Petty Cash Reconciliation: What It Is, Best Practices and Automation

Petty cash, also known as petty cash fund, is a fixed amount of money set aside for minor expenses in a business. These expenses typically include small purchases such as office supplies, travel expenses, or miscellaneous items that are too insignificant to justify writing a check or initiating an electronic payment.

Despite its small denomination, petty cash plays an important role in daily operations, offering flexibility and convenience to handle minor expenses without the need for formal approval processes. Petty cash reconciliation is the process of verifying and documenting petty cash transactions to ensure that the amount of cash on hand matches the balance recorded in the petty cash account. It serves as a control mechanism to maintain accurate financial records and prevent misuse or misappropriation of funds.

In this article, we'll dive deeper into petty cash reconciliation: what's the best way to do it, common challenges, and how advanced automation solutions like Nanonets can help.

Are you looking for reconciliation software?

Verify Nanogrid Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

Integrate nanonetworks

Reconcile financial statements in minutes

What is petty cash reconciliation?

Petty cash reconciliation refers to the systematic process of comparing actual cash on hand with the balance recorded in the petty cash account. It involves reviewing and validating petty cash transactions to ensure the accuracy and integrity of financial records.

The primary objective of petty cash reconciliation is to identify any discrepancies between the physical cash count and the recorded balance, thereby maintaining the integrity of the company's finances and ensuring compliance with internal controls and accounting standards.

Companies often establish petty cash funds to facilitate the timely payment of small expenses that do not justify formal procurement processes. However, without proper monitoring and reconciliation procedures, petty cash can be susceptible to misuse, errors or theft. Petty cash reconciliation serves as a safeguard against such risks by providing a structured framework to monitor and control cash disbursements.

What are the steps involved in petty cash reconciliation?

During the petty cash reconciliation process, the following steps are typically performed:

- Transaction log: All petty cash transactions, including withdrawals and expenses, are documented with receipts or supporting vouchers.

- Physical cash counting: The actual amount of cash remaining in the petty cash fund is counted and verified against the recorded balance.

- Comparison and analysis: Recorded transactions are compared to the physical cash count to identify any discrepancies or irregularities.

- Adjustments and Corrections: Any discrepancies found during the reconciliation process are investigated and adjustments are made to reconcile the petty cash account balance.

- Documentation and reports: The results of the reconciliation are documented in a reconciliation report, which details the findings, adjustments made, and corrective actions taken. This report serves as a formal record of the reconciliation process and provides transparency and accountability.

Overall, petty cash reconciliation plays a vital role in maintaining financial accuracy, transparency and control within an organization. Helps ensure that petty cash funds are used appropriately, expenses are properly accounted for, and financial records are kept current and accurate.

Challenges of Petty Cash Reconciliation

Petty cash reconciliation, while essential and seemingly easy, can actually pose several challenges for businesses. Some common ones include:

- Lack of documentation: Inadequate documentation of petty cash transactions, such as missing receipts or incomplete records, can hinder the reconciliation process and make it difficult to accurately verify expenses.

- Manual processes: Relying on manual processes for petty cash reconciliation can be time-consuming and error-prone. Manual data entry and calculation increases the risk of inaccuracies and discrepancies in financial records.

- Cash discrepancies: Discrepancies between the recorded balance and the actual cash count may occur due to theft, mismanagement or human error. Identifying and resolving these discrepancies requires extensive investigation and reconciliation efforts.

- Compliance risks: Failure to comply with internal controls and compliance requirements can lead to regulatory violations and financial losses. Companies should ensure that petty cash reconciliation procedures align with established regulatory policies and standards.

- Lack of responsibility: Without clear accountability and oversight, petty cash funds can be vulnerable to misuse or unauthorized expenditures. Implementing robust controls and monitoring mechanisms is essential to mitigate the risk of fraud or misappropriation.

Despite these challenges, companies can overcome them by implementing effective petty cash management practices and leveraging technology solutions to streamline the reconciliation process.

Best Practices for Petty Cash Reconciliation

To overcome the challenges associated with petty cash reconciliation, companies can adopt the following best practices:

- Establish clear policies and procedures: Develop comprehensive policies and procedures governing the use of petty cash, including guidelines for recording transactions, approving expenses, and conducting reconciliations.

- Maintain proper documentation: Require employees to provide detailed receipts or vouchers for all petty cash transactions. Maintain accurate records of expenses, withdrawals and replenishments to facilitate the reconciliation process.

