Xero is an accounting software suitable for small to medium-sized businesses seeking a robust cloud-based accounting solution. The platform simplifies financial management, providing real-time visibility of financial positions and performance. Yet, despite its advanced capabilities, managing accounts payable and invoice processing manually in Xero is becoming more and more challenging.

The challenges are numerous:

- painstakingly slow manual data entry

- ever-present risk of human error

- lack of efficiency in the approval process

Businesses are constantly seeking ways to streamline these critical operations. Today, AP automation technology can automate what was once a laborious process. When paired with Xero accounting software suites on the market, the integration of AP Automation software becomes a necessity for businesses aiming for efficiency and accuracy. Nanonets integration with Xero represents a leap forward in managing financial transactions, setting a new standard for operational efficiency in the digital age. Let’s see how this works, and how you can set this up for your teams.

The Evolution of Invoice Processing

The journey of invoice processing from its traditional, manual roots to the digital frontier is a tale of technological evolution.

Pre 1980s: Manual Accounts Payable

Accounts payable processes were entirely manual, involving physical invoices, paper checks, and ledger books.

1980s-1990s: Digital Ledgers

Early software solutions provided basic digital ledger capabilities, streamlining some parts of the process.

2000s: Electronic Invoicing Unlocked

The internet revolutionized accounts payable, introducing electronic invoicing, online transactions, and email communications. This era saw a significant reduction in paper-based processes.

2010s: Easy-to-use Cloud Solutions

Cloud-based solutions allowed for more scalable, flexible, and accessible financial operations, while mobile technology enabled on-the-go invoice management and approvals.

Late 2010s-Present: Automated Accounts Payable Solutions

The latest evolution involves the use of automation and artificial intelligence to automate the entire process including –

- Accounting and AP Intelligence: The advent of ai-based accounting systems has ushered in a new era of efficiency. Capable of performing repetitive tasks such as data entry, invoice matching, and transaction processing, these systems operate with a speed and accuracy beyond human capabilities.

- Connected Workflow Across Apps: In today’s interconnected digital landscape, seamless communication between applications is crucial. Emails, AP tools, accounting software, ERPs, and other databases now operate in concert, automating data capture and synchronization across platforms.

- Intelligent Data Capture: Leveraging ai technologies like natural language processing and optical character recognition (OCR), today’s systems automate the extraction and interpretation of data from various invoice formats. This includes handling unstructured and scanned data with unprecedented efficiency, making the accounts payable process smoother and more accurate than ever before.

<h3 id="ocr-technology-for-invoice-scanning”>OCR technology for Invoice Scanning

OCR (Optical Character Recognition) simplifies how businesses handle documents. In our use case, OCR scans invoices and other paper documents, turning them into digital text. The digital text is interpreted using ai and invoice details are extracted –

- Fields (invoice date, invoice number, amount, seller details, buyer details, etc)

- Line Items (descriptions and costs of the Goods and Services Sold).

- GL Codes (automatically assigned by ai based on past data).

- Other dimensions based on context (expense categorization, etc.)

What impact does OCR and Invoice Scanning Software have?

Various reported statistics underscore the impact of automation software. These numbers represent a narrative of the kind of success that you and your team can look forward to experiencing.

Dramatic Cost Reductions in Processing

Let’s start with the financial health of your department. AP Automation has been shown to slash processing costs by a staggering 70%. This isn’t just about saving pennies; it’s about reallocating your budget towards growth, training, and maybe even that office espresso machine everyone’s been eyeing. Think of this as an investment in both your team’s efficiency and their well-being.

Time is of the Essence

Now, imagine reducing your invoice processing time by 384%. This dramatic decrease means your team can process more invoices faster than ever before, freeing up time to focus on strategic initiatives that truly matter. With AP Automation, “I don’t have time for that” becomes “What’s next on the agenda?”

Error Reduction for Peace of Mind

We know errors can be more than just annoying—they can be costly. With a 37% reduction in invoice processing errors, AP Automation brings peace of mind to your operations. Fewer errors mean fewer hours spent in correction cycles and more confidence in your data integrity. This also translates into less friction with vendors and stakeholders, smoothing the way for smoother relationships and operations.

Cultivating Vendor Relationships

Speaking of relationships, let’s talk about the 76% of organizations reporting increased vendor satisfaction. This is key. Happy vendors mean a reliable supply chain and opportunities for negotiations and discounts down the road. Your vendors will notice and appreciate the punctuality and accuracy of your payments, thanks to AP Automation.

Cash Flow Optimization through Early Payment Discounts

A 3% savings through early payment discounts gives your organization a financial facelift, enhancing your cash flow, and providing you with more leverage and flexibility in your financial operations.

Compliance Without the Complications

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age where regulatory demands are ever-increasing, achieving complete compliance without the stress is nothing short of miraculous.

Nanonets for OCR and Invoice Scanning in Xero

For companies utilizing Xero for their accounting needs, the manual process of handling invoices is not just a test of patience but also a significant drain on resources. An OCR and Invoice Scanning Software for Xero transforms this critical yet cumbersome process into a streamlined, efficient workflow.

Let’s take a look at how accounting teams can use an OCR-based AP automation software like Nanonets and integrate it with Xero to streamline their accounting workflow.

Manual AP Workflow in Xero

Let’s walk through the typical manual AP process for a company using Xero:

Invoice Receipt: Invoices arrive in various formats, including paper and digital. Staff must manually collect and organize these documents.

Manual Sorting and GL Coding: Each invoice is then sorted based on criteria such as vendor, amount, or due date, requiring significant time and effort. Each invoice must then be coded to the appropriate General Ledger accounts.

Data Entry: Critical information from each invoice, such as vendor details, amounts, and dates, is manually entered into Xero.

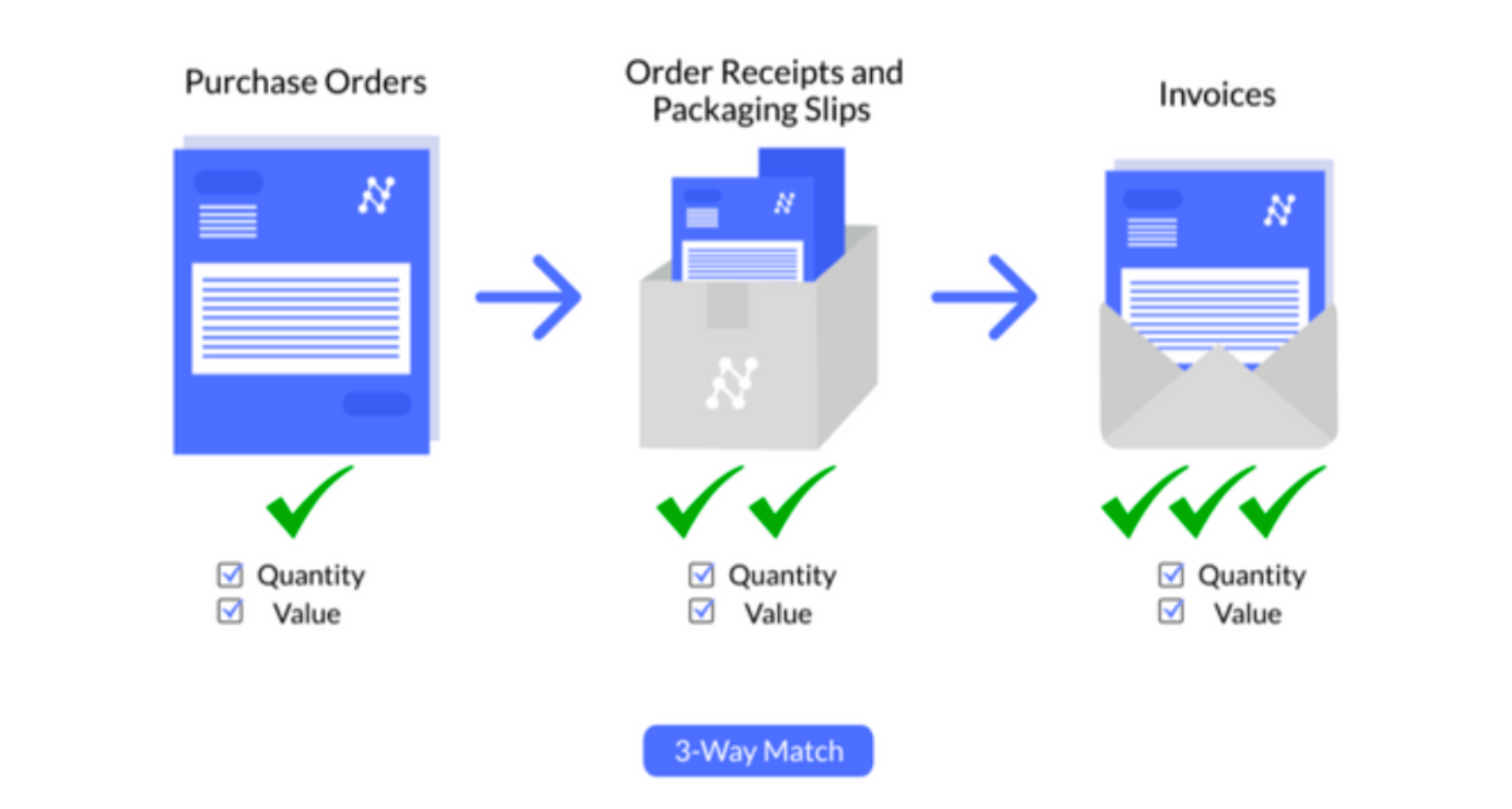

Invoice Verification: Depending on the company’s policies, invoices may undergo two-way (invoice and PO), three-way (invoice, PO, and receiving report), or four-way (invoice, PO, receiving report, and inspection report) matching to verify transactions.

