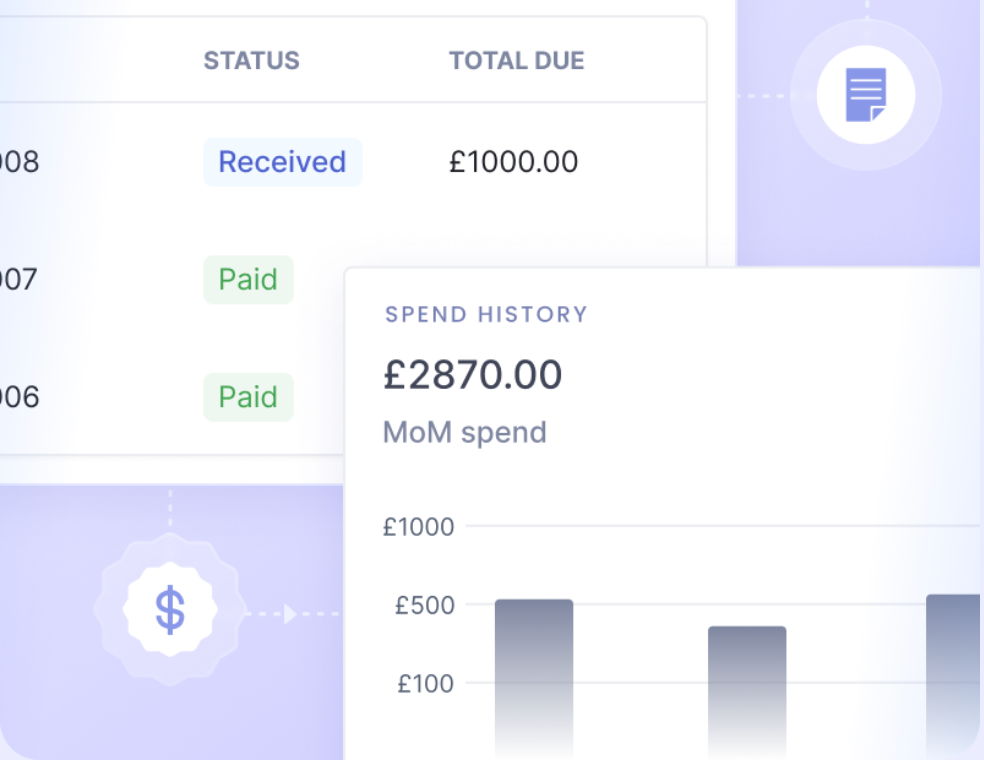

Automation and artificial intelligence has transformed this gloomy landscape, and made expense management a breeze. Let’s take a look at how a modern expense management software like Nanonets employs these technological advancements to make expense automation seamless, efficient and error-free.

1. Expense Incurrence: Same old expenses, but here’s where the magic happens. Receipts are captured faster than a speeding bullet, thanks to the wonders of mobile technology and seamless integrations to import receipts from your apps and databases.

