Editor's Image | Ideogram

Time series analysis studies data points collected over time. It helps in identifying trends and patterns. This analysis is useful in economics, finance, and environmental sciences. R is a popular tool for performing time series analysis due to its powerful packages and features. In this essay, we will explore how to perform time series analysis using R.

Load libraries

The first step in time series analysis in R is to load the necessary libraries. 'forecast' The library provides functions for time series forecasting. 'series' The library offers statistical tests and time series analysis tools.

library(forecast)

library(tseries)Importing time series data

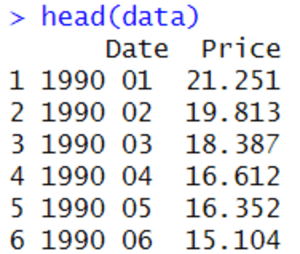

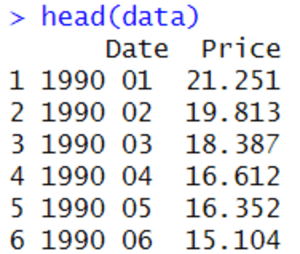

We import time series data from a CSV file into R. In this example, we use a dataset that is used for financial analysis. It tracks price movement over time.

data <- read.csv ("timeseries.csv", header = TRUE)

head(data)

Create a time series object

Converts data into a time series object using the 'is' Function. This function converts your data into a time series format.

ts_data <- ts(data$Price)

