A new invoice arrives in your inbox. And as you begin processing it, you get a sense of déjà vu. The address and the amount – you’ve seen this before, but not sure where. So you start searching, scrolling through endless spreadsheets and folders, trying to find a match…

Sound familiar? This scenario plays out in countless AP departments everywhere. But imagine a system that could instantly flag duplicate invoices, extract data with precision, and even learn from its mistakes. ai invoice processing can do that and a whole lot more.

This isn’t some Minority Report-level tech. It’s here, it’s now, and it’s transforming businesses. PwC’s Global artificial intelligence Study expects ai‘s potential contribution to the global economy by 2030 to be close to $15.7 trillion. Accounting automation is a significant part of this transformation.

In this article, we’ll discuss ai‘s role in invoice processing. We’ll explore its practical applications – from extracting invoice dates in specific formats to automating 3-way matching – and show you how to implement it in your organization.

<h2 id="what-is-ai-based-invoice-processing”>What is ai-based invoice processing?

ai-based invoice processing uses artificial intelligence to automate invoice data capture, extraction, recognition, validation, and processing. Furthermore, it can route the extracted data through the appropriate channels and tools for approval and payment.

This automated workflow reduces manual work, improves accuracy, and speeds up the entire process from receipt to payment.

Critical technologies in modern invoice processing:

- Optical Character Recognition (OCR) converts text from invoice images or PDFs — implemented with a layer of ai for enhanced accuracy.

- Machine Learning (ML) analyzes invoice data, identifying patterns and improving accuracy over time.

- Natural Language Processing (NLP) interprets text context, regardless of language or format.

- Robotic Process Automation (RPA) automates repetitive tasks based on predefined rules—often combined with ai to handle more complex tasks.

These core technologies form the foundation for various ai-powered invoice processing solutions. For starters, you have Large Language Models (LLMs) like GPT being used to interpret invoice data and extract relevant information.

Then, many accounting tools have started incorporating ai into their workflows. For instance, QuickBooks has something called Intuit Assistant, which can help you identify overdue invoices, draft email reminders, and so on.

Microsoft’s Power Platform offers ai-powered, low-code tools for creating custom document processing solutions. You can use it to process invoices as well.

And lastly, you’ve Intelligent Document Processing (IDP) platforms. They combine OCR, ML, NLP, and workflow automation to automate the process end-to-end, from capturing invoices, extracting data, and validating information to integrating with accounting systems and ERPs.

Manual vs. automated invoice processing – Key differences

Impressive, right? But why is there such a stark difference? Let’s compare manual and automated invoice processing (and semi-automated options in between) to understand the key differences:

Manual invoice processing

You get invoices via email, mail, or fax. An employee manually sorts them and checks vendor information, invoice numbers, line items, and other details for completeness. The data is then manually entered into accounting systems.

Next, it is verified through a three-way matching process, comparing the invoice against purchase orders and delivery documentation. It then moves through an approval workflow, where designated individuals review and sign off. Once approved, the payment is scheduled and processed according to vendor terms. Finally, all documents are archived for record-keeping and audit purposes.

There are just way too many manual touchpoints. It makes the process time-consuming, error-prone, and lacking visibility. And if you’re using spreadsheets for compiling and tracking invoice data, you’re adding another layer of complexity and potential errors.

Semi-automated invoice processing

With the increasing adoption of digital invoicing, many businesses have moved to a hybrid approach that combines some digital tools with manual oversight.

It often uses template-based invoice processing. Here, you have specific templates for different invoice formats. Data is extracted using a basic OCR tool and mapped to the appropriate fields in the accounting system. Manual intervention is still needed for validation, exception handling, and approvals.

Fully automated invoice processing

This method incorporates artificial intelligence and machine learning into invoice processing workflow. For starters, invoices from various sources (email, EDI, forms) are automatically imported for processing. ai works with OCR to extract data accurately, regardless of format.

The system validates extracted data against predefined rules and existing records, flagging exceptions for human review while processing routine invoices automatically. Three-way matching occurs instantly, and approval workflows are digitized with automated notifications. Once approved, payment is triggered based on predefined terms.

ai-powered systems continuously learn from each processed invoice, adapting to new formats and improving accuracy over time.

Here’s a table offering a quick overview of manual, semi-automated, and fully automated invoice processing workflows and how they differ:

| Process Area | Manual Processing | Semi-Automated Processing | Fully Automated Processing |

|---|---|---|---|

| Processing Speed | Baseline | 2-3x faster | 5-10x faster |

| Error Rate | 3-5% error rate | 1-2% error rate | <0.5% error rate |

| Cost Savings | Baseline | 30-50% cost reduction | 60-80% cost reduction |

| Staff Productivity | 100% time on processing | 50% time freed for analysis | 80% time for strategic tasks |

| Scalability | Requires new hires to scale | Requires new hires to scale | Can handle 5-10x volume |

| Payment Accuracy | 90-95% on-time payments | 95-98% on-time payments | >99% on-time payments |

| Audit Readiness | Days to prepare | Hours to prepare | Minutes to generate reports |

Automated invoice processing ROI calculator

Annual number of invoices processed:

Current cost per invoice ($):

Number of AP clerks post-implementation (optional):

Notes and assumptions (click to expand)

- The manual processing cost per invoice ranges from $15 to $40

- According to salary data, an AP clerk’s average annual salary varies between $40,766 and $50,080.

- Nanonets’ PRO Plan is offered at a fixed rate of $999 per month for each model, which includes processing up to 10,000 pages.

- There is an additional charge of $0.10 for each page processed beyond the initial 10,000 pages included in the PRO Plan.

- According to feedback from our customers, the solution can reduce the turnaround time for manual invoice processing by up to 90%. This significant reduction in processing time is not included in the cost savings calculation to keep the computation straightforward.

- Employing a dedicated AP clerk to manage the Nanonets system is optional, depending on the company’s size, policies, and volume of invoices.

- The cost savings we’ve calculated are only based on the differences in processing costs between the manual method and Nanonets AP automation. And it doesn’t consider any potential decrease in turnaround time or clerical work hours.

- Nanonets also offers a pay-as-you-go model where the first 500 pages are free, then $0.3/page afterward. This model can be more cost-effective for smaller businesses or those with lower document processing volumes.

