Invoices are a time-consuming hassle, but they are part of every business. Sage Intacct simplifies the entire process. Create professional invoices for your accounts receivable and help process invoices as part of your accounts payable. Sage Intacct has additional features to simplify both ends of invoices. With tracking and reporting, support for recurring invoices, and payment logging, these additional features make Sage Intacct's capabilities one of the best.

This blog will look at how you can manage invoices in Sage Intacct, allowing you to conquer invoice creation and processing and ensure a smooth financial workflow. We'll detail the steps for some of the basic invoice management operations in Sage Intacct, briefly touch on advanced features, and discuss the role of improving efficiency with automation and ai. The detailed process is similar to Sage offerings such as Sage 50 and 100.

Let's dive into how Sage Intacct transforms your invoice management, ensuring a smooth and efficient workflow.

Creating invoices in Sage Intacct

Sage Intacct streamlines invoice creation, freeing you from tedious tasks. Here's how to conquer invoice creation:

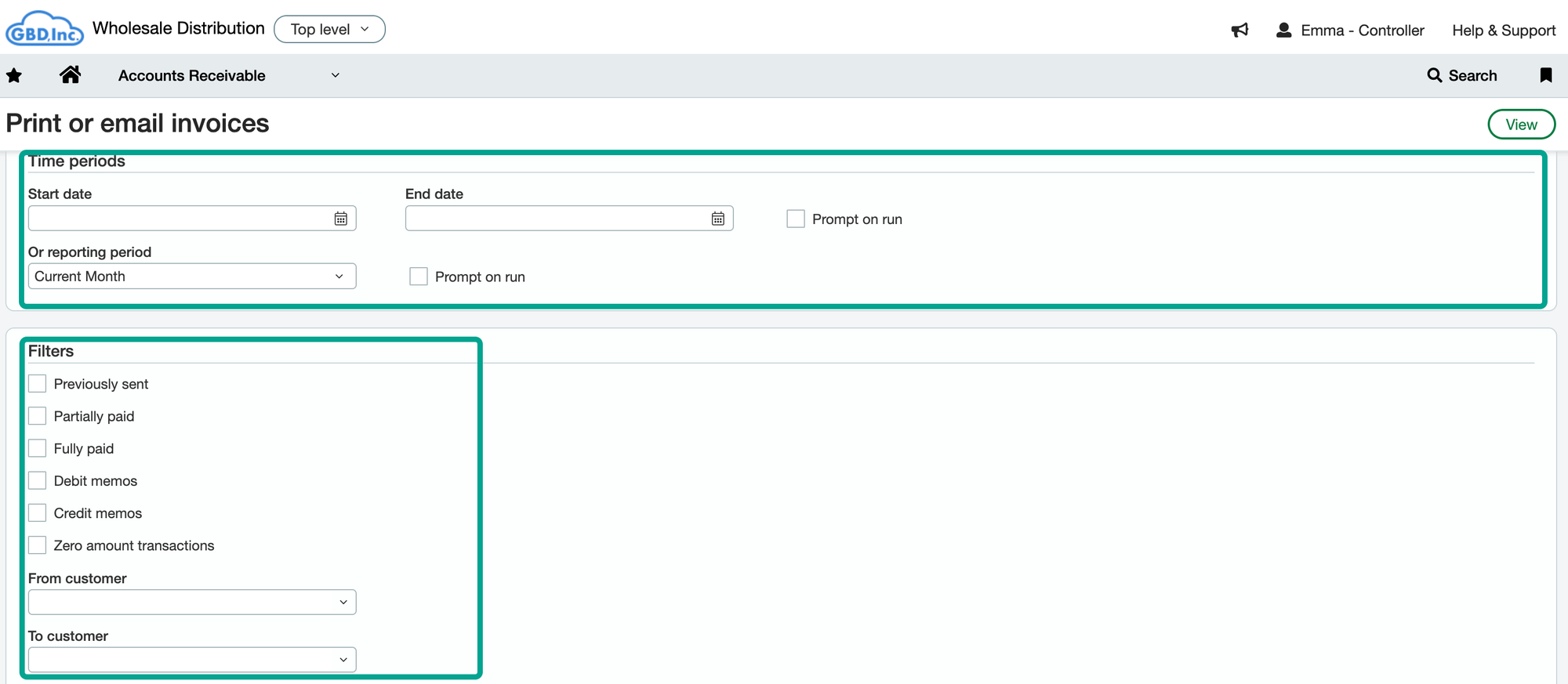

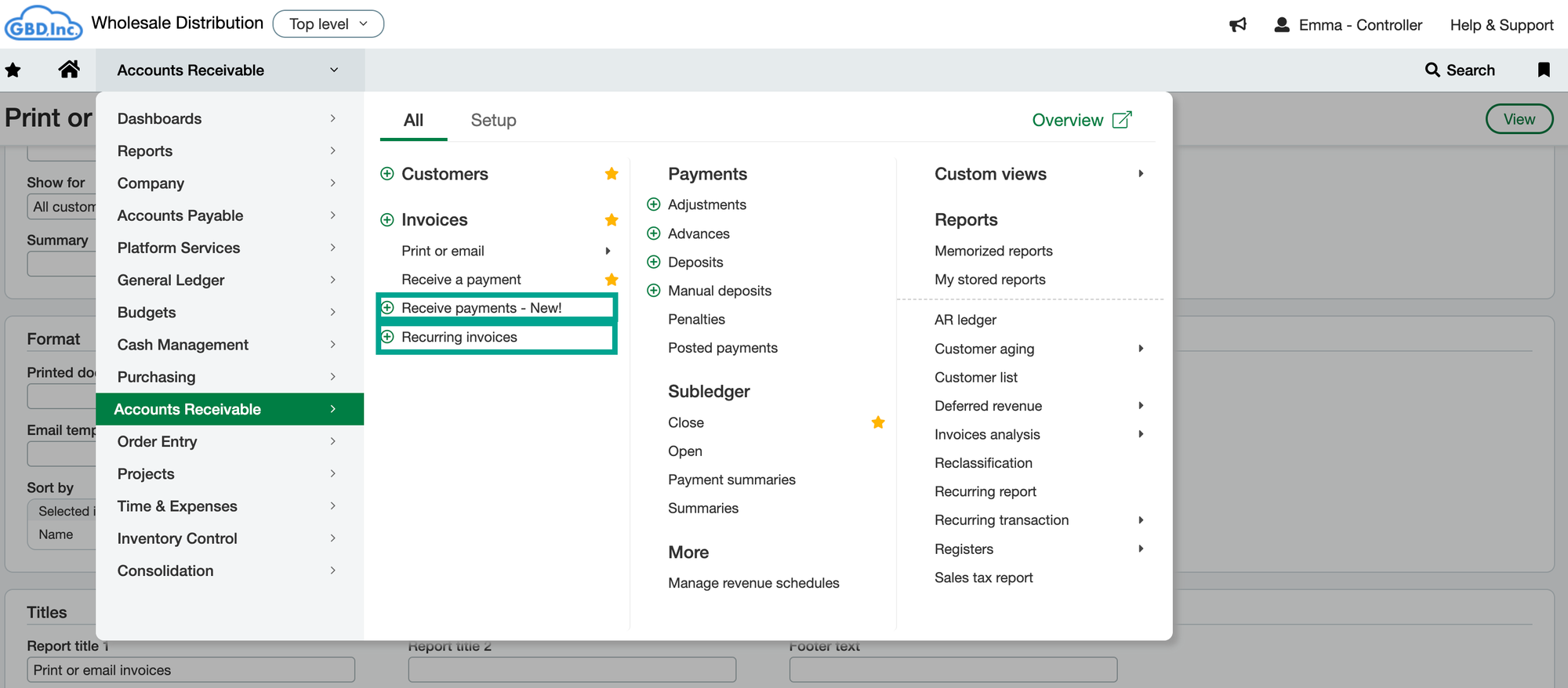

- Navigate to Invoices: Locate the “Invoices” tab within Sage Intacct in the “Accounts Receivable” section. Here you will create and manage all your invoices.