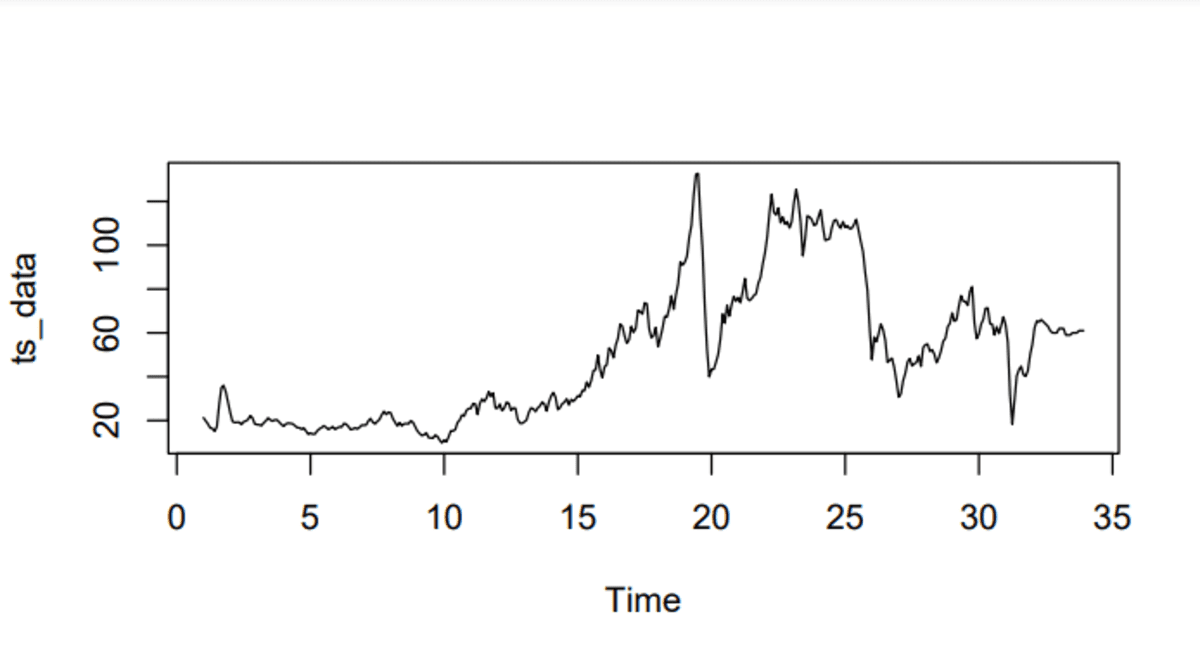

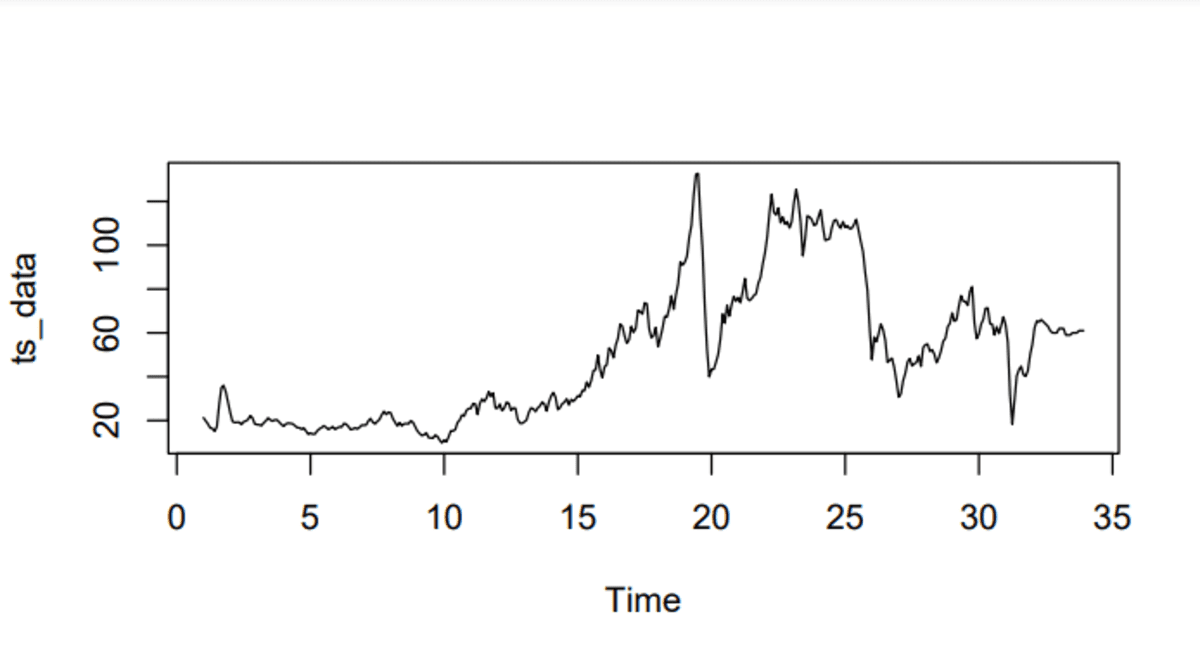

Plotting the time series

Visualize time series data. This helps identify trends, seasonality, and anomalies. Trends show long-term increases or decreases in data. Seasonality reveals regular patterns that repeat at fixed intervals. Anomalies highlight unusual values that stand out from the normal pattern.