<h2 id="practical-applications-of-ai-in-invoice-processing”>Practical applications of ai in invoice processing

Now, let’s bring things back to the everyday running of your AP department. How does ai invoice processing impact their day-to-day functions? The answer lies in its ability to transform tedious, repetitive, manual intervention-heavy tasks into streamlined processes.

Let’s explore some automated workflows that your AP team can set up to quickly improve their operations:

1. Automate data entry

AP teams often spend hours manually scanning invoice data and inputting it into different systems. It risks errors that can lead to payment issues and financial discrepancies.

OCR extracts data from structured documents. Add ai, and it gets smarter. ai-powered OCR understands context, adapts to different invoice formats, and learns from corrections.

Your AP team just needs to upload invoices. The system does the rest, from data extraction to populating fields in your accounting software. It also handles PDFs, images, and scanned documents with ease. No more conversions or copy-pasting.

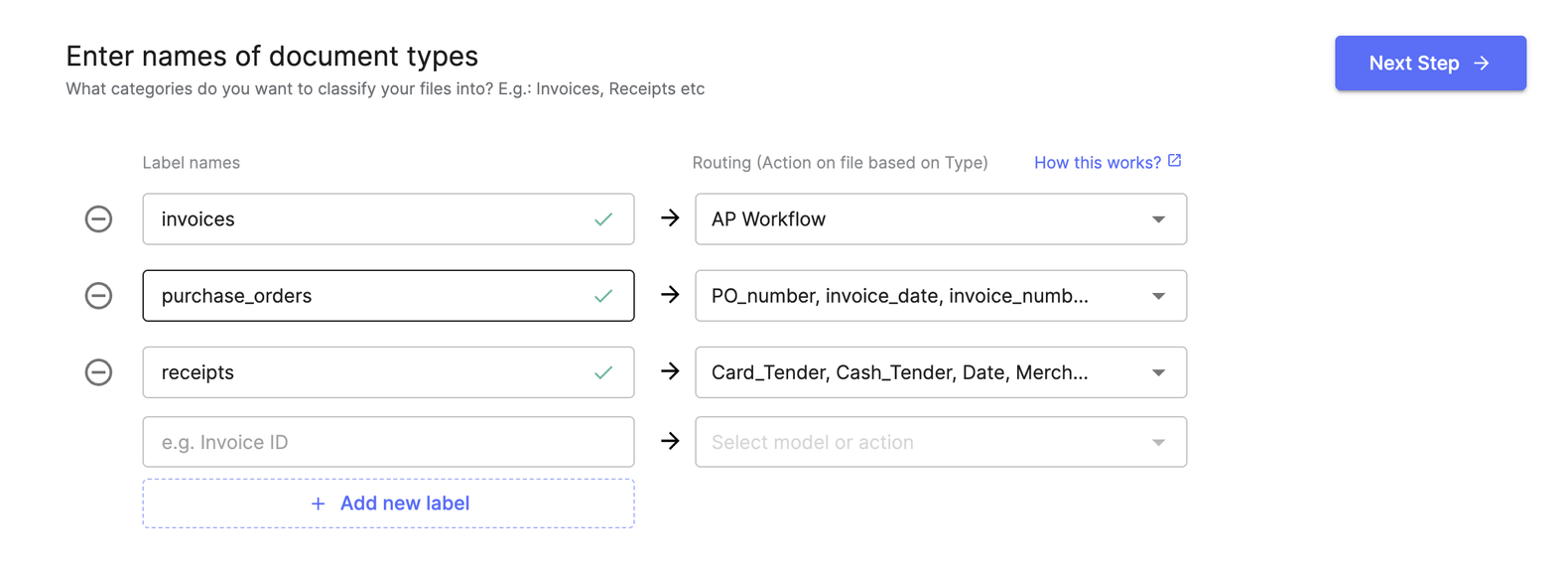

2. Intelligent document sorting

Manually sorting through various documents like invoices, purchase orders, and receipts is time-consuming and prone to misclassification, leading to processing delays and potential compliance issues.

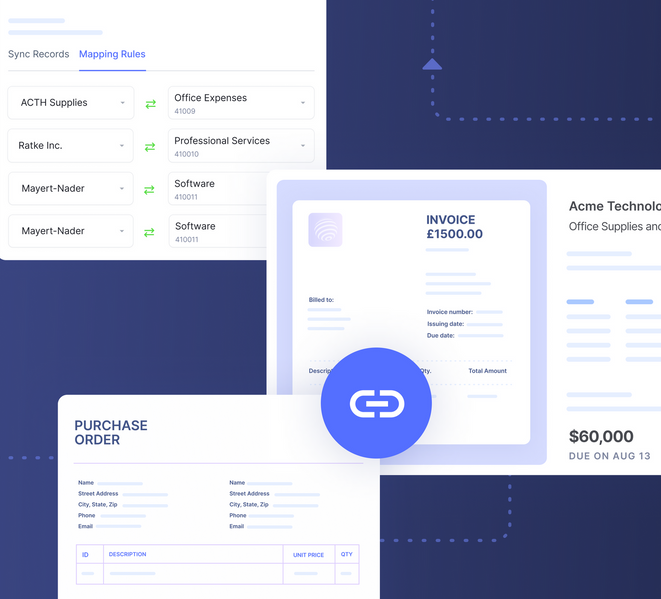

ai-powered tools enable you to create document classification models that route the incoming documents to the correct OCR model. In this case, you can set up ai to automatically classify invoices, purchase orders, or receipts and route each to the appropriate processing workflow. This eliminates manual sorting and reduces the risk of misplaced documents.

3. Smart three-way matching

Manually sorting through various documents like invoices, purchase orders, and receipts is time-consuming and prone to misclassification, leading to processing delays and potential compliance issues.

Some IDPs offer three-way matching capabilities that automatically match invoice data with corresponding purchase orders and receiving documents. The ai compares key fields like item descriptions, quantities, and prices to identify discrepancies. If a mismatch is detected, the system flags it for manual review.

4. Exception handling

Manually reviewing every invoice for errors, discrepancies, or missing information is time-consuming and can lead to processing delays or payment errors.

