Switching to paperless accounts payable is intimidating. It often means digitizing years of data, training your staff, and shifting your workflows. However, this change can yield significant rewards.

Consider this: Levvel Research found that 50% of businesses grapple with late payments and missed discounts due to protracted approval cycles. Staggeringly, 79% of SMEs and 68% of mid-market firms cite manual data input and inefficient procedures as their primary pain point. For large enterprises, the main issue is that most invoices arrive in paper form, with 60% experiencing this difficulty.

These figures underline the need for a more efficient, streamlined way to handle invoices, purchase orders, and payments. Could adopting a paperless accounts payable process be the solution? In this article, we’ll delve into why it might be. We’ll also guide you on transitioning to a paperless system and share valuable tips for a seamless shift.

What are paperless accounts payable?

The term paperless accounts payable refers to a completely digital AP process, eliminating the need for paper invoices. It involves the AP department leveraging technology to digitize invoices and related documents, automating the approval process, and conducting payments through electronic means.

You may create a tech stack of specialized tools or comprehensive paperless accounts payable software to manage all aspects in one place. Either way, the goal is to eliminate manual steps, reduce the chance of error, and increase speed and efficiency.

Every business wants to be able to pay their vendors on time and get discounts for early payments. But the paperwork and bureaucracy often stand in the way. Add Excel and email into the mix, and it’s easy to lose invoices, miss payments, or delay reports.

Here’s where going paperless is a game-changer. It helps businesses manage more invoices without adding staff or extending work hours. The cherry on top? A standardized AP workflow that you can tweak for even better efficiency over time.

Why do you need to go paperless in accounts payable?

Processing an invoice could cost you anywhere between $15 to $40. But here’s the silver lining: an AIIM report reveals automated invoices can cut costs by 29.2%. Let’s say you process 10,000 invoices monthly at $10 each. That’s roughly $300,000 saved annually.

Now consider this: roughly a third of businesses surveyed were able to reduce invoice processing costs even more: a whopping 50%. That means an annual savings of $600,000. Impressive, right? However, the benefits of going paperless extend beyond simply saving money.

Shifting to paperless allows your team to prioritize strategic tasks. It minimizes human error and bolsters compliance. It smooths vendor relationships through prompt payments. And not to mention the environmental impact. By going paperless, you can significantly reduce your company’s carbon footprint.

How does a paperless accounts payable system work?

Ask AP clerks what their least favorite task is, and they’ll likely tell you: manual data entry. It’s everywhere. From inputting invoice data to tracking payments and reconciling accounts, the list goes on. With a paperless accounts payable system, much of this struggle is eliminated.

But that’s not all. Let’s look at how a paperless accounts payable system operates and how it can streamline different aspects of your AP workflow.

1. Capture information and digitize documents

You might receive purchase orders, receipts, and invoices from various channels — email, Dropbox, Google Drive, post, or even fax. Typically, you’d need to manually enter this data or scan the paper documents into your system. This process is time-consuming, prone to errors, and delays vendor payments.