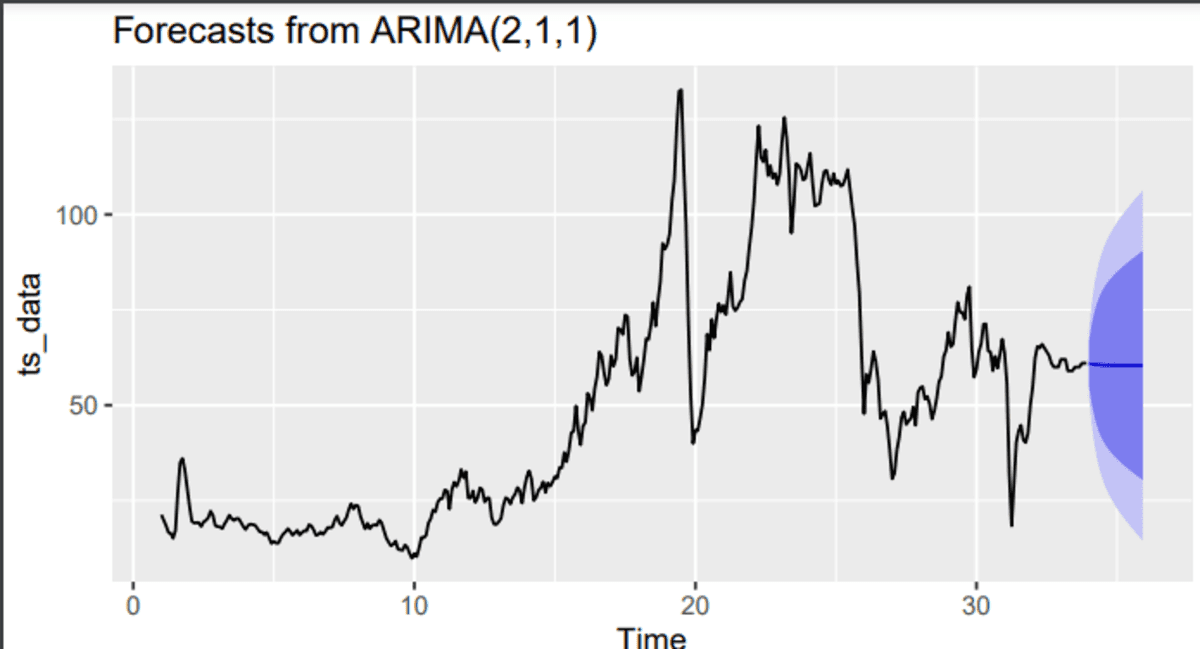

ARIMA models

The ARIMA model is used to forecast time series data. It combines three components: autoregression (AR), differencing (I), and moving average (MA). 'auto.arima' The function automatically selects the best ARIMA model based on the data.

fit <- auto.arima(ts_data)

