As everyday tools and services become more subscription-based, so does our overall automation strategy when it comes to business management. But, just as keeping a subscription on auto-renewal unattended can be a costly mistake, so can mishandling recurring ACH transactions.

QuickBooks, one of the most popular accounting and accounting platforms on the market, offers a fairly simple method of managing recurring ACH payments to help ensure there are no surprises during reconciliation time.

What are ACH payments?

Although generally referred to simply as ACH payments or ACH transfers, the term more specifically refers to a national payments network that banks and other institutions rely on to process payments securely and accurately between parties. In its simplest form, the ACH network is like a trusted third party that receives money from the payer and processes it on their behalf before depositing it into the payee's account.

ACH payments are typically fast during the work week, but not instant. Instead of routing directly to the beneficiary at the time of payment, like similar payment apps and processing tools, the ACH network bundles and routes payments daily rather than individually. This is why ACH payments typically take 1-3 business days to execute, although ACH payments are increasingly being made the same day when sent during business hours early enough in the day.

ACH payments will generally fall into one of two main categories:

Direct payment: This type of ACH payment describes how a buyer pays for goods or services. Examples include direct ACH payments for utility bills, to a friend as an alternative to bank transfers, and to your credit card company to pay your monthly statement.

Direct deposit: Direct deposit, the variety of ACH payment we are most familiar with, refers to businesses, employers, and government entities that offer ACH payments to recipients for payroll, government entitlements and benefits, and even tax refunds.

Within these two general labels, depending on your role in the exchange, your transaction will be classified as:

ACH Credit: If you are on the receiving end, your account is credited with the payment balance of the sender's account. ACH credit transactions may include your payroll, government benefit payments, tax refunds, or payments billed to contractors.

ACH Debit: The sender's transaction is an ACH debit, as the money is debited from your account when it is sent to the recipient. If you pay your mortgage using ACH payment, then it is an ACH debit transaction.

What are recurring ACH payments?

Often, for predictable and ongoing expenses, we will set up recurring ACH payments to ease the mental load and avoid the risk of missing an invoice. Recurring payments are made on a scheduled basis and are charged the exact amount indicated; They are usually best for fixed costs such as subscriptions, mortgage or lease payments, and membership costs. Payroll deductions, although variable, are also typically classified as recurring to reduce friction between payroll processing and staff pay.

Recurring ACH payments vs. automated payments

Although recurring payments are automated, not all automatic payments are recurring. Classifying an ACH payment as recurring depends on frequency: If the payment is made periodically on a planned schedule, that is, monthly, it is recurring. If this is a planned, pre-scheduled ACH payment that will run in the future but on a one-time basis, it is simply an automated ACH payment.

How do recurring ACH payments work in QuickBooks?

If you plan to use recurring ACH payments in QuickBooks, note that only QuickBooks Online offers the feature; As QuickBooks phases out its desktop platform, expect new integrations and features to be exclusive to the online platform; Recurring ACH payments are no exception.

Recurring customer payments

Before receiving any ACH payments in QuickBooks, you must have an active QuickBooks Online and QuickBooks Payments license. Before you begin, you will also need the client's authorization to invoice. Whether it's verbal or written consent, validating that your customer knows an ACH transaction is incoming is simply good customer service.

From there, you will be able to:

Add recurring transactions by selecting Recurring transactions from the settings dropdown menu.

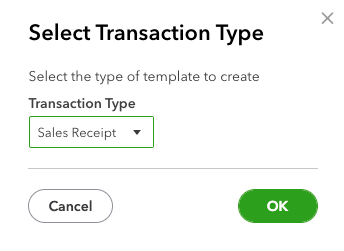

Click Newthen select Purchase receipt in the dropdown menu.

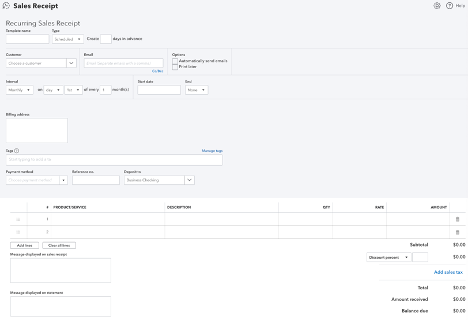

You will then fill out all the customer or customer information.