Approval: Once verified, invoices are routed for approval, often involving multiple departments or levels of authority.

Payment Processing: Approved invoices are scheduled for payment based on terms and cash flow considerations.

Reconciliation: Finally, payments are reconciled in Xero, ensuring that all transactions are accurately reflected in financial records.

Automated AP Workflow with Nanonets

Now, let’s reimagine this workflow with Nanonets integrated into Xero:

Invoice Receipt: Picture this- every invoice your business receives, regardless of its source, lands neatly in one digital spot. Invoices are automatically imported from the mess of emails, drives, and databases as soon as they arrive, saving you time and reducing mistakes.

Nanonets automatically reads emailed invoices from email body and attachments.

All handwritten and printed invoices can be easily scanned using a smartphone or directly uploaded into the platform.

Digital receipts can either be created and printed directly using the Nanonets platform, or imported into Nanonets from your mail, apps and databases.

This process ensures that every piece of data, regardless of its origin, finds its place in a centralized, digital repository, ready for further action.

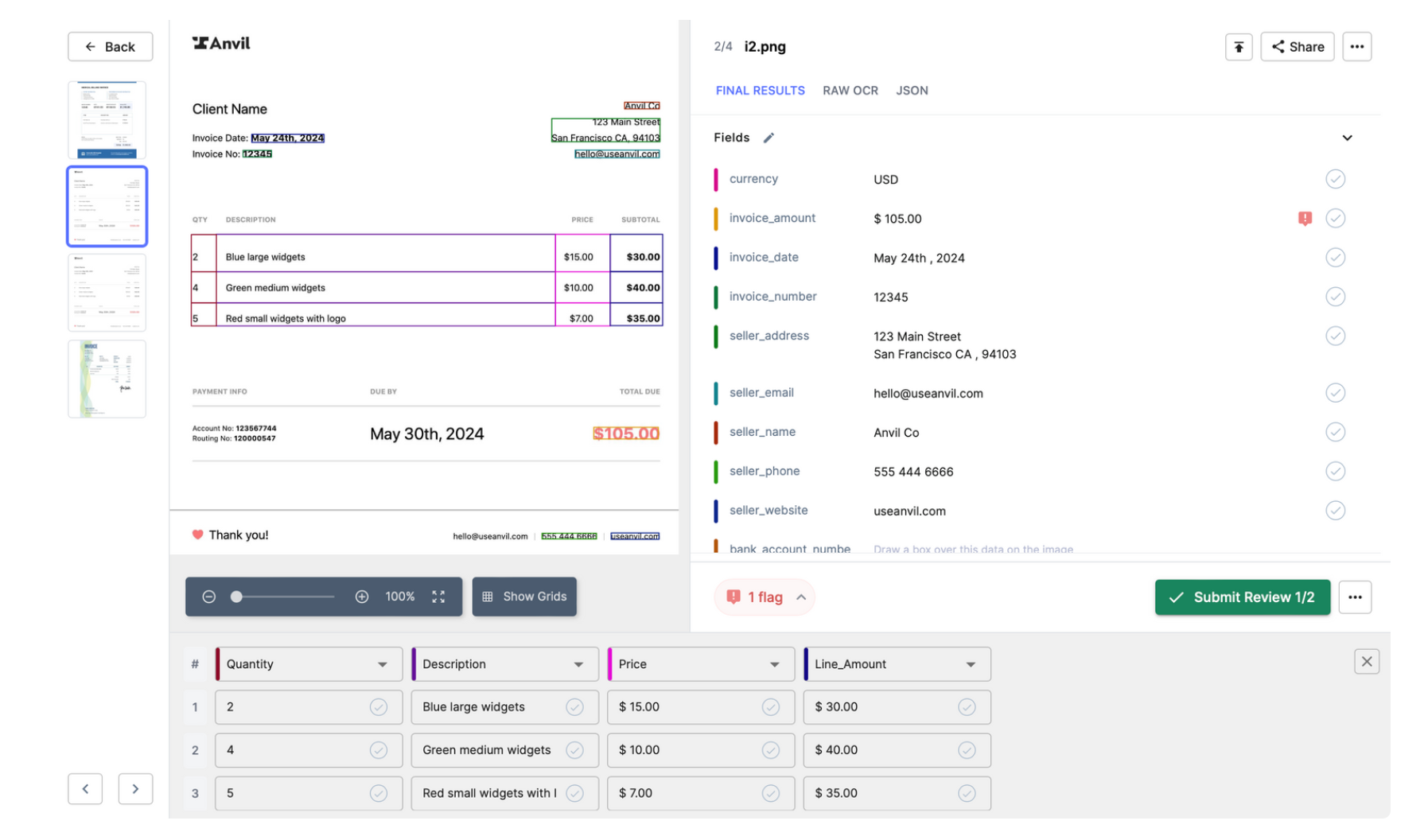

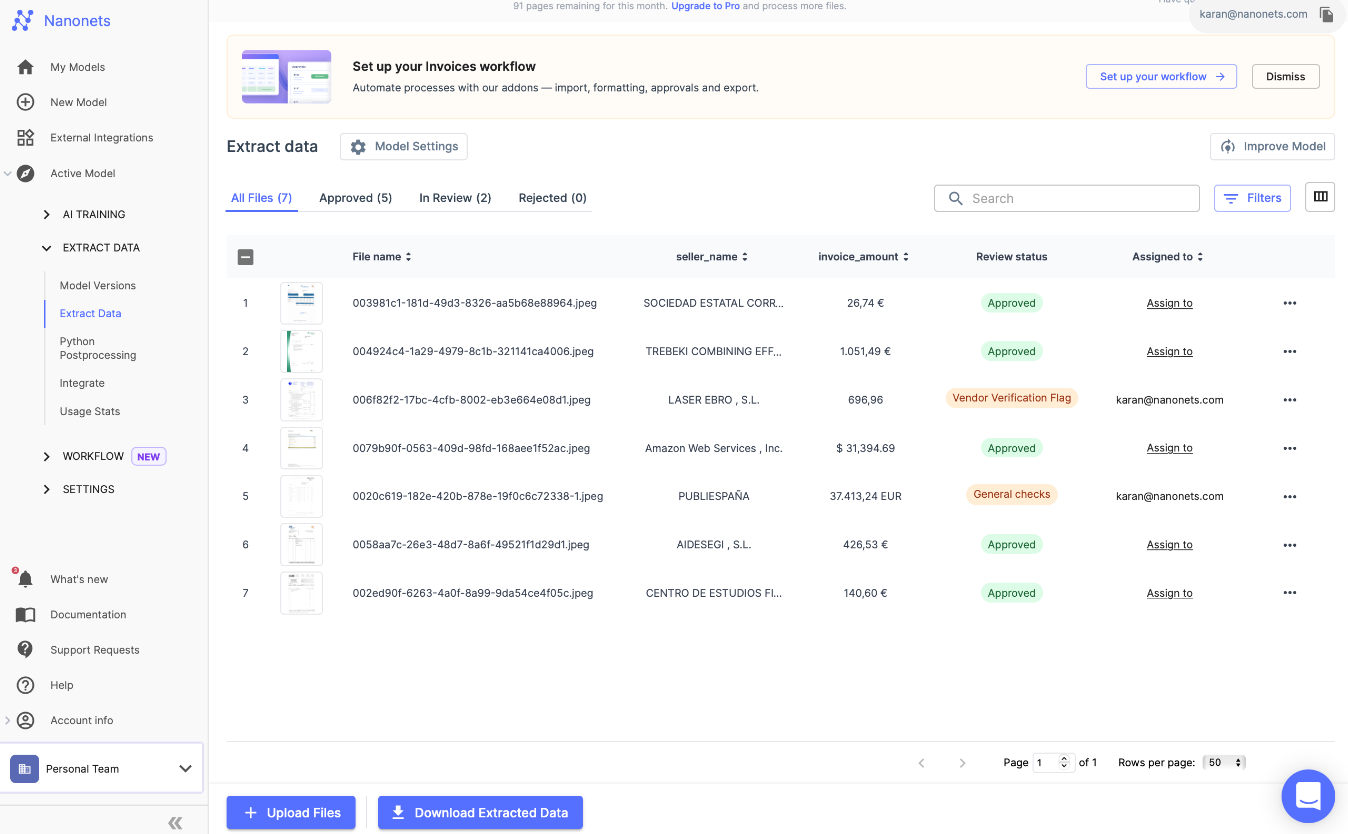

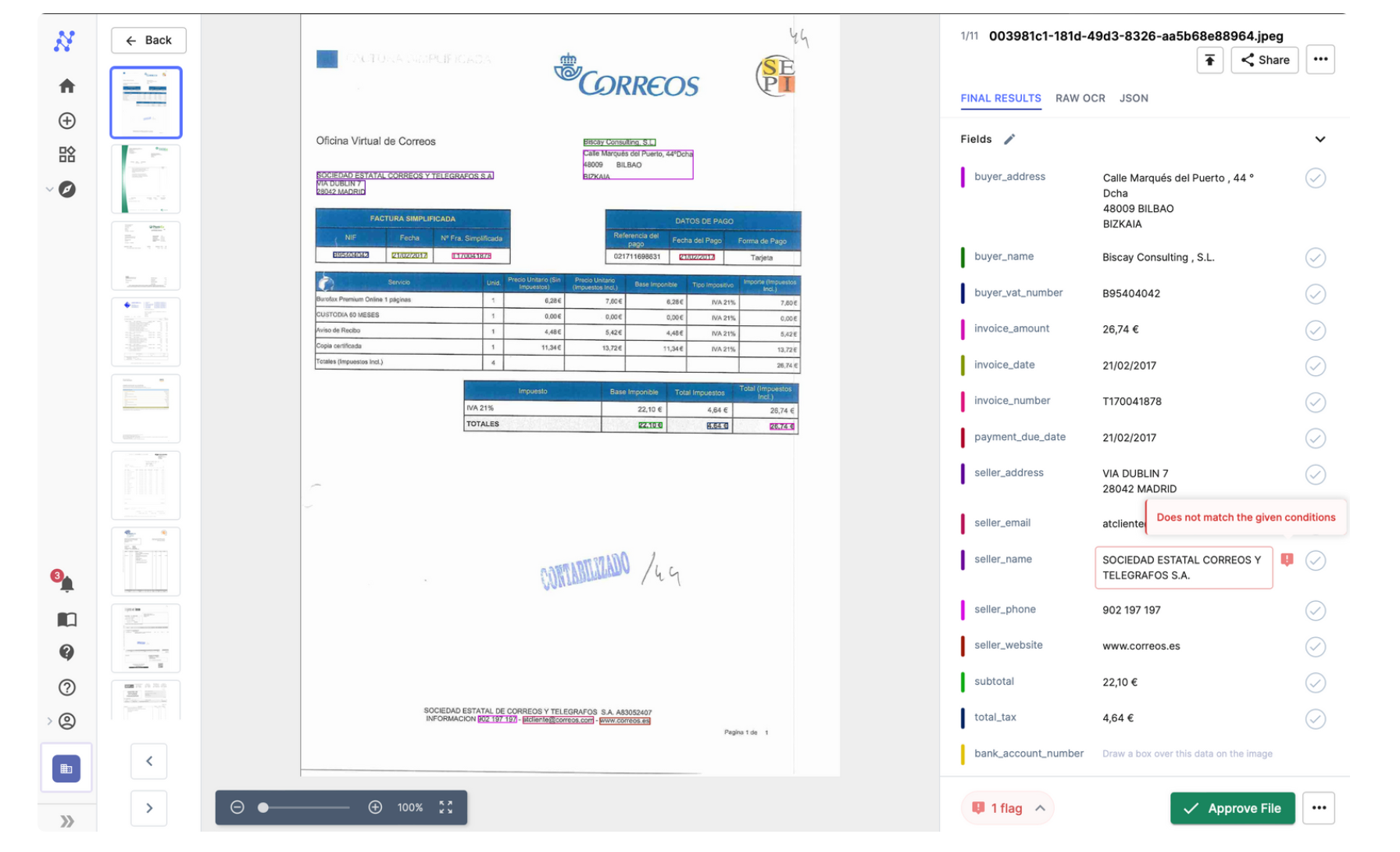

Automated Data Entry: Nanonets ai reads invoices with over 99% accuracy, cutting down the hours to mere moments. This change means your team can ditch the drudgery and dive into work that actually matters. Data is then extracted and directly inputted into Xero, with no manual data entry required.