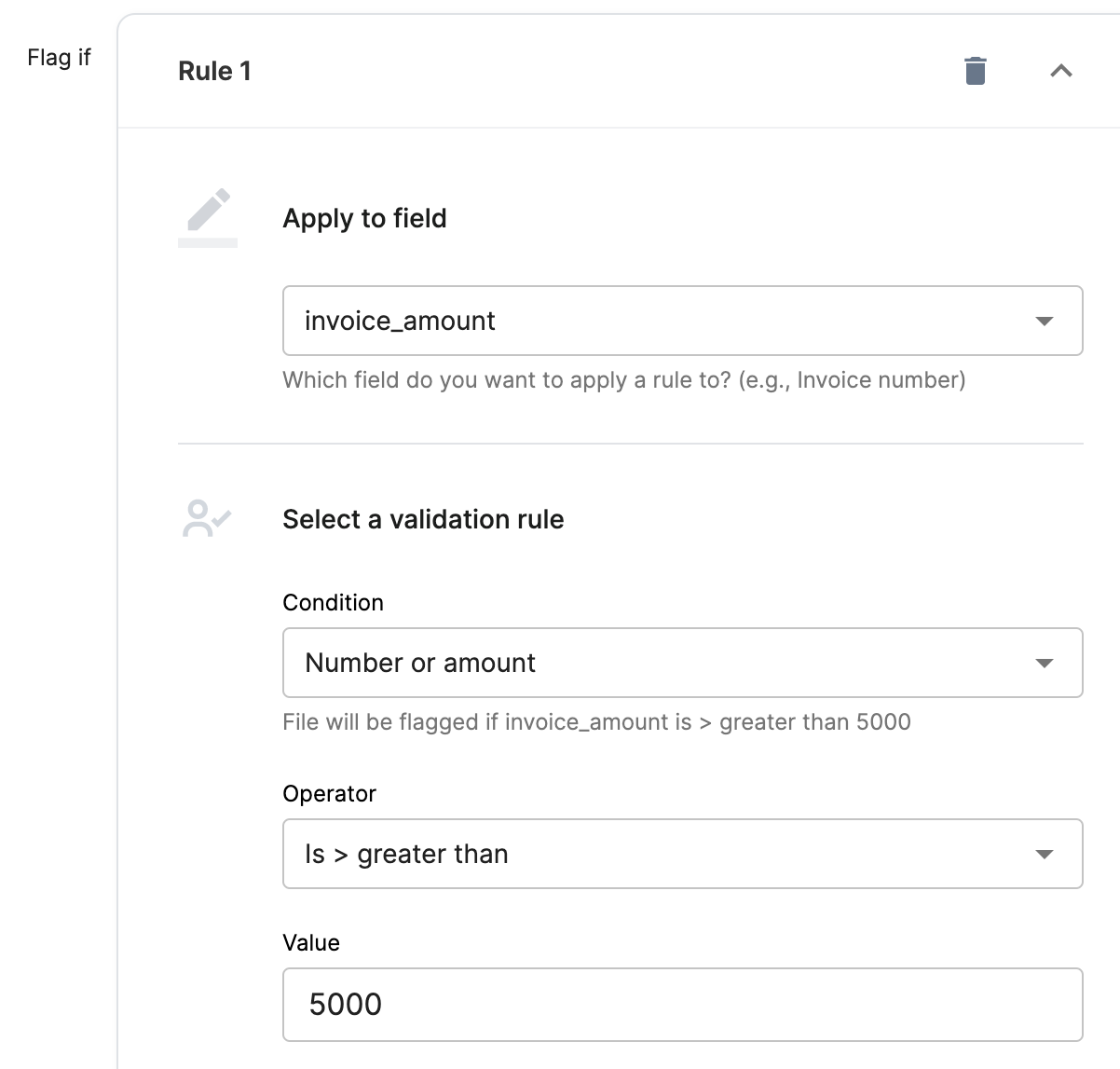

ai-powered invoice processing solutions offer specific rules to automatically flag invoices with missing information, pricing discrepancies, or other anomalies. For example, you can set up ai to flag invoices with amounts exceeding $5,000 for senior manager approval.

5. Invoice coding and GL mapping

Manual coding of invoices to the correct general ledger accounts is time-consuming and prone to errors, leading to inaccurate financial reporting and compliance issues.

Intelligent automation tools can trained to automatically assign the correct general ledger codes to invoice line items based on historical data, reducing the need for manual coding. The system analyzes patterns in your existing data to predict and apply the appropriate codes, even for complex or multi-line invoices.

6. Duplicate invoice detection

Identifying duplicate invoices is a pain. More so when you have a huge stack of invoices to process. This can lead to double payments, causing financial losses and reconciliation headaches.

ai-powered systems can automatically identify duplicate invoices. It can compare critical fields like invoice numbers, dates, and amounts across large datasets. When a potential duplicate is detected, the system flags it for review, preventing double payments and reducing financial risks.

7. Line item extraction and categorization

When you are processing complex invoices with multiple line items across multiple pages, things can get tricky. Items may not be in the same order or format on every invoice, making manual extraction and categorization time-consuming and error-prone. This can lead to incorrect expense allocations and inaccurate financial reporting.

With IDP solutions, you can identify, categorize, and download complicated line items on invoices, even when they span multiple pages or have complex structures. This capability accurately extracts detailed information such as item descriptions, quantities, unit prices, and totals.

8. Invoice approval routing

Tired of chasing approvals from managers? Manual routing of invoices for approval is often slow and inconsistent, leading to delays in payment processing and potential bottlenecks in the accounts payable workflow. This can strain vendor relationships and result in missed early payment discounts.

With IDP tools, you can automate the invoice approval process based on predefined rules. For example, you can set up the system to automatically route invoices to the appropriate approvers based on criteria such as invoice amount, department, or project code.

9. Enhance data

Imagine switching tabs and trying to match vendor names against your approved vendor list or verifying invoice numbers against previous records. It often leads to errors, missed discrepancies, and time wasted on data validation.

With ai-powered IDP tools, you can automatically match vendor names against your approved vendor list to flag discrepancies. You can also use it to verify invoice numbers against your database to prevent duplicate payments. Moreover, you can automatically populate additional fields (like vendor ID or payment terms) based on matched database records.

10. Multi-language support

Processing invoices from international vendors often requires manual translation or specialized staff, leading to delays and potential misinterpretations. This can result in payment errors, compliance issues, and inefficiencies in global operations.

ai-powered OCR can extract and understand invoice data in multiple languages, eliminating the need for manual translation. These systems can automatically detect the language of the invoice and extract relevant information, regardless of the origin or format.