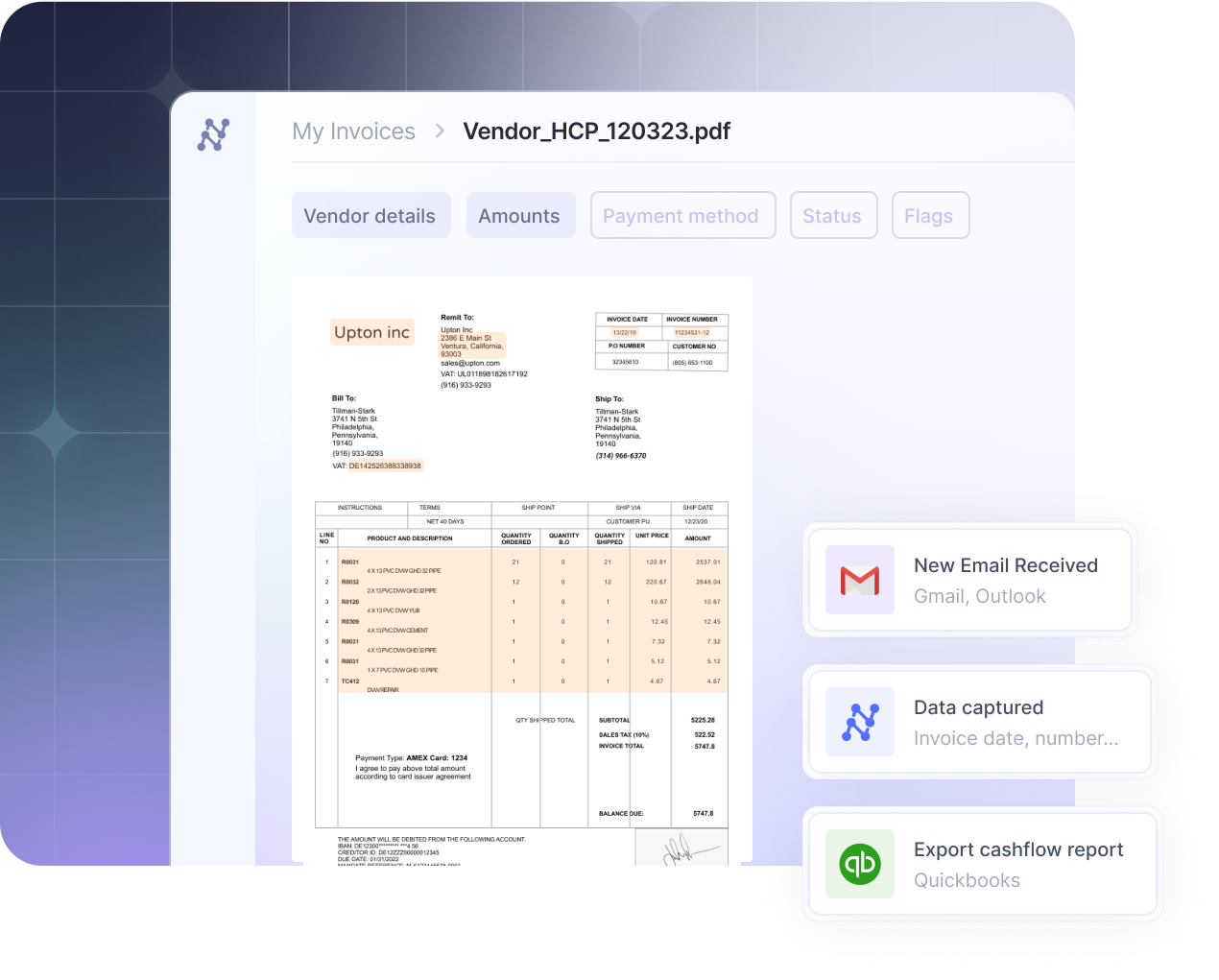

Paperless accounts payable systems like Nanonets have features like ai-OCR (Optical Character Recognition), preset rules, and automated workflows. You’d be able to capture document data from any channel effortlessly. The system scans, extracts, and validates data as soon as it arrives and then digitizes it.

Structured or unstructured, different currencies, tax regulations, and languages — it doesn’t matter. The system can handle it all. Your team won’t be staring at Excel sheets, manually cross-checking numbers. Instead, data would be readily available, accurate, and easily searchable.

2. Automate approval and matching workflows

The next step is to get the documents approved. This often involves routing them physically or via email to the responsible parties for approval in traditional setups. AP clerks would often have to follow up repeatedly to ensure timely approvals.

Additionally, the invoices must be matched with the corresponding purchase orders and goods receipts to avoid duplicate invoices, fraud, and errors. It often involves manually pulling up each document, printing them, and comparing them line by line. It’s not the most fun job in the world, and certainly not the most efficient.

When you switch to a paperless accounts payable system, this whole process is automated. The system routes documents to the right individuals based on predefined rules for approval. With Nanonets, you can set up auto-reminders and alerts to approvers, ensuring they sign off on time. Automated status updates facilitate a more transparent and efficient communication process for all parties involved in the approval process. These updates allow for easy tracking of progress and ensure that everyone is aware of the current status of the documents.

The system also automatically matches the invoices with purchase orders and goods receipts. In case of a mismatch or discrepancy, it raises an alert, allowing you to catch errors early and avoid payment delays or disputes. This automation reduces manual labor and significantly decreases the chance of error, fraudulent activity, and potential financial loss.