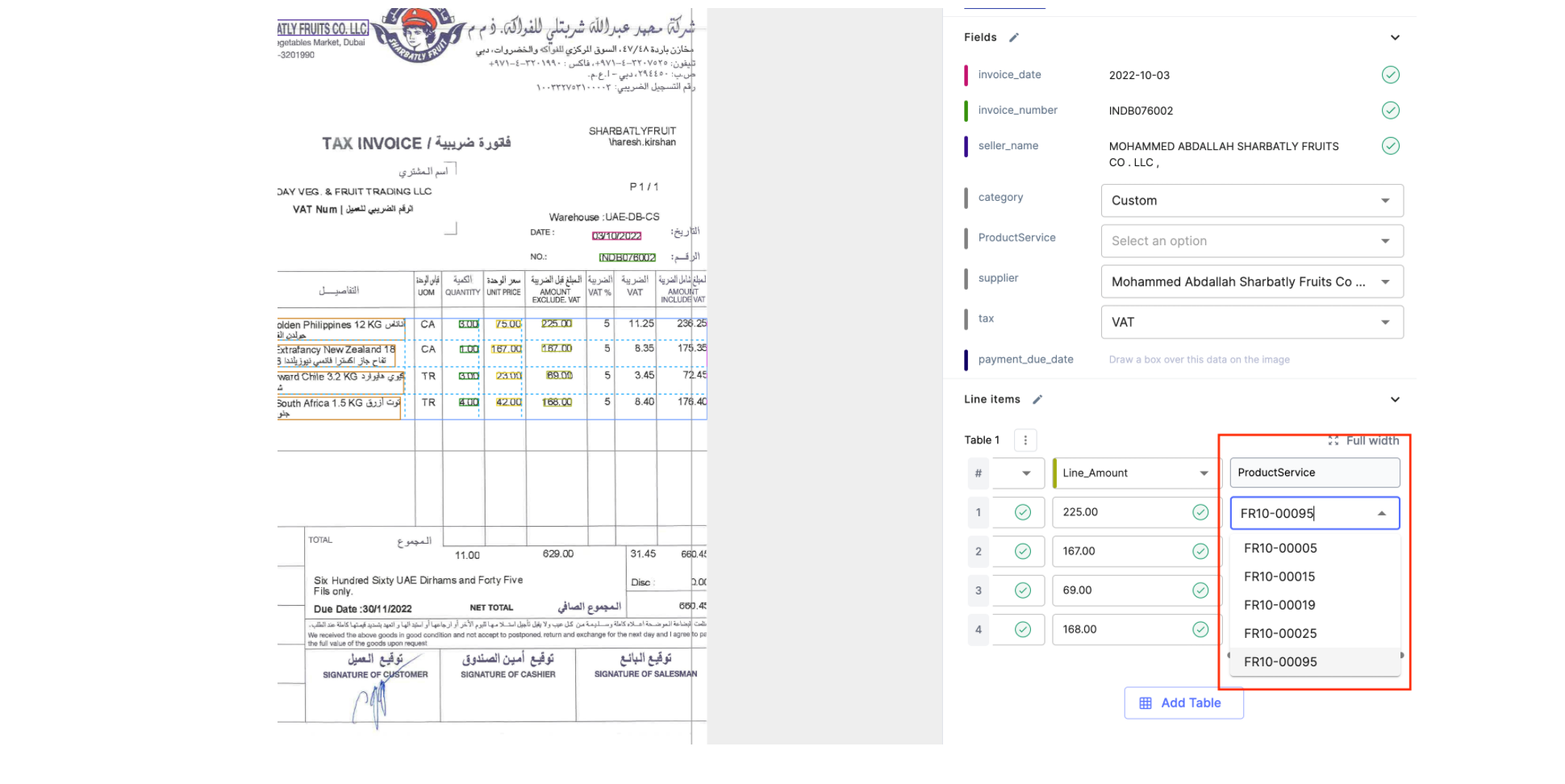

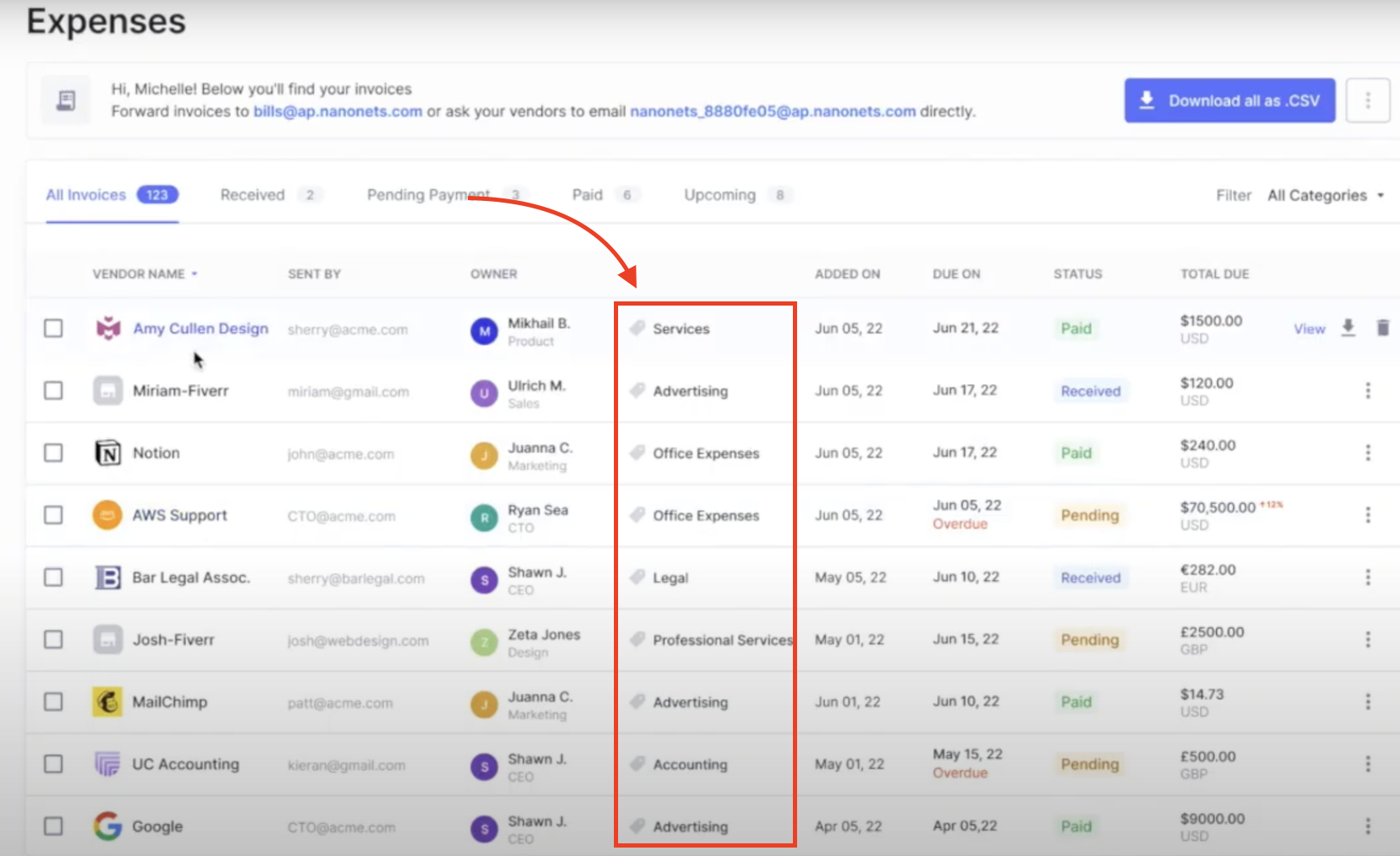

Automated Sorting and GL Coding: Nanonets uses OCR to automatically recognize and categorize invoices by vendor, date, amount, and other relevant criteria. GL code assignment can be automated by –

- Training on past data: This involves uploading historical financial documents and transactions tagged with historically correct GL codes. The model learns from these examples to accurately predict GL codes for new transactions.

- Out of the Box Gen ai: By using Nanonets GenAI, our software can interpret the text on financial documents in a way that mimics human understanding. This allows it to extract relevant information, context and semantics in order to apply complex reasoning to assign GL codes accurately, even in cases where transaction details are ambiguous or sparse.

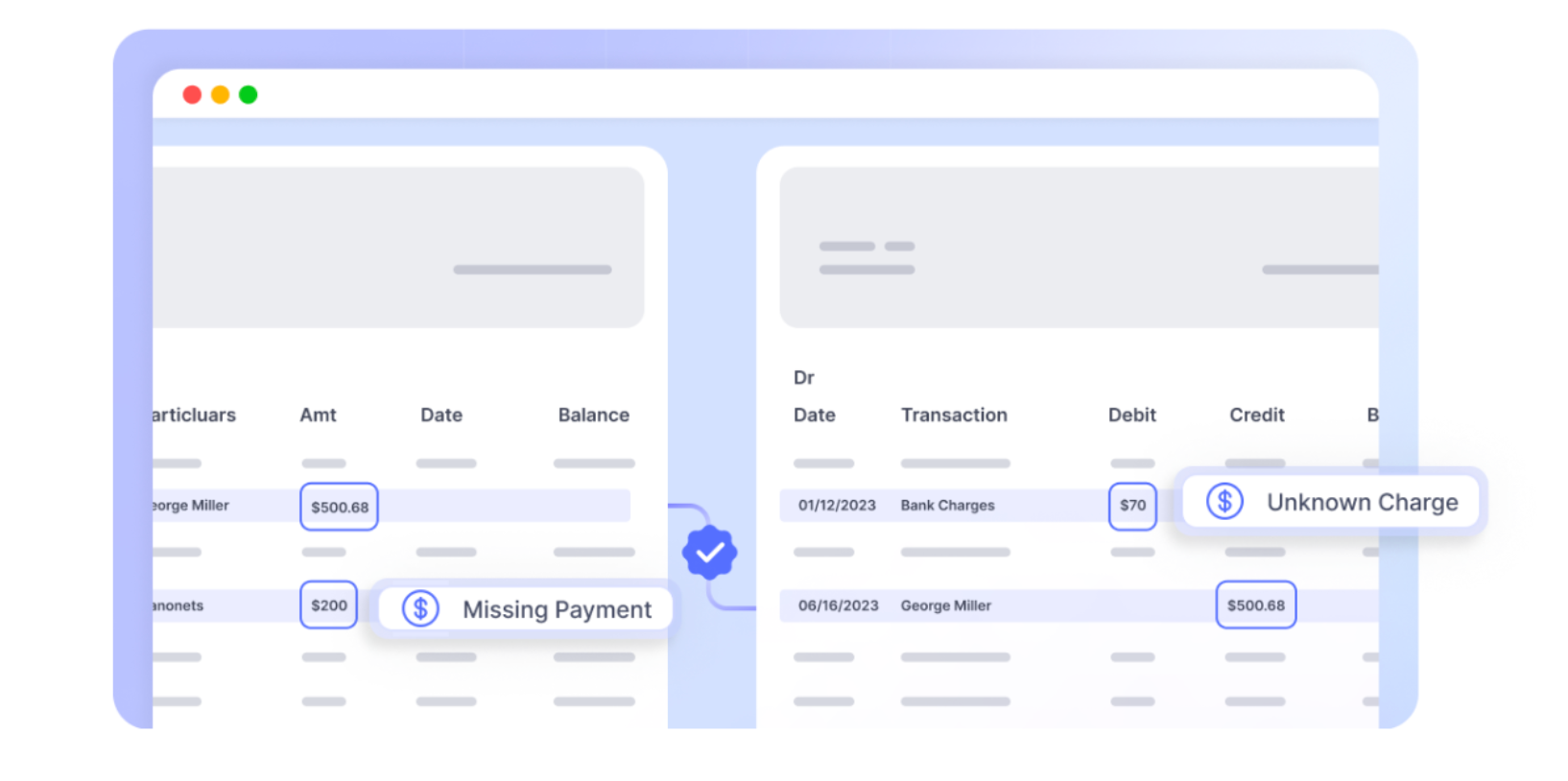

Intelligent Invoice Verification: Leveraging ai, Nanonets automatically performs two-way, three-way, or four-way matching by reading and cross-referencing the extracted invoice data with purchase orders, receiving reports, and inspection reports present in Xero.

