Keeping track of receipts is an essential part of managing personal or business finances. However, managing and organizing receipts, especially physical or paper ones, can be a huge hassle:

- Imagine having to deal with a year's worth of physical receipts while trying to keep track of your personal expenses.

- Or imagine sorting and categorizing multiple employee expense reimbursement requests with photos of crumpled receipts.

- Physical receipts, in particular, tend to fade or become illegible, get lost, or accumulate in an overwhelming mess.

Scanning receipts is the best way to store and organize them in digital format (PDF or image). Receipts scanned using OCR (optical character recognition) are much easier to store, organize, and use for personal or business processes.

In this article, we share some popular options for scanning receipts using OCR, where such receipt OCR solutions fall short, and how ai-based Intelligent Document Processing (IDP) solutions like Nanonets offer a much better alternative.

Scanning receipts with OCR scanners

OCR scanners are still used to digitize receipts, although the technology and implementation have evolved significantly.

Although less common now, some businesses still use dedicated OCR hardware for high-volume receipt processing. Modern office printers and scanners often include built-in OCR capabilities for digitizing a variety of documents, including receipts.

1. Old-school physical scanners typically produce more consistent image quality than smartphone cameras.

2. It is also easier to batch process or scan multiple receipts at once.

3. Designed for frequent and high volume scanning purposes.

1. The performance or accuracy of OCR scanners cannot be “trained” or “improved.”

2. Dedicated receipt OCR scanners can be expensive, especially for small businesses or individuals.

3. They are not as portable as smartphones and also require much more regular maintenance and repair.

Exploration receipts with your smartphone

Scanning receipts with your smartphone is a much more convenient and faster option for digitizing receipts on the go. Below are some popular options for digitizing receipts with your smartphone:

- Today's smartphone cameras come with built-in scanning features that work on virtually any document.

- Free scanner apps, available on the Appstore or Playstore, can also be used to scan receipts and other paper documents.

- Standalone expense tracking apps offered as part of larger expense management suites are a popular choice among business users, e.g. Expensify, Zoho Expense, Fyle, etc.

1. Extremely convenient and cost-effective, even free in many cases.

2. Receipts can be scanned immediately after a transaction, reducing the risk of losing them or wasting expenses.

3. Easily integrate with or export to select cloud storage services, accounting software, or expense management services.

4. Easy to organize, group or categorize expenses once scanned.

5. The software layer allows some room for improving the OCR output.

1. Smartphone cameras can struggle in low light conditions or with wrinkled receipts, which could lead to poor OCR results.

2. Large or long receipts can be difficult to capture in a single image or scan.

3. Expense tracking apps may not be interoperable with other expense management suites!

Limitations of traditional OCR receipt scanning options

While OCR technology has made receipt scanning really easy, traditional OCR methods still face several challenges that can limit their effectiveness in receipt processing workflows.

1. Accuracy issues

Once receipts are scanned and saved as digital versions (images or PDFs), the next step in most receipt processing workflows is to extract structured data from them.

OCR technology works by recognizing and extracting text from images, but its accuracy depends on the quality of the receipts being scanned. Poorly printed, wrinkled, or faded receipts can result in inaccurate data extraction.

Additionally, receipts come in various designs or formats, which can confuse traditional OCR systems.

2. Manual validations and categorizations

Inaccurate data extraction leads to increased manual validation to correct or verify the data extracted from receipts. Receipt data must be validated to accuracy levels, especially since it is used to compare or verify supporting business documents such as invoices or purchase orders.

Traditional OCR technology also struggles to categorize or organize receipts based on expense type. Such categorization requires context and an understanding of the company’s internal expense policies, something that falls outside the scope of standard OCR tools.

3. Limited integration capabilities

Traditional OCR systems often operate in isolation, scanning receipts and converting them to digital formats without integrating with other tools or systems. This lack of integration makes it difficult to automate workflows like expense reporting or reimbursements, which still require manual data entry into other systems.

For businesses looking to streamline their operations, OCR systems that don’t offer integration with a wide choice of accounting software, cloud storage, or expense management platforms are of little use.

Digitizing receipts using IDP software

IDP software goes beyond basic optical character recognition (OCR) of receipts by combining artificial intelligence (ai), machine learning (ML), and workflow automation capabilities. Essentially, IDP software transforms unstructured data (such as data from paper receipts) into structured, usable data that seamlessly integrates with other business operations.