3. Process payments electronically

Processing payments typically involves a lot of papers and paperwork. Cheques, money orders, bank drafts — you name it. These traditional methods require resources, add to the processing time, and delay vendor payments.

Your AP clerks have to manually record each payment, ensuring that the correct amount is sent to the right vendor. They’d have to keep track of these payments, cross-checking against bank statements and resolving discrepancies when they arise. Finally, they’d have to painstakingly reconcile these payments against the original invoices and the general ledger. This process is both time-consuming and error-prone.

But with a paperless accounts payable system, seamless data flow and automated workflows ensure these challenges are effectively mitigated. It can integrate with your existing bank or payment processor to facilitate smooth and secure payments. You can choose the payment method that works for you — ACH, credit card, wire transfer, or even virtual cards.

For instance, Nanonets integrates with Stripe and QuickBooks, facilitating streamlined payments while keeping your financial records up-to-date. You can schedule payments according to your cash flow and vendor terms.

Paperless systems can also automatically record each payment and its corresponding invoice and vendor details. This means no more manual recording and no more cross-checking against bank statements. Discrepancies, if any, are flagged by the system in real-time, allowing your team to resolve them promptly and efficiently. The system also ensures that all payments are accurately reconciled against the original invoices and the general ledger.

4. Automate reporting and audit trails

With paper-based systems, these tasks often require more time and effort. You’d have to sift through stacks of invoices, receipts, and other documents, manually entering and cross-referencing data to generate reports. Maintaining a clear audit trail is also a challenge, as it’s easy to lose track of paper documents.

With a paperless system, your data is automatically stored and managed in a central repository. This makes data retrieval and report generation a breeze. Whether it’s month-end closing, auditing, or financial forecasting, you can instantly access the data you need.

Automated, real-time reporting reduces the time spent on manual data consolidation. It also provides valuable insights into your financial operations, helping you identify trends, detect anomalies, and make data-driven decisions.

As for audit trails, the system logs all activities, from invoice receipt to payment, including all approvals and changes made. This level of transparency ensures accountability, simplifies compliance and makes investigating potential issues or disputes easier. Moreover, integrations with your ERP or accounting software ensure that all financial data is synchronized and up-to-date, reducing the risk of inaccuracies and duplication.

5. Keep vendors updated and maintain transparency

In traditional setups, supplier relationship management can be pretty challenging. Late payments, lost invoices, and miscommunication can strain your relationship with vendors. Plus, keeping track of every supplier’s terms and preferences can be daunting.

However, a paperless accounts payable system simplifies this process. Faster processing and approval of invoices mean that payments are made on time, which boosts vendor satisfaction. The system also stores all your vendor information centrally, making it easy to access and manage.

Automated supplier portals allow vendors to submit their invoices, track payment status, and communicate in real-time, reducing the need for back-and-forth emails or phone calls. Automatic notifications, alerts, and reminders are sent to both parties in case of delays or discrepancies, thus ensuring transparency and reducing misunderstandings.

In addition, the system can accommodate different payment terms, discounts, or other preferences for each supplier, managing these variables seamlessly. This ensures compliance with your vendor’s requirements and enables you to take advantage of early payment discounts or other incentives, optimizing your cash flow and strengthening your supplier relationships.

At the end of the day, transitioning to a paperless accounts payable system is not just about cost and time savings. It’s about transforming your AP process into a strategic business function that drives efficiency, transparency, and control.

How do you implement a paperless accounts payable system?

Okay, so you’re convinced about the benefits of a paperless accounts payable system. You can see how it can transform your financial operations, streamline processes, and enhance control. But how do you go about implementing it?

Here’s a step-by-step implementation guide to give you a clear path toward your transition:

Step 1: Evaluate your current process

Identify the areas that need improvement and the challenges that you’re facing. Are there late payments? Do you find reconciliation difficult? Are there frequent errors, and where do these occur most often?

Speak to your team and gather their input. What are their primary pain points? What do they spend most of their time on? What parts of the process do they find most challenging or frustrating? This feedback can help you understand what you need from a paperless accounts payable system.