- Client selection: From a pre-populated list, you can efficiently select your billing client.

- Invoice details: Enter all relevant details about the invoice. You can also accommodate one-time sales, service-based projects, or partial payments.

- Detail your invoice: Add line items for your products or services. Specify descriptions, quantities, unit prices and any applicable taxes.

- Invoice templates: You can create and access invoice templates that allow you to reflect your brand identity with logo, color scheme and legal information.

Process invoices with ease

Once invoices have been sent, Sage Intacct simplifies the management process:

- Recurring income: Define the billing cycle for recurring invoices to repeat customers and subscriptions, and Sage Intacct will automatically generate and share invoices at designated intervals.

- Real-time payment tracking: You will be able to see which invoices have been paid, which are overdue and their respective amounts.

- Automated reminders: You can set up automatic reminders for overdue invoices and late payment notifications.

- Payment record: When a payment is received, you can easily record it in Sage Intacct. Match the payment to the corresponding invoice and the system will automatically update your financial records. This ensures accurate accounting and simplifies reconciliation.

- Reports and analysis: Sage Intacct offers robust reporting tools. Generate reports to analyze your billing data, identify sales or overdue payment trends, and gain valuable insights into your business performance.

Invoice Processing – Accounts Payable

Invoice processing is a crucial part of Accounts Payable and Sage Intacct can handle this side of invoices and create invoices.

Accounts payable, or AP, is the amount of money a company owes its suppliers for goods or services that were delivered but not paid for. The AP department is responsible for maintaining detailed records of invoices, ensuring payments are processed accurately and on time, and maintaining detailed financial records.

Sage Intacct provides valuable insights to the Accounts Payable team. It also allows invoices, reconciliations and other relevant tasks.