11. Ensure data consistency

Inconsistent data formats across invoices can lead to errors in processing and reporting. Manual standardization is time-consuming and prone to mistakes, especially when dealing with large volumes of invoices from various vendors.

IDP tools allow you to format and normalize extracted data to ensure consistency. It can handle tasks like converting different date formats (e.g., MM/DD/YYYY to YYYY-MM-DD), removing special characters from numeric fields, or standardizing vendor names (e.g., “ABC Corp.” and “ABC Corporation” to a single format).

These are just some ai-powered workflows that can streamline your AP processes. They can help your team dedicate more time, mind space, and effort to higher-value tasks such as vendor relationship management, strategic financial planning, and cash flow optimization.

<h2 id="how-to-implement-ai-in-invoice-processing-in-your-business”>How to implement ai in invoice processing in your business

Implementing ai in invoice processing can revolutionize your accounts payable workflow, but choosing the right approach is crucial. There are several ways to incorporate ai into your invoice processing, each with its own strengths and considerations.

Let’s explore three popular approaches:

- Large Language Models (LLMs)

- Microsoft’s ai Builder

- Intelligent Document Processing (IDP) solutions

We’ll explore the advantages and limitations of each approach to help you make an informed decision.

1. Large Language Models (LLMs)

LLMs like GPT have gained a lot of attention over the past few years. They excel at understanding context and can be used for tasks like categorizing expenses or generating summaries of invoice data.

These ai models use natural language understanding to extract information from various document formats.

How LLMs work for invoice processing:

- The invoice (in various formats like PDF, image, or text) is fed into the LLM along with a specific prompt.

- The LLM analyzes the entire content based on your instruction and tries to understand the context and relationships between different pieces of information.

- The LLM identifies and extracts the requested data, handling both structured and unstructured information.

- The extracted information is organized into a structured format as specified by the prompt.

They offer tremendous flexibility, both in terms of usability and integration options. Since they are prompt-based, you can easily customize them for your specific invoice processing needs. You can easily build on top of LLMs using APIs and workflow automation tools like Make or Zapier.

But it also comes with significant limitations. For starters, these LLMs may hallucinate or generate inaccurate information. These models are trained on large datasets and try to predict the most likely next word or phrase based on patterns they’ve learned. They don’t have a true understanding of the information they process. So, outputs can vary even for identical prompts, making results unreliable.

LLMs are general-purpose tools that are not optimized for the specific requirements of invoice processing. They may struggle with exact numerical data extraction and complex financial rules. Moreover, processing sensitive financial information through external LLM services raises data security issues.

While LLMs show promise in certain areas, their limitations make them less suitable for the precise, consistent, and secure requirements of invoice processing.

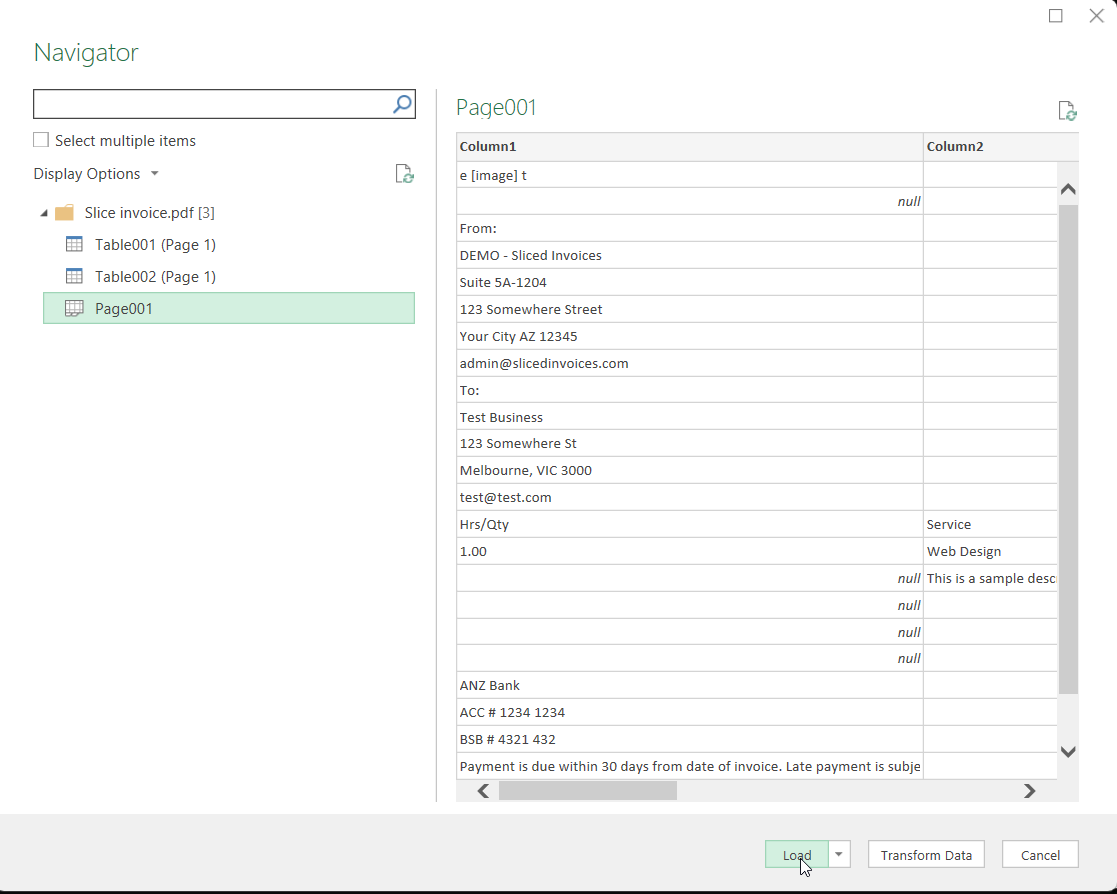

<h3 id="2-microsofts-ai-builder”>2. Microsoft’s ai Builder

Microsoft’s ai Builder is a component of the Power Platform that allows users to incorporate ai capabilities into their business processes with minimal coding. It offers a pre-built model for invoice processing that can be customized to an organization’s needs.

How it works:

- Upload sample invoices to train the ai model or use the pre-built invoice processor.

- The model is integrated into Power Apps or Power Automate workflows.

- When new invoices are received, the ai extracts critical information like invoice numbers, dates, and amounts.