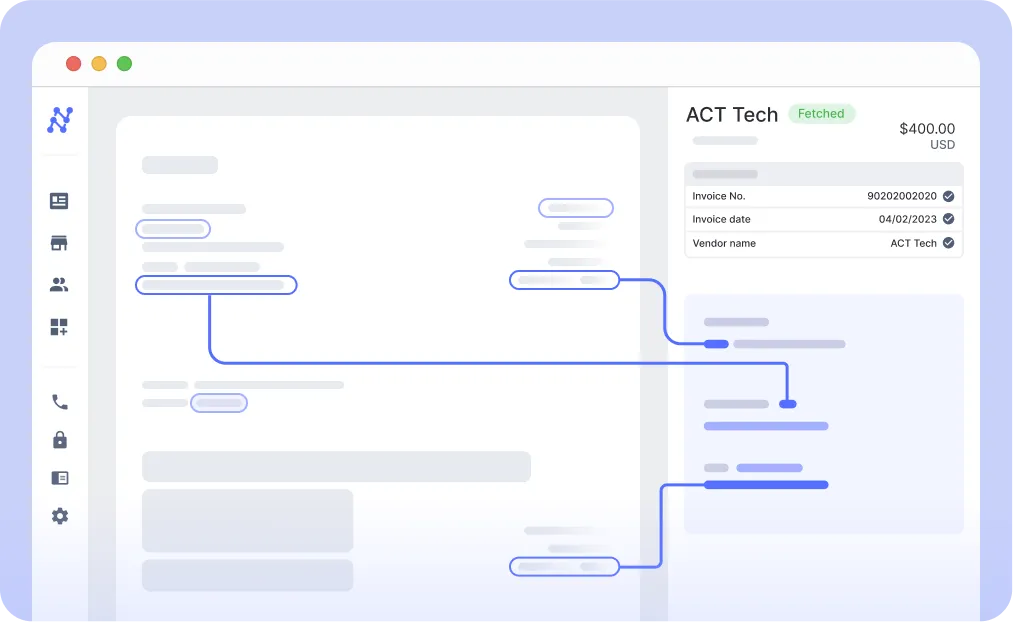

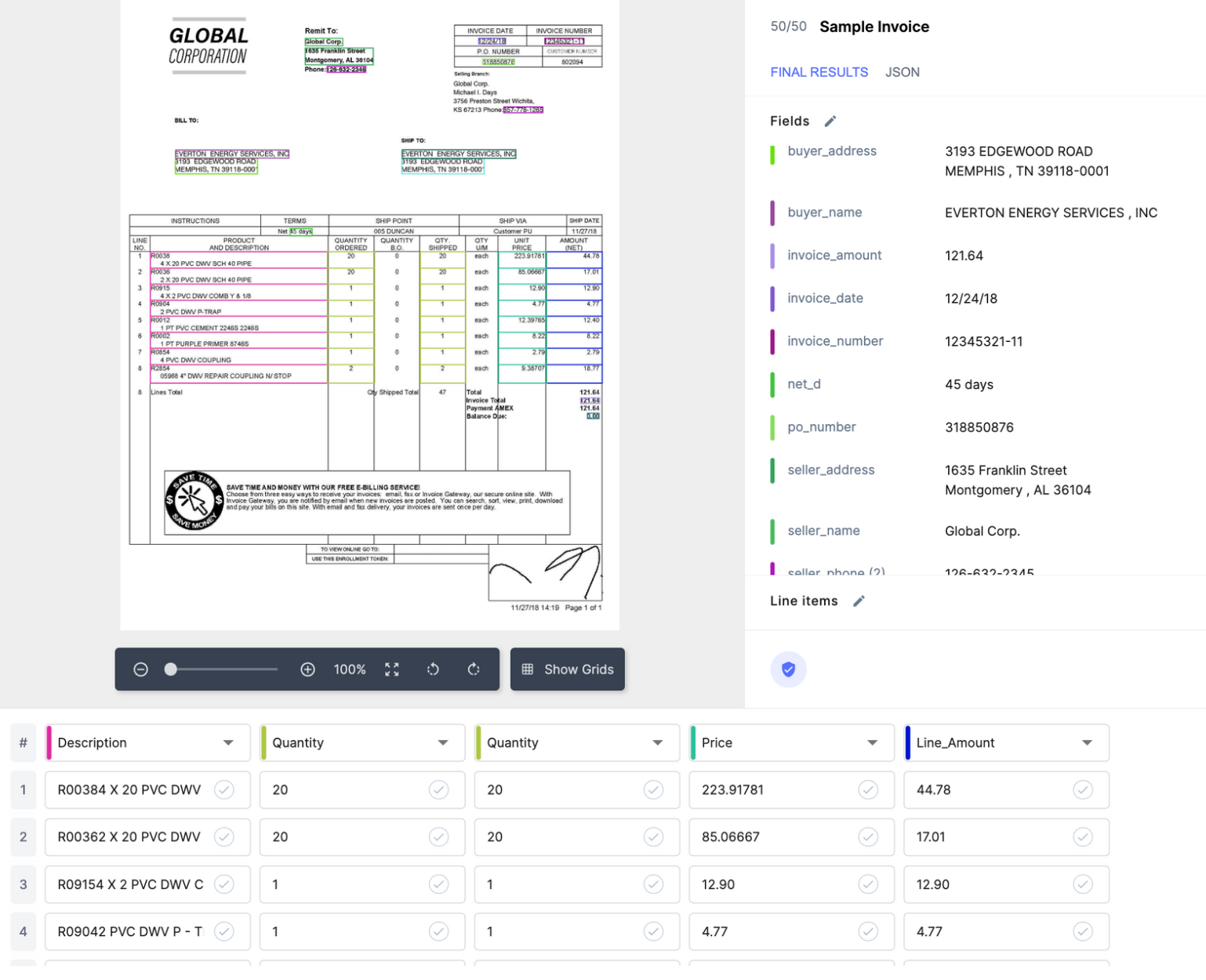

2. Auto-Magic Recording: Optical Character Recognition (OCR) technology steps in, extracting structured data from receipts into digital data faster than you can say “expensed.”