Validation: The system flags any discrepancies for human review, but otherwise, invoices that match company criteria are automatically routed for approval or directly approved based on pre-set rules.

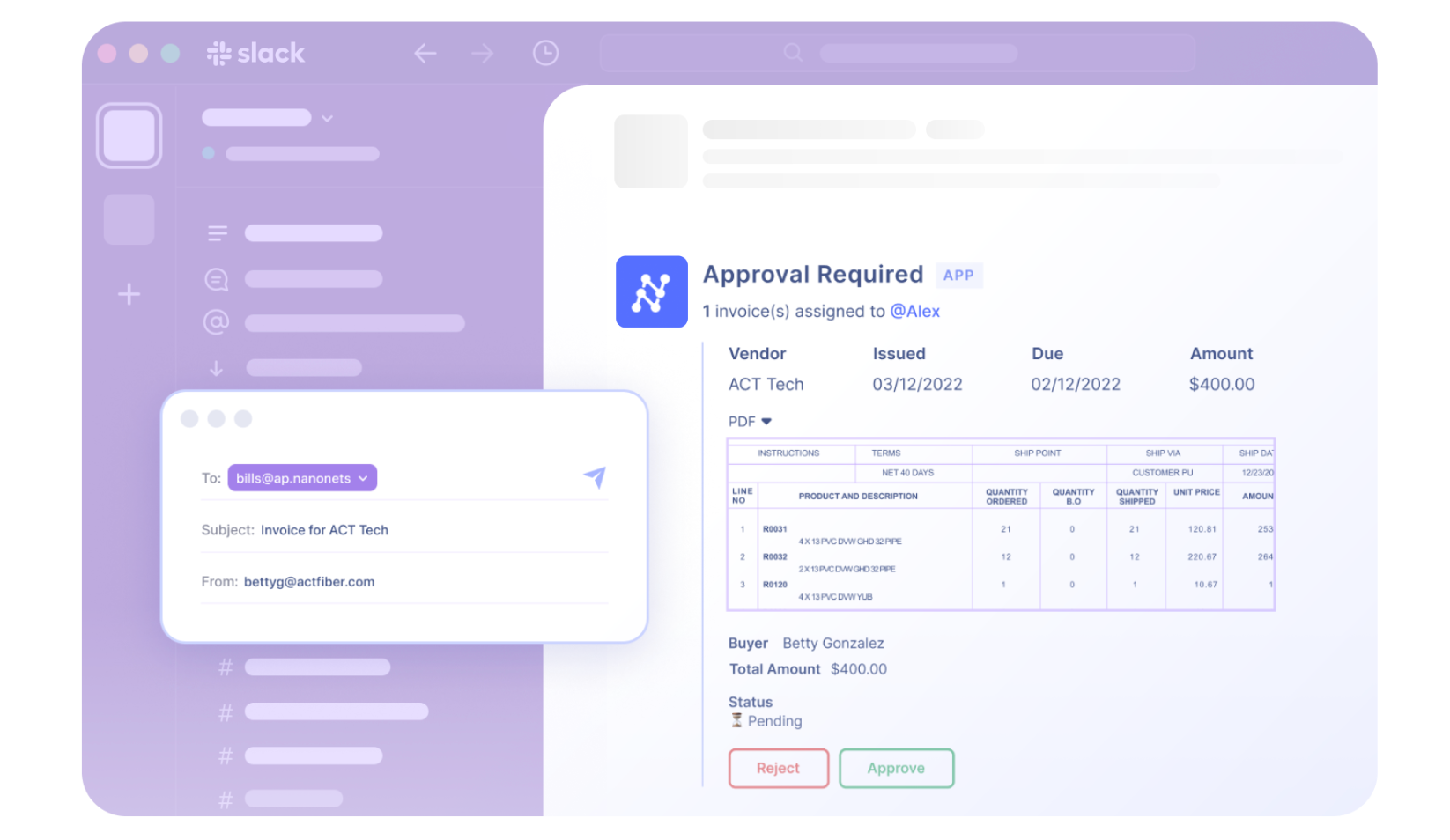

Approval: Approvals with Nanonets are no longer a bottleneck. They become flexible and live where your organization does—whether that’s on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders.

Payment Processing: Approved invoices are automatically queued for payment according to their terms, optimizing cash flow management.

Reconciliation: You can import your bank statements, and Nanonets reconciles the payments automatically in Xero, ensuring that financial statements are up-to-date and accurate, and your books close 90% faster.

We discussed the tangible benefits of using OCR and Invoice Scanning Software for Xero earlier. But on top of that, the transition from a manual to an automated AP process represents not just a shift in how tasks are performed but a fundamental transformation in the role of the finance department. With tools like Nanonets, finance teams move from back-office functions to strategic contributors, leveraging real-time data and analytics to drive business decisions. This is the future of finance, and it’s available now for Xero users through the power of automation with Nanonets.

Steps to Integrate Nanonets for Xero

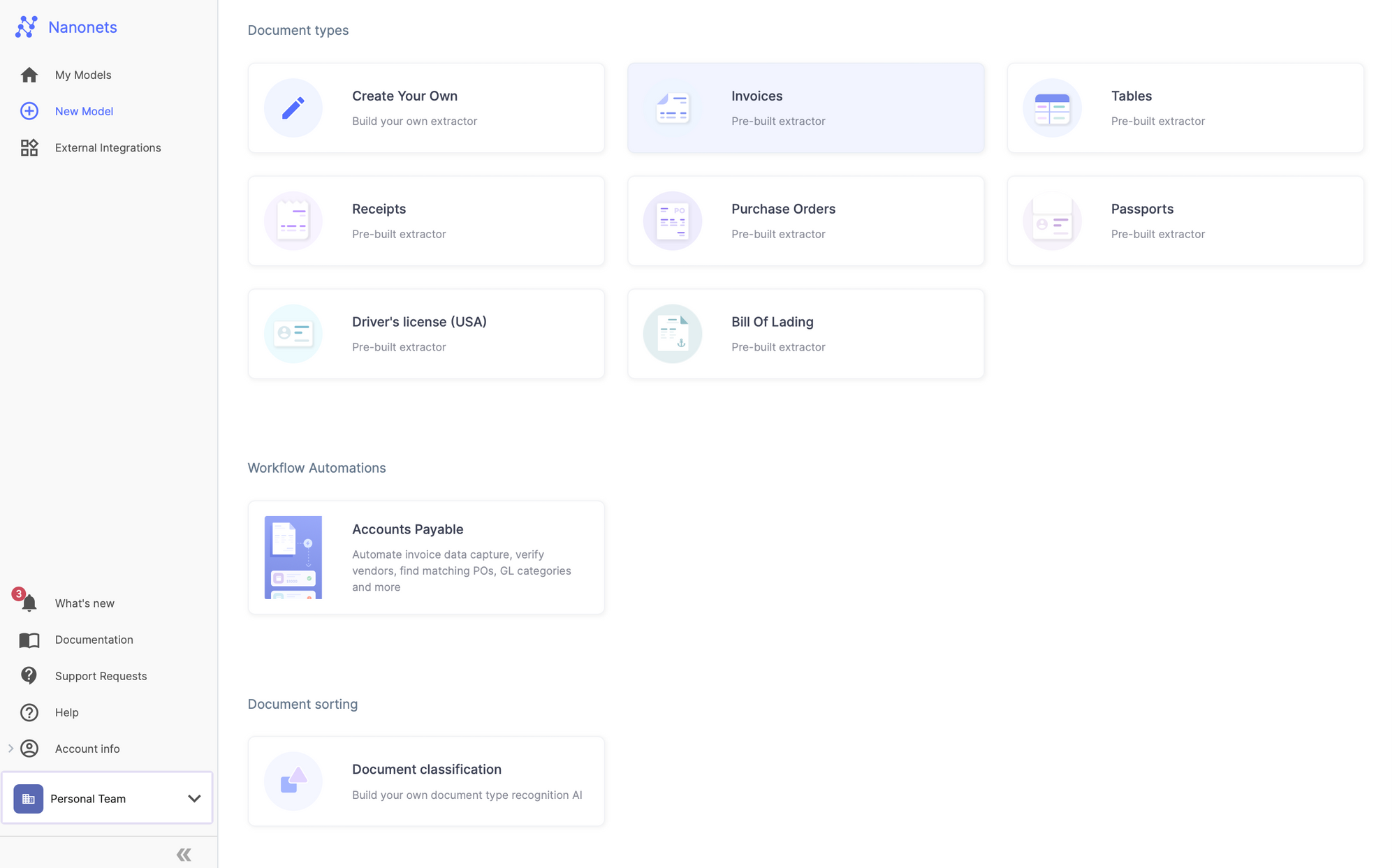

You can integrate Nanonets with Xero, and start using the platform to automate your invoice processing and AP workflows. Her’s how to get started –

- Choose the Invoices pre-trained model.