- Extracted data can be used in Microsoft applications or exported to other systems.

ai Builder has some perks. It’s user-friendly, especially if you’re familiar with Microsoft products. You don’t need to be a coding whiz to set it up, and it plays well with other Microsoft tools you might be using.

But it’s not without its challenges: It works best with consistent invoice formats. You might struggle to get accurate results if you’re dealing with many different layouts. Then, training the model can be tricky. You might need more samples than you’d expect to get good results.

Moreover, it’s not great at handling complex or unusual invoice formats. You might hit some performance snags if you’re processing a high volume of invoices. Overall, while it’s a good starting point, it lacks some advanced features you’d find in specialized invoice processing tools.

In a nutshell, ai Builder can be a good fit if you’re already using Microsoft tools and want a simple way to automate some of your invoice processing. But if you’re handling a large volume of complex invoices from different sources or need more specialized features, you should look into dedicated Intelligent Document Processing (IDP) platforms. They’re designed specifically for tasks like invoice processing and often offer more robust and scalable solutions.

3. Intelligent Document Processing (IDP) solutions

When it comes to invoice processing, businesses need reliable, consistent results. This is where IDP solutions shine. Unlike more general ai tools, IDP platforms are built specifically for tasks like invoice processing, offering a more predictable and accurate approach. They’re designed to handle all sorts of invoices – from simple to complex, typed to handwritten – with high accuracy.

What sets them apart is their ability to deliver consistent results time after time, regardless of the invoice format or complexity. IDP solutions work methodically, following set rules and patterns while also learning from each document they process. This means they can adapt to new invoice formats over time but in a controlled, predictable way.

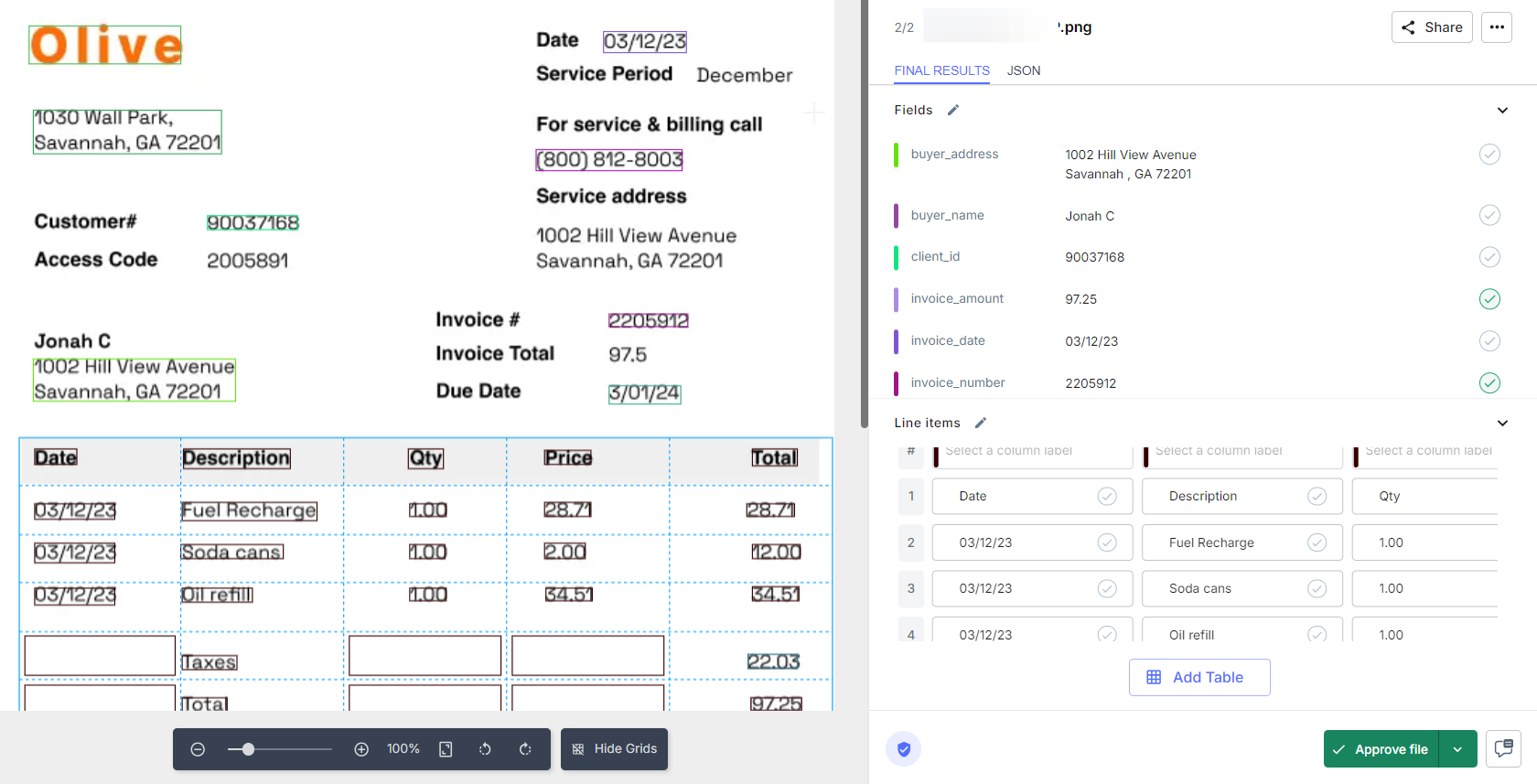

Here’s how to implement ai invoice processing using Nanonets as an example:

Step 1: Sign up for Nanonets and log in to your account.