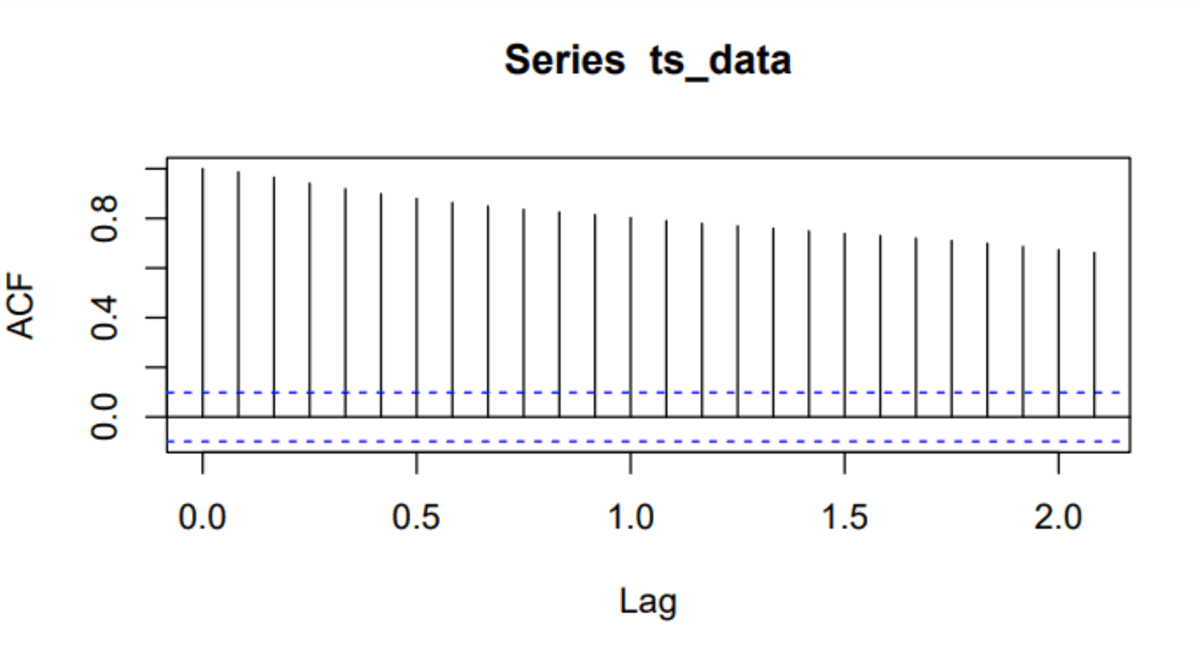

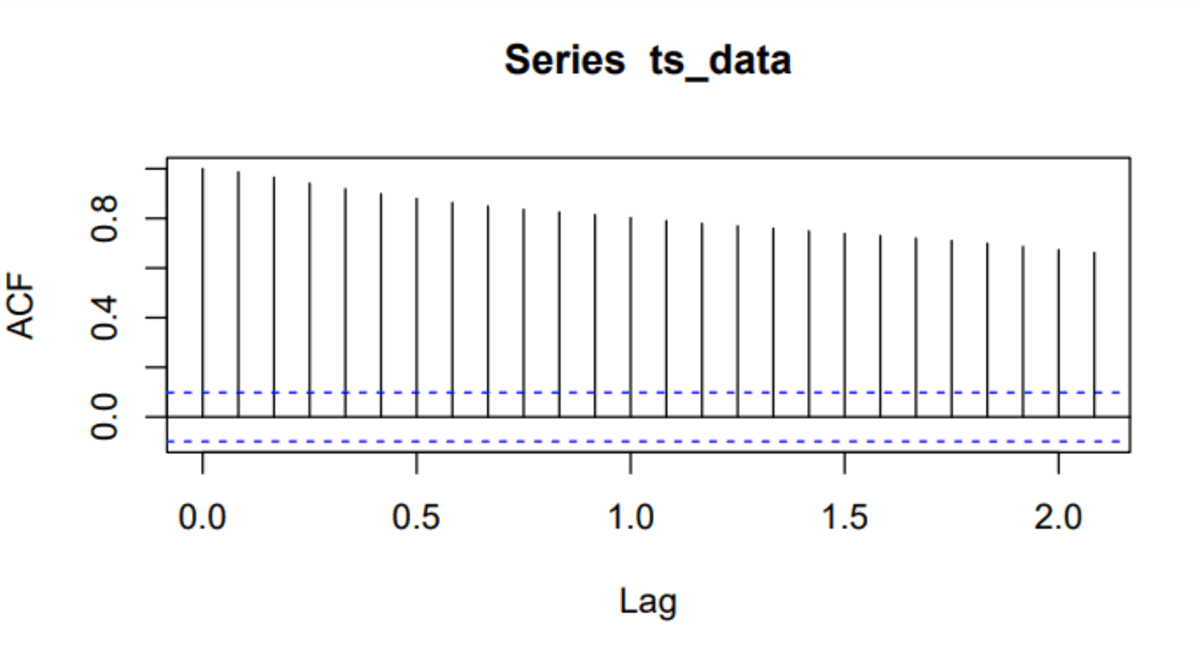

Autocorrelation function (ACF)

The autocorrelation function (ACF) measures how a time series is correlated with its past values. It helps to identify patterns and lags in the data. It shows these correlations at different time lags. The ACF chart helps to determine the order of the moving average (MA) ('q').