Step 2: Define your needs and objectives

Once you understand your current situation and challenges, identify what you want to achieve with your new system. Do you want to speed up invoice processing? Improve accuracy? Increase transparency? Reduce costs?

Set clear, measurable objectives. For example, you may want to reduce invoice processing time by 50% or achieve 100% accuracy in payment reconciliation. Then, identify your functional requirements. Do you need an approval workflow? How about integration with your existing ERP or accounting software? Do you want real-time reporting and analytics? A supplier portal?

Consider future needs as well. As your business grows, you may need to onboard more vendors, handle larger volumes of invoices, or comply with additional regulations. Make sure the system you choose can scale and adapt to these changes.

Step 3: Research and evaluate potential solutions

Start researching available paperless accounts payable systems. Look at product descriptions, blog posts, customer reviews, case studies, and demo videos. Attend webinars or product demonstrations if possible.

There are numerous paperless accounts payable systems available in the market. Some are standalone systems, while others can be integrated with your ERP or accounting software. Consider various factors such as the system’s features, ease of use, scalability, security, customer support, and cost.

Look for features that specifically address your needs. For instance, choose a system with automated reminders and approval workflows if you’re struggling with late payments. If data entry errors are a problem, opt for a system with advanced OCR technology for accurate, automated data extraction.

Step 4: Plan and execute the implementation process

The actual implementation of your chosen accounts payable system is a critical step. It involves installing or setting up the software, migrating your existing data, setting up workflows, and training your staff.

Here’s a checklist of things to consider during the implementation process:

- Data migration: Ensure all your existing data is transferred accurately and securely to the new system. This includes vendor information, invoice data, payment history, and other relevant data.

- Workflow setup: Configure the system to reflect your desired workflows and approval processes. Ensure the system is set up to handle your specific needs and requirements.

- Integration: If your new system needs to integrate with other software (like your ERP or accounting system), ensure these integrations are set up correctly and tested thoroughly.

- Training: Provide your team comprehensive training to ensure they understand how to use the new system effectively. This can include one-on-one sessions, group workshops, or even self-paced online tutorials.

- Testing: Before going live, thoroughly test the system to identify and fix any potential issues. This includes checking the accuracy of data migration, testing workflows, verifying integrations, and ensuring the system is user-friendly and functional.

- Support: Ensure that you have a reliable support system in place. This can be from the vendor’s customer support team or an internal IT team. It would be best to have someone who can quickly resolve any issues during the implementation or post-implementation period.

Step 5: Monitor and optimize the performance

Once your paperless accounts payable system is up and running, it’s essential to continuously monitor its performance and identify areas for improvement or optimization.

Here’s a list of KPIs you may want to track:

Invoice Processing Time: This measures the time it takes from receipt of an invoice to its payment. A shorter processing time can indicate a more efficient process.

Cost per Invoice: This calculates the total cost of processing an invoice. Lower costs indicate a more efficient and cost-effective system.

Invoice Accuracy Rate: This KPI measures the percentage of invoices processed without errors. Higher accuracy rates signify a reduction in costly mistakes.

Invoice Exception Rate: This tracks the percentage of invoices that require manual intervention due to discrepancies or errors. A lower exception rate can denote a more streamlined and automated process.

Approval Cycle Time: This measures the time taken from when an invoice is received to when it’s approved. Reducing this time can speed up your entire accounts payable process.

Additionally, conduct regular reviews of the system and its impact on your business. Find out if your team is meeting their objectives? Are there any issues or roadblocks? Is there additional training required for your team? Has the system helped improve their relationships with vendors due to timely payments and better communication?

Paperless accounts payable system best practices

Going paperless requires discipline and consistency to make it truly effective. You may already have standard practices established to deal with paper-based accounts payable — routing invoices above a certain threshold for managerial approval, all the invoices stored in a specific filing cabinet, etc.

Similarly, when transitioning to a paperless system, you should establish certain best practices to maximize your new digital system.

1. Automate data import

It would be a pain if your team manually uploaded all invoices to your paperless system. Constantly refreshing your email inbox and scanning through attachments is hardly efficient.

Instead, having an automatic data import feature will save you time and reduce the chances of error. It will also ensure a smooth flow of invoices into the system without any bottlenecks or delays.