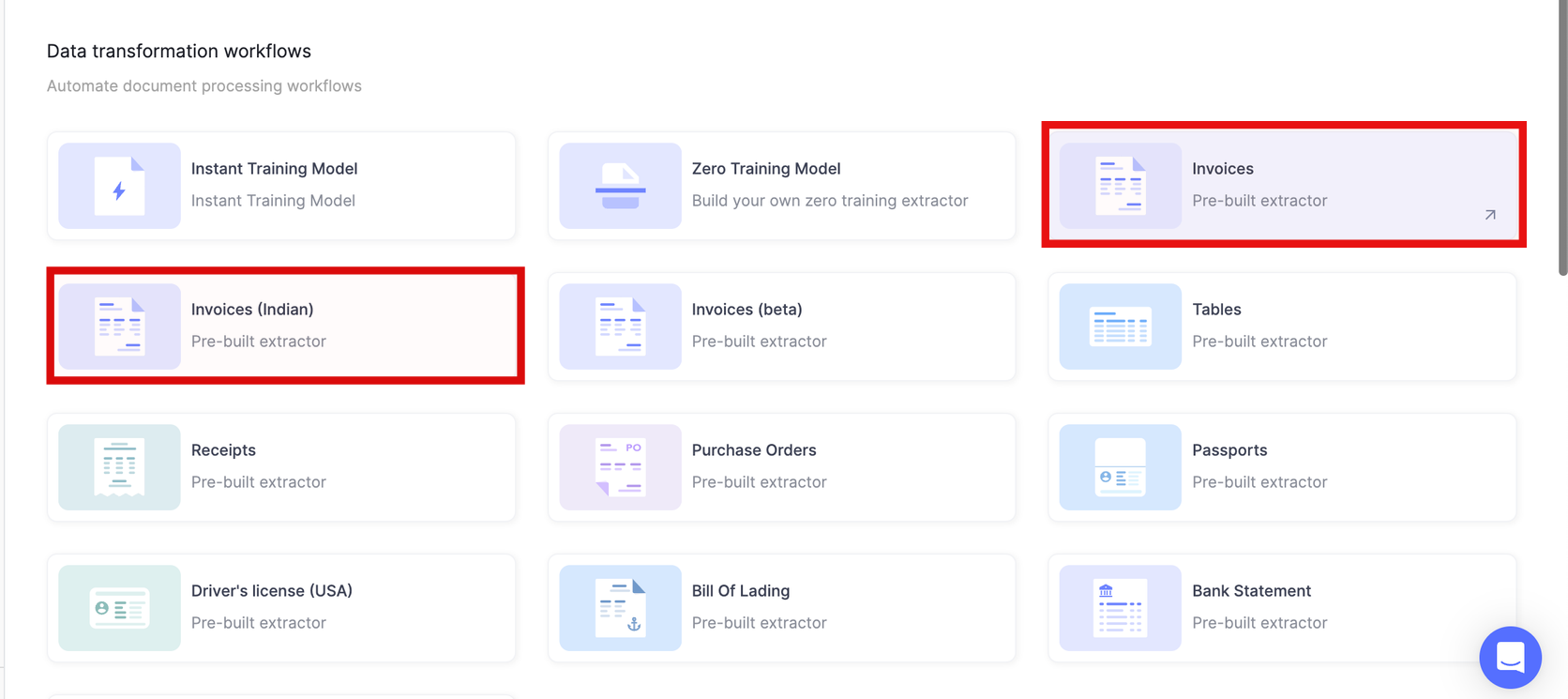

Step 2: Once you verify your email and log in, navigate to the ‘Workflows’ section and choose the pre-built Invoice processing model.

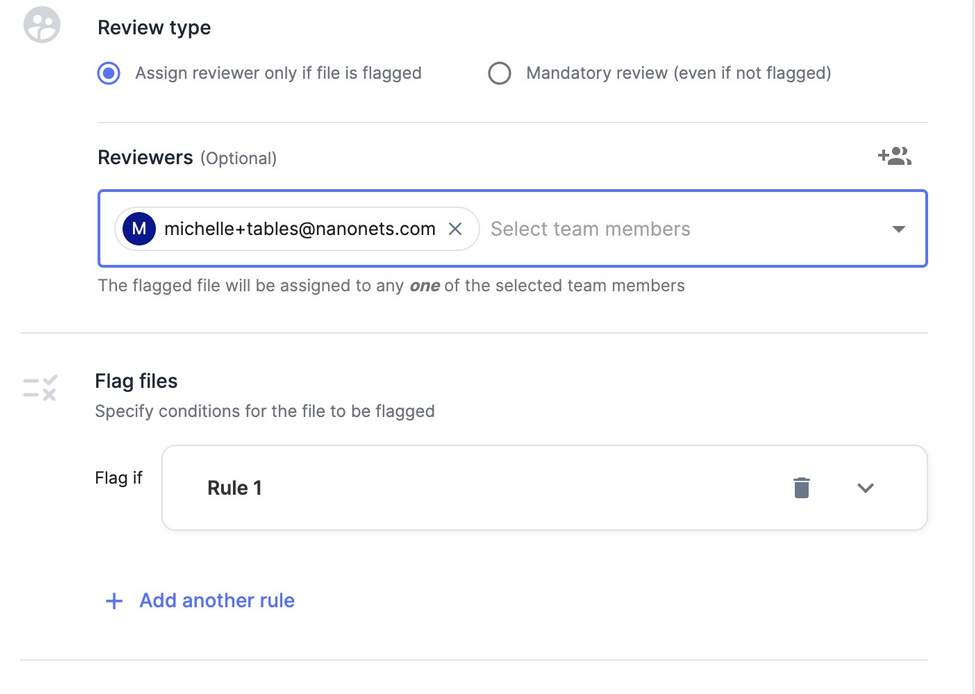

Step 3: Establish approval rules and stages based on your requirements. Assign approvers to review flagged invoices.

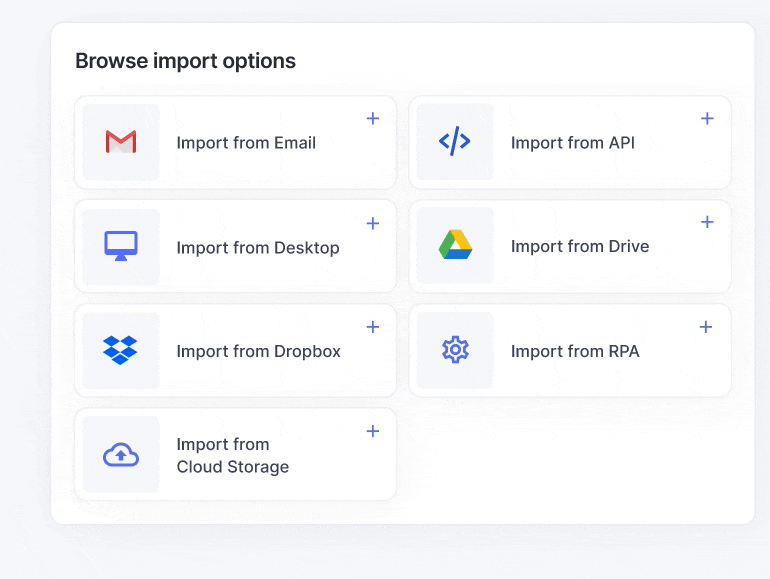

Step 4: Choose how invoices will enter the system: upload locally stored invoices (PDFs, JPG, PNG, etc.) or import files from different sources such as email or cloud storage like Google Drive, OneDrive, or Dropbox.