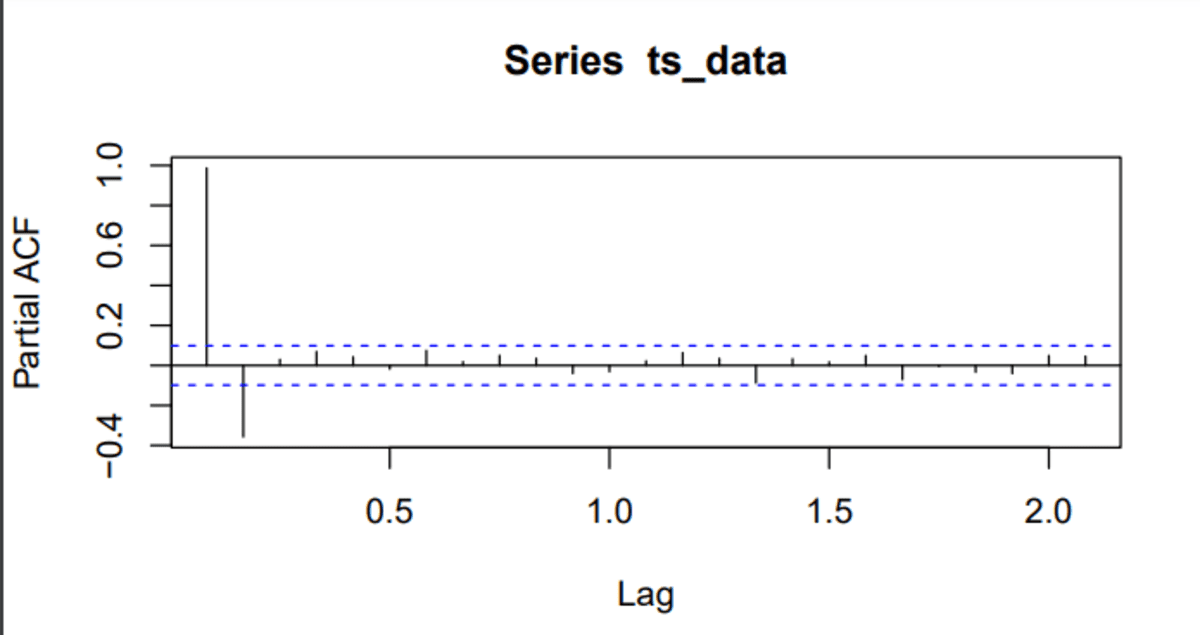

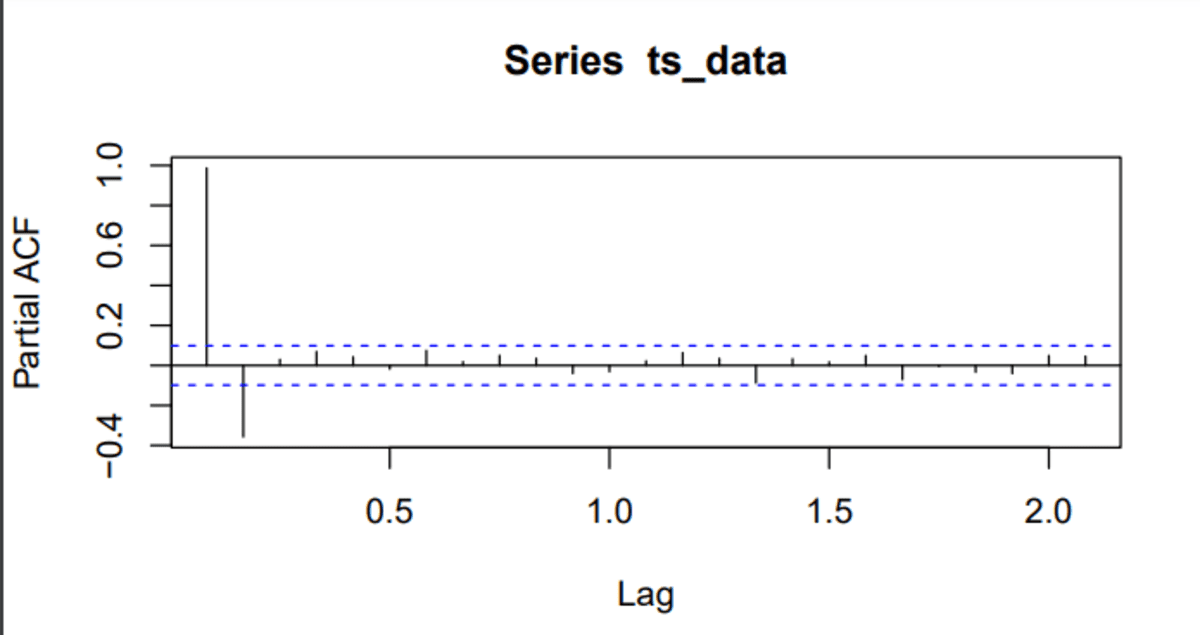

Partial autocorrelation function (PACF)

Partial autocorrelation function (PACF) measures the correlation of a time series with its past values. It excludes the effects of intermediate lags. It helps to identify the strength of direct relationships at different lags. PACF chart displays these correlations for various time lags. PACF chart helps to identify autoregressive (AR) order ('p').