3. Real-Time Reporting: Reports are generated with the click of a button – it’s like having your own personal assistant, minus the coffee runs.

4. Easy Approvals: System-driven compliance checks kick in first, flagging only the outliers. Managers get to focus on real issues instead of playing Whack-a-Mole with every report. You can then add humans-in-the-loop to ensure invoices are sent to approval to the right person at the right time. Furthermore, you can enforce your approval policy and custom validation checks.

5. The Compliance Cruise Control: Continuous, automated audits make life easier. Anomalies stick out like a sore thumb, and policy enforcement is tighter than a drum.

6. The Speed of Light Reimbursements: Reimbursements happen at warp speed, boosting employee morale to the stratosphere.

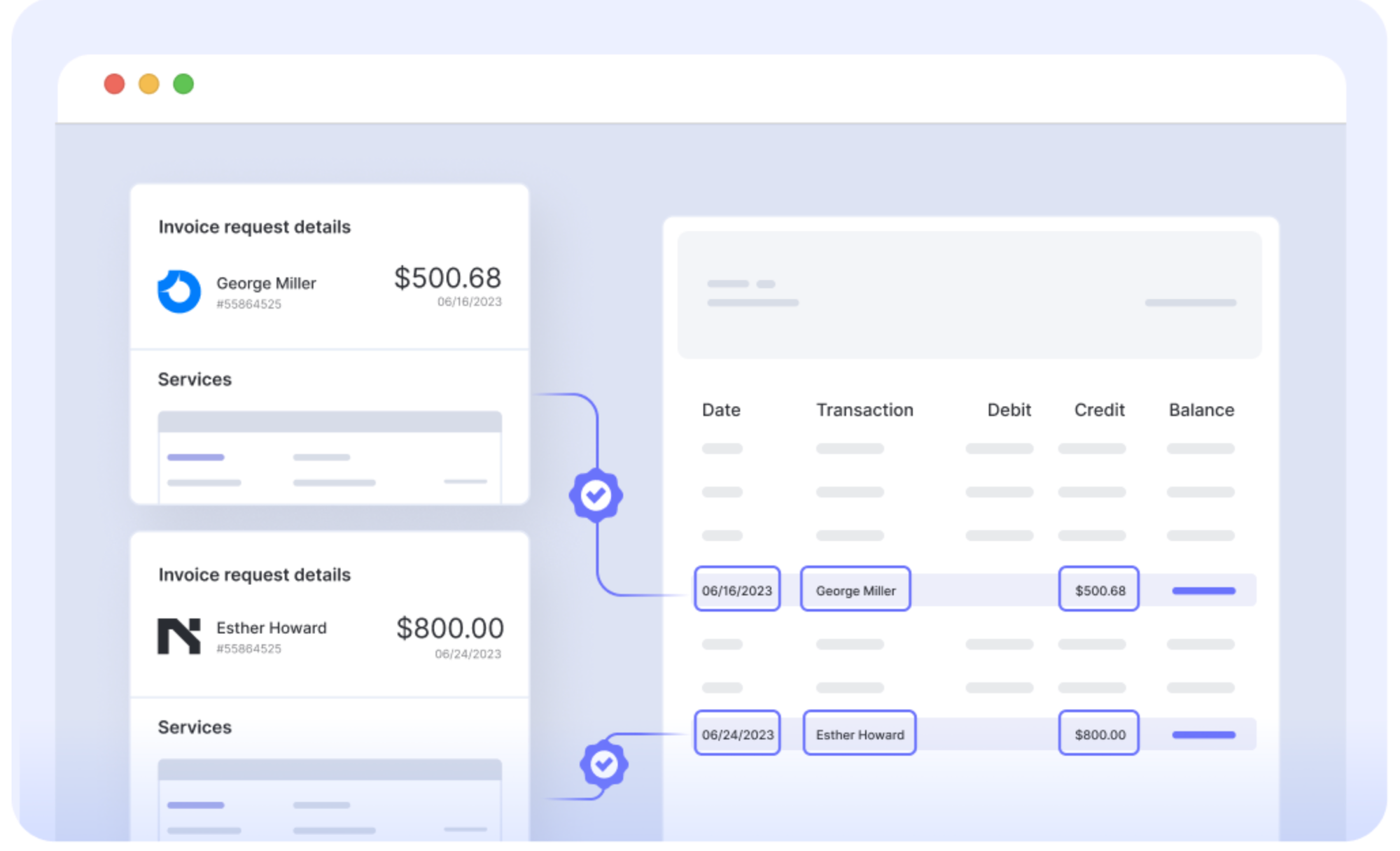

7. The Sync Symphony: Seamless integration with your accounting software and other apps turns data entry and reconciliation into a harmonious symphony rather than a chaotic cacophony.