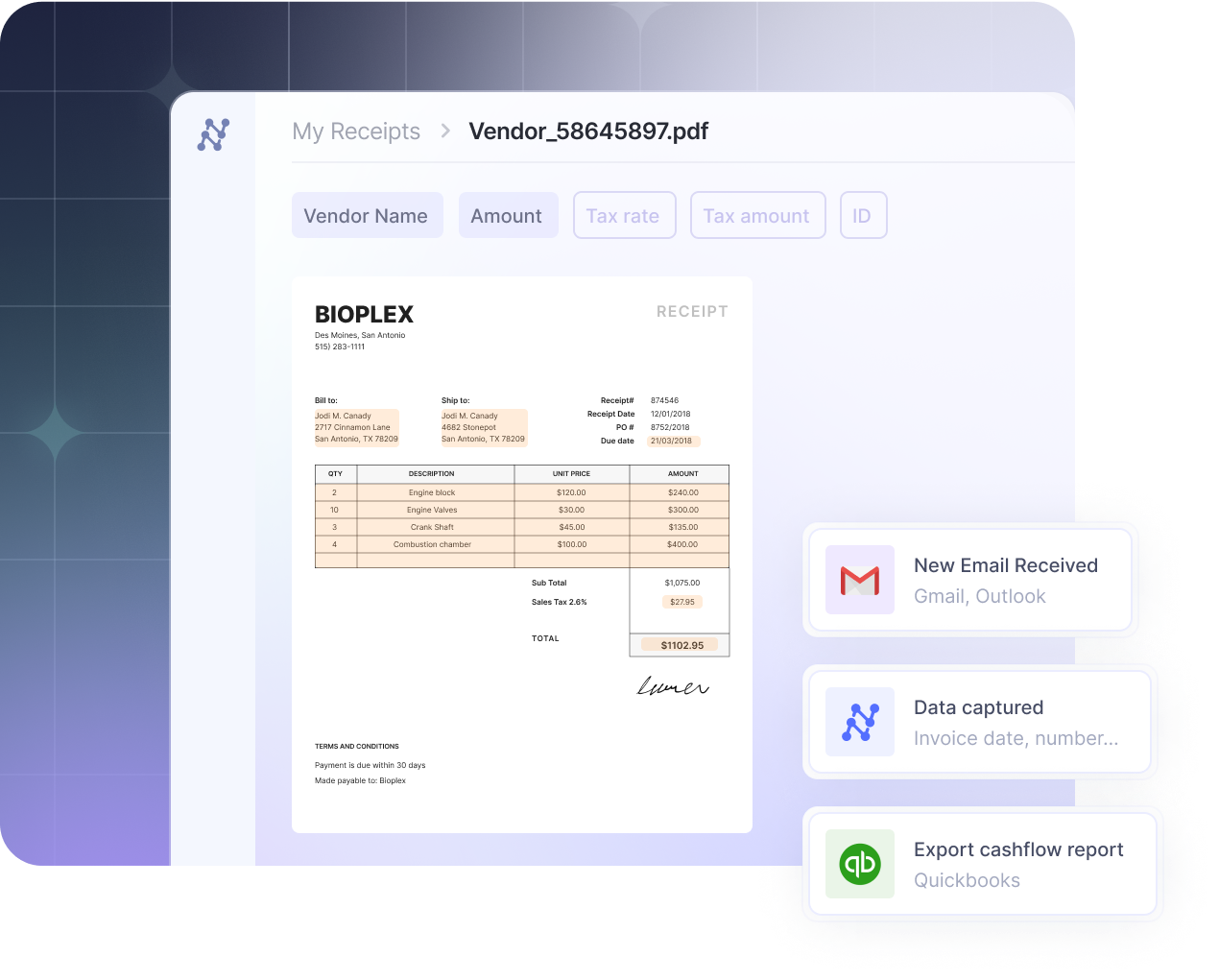

A typical IDP solution, such as Nanonets, goes beyond simply extracting text from receipts, but understands the context, validates the extracted information, and integrates with your existing systems to automate tasks such as categorizing expenses, sending reports, and updating your accounting records.

1. IDP solutions can be “trained” and can receive “feedback” to improve their accuracy in data extraction.

2. They come equipped with ai-powered data validation processes and approval workflows that greatly reduce the need for human oversight.

3. They can automatically categorize expenses according to internal spending policies and contextual rules.

4. They integrate seamlessly with most accounting tools, expense management tools or ERP systems.

5. They are designed to scale without increasing staff or associated overhead.