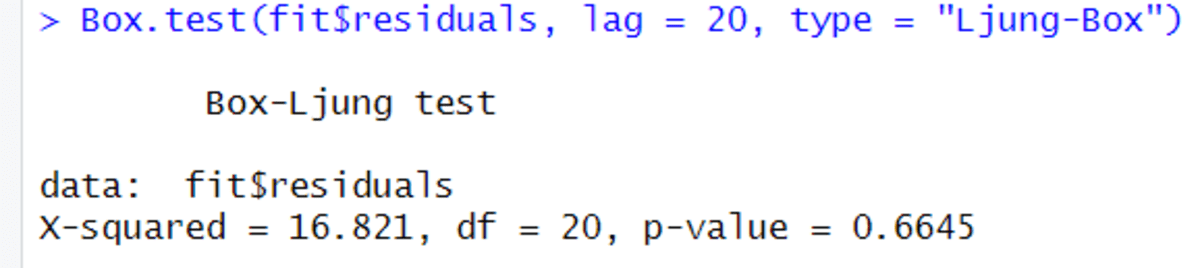

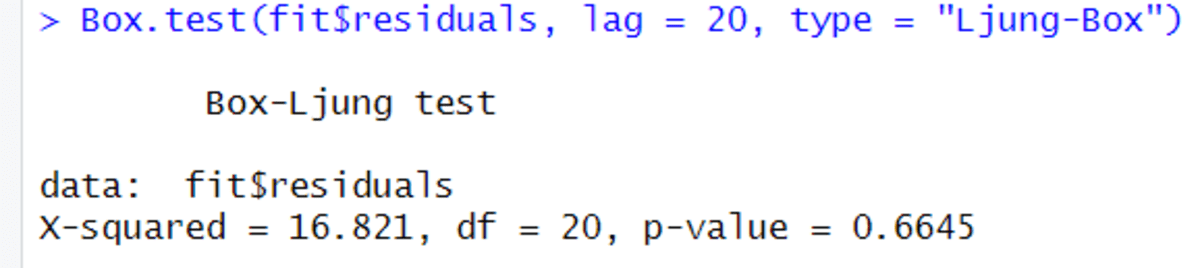

Ljung box test

The Ljung-Box test checks for autocorrelation in the residuals of a time series model. It tests whether the residuals are random. It tests for autocorrelation at multiple lags. A low p-value suggests significant autocorrelation. This means that the model might not be a good fit.

Box.test(fit$residuals, lag = 20, type = "Ljung-Box")