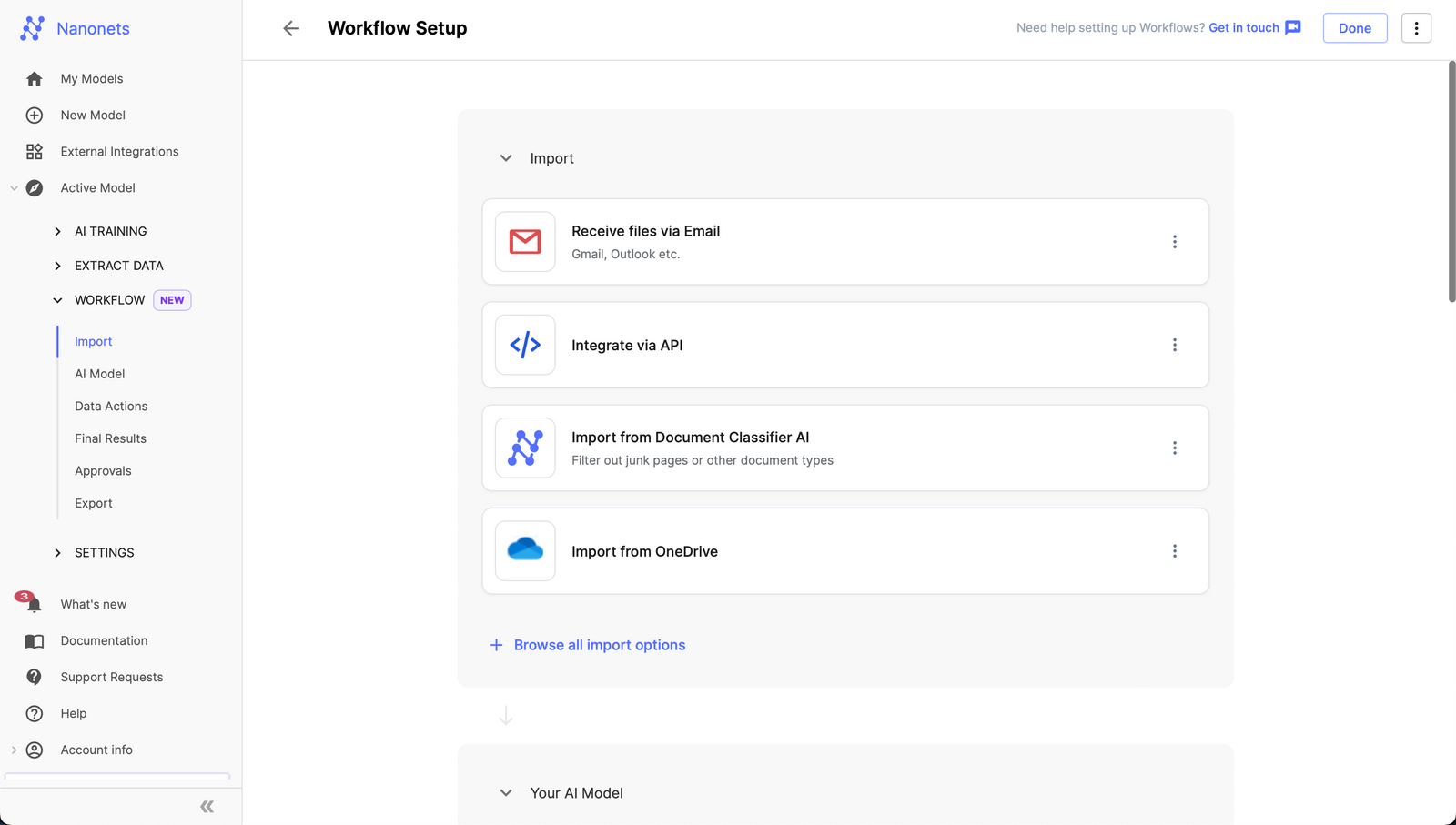

- Once you have created the model, navigate to the Workflow section in the left navigation pane.

