Remember the last time you made a business expense?

Who did you reach out to for reimbursement? How many people had to approve your expense? What did you need for approval? How long did it take the money to reach your bank account?

This process of seeking approvals is a crucial step in the expense management process.

Welcome to the messy world of expense approvals!

Why do companies need to track employee expenses?

Tracking all employee expenses is essential for a business. A well-defined expense tracking and approval process for such expenses is important to:

- Track company spending patterns

- Detect expense fraud and mitigate financial risk

- Save costs and increase the bