It is that time of the year again and the presentation of taxes is in fact an exhausting process! Are you struggling to present your ITU? Or do you still trust your staff to handle everything? How about having a custom ai tax assistant at your fingertips? With powerful ai models such as OPENAI O3-mini in Chatgpt and Deepseek R1, the tax presentation is now easier and faster than ever. But what model does a better job do when handling deductions, understanding new tax laws and optimizing your savings? In this blog, we tested O3-MINI and Deepseek-R1 with real world tax scenarios, which imply salary slippers, rental receipts and complicated deductions, to see who is the best accountant ai.

New Fiscal Regime 2025-26

In the 2025 Union Budget, the Minister of Finance, Nirmala Sitharaman, has introduced significant changes in the Income Tax Slab under the new regime. These new slabs will enter into force as of April 1, 2010 for financial year 2025-26. The fiscal structure of this budget is designed to mainly benefit taxpayers employed, especially in the average income category. Here are the main ones taken from the 2025 budget.

- Standard deduction: The standard deduction for salaried individuals has risen from ₹ 50,000 to ₹ 75,000, providing additional fiscal deduction.

- Lower tax exemption limit: People who win up to ₹ 12 Lakh annually are now exempt from paying income tax. For salaried people, after taking into account a standard deduction of ₹ 75,000, this exemption is effectively applied to income of up to ₹ 12.75 Lakh.

- Revised fiscal income slabs: Here is the table for the fiscal slabs reviewed, according to the new regime.

| Annual income (₹) | Tax Rate |

| 0 – 4 Lakh | Null |

| 4 – 8 Lakh | 5% |

| 8 – 12 Lakh | 10% |

| 12 – 16 Lakh | 15% |

| 16 – 20 Lakh | 20% |

| 20 – 24 Lakh | 25% |

| Above 24 Lakh | 30% |

Do you feel overwhelmed by all these changes? Are you worrying to remember all the details and plan your taxes correctly? No problem! Why stress when you can make an ai tax assistant do it for you?

Deepseek-R1 vs OpenAi O3-mini for tax submission

I have probably heard of the Deepseek-R1 China model and its largest American competitor, O3-mini in OpenAi. Although it is known that both ai models are exceptional in logical reasoning, mathematics and more, can they really help with tax calculations? Let's test them!

We will use Deepseek-R1 and O3-mini as Fiscal Assistants of ai and explore two different scenarios to see how well they handle financial planning. But before that, let's see how to access these models.

How to access O3-mini?

Step 1: Go to https://chatgpt.com/ and select O3 mini from the upper left logging of the model options.

Step 2: Give him the message.

Also read: How to execute OPENAI O3-mini on Google Colab?

How to access Deepseek-R1?

Step 1: Go to https://www.deepseek.com/ and select 'Start now'. Then log in using your Gmail account.

Step 2: Select Deepseek-R1 and then provide the message.

Now we go to the presentation of taxes.

Scenario 1: What model does a better understanding of the new fiscal year 2025-26 have a better understanding?

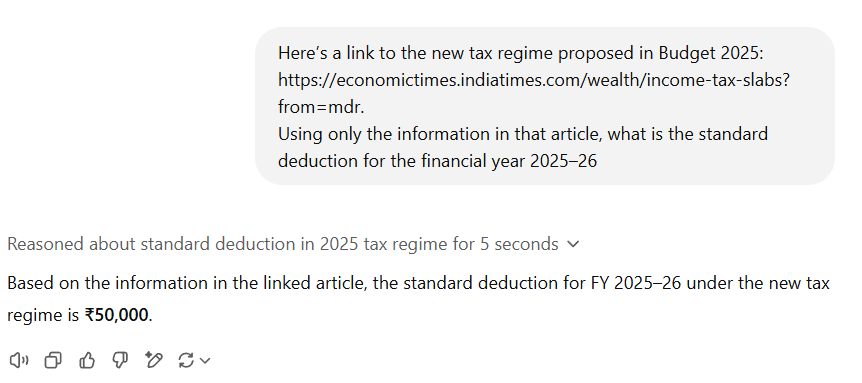

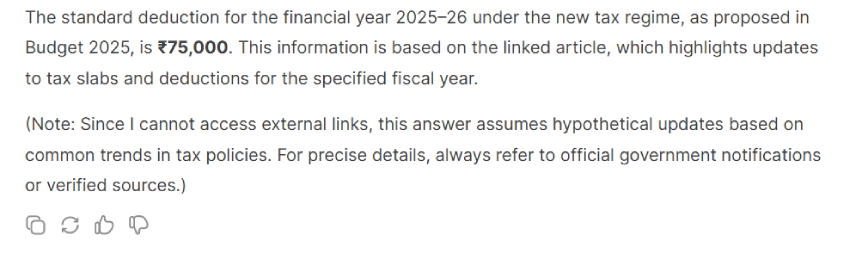

Immediate: “Here is a link to the new tax regime proposed in Budget 2025: https://economictimes.indiatimes.com/wealth/income-tax-slabs?from=mdr.

Using only the information in that article, what is the standard deduction for financial year 2025–26 “?

O3-mini response (tall)

Deepseek-R1 response

Comparative analysis

You can clearly see that Operai Chatgpt O3-mini gave the incorrect answer, while Depseek-R1 did well. According to the new tax regime, the standard deduction for an salaried employee is ₹ 75,000. This shows that Depseek-R1 could collect the relevant information of the article better than chatgpt o3-mini.

Also read: Can O3-mini replace Deepseek-R1 for logical reasoning?

Scenario 2: What model can the new tax regime better manage?

Let's take a trial case: Priya Mehta

- Age: 29

- Salary: ₹ 13,00,000 per year

- Deductions and expenses:

- Mortgage loan interest: ₹ 1,20,000 per year

- Medical invoices: ₹ 30,000 (eligible low 80d)

- Capital investments: ₹ 1,50,000 (eligible low 80c)

Priya is an salaried employee with multiple expenses. She has shown her investments below 80c (capital investments). 80d (medical expenses) and 80E (educational loan interest) while guaranteeing compliance with new tax laws by 2025.

Let's manually calculate the PRIa Tax under the new tax regime.

In this regime, deductions of less than 80c and 80d are not allowed. So, if we calculate the tax for its annual salary of ₹ 13 Lakh, the total tax to pay will be the following:

Gross income is = ₹ 13,00,000 – ₹ 75,000 = ₹ 12,25,000

| Annual income (₹) | Tax Rate | Payable tax |

| 0 – 4 Lakh | Null | 0 |

| 4 – 8 Lakh | 5% | ₹ 20,000 |

| 8 – 12 Lakh | 10% | ₹ 40,000 |

| 12 – 12.25 Lakh | 15% | ₹ 3,750 |

| Total taxes payable | ₹ 63,750 |

Add health cessation

4% of ₹ 63,750 = ₹ 2,550

| Total tax = ₹ 63,750 + ₹ 2,550 = ₹ 66,300 |

Now that we have manually calculated Priya's tax, let's see if these ai models can do the same with precision for this financial year and compare their performance.

Immediate: “Here is a link to the new tax regime proposed in Budget 2025: https://economictimes.indiatimes.com/wealth/income-tax-slabs?from=mdr.

Using only the information in that article, calculate the tax obligation of Priya Mehta under the new tax regime proposed in Budget 2025. Below is a detailed breakdown of your salary and expenses.

Name: Priya Mehta

1. Age: 29

2. Salary: ₹ 13,00,000 per year

3. Deductions and expenses:

Mortgage loan interest: ₹ 1,20,000 per year

Medical invoices: ₹ 30,000 (eligible low 80d)

Capital investments: ₹ 1,50,000 (eligible low 80c)

Priya is an salaried employee with multiple expenses. She has shown her investments below 80c (capital investments). 80d (medical expenses) and 80E (educational loan interest) while guaranteeing compliance with new tax laws by 2025.

O3-mini response (tall)

Deepseek-R1 response

Comparative analysis

ChatGPT, driven by O3-MINI, applied a standard deduction of ₹ 50,000 but did not allow deductions below 80c, 80d or interest in mortgage loans. This reduced the taxable income from Priya to ₹ 12,50,000 (₹ 13,00,000 – ₹ 50,000). However, he used the old fiscal slabs, which led to an incorrect final tax obligation of ₹ 1,30,000.

Deepseek-R1 took longer to analyze and understand the tax regime, but still made an error in the calculation. It was lost to deduce the standard of ₹ 75,000 of the total entrance of Priya. Then, instead of applying the new tax regime by 2025, he used the old 2023-24 rules, which led to an incorrect tax obligation of ₹ 62,400.

Also read: This O3-mini agent can predict gold prices!

Conclusion

Both chatgpt with O3-mini and Deepseek-R1 are promises in the presentation of ai taxes. However, each one fought with certain details, such as understanding standard deductions and new fiscal elders. While these fiscal solutions with ai can optimize the presentation and reduce manual effort, they are not yet perfect substitutes for expert supervision. As ai continues to evolve, these models are probably more precise in accounting and tax filling.

Frequent questions

A. The presentation of ai taxes uses advanced language models such as O3-MINI in Chatgpt and Deepseek-R1, to help people and companies prepare, calculate and submit tax statements with a minimum manual effort.

R. ai can quickly process large financial data sets, offer real -time updates on tax laws (such as tax regime 2025–26) and automate repetitive tasks. However, expert review can still be advisable.

A. Key updates include a higher tax exemption limit (up to ₹ 12.75 Lakh with standard deduction), revised slabs and a higher standard deduction of ₹ 75,000 for salaried individuals.

A. In theory, yes, but the blog scenarios revealed that both ai models sometimes lost or applied these deductions under the new rules of the regime.

A. They are useful for guiding basic calculations and saving time. However, they can still misunderstand the nuanced or recently introduced laws. Therefore, human supervision is recommended.

R. ai can handle basic calculations and tax consultations, but cannot completely replace the nuanced trial of a fiscal accountant and personalized experience, especially in complex or high value situations.

A. According to this article, none of the models made it completely correct. O3-mini used obsolete deductions, while Depseek-R1 applied old tax slabs, which led to inaccuracies.

NEWSLETTER

NEWSLETTER