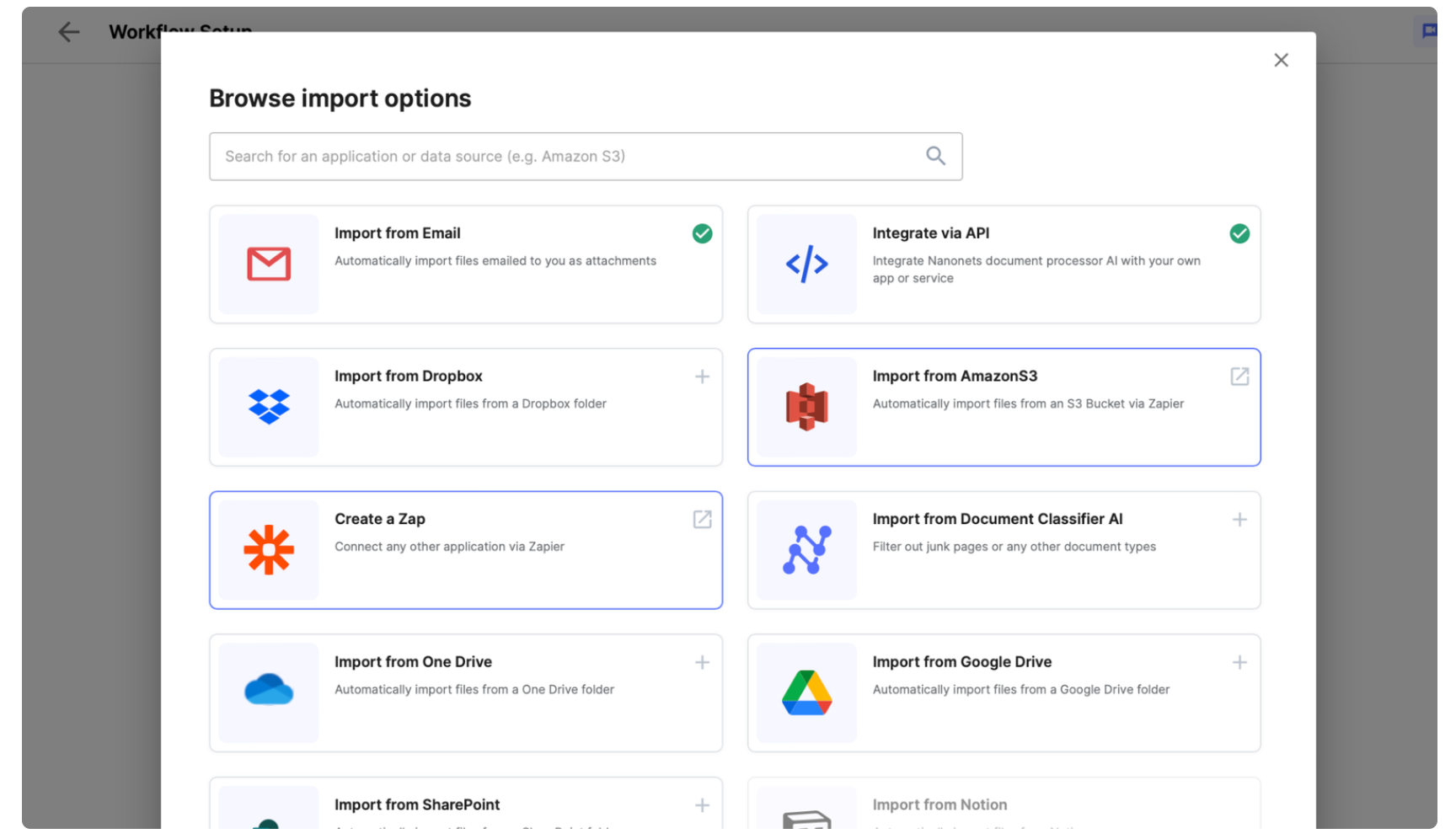

- Go to the import tab and configure your import options –

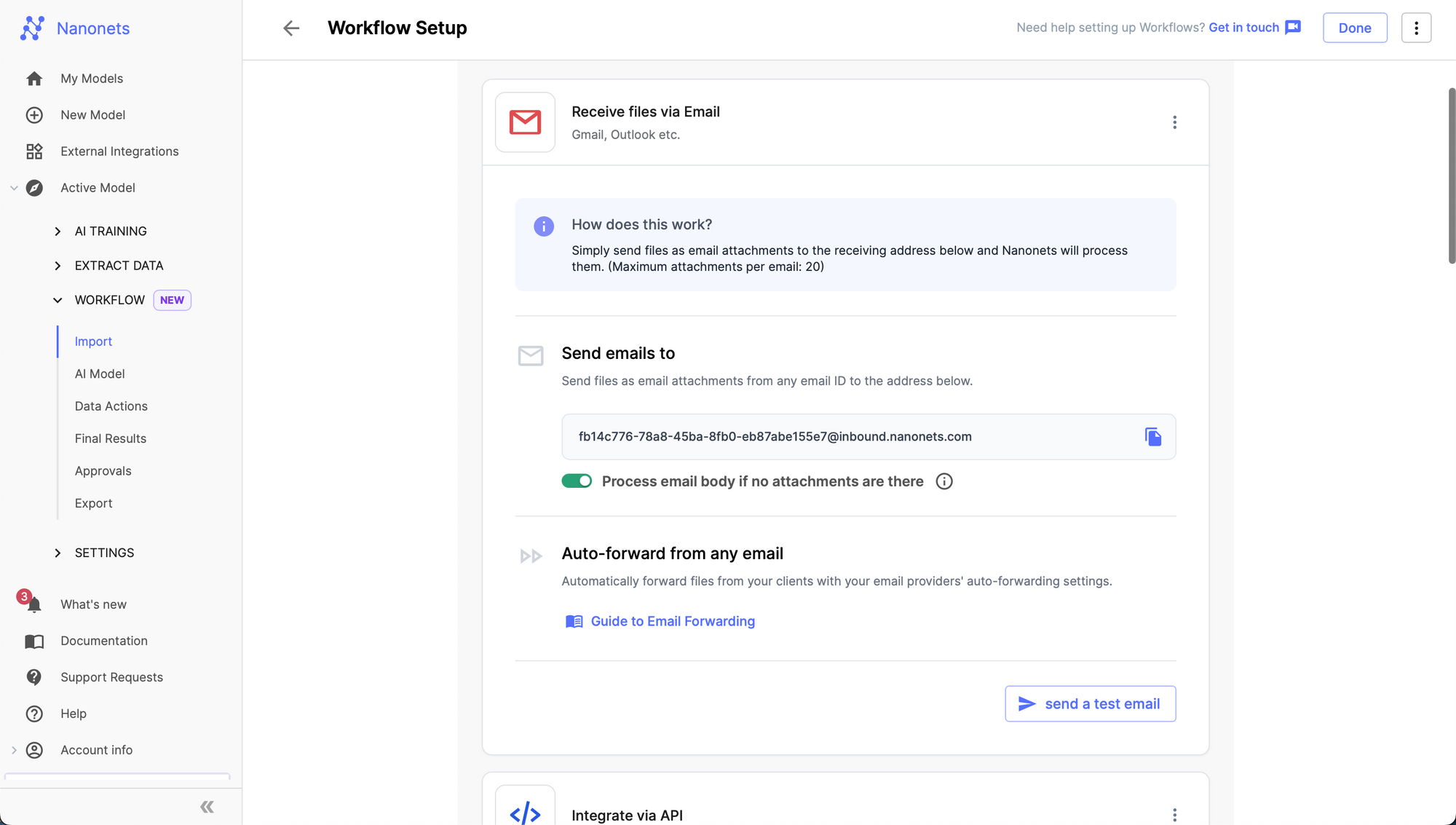

- 1. Email :

- Go to the import tab and click on “Receive files via Email”.

- In the expanded view, you will be able to find an auto generated email address created by Nanonets.

- 1. Email :

- Any Email sent to this address will be ingested by the Nanonets model you created and structured data will be extracted from it. You can set up email forwarding to automatically forward incoming emails from any email address to the Nanonets email address to automate email ingestion and data extraction.

- Learn how to set up Email Forwarding from any email

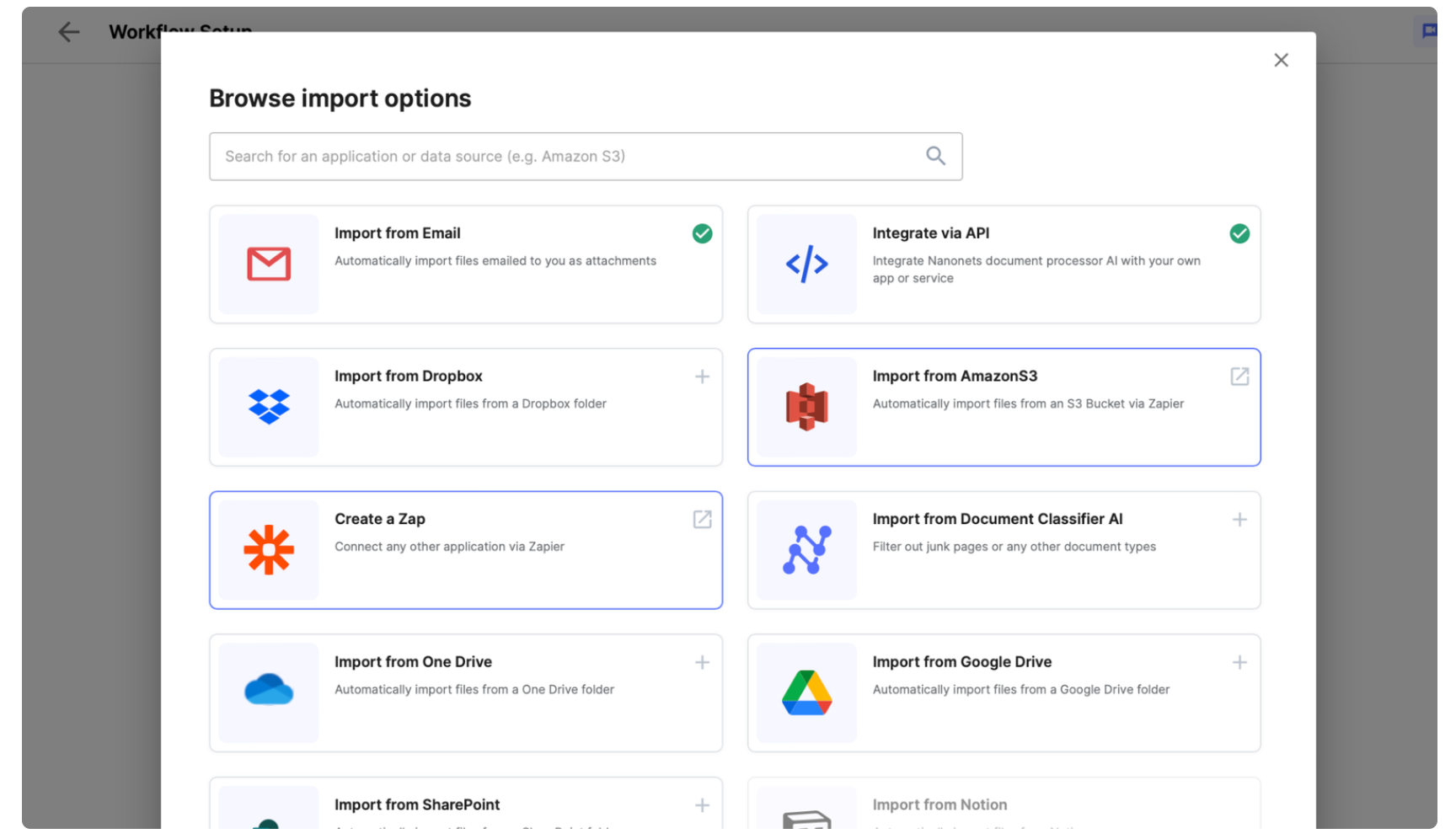

- 2. Automated Import from Apps and Databases

- Set up your imports from the “Browse all import options” modal.

- 3. Direct Upload

- You can also choose to directly take photos and upload invoices using the Nanonets platform or mobile app.

- Test Data Extraction: Upload an invoice and Nanonets works on the imported document and extracts fields, line items and tables.