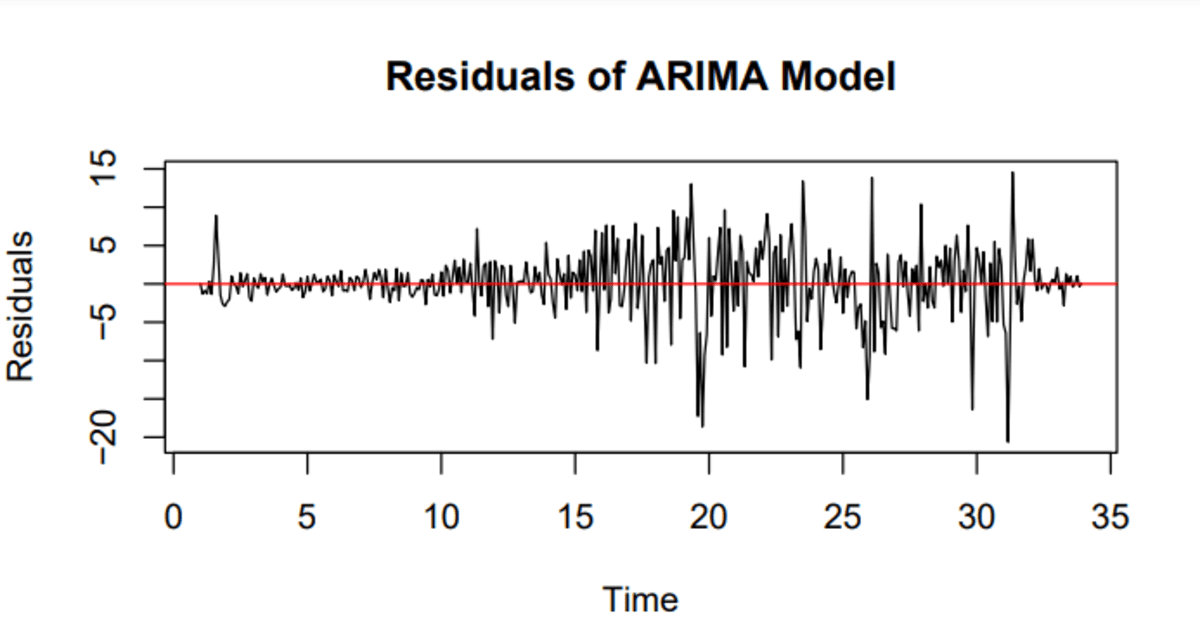

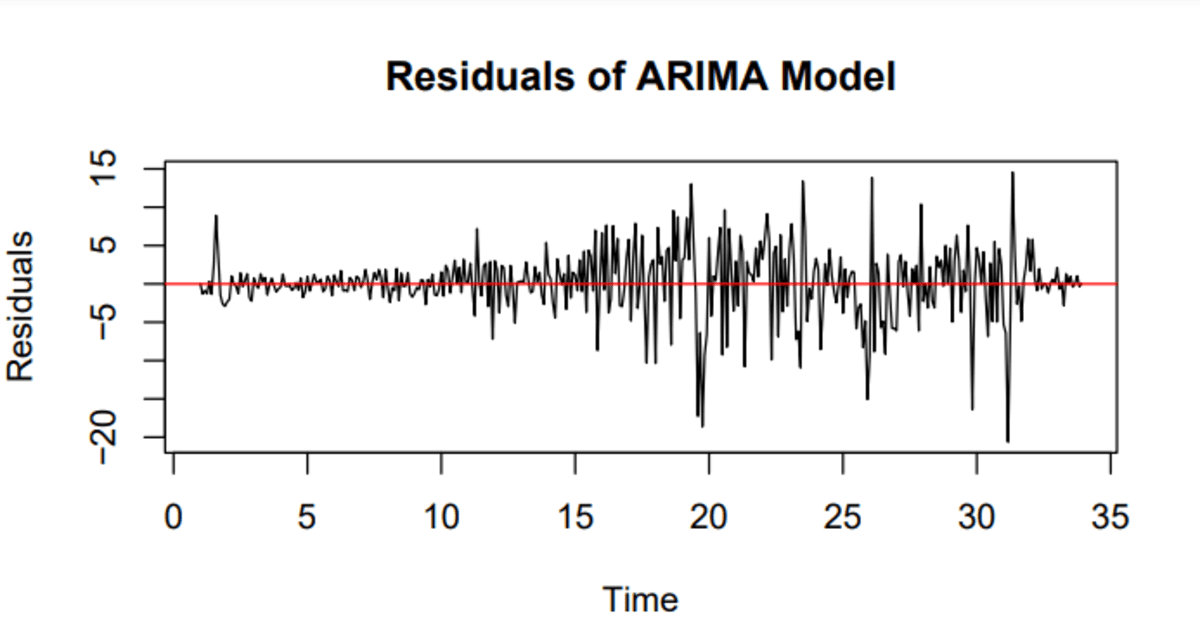

Waste analysis

Residual analysis examines the differences between observed and predicted values from a time series model. It helps to check whether the model fits the data well.

plot (fit$residuals, main="Residuals of ARIMA Model", ylab="Residuals")

abline(h=0, col="red")

Forecast

Forecasting involves predicting future values based on historical data. Use the 'forecast' to generate these predictions.

forecast_result <- forecast (fit)

Viewing forecasts

View forecast values against historical data for comparison. 'automatic plot' The function helps to create these visualizations.

autoplot(forecast_result)

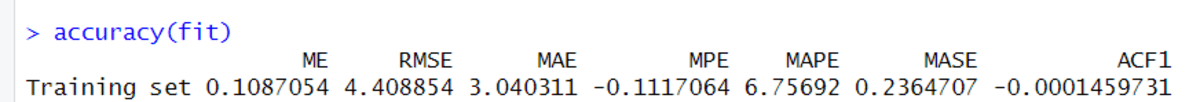

Model accuracy

Evaluate the accuracy of the fitted model using the 'accuracy' function. Provides performance metrics such as mean absolute error (MAE) and root mean square error (RMSE).

Ending up

Time series analysis in R begins with loading data and creating time series objects. Exploratory analysis is then performed to find trends and patterns. ARIMA models are fit to forecast future values. The models are diagnosed and the results are visualized. This process helps in making informed decisions using historical data.

Jayita Gulati She is a machine learning enthusiast and technical writer driven by her passion for building machine learning models. She holds a Masters in Computer Science from the University of Liverpool.