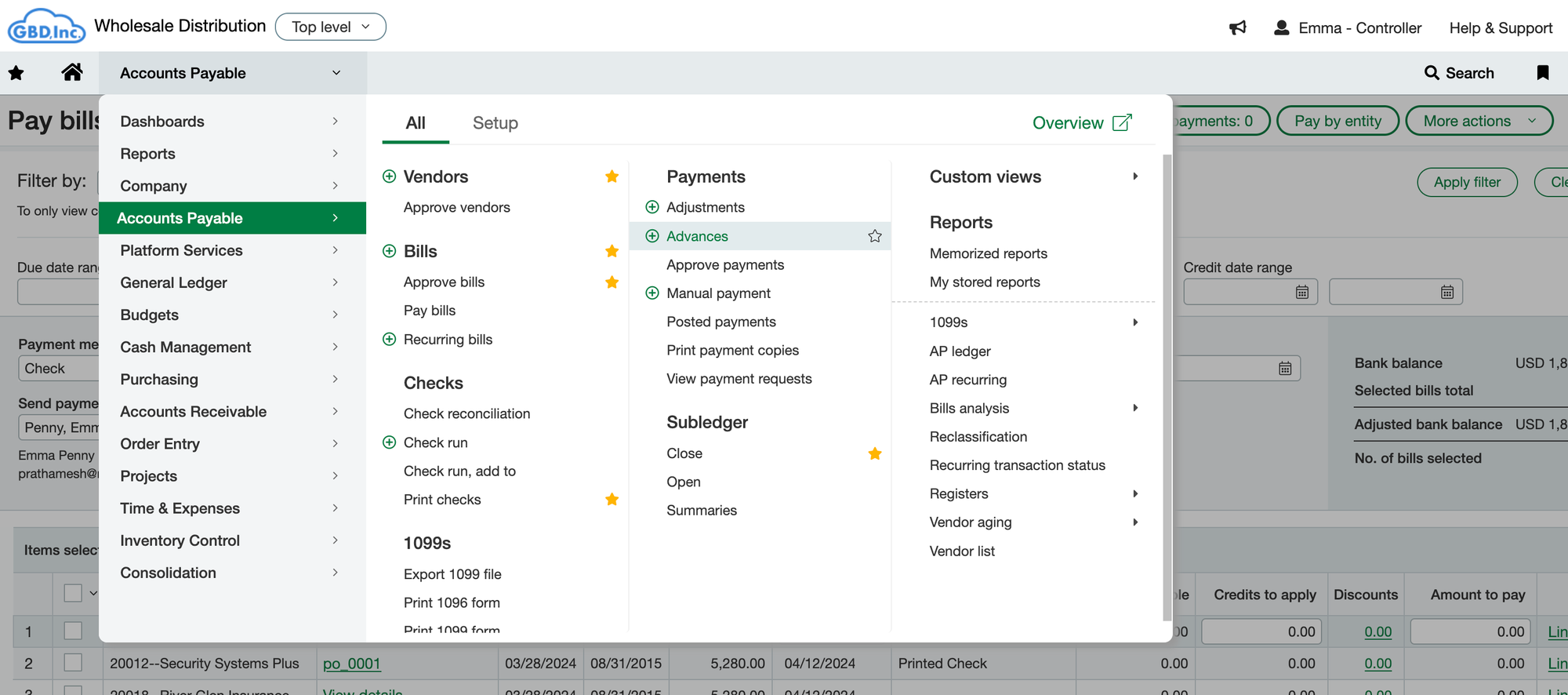

- Approve invoices: In the Accounts Payable section, click Pay Invoices to approve and pay invoices.

- Record and approve payments: You can record any payment made and approve the payment using any of the built-in credit cards and other payment methods.

The manual AP process could be more active, vulnerable to human error, and laborious. Accounts payable automation, or APA, becomes crucial for digitization, rationalization and optimization. Wise intact is

Accounts Payable Automation in Sage Intacct

Sage Intacct offers two main ways to automate the accounts payable (AP) process:

- Intact Sage ai: Sage has a built-in AP automation feature with ai capabilities. You can capture invoice data and flag duplicate invoices.

- Third Party AP Automation Integrations: Sage Intacct has a wide range of technology and integration partners, some of which are in your market.

Sage 50 integrations and Sage 100 integrations allow for a similar experience

NanonetsAI to automate your AP process.

Nanonets is a powerful AP automation solution that leverages the magic of artificial intelligence (ai) to streamline invoice processing.

Trusted by over 10,000 brands, Nanonets is a Sage Intacct Marketplace partner with the best ai and invoice recognition software for accurate AP recognition and processing.

Below is how Nanonets automates the AP workflow:

- Automated invoice receipts: Importing invoices into Nanonets from multiple sources is best in class

- Automated data entry: Nanonets extracts structured data from your invoices, regardless of the invoice format and whether the invoice is scanned or digital.

- Automated verification: Two-way pairing and more. Match invoice information to purchase orders, delivery notes, and other open AP documents.

- Multi-stage approval route: Send automatic notifications to the appropriate person in the organization to review invoices before approval.

- Real-time synchronization: Import your Sage chart of accounts and create rules to code documents from your suppliers.

With the automation above and the use of ai, Nanonets significantly reduces manual effort and time, while minimizing errors. This allows your team to focus on strategic initiatives.

Sage Intacct: the comprehensive solution

Sage Intacct can be the final piece of your financial puzzle. With an easy-to-use interface, features, and integrations, Sage allows you to create invoices, manage, and even handle incoming invoices. Its reports provide visibility to take control of your company's finances and say goodbye to invoice problems.

A powerful ally in the form of Nanonets can help Sage Intacct automate the accounts payable process. Therefore, it reduces time, costs and efforts.

See how Nanonets tailors solutions with a free demo. Delve into the future of finance with Nanonets.