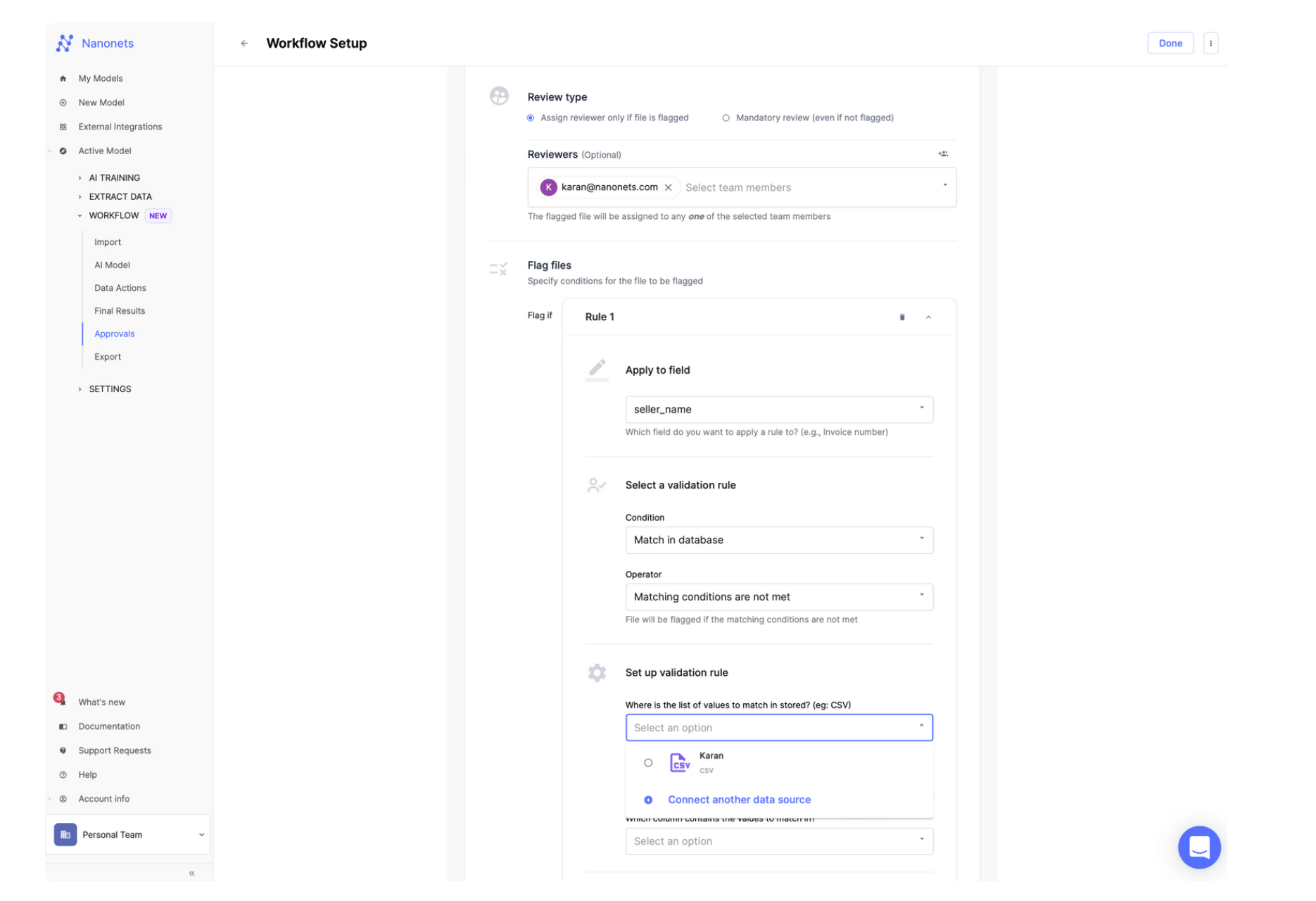

- Set up any Validation Rules and Approval Steps: You can perform postprocessing of data, set up conditional rules, assign manual approvers and set up automated approval based on validation rules. These rules can also be based on interacting with data located on external software / database through integrations.

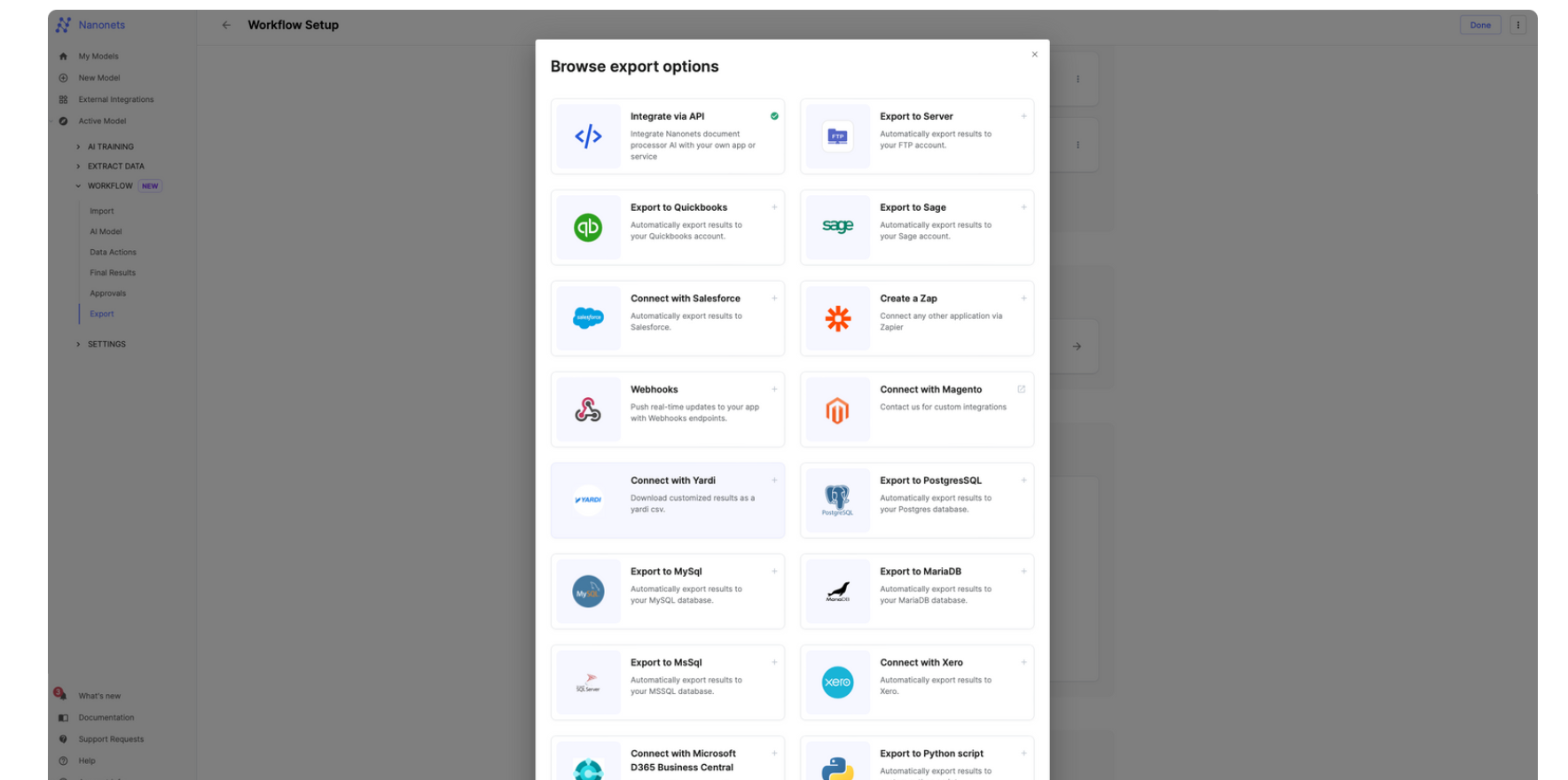

- Add the Xero Integration, Authenticate your Xero Account, and Set up the export into Xero Accounting Software.

This completes the basic set up. You can enhance the Nanonets workflow further and activate features such as GL coding and 2/3/4 way matching.

As we’ve explored, the integration of Nanonets with Xero accounting software is a game-changer for businesses bogged down by the inefficiencies of manual invoice processing. The evolution from manual to automated accounts payable processes is not just a step forward; it’s a leap into a future where financial operations are streamlined, error rates plummet, and strategic decision-making is empowered by real-time data analytics. By moving from manual drudgery to strategic insight, finance teams equipped with the right automation tools can drive their companies towards greater profitability, agility, and competitive advantage in the digital age.

NEWSLETTER

NEWSLETTER