- Periodic reconciliation: Perform regular reconciliations of petty cash funds to ensure the recorded balance aligns with the actual cash count. Schedule reconciliation activities weekly or monthly to quickly identify and address any discrepancies.

- Segregation of duties: Implement segregation of duties to prevent fraud and errors. Assign distinct roles and responsibilities to manage petty cash, record transactions, and perform reconciliations to ensure accountability and oversight.

- Take advantage of technological solutions: Invest in accounting software or petty cash management systems that automate and streamline the reconciliation process. These tools can help reduce manual effort, improve accuracy, and improve visibility into petty cash transactions.

By implementing these best practices, companies can improve the efficiency, accuracy and control of their petty cash reconciliation processes, ensuring compliance with regulatory requirements and maintaining financial integrity.

Petty Cash Reconciliation Automation

With technological advances, companies can take advantage of automation to streamline petty cash reconciliation processes. Advanced optical character recognition (OCR) solutions like Nanonets can automate petty cash reconciliation to save your business time and money and improve the efficiency and accuracy of petty cash reconciliation:

- Digital receipt management: Implement digital receipt management solutions that allow employees to upload receipts directly into the system using mobile devices. This eliminates the need to manually collect receipts and ensures all transactions are documented electronically.

- OCR technology: Advanced optical character recognition (OCR) technologies such as Nanonetworks can extract data from receipts and automatically populate transaction details into the reconciliation system. OCR can accurately capture information such as date, supplier name, and amount, reducing manual data entry errors.

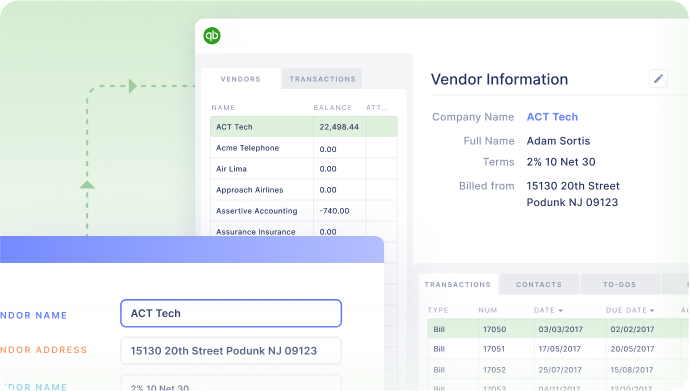

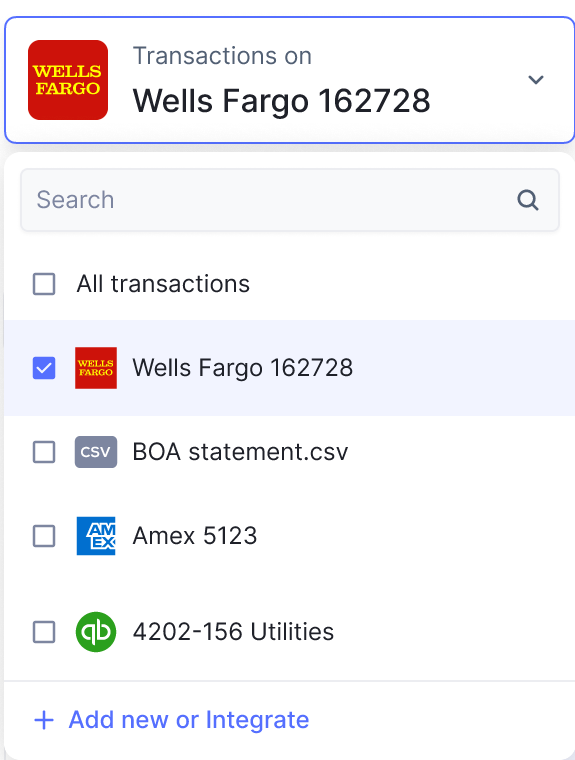

- Integration with accounting software: Integrate petty cash reconciliation software with accounting systems like QuickBooks or Xero to synchronize transaction data in real time. This ensures seamless communication between financial systems and eliminates the need for manual data transfer.