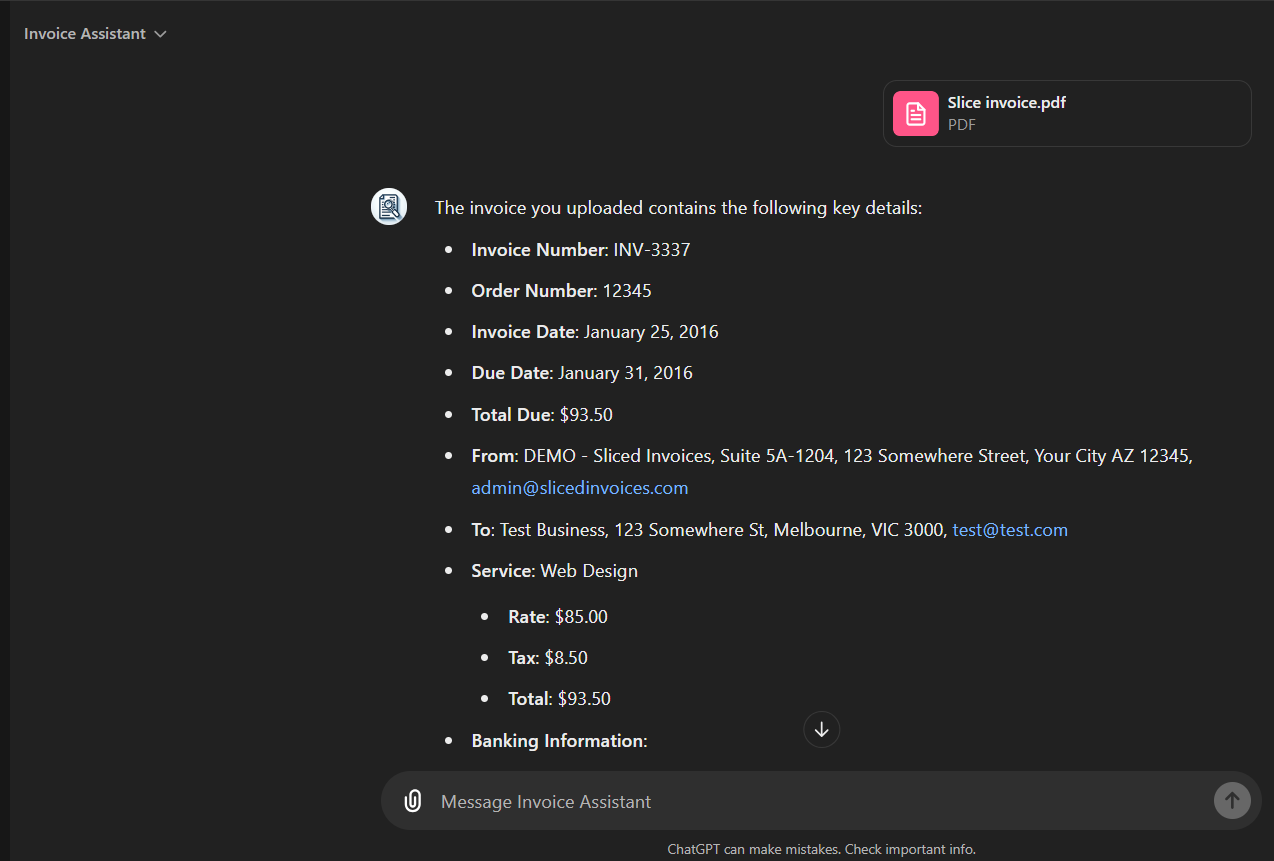

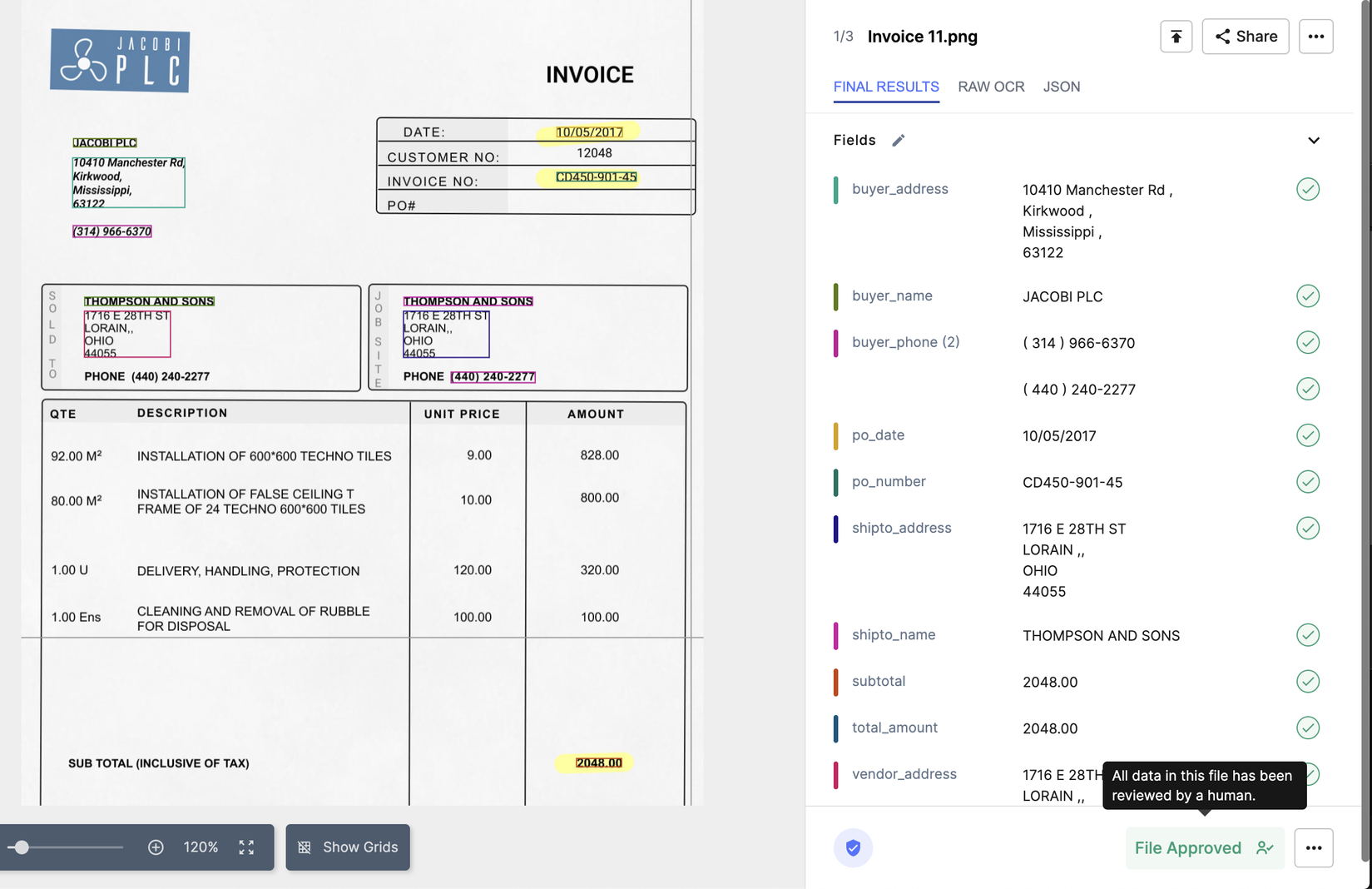

Here’s a quick demonstration of how Nanonets extracts key data from a sample invoice

Step 5: The ai model automatically extracts crucial information such as vendor details, line items, and totals with exceptional accuracy. Review the extracted data and make necessary adjustments. Each correction you make improves model performance.

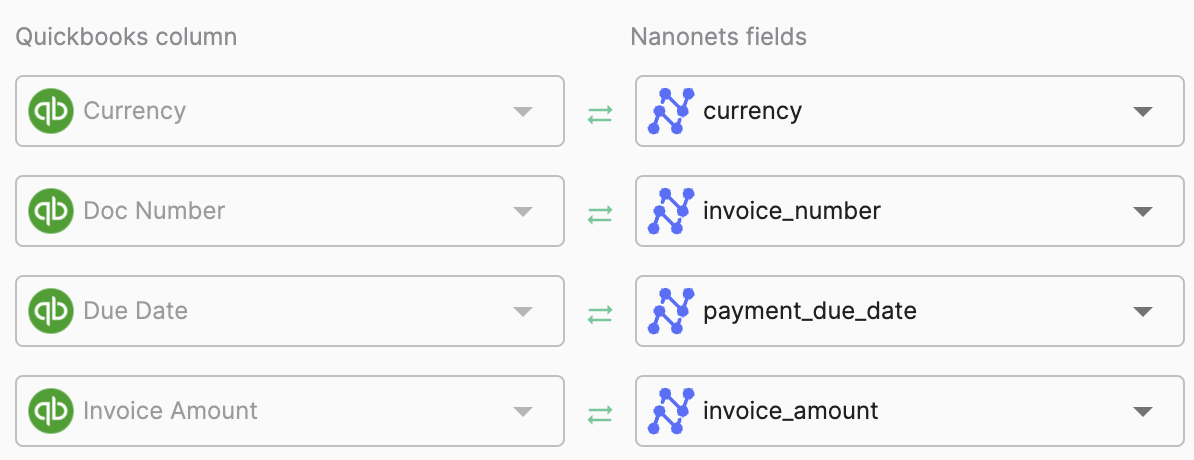

Step 6: Configure the automatic export and real-time synchronization of approved invoices to your accounting software or ERP. Nanonets integrates with QuickBooks, Xero, SAP, and more. You can also manually download the data in various formats or share it directly with team members. You can even automatically create journal entries in your accounting software or update inventory levels based on invoiced items.

Nanonets offers several advantages:

- No-code platform, making it accessible to non-technical users

- Highly accurate data extraction, even for complex invoice formats

- Continuous learning and improvement based on user feedback

- Robust security measures, including SOC-2 certification and GDPR compliance

- Flexible integration options with existing accounting and ERP systems

From hours to seconds: Achieve similar results!

“Tapi has been able to save 70% on invoicing costs, improve customer experience by reducing turnaround time from over 6 hours to just seconds, and free up staff members from tedious work.” – Luke Faulkner, Product Manager at Tapi. Schedule a personalized demo with Nanonets to learn how ai can streamline AP processing for your business.

<h2 id="the-real-world-impact-of-ai-powered-invoice-processing”>The real-world impact of ai-powered invoice processing

Implementing Nanonets can make a huge difference. Here’s what the folks at Tapi, a property maintenance company from New Zealand, had to say about their experience with Nanonets.