8. Analytics at the Speed of Thought: Real-time insights are at your fingertips, offering a crystal ball into spending patterns and saving opportunities.

In conclusion, while the jump from implementing manual to automated expense management might seem like a giant leap, in reality, it’s a series of small, practical steps towards efficiency, clarity, and ultimately increased profitability.

Here are a few cases studies of businesses that have successfully implemented expense management and automation –

- SaltPay Uses Nanonets to Integrate with SAP to Manage Vendor Invoices.

- In2 Project Management helps Water Supply Corporation save 700,000 AUD with Nanonets ai.

- How Happy Jewellers, a SMB, benefitted from NanoNets.

- Nanonets ai helps ACM Services automate extraction from expense documents, saving 90% time for the Accounts Payable team.

- Tapi automates property maintenance invoices using Nanonets.

- Puma automates their expense management process with Zoho Expense.

- SWISS improved expense processing efficiency by 80% with Rydoo.

- Suncommon manages their company spend and saves company time by leveraging the the Expensify Card.

The Top 15 Expense Management Software

In this section, we’ll examine in detail the pros and cons of the best expense management softwares in the market.

1. Flow by Nanonets

Flow is an ai-based expense management software that offers automated data capture for intelligent processing of expenses. With advanced OCR and machine learning capabilities, Flow can extract relevant information from various expense documents such as receipts and invoices. It provides a user-friendly interface, customizable OCR models, and seamless integration options, making it a versatile solution for expense management.

Flow demo

Top features:

- All your expense data in one place.

- Complex approval workflows, duplicate alerts and fraud detection

- Payment and reconciliation that works like magic. Flow reads transaction information from any source and posts to your ERP.

- API integration for seamless integration with other tools and systems.

- Scalable, and capable of handling large volumes of documents and data, thereby catering to businesses of all sizes.

- ai algorithms ensure data accuracy and readiness for review

- Seamless integration of transaction information from diverse sources into the ERP, facilitating accurate and timely payments.

- Automated expense recognition and classification, reducing manual data entry and GL coding efforts.

- Streamlined expense approval processes, automating spend limits and approval mechanisms

- Spend data analysis to identify savings opportunities and recommend cost-saving measures.

- Integration with NetSuite, Quickbooks Online, Xero, and Sage Intacct,

- Integration with Slack, allowing employees to receive alerts, handle requests, and obtain approvals directly within the Slack interface.

Pros:

- Zero shot ai that can capture data from documents from day 1.

- Transparent pricing policy.

- Multiple direct support options, including chat, support portal and email.

- Generous trial offer for users to test the platform.

- Dedicated account manager available for the top plan.

- Offers annotation services to assist with data labeling.

- Includes pre-built templates for easier implementation.

Cons:

- Limited choice of tiers for plans.

- No virtual card offering available yet.

Sources:

2. Brex

Brex is a comprehensive expense management software that makes it easy to control various kinds of spends, from corporate cards, reimbursements, and travel to bill pay and business accounts—all in one unified system.

Its customizable workflows can handle complex and diverse types of spend, enabling compliance with the least amount of friction for employees.

Top features:

- Tailored for compliance and accountability

- Used widely by startups and small businesses

- Streamlined expense tracking, real-time insights, and integration with accounting systems

Pros:

- No personal credit checks to get started

- Easy-to-use drag-and-drop user interface

- Quick setup and onboarding process

- Real-time email notifications that help you stay on top of reports

- Seamless mobile app functionality

Cons:

- Limited customization and categorization options

- Expense reporting functionality could be improved

- Incompatibility with mainstream card options

- Might not be suitable for larger organizations with complex expense management needs

Source:

3. Expensify

Expensify is a user-friendly expense management software that simplifies expense tracking and reporting. It’s a single app for various features such as receipt scanning, automatic expense categorization, policy enforcement, approval workflows, and seamless integration with popular accounting systems.