Nanonets offers a whole bunch of auto-import options, including email, API integration, OneDrive, Google Drive, Dropbox, and Zapier. No matter where your invoices originate, you can easily import them into the system automatically.

2. Employ intelligent data capture and extraction

You may receive invoices in various formats, styles, currencies, and languages when your business grows. You cannot rely on simple OCR and manual data entry to handle the complexities.

The AP department needs an intelligent data capture and extraction system to understand the complexities and adapt accordingly. This way, you can process various invoices quickly and accurately.

Nanonets combines ai and best-in-class OCR to extract necessary information from invoices accurately, regardless of format or language. Structured, semi-structured, or unstructured data — Nanonets can handle it all. This ensures that you can work with diverse suppliers without any data gaps or inaccuracies.

3. Implement automated approval workflows

Purchase orders, invoices, and other financial documents often need multiple approvals before processing. Manual approval workflows can be slow, opaque, vulnerable to fraud, and may lead to missed payment deadlines.

Automating your approval workflows can expedite this process while increasing transparency. You can set up custom approval sequences based on invoice amount, department, project, or any other criteria.

With Nanonets, you can customize your approval workflow based on your business needs. You can set up rules for automatic routing and approval hierarchies to ensure the right invoices reach the right approvers at the right time. With live status updates, automated alerts, and reminders, you can clearly track each invoice’s progress, maintain transparency, and prevent any delays or missed payments.

4. Set up integrations to eliminate data silos

Imagine spending hours manually transferring data from your AP system to your payment system, accounting system, or ERP. It’s not only time-consuming but also prone to errors. What if an additional zero is added to an invoice amount or a decimal point is missed?

Integration between various systems is vital to ensure seamless data transfer and avoid any errors. Not only does it help in saving time, but with automated 3-way matching and reconciliation, it also enhances data accuracy and reliability.

Nanonets is built to play well with other systems. It supports integration with popular accounting, ERP, and payment systems, including QuickBooks, SAP, Oracle, etc. The data from Nanonets can be easily synced with these systems in real time, eliminating data silos and ensuring smooth, error-free data transfer. This way, you can focus more on strategy and less on manual data entry.

5. Regularly audit and optimize your system

To ensure that your paperless system is functioning optimally, it’s necessary to regularly audit and review the system’s performance. It would help if you track key metrics like accuracy, processing time, and error rates and also pay attention to user feedback.

Regular audits will not only help you identify issues and bottlenecks but also uncover opportunities for improvement. Optimizing your system based on these insights will ensure that it continues to meet your needs as your business evolves and grows.

Nanonets provides robust real-time analytics and reporting capabilities to monitor your AP processes. With actionable insights, you can continuously improve your system’s performance, reducing errors, improving speed, and increasing overall efficiency.

5. Prioritize security and compliance

Maintaining the security of your financial data is a non-negotiable requirement. Likewise, ensuring compliance with various laws and regulations is crucial to avoid penalties and legal issues.

Your paperless AP system should have robust data security measures like encryption, secure data storage, and user authentication. It should also be flexible enough to accommodate changes in regulatory requirements.

Nanonets delivers high-grade security to keep your sensitive data safe. It complies with global privacy standards, including GDPR and CCPA. It uses advanced security measures like data encryption and secure cloud storage. Nanonets’ audit trails also maintain a clear record of every action, helping you ensure accountability and regulatory compliance.

Final thoughts

Transitioning to a paperless AP process is no small task. It involves careful planning, strategizing, and implementing. However, the benefits outweigh the challenges with the right tools and an effective strategy. From increased efficiency and transparency to cost savings and improved security, the advantages of a paperless AP system are indisputable.

By harnessing the power of Nanonets, businesses can streamline their AP processes, achieve their operational goals, and set themselves up for future growth. It reduces manual labor and associated errors, accelerates the invoice approval process, enhances data accuracy, and facilitates seamless system integrations. With its strong focus on security and compliance, Nanonets offers a reliable solution for businesses to confidently transition to a paperless environment.

The road to paperless AP may be complex, but with Nanonets, it’s worth embarking on. The opportunities that lie ahead — improved efficiency, cost reduction, transparency, and data security — make this journey essential for businesses aiming to stay competitive in a digital-first world.

NEWSLETTER

NEWSLETTER