And that is! Beyond keeping an eye out for recurring ACH payments, validate one last time before pulling the trigger to know that your customer knows and agrees to the recurring ACH payment; Otherwise, you're good to go!

Payments to suppliers

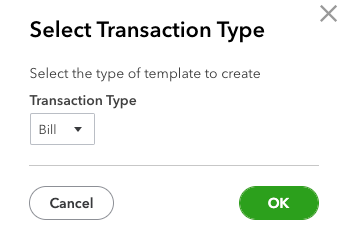

You will follow the same steps above, although instead of selecting Purchase receiptyou will click Bill:

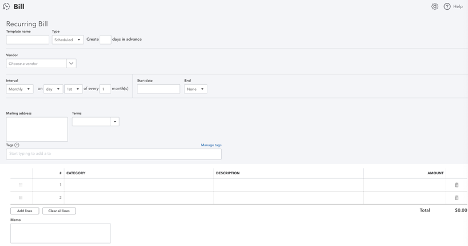

From there, simply fill in the supplier details or select an existing one supplier and recurring payment interval – it's that easy!

How to Stop Recurring ACH Payments in QuickBooks

Once you've set up a recurring ACH payment in QuickBooks, whether credit or debit, you can monitor its status from the Recurring transactions panel:

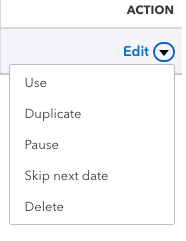

Canceling or stopping a recurring ACH payment is as simple as selecting the Edit drop down menu below Action column and selecting Delete. You can also pause recurring ACH payments or skip the next recurring ACH payment.

Disadvantages of Recurring Payments in QuickBooks

Although no system is perfect, setting up and using recurring payments in QuickBooks has some unique drawbacks:

- Daily limits: If you initiate ACH (credit or debit) from a third-party bank, you are restricted to a daily deposit limit of $500,000 (in QuickBooks) and a weekly debit limit of $100,000 (money sent from QuickBooks). If you initiate the ACH transfer from QuickBooks, you can transfer up to $20,000 per day and $40,000 per week in QuickBooks and up to $50,000 daily outside from QuickBooks.

- Processing delays: Although the ACH network has become faster in recent years, there is no guarantee that an ACH payment will be fully executed on the same day. This is especially true if you initiate the transaction outside of standard business hours.

- Risk of insufficient funds: Although not specifically tied to QuickBooks, you always run the risk of overdrawing your accounts or paying non-sufficient funds fees if you don't monitor your debited account balance. Again, this is not an inherent risk or inconvenience, but rather it can be frustrating and costly.

- International Payments: QuickBooks lacks native integration of cross-border ACH payments; through third parties accessories fill the gap, companies that work extensively with international suppliers or buyers may find better solutions elsewhere.

Alternatives to ACH Payments in QuickBooks

If you prefer not to use QuickBooks for ACH payments, or want to avoid ACH transactions altogether, there are many alternatives that give you the flexibility to choose the systems that best align with your workflows. Some common alternatives include:

- QuickBooks Go Payment: For QuickBooks users, this mobile payment app serves as an alternative to ACH transactions and includes automatic syncing with your main account.

- Other apps: A range of mobile payment processing apps provide flexibility and ease of use on the go, including Venmo, PayPaland CashApp.

- Payment processors: If you need more robust transaction management tools, payment processors like square and Stripe Provide all-in-one payment solutions.

- Bank transfers: Although more expensive in most cases, wire transfers are popular for international and cross-border transactions.

Conclusion

Although there are alternatives, managing recurring ACH transactions directly within the QuickBooks platform tends to be a safe bet for users interested in keeping their business accounting on a centralized platform without having to learn and manage multiple products. Recurring ACH transactions are a simple, secure, and easy way to keep cash coming in and happy sellers – and QuickBooks simplifies the process even further.

NEWSLETTER

NEWSLETTER