Top features:

- Single app for corporate cards, receipt scanning, and expense tracking

- Expensify CPA card that’s tailored for accountants

Pros:

- User-friendly interface that makes it easier and faster to log expenses

- Automatic expense categorization

- Reimbursements sent in direct deposits to bank account

- Mobile app for on-the-go expense management

Cons:

- Pricing can be expensive for larger organizations

- Some users find the interface cluttered and the product ill-suited to enterprise use-cases

- Poor customer service

Source:

4. SAP Concur

SAP Concur is a holistic expense management solution that automates spending process so that businesses can run efficiently. It integrates travel, expense, and invoice management and offers robust reporting capabilities, policy enforcement, and approval workflows.

It also has extensive integration options, and is especially used by enterprise businesses.

Top features:

- Connects financial data across sources and enables you to control spending

- Automate business, travel, and AP processes

- Leading brand for travel, expense and invoice management

Pros:

- Comprehensive expense management solution

- Integration with travel and invoice management, with appropriate options to choose from

- Robust reporting capabilities

- Seamless policy enforcement and approval workflows

- Extensive integration options

- Easy to raise tickets and get immediate resolution without manual customer support involved

Cons:

- Unintuitive interface and that some users find overwhelming and difficult to operate

- Difficult to attach files

- Higher pricing compared to other solutions

- Complex setup and configuration

Source:

5. Ramp

Ramp makes spending smarter with its corporate card and expense management platform, which provides real-time spending insights, automated receipt matching, vendor negotiation and expense optimization.

Ramp seamlessly integrates with accounting systems, making it a convenient choice for businesses.

Top features:

- Rewards and incentives in the form of cashbacks

- Easy-to-use cards, spend limits, approval flows, vendor payments

- Average savings of 3.5%

- ai for Finance feature that helps you uncover savings and insights

Pros:

- Intuitive and user-friendly interface

- Corporate card and expense management platform that works globally across international transactions, cross-border bill payments, and multi-currency reimbursements

- Real-time spending insights and automated receipt matching

- Vendor negotiation and expense optimization features

- Companies that use Ramp close their books 8x faster

Cons:

- Limited availability in certain regions, which impacts time limits and automatic triggers

- Some users reported difficulty in integrating with existing systems

- No customer support, with ticket resolution only via email

- Unable to stop multiple notifications by marking some payments as recurring

Source:

6. Airbase

Airbase is a top-ranked modern spend management platform for businesses with 100-5,000 employees. It combines expense management, bill payments, corporate cards, budgeting, approval workflows, and virtual cards, thus providing comprehensive spend visibility and control for businesses.

Top features:

- Offers accounts payable automation and guided procurement

- Fully integrated global purchasing platform

Pros:

- All-in-one spend management platform with real-time reporting

- Intuitive and easy-to-use UI

- Virtual cards for easy expense tracking

- Great customer support

- Extensive workflows, approval and accounting automation

Cons:

- Slow on disbursing vendor payments

- Not supportive of all types of credit cards

- Limited functionalities on mobile app for iPhone and iPad

Source:

7. Pleo

Pleo is a smart expense management solution that simplifies company spending. It provides virtual and physical cards for employees, along with real-time expense tracking and automated reporting. Pleo integrates with accounting systems, making it a convenient choice for businesses.

Top features:

- Europe’s #1 business spend solution, trusted by 25,000+ businesses in the region

- All-in-one expense management solution

- Track spending real-time, along with analytics and customisable purchase limits

Pros:

- Smart company cards, virtual and physical, for employees

- Real-time expense and reimbursement tracking

- Automated reporting

- Clean and user-friendly UI

- Helps save 138+ hours by digitizing receipts and automating expense management

- 1% cashback on every Pleo card transaction

Cons:

- Too many categories and options for types of expenses

- Some users found the UI confusing, especially when operating as admin

Source:

8. Zoho Expense

Zoho Expense is an intuitive expense management software that automates expense reporting and streamlines reimbursement processes. It offers features like receipt scanning, policy enforcement, and integrations with popular accounting systems. Zoho Expense provides a user-friendly experience for both employees and administrators.