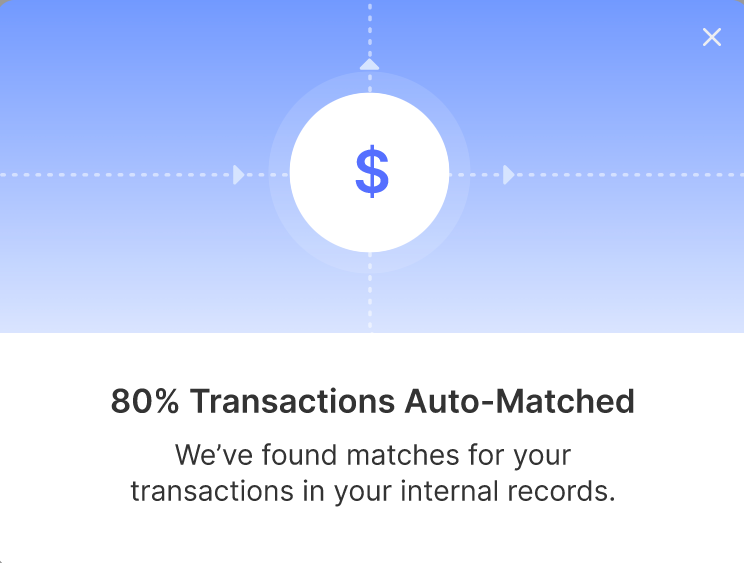

- Automated matching algorithms: Implement automated matching algorithms that compare transaction details from receipts to expenses recorded in the reconciliation system. These algorithms can identify discrepancies and flag potential errors for further investigation.