How does it all translate into tangible benefits for businesses? Let’s look at some real-world examples of how ai-powered invoice processing has made a tangible difference for companies across various industries.

Case Study 1: Tapi (New Zealand-based property maintenance company)

Tapi, managing over 110,000 properties, saw remarkable improvements after implementing Nanonets’ ai invoice processing solution:

- Invoice processing time: Reduced from 6 hours per invoice to just 12 seconds

- Operational costs: Reduced by 70%

- Data extraction accuracy: Achieved 94%+ accuracy

- Scalability: Effortlessly handling invoices for 110,000 properties

Case Study 2: Ascend Properties (UK-based property management company)

Ascend Properties, which experienced 50% year-over-year growth, implemented Nanonets’ ai tool for invoice processing:

- Cost savings: 80% reduction in processing costs

- Staffing efficiency: Reduced from a potential five full-time employees to 1 part-time employee

- Processing time: Reduced from six hours a day to 10 minutes

- Scalability: Managed growth from 2,000 to 10,000 properties without a proportional increase in staff

These case studies demonstrate how ai-powered invoice processing can dramatically improve efficiency, reduce costs, and enable scalability for growing businesses. The impact goes beyond just time and cost savings – it allows companies to reallocate resources to more strategic tasks, improving overall business operations.

David Giovanni, CEO of Ascend Properties, notes, “Nanonets has helped us grow faster as a business and has set a high bar for customer service.” This highlights how effective ai implementation can become a competitive advantage, enabling businesses to focus on growth and customer service rather than getting bogged down in manual processes.