Top features:

- Trusted by businesses across 150+ countries

- Streamlines corporate travel and automated expense reporting

- ai-driven fraud detection engine

Pros:

- Intuitive expense management software with policy enforcement and customizable reimbursement workflows

- Auto-scanning of receipts and expense categorization

- Competitive pricing

- ai-driven fraud detection engine helps with audits and tax management

- Coupled with Zoho One, it can integrate invoicing, customer data housing, sales and marketing, expense management, and collaboration with teammates

- 24/5 customer support and free 2-hour onboarding assistance

Cons:

- Expense reporting could look more compact

- Lengthy onboarding process

- Slow customer support with long lead times

- Steep learning curve in using the UI

- Some users find that the features don’t talk to each other and UI is not user-friendly

Source:

9. Divvy

Divvy is an all-in-one expense management platform with seamless experience for requesting, spending, and tracking your business finances. It also offers customizable spending limits and automated expense reporting. Divvy aims to simplify expense management for businesses of all sizes.

Top features:

- Virtual and physical credit cards for employees, with credit lines from $500 to $15M

- Free automated expense management software

Pros:

- Individual business credit card for employees along with custom spend limits

- Comes with expense management tool for free

- Ease of expense management and budget tracking

- Easy to categorize bills and spend items, take pictures, even on phone

- Reported average monthly savings of $10,630

- Faster settling of books with12 hours average monthly time savings

- Fast and flexible credit for businesses of all sizes

Cons:

- Security concerns in terms of fraud and fraud prevention

- Difficult to get cards replaced

- Some users reported poor customer service

- Difficulty syncing/integrating with QuickBooks

Source:

10. Fyle

Fyle is an intelligent expense management solution that automates expense tracking, reporting, and policy enforcement. It offers features like receipt capture, real-time expense categorization, and integrations with accounting systems. Fyle provides a seamless experience for employees and administrators.

Top features:

- Real-time feeds on existing credit cards

- Reimburses employees on time with ACH payments

Pros:

- Real-time credit card reconciliations for cards like Visa, Mastercard, AmEx, etc.

- Fyle sends an SMS for new transactions instantly, and employees just need to reply with an image of the receipt for it to be reconciled automatically

- Seamless integrations with Slack, Gmail, Outlook and other apps so expenses can be managed on-the-go

- Matches pictures of receipts to corresponding credit card transaction

- Fyle integrates with all credit cards

- 24×7 customer support over chat and email

- Named account manager who is always there to help

Cons:

- Mobile interface not as seamless as online UI

- Auto-scan features do not work accurately at times

- Requires a learning curve if switching from another system

- Real-time feeds are only for VISA and Mastercard

Source:

11. Spendesk

Spendesk is an expense management software that focuses on simplifying and automating expense management processes. It provides features like expense tracking, virtual cards, invoice management, and approval workflows to help businesses streamline their spending.

Top features:

- Unlimited virtual cards, subscriptions and users

- Free setup and zero hidden fees

- 7-in-1 platform for managing company cards, invoices, expenses, budgets, approvals, accounting automation and reporting

- Scalable spend management tools

Pros:

- Makes the finance workflow and processing more seamless

- Provides accurate analytical reports for revenue calculations at the end of the month

- Virtual cards for secure and controlled spending

- Customizable approval workflows

- Integration with popular accounting systems, including UPI and Netbanking, for instant transactions

- 95% of receipts are collected automatically, and reconciled within 2 days

- 4x faster processing of books 4x every month

Cons:

- Inconsistent policy workflows

- Card is not accepted at all locations or websites

- Incorrect values filled with auto-scan functionality

Source:

12. Mesh Payments

Mesh Payments is an expense management software that offers a comprehensive platform for businesses to track, manage, and control their expenses. It is used by 1,000 finance teams and provides features like expense tracking, receipt capture, automated expense approvals, and integration with accounting systems.

Top features:

- Tailored to give global enterprises control and visibility over spends

- Offers automatic workflows and bookkeeping along with payment management and budget controls

- Tailored solutions for different types of corporate spends

Pros:

- Convenient and user-friendly interface

- Implementation of daily payment limits

- Quickly extract information from reports

- Easy to attach receipts immediately

- Responsive customer support

Cons:

- Limited integration options with existing ERPs

- Only provides virtual card for expenses, and the card is not accepted everywhere

- Mobile app not as intuitive to use as website

Source:

13. Happay

Happay is an all-in-one integrated solution for corporate travel, expense, and payments management. It is India’s largest travel, expense, and payments with 7000+ customers across 20+ countries. platform aims to simplify expense reporting and reimbursement processes for businesses. It offers features such as expense tracking, receipt capture, expense approvals, and integration with accounting systems.