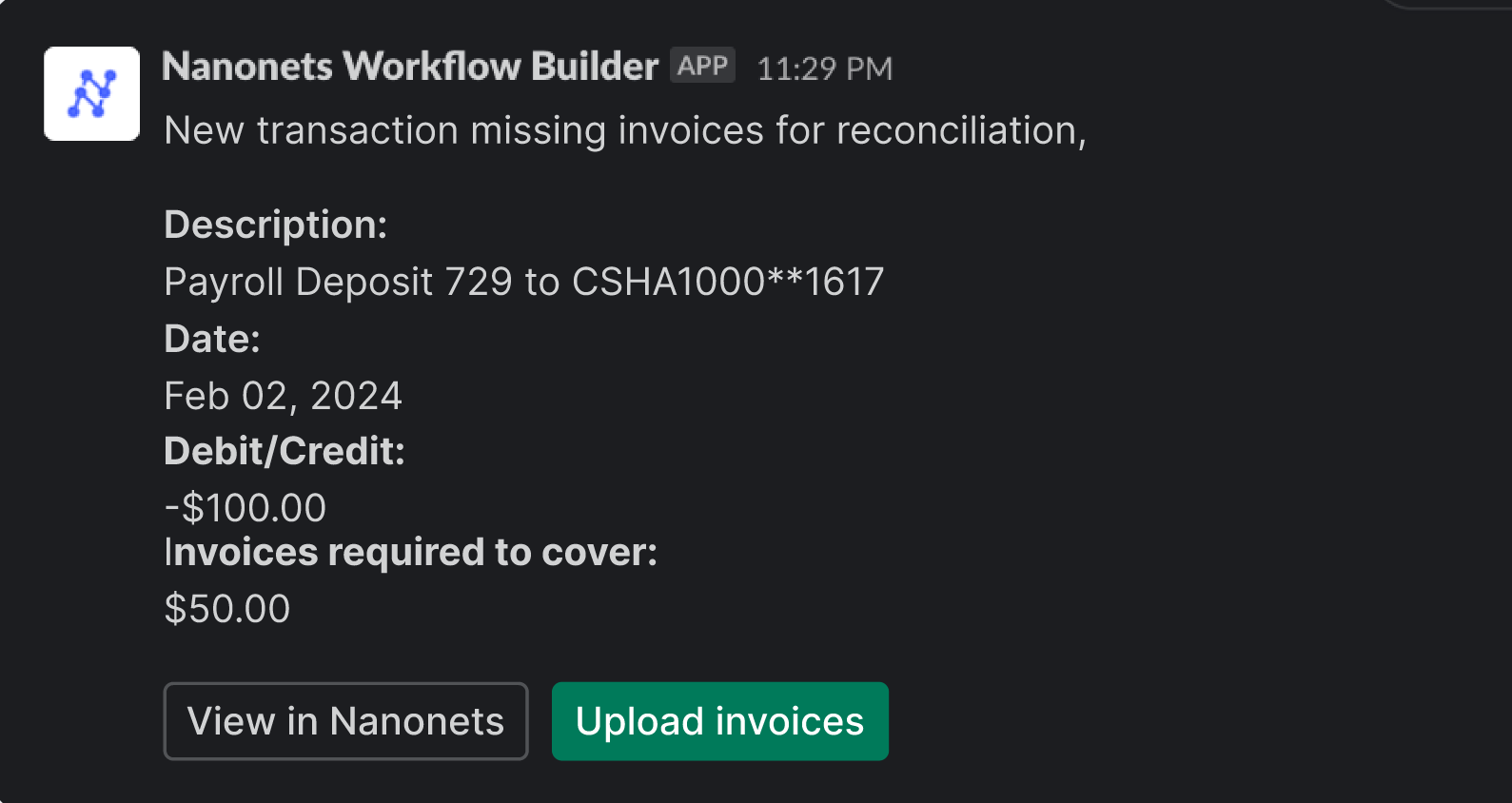

- Workflow automation: Implement workflow automation tools to streamline the petty cash expense approval process. Define approval hierarchies and configure automatic notifications to notify relevant stakeholders when action is required, reducing delays and improving accountability.

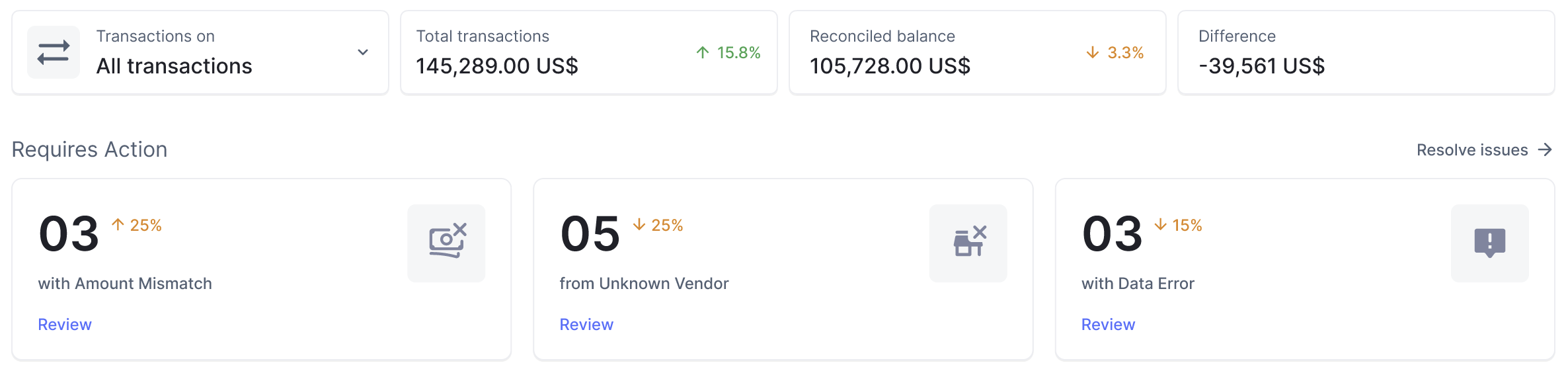

- Real-time reports and dashboards: Use real-time reporting capabilities to generate customizable reports and dashboards that provide insights into petty cash transactions, balances, and trends. This allows stakeholders to monitor petty cash activity and proactively identify areas for improvement.

By adopting automation technologies, companies can transform their petty cash reconciliation processes, reducing manual effort, minimizing errors and improving overall efficiency.

Conclusion

Petty cash reconciliation plays a critical role in maintaining accurate financial records and ensuring compliance with internal policies and regulatory requirements. By understanding the challenges associated with petty cash reconciliation and adopting best practices, companies can optimize their reconciliation processes and effectively mitigate risks.

Additionally, leveraging automation technologies such as digital receipt management, OCR technology, integration with accounting software, automated matching algorithms, workflow automation, and real-time reporting can streamline petty cash reconciliation. and improve accuracy and efficiency.

As businesses continue to evolve and embrace digital transformation, investing in automation solutions for petty cash reconciliation can deliver significant benefits, including time savings, cost reduction, greater control, and better decision making. By prioritizing automation, companies can optimize their petty cash management processes and focus on driving growth and innovation.