Top features:

- Self Booking Tool (SBT) to help travelers self-book flights, hotels and cabs

- Zero collateral credit lines with rewards

- Prepaid cards for various use cases, from corporate spends to petty cash expenses

Pros:

- Easy to report and reimburse expenses

- Convenient and user-friendly UI

- Automates the entire expense workflow, from capturing receipts to approving and reimbursing expenses

- Faster reimbursement cycle and higher cash savings through increased productivity

Cons:

- Scope to improve how claim reports are tagged to individual expenses

- Card charges fees for ATM withdrawals

- Time-consuming refund process if the payment fails during an online transaction

- Limited customization options and integrations with other platforms

- UI needs to be improved

Source:

14. Rippling

Rippling is an all-in-one HR and employee management platform that includes expense management functionality. It provides features such as expense tracking, automated expense approvals, and integration with payroll systems.

Top features:

- Simplify HR, IT and finance through one platform

- Manage analytics, workflow automation, policies, and permissions

- Single system for business as small as 2 employees to as many as 2000

Pros:

- One place for businesses to run HR, IT, Finance

- Responsive chat support and customer service

- Easy to implement with a user-friendly UI

- Allows you to manage employees with time-off requests, HR information, clock-ins, etc.

- Quick onboarding of employees and contractors in 90 seconds

- Automate global compliance processes

Cons:

- Absence of points system, scheduling, and employee reviews

- Not a focussed expense management solution

- Some users report difficulty in setting up

Source:

15. Emburse Chrome River Expense

Emburse Chrome River Expense is an expense management software designed for mid to large-sized enterprises. It offers features such as expense tracking, receipt capture, policy enforcement, and integration with accounting systems.

Top features:

Designed for complex enterprises, higher education and professional services

Globally-focused expense management and accounts payable automation solutions

Pros:

Easily configurable to address business needs

Compliance workflows help spot incorrect or fraudulent documents before submission

Completely electronic from start to finish

Approval workflows can happen through email

Some users report it’s easier to use and more cost effective than Concur

Significant cash and time savings

Cons:

Slow analytics and not intuitive

Pre-defined reports are clunky; more detailed reports require an extra cost

Some users report difficulty in setting up

Source:

https://www.g2.com/products/emburse-chrome-river-expense/reviews#reviews

Corporate Culture and Expense Management

It’s often said that culture eats strategy for breakfast. In the realm of expense management, this couldn’t be truer. A company’s culture profoundly influences how expenses are handled, approved, and scrutinized. It’s not just about the policies in place; it’s about how these policies are ingrained in the everyday actions and attitudes of every team member.

- Take Google, for example. Their culture of innovation and freedom has a direct impact on how they manage expenses – with an emphasis on trust and accountability.

- Salesforce is known for its vibrant culture. They’ve seamlessly integrated their values into their expense management. With a culture emphasizing transparency and responsibility, Salesforce has cultivated an environment where expense management is not seen as a bureaucratic hurdle but as a reflection of their collective values.

- Another exemplary case is Netflix. Their culture of freedom and responsibility empowers employees to make spending decisions as if it’s their own money. They don’t have strict budgets but rely on a culture of self-discipline and prudence, which has paid off in their agile financial operations.

Cultural Shift for Better Management

A cultural shift towards better expense management starts at the top. When leaders model the importance of efficient and ethical expense management, it sets a tone for the entire organization. This doesn’t mean micromanaging every expense. Instead, it’s about fostering a culture where expenses are viewed through the lens of value creation and business ethics. Leaders need to ask: Are we spending in a way that aligns with our core values and objectives?

So, how do you foster this culture?

- Start by making expense management part of your regular dialogue. Discuss it in meetings, highlight when team members make smart spending decisions, and openly talk about the rationale behind expense policies.

- Transparency is key. Ensure the expense management policy is accessible, present in the onboarding documents, and attached to your expense management software.

- Encourage team leads to set examples. When managers scrutinize their expenses and make cost-effective choices, it sends a clear message.

- Celebrate good expense management. Recognize and reward teams and individuals who exemplify responsible spending. This could be as simple as a shout-out in a team meeting or as significant as an annual award.

- Consider offering incentives for employees who consistently adhere to expense policies or come up with innovative cost-saving ideas.

- Open forums, in particular, can be a goldmine of insights. They can be a platform where employees discuss challenges they face with current policies and suggest improvements. This not only helps in refining the expense management process but also reinforces a culture of openness and trust.

- Open financial reports are another powerful tool. When companies share detailed reports with their teams, it not only fosters transparency but also encourages informed discussions and decisions around spending. Cloud-based platforms, offering shared dashboards and reports, are particularly effective. They allow for a seamless flow of information and make it easy for team members to access and understand spending data, regardless of their financial expertise.

- Creating an environment where accountability is the norm starts with setting clear expectations. It’s about establishing a culture where every dollar spent is a dollar that needs to be justified – not in a punitive sense, but in a way that aligns with the company’s goals and values. This culture of accountability also involves regular reviews and audits of expenses. These shouldn’t be seen as witch hunts but as opportunities to ensure compliance with policies and to identify areas for improvement.

Future Trends

As we stand on the brink of 2024, let’s play the role of a futurist for a moment. Looking back, we’ve seen predictions in the world of finance and technology come to life in ways we never imagined, while others have fizzled out, never seeing the light of day. So, as we peer into the future of expense management, what do the next ten years have in store?

ai and Automation: The Brainy Backbone of Expense Management

One prediction that’s a safe bet: ai and Machine Learning are not just going to be part of the expense management landscape – they’re going to be its backbone. We’re looking at ai that’s not just smart but borderline genius in categorizing expenses, streamlining approval workflows, and ensuring policy compliance. Imagine a system that learns from each transaction, getting smarter, more efficient, and more accurate. It’s not just about automating processes; it’s about enhancing them to a level of precision we’ve only dreamed of.

Blockchain: The Ledger of Trust and Transparency

Blockchain and expense management – it’s a match waiting to happen. The transparency and security that blockchain brings to the table are set to revolutionize how we handle expense transactions. We’re talking about a world where every transaction is recorded on a ledger that’s virtually tamper-proof, bringing an unprecedented level of trust and accountability to the process. The potential for reducing fraud and enhancing compliance is enormous.

Personalization: The New Normal

The future is personal – especially in expense management. Systems will evolve to offer experiences tailored to individual spending habits and preferences. We’re moving beyond the one-size-fits-all approach, entering an era where your expense management system knows you – really knows you – and adapts to your unique needs and patterns. It’s the kind of user-centric innovation that turns a mundane task into a delightful experience.

Redefining Financial Practices

These advancements in ai, blockchain, and personalization aren’t just going to change how we manage expenses; they’re going to reshape broader financial practices within organizations. We’re looking at a more integrated, intelligent, and interconnected financial ecosystem. The implications are vast – from better financial planning and analysis to more strategic decision-making.

In sum, the next decade in expense management is not just about new tools and technologies. It’s about a fundamental shift in how we approach, understand, and manage our finances. It’s a brave new world, and it’s closer than you think.

Conclusion

As we wrap up this comprehensive exploration of expense management, it’s clear that the landscape of financial tracking and analysis is undergoing a dynamic transformation. The journey from ledger books to ai-driven software solutions like Nanonets illustrates not just technological advancement, but a fundamental shift in how businesses approach fiscal responsibility.

Flow demo

In today’s volatile business environment, managing expenses is no longer a back-office task but a strategic imperative. Companies like InnovateX and others mentioned in our case studies exemplify the transformation that a robust expense management system can bring about.

Businesses that recognize and adapt to these changes will find themselves well-equipped to navigate the complexities of the modern financial landscape, turning what was once a mundane task into a critical component of their overall business strategy.

Ready to Transform Your Expense Management?

Interested in seeing how Nanonets can revolutionize your company’s expense management? We invite you to experience the power and efficiency of our cutting-edge solution firsthand.

Schedule a personalized demo with Nanonets today!

Discover how our ai-driven expense management software can streamline your processes, enhance real-time data analysis, and integrate seamlessly with your existing systems. Don’t miss this opportunity to take a significant step towards strategic financial governance and operational efficiency.

Click here to schedule your demo with Nanonets

Embrace the future of expense management – smart, seamless, and strategically empowering. Let Nanonets be your partner in navigating the financial landscape of tomorrow.

Additional Resources

Here are some additional resources that provide further reading and tools to deepen your understanding of the expense management landscape:

- Expense Management Market Growth | Research Report (2029): This report offers data and insights into expense management trends. Fortune Business Insights Report.

- Expense Management 101: Your Guide to Expense Reporting: This guide is an excellent resource for those looking to delve deeper into financial management topics, especially related to expense reporting. G2 Learning Hub.

- Effective Global Travel and Expense Management Compliance: This resource provides relevant information on regulatory guidelines that can impact expense management practices, especially for businesses operating in multiple countries. Mobilexpense Compliance Guide.

NEWSLETTER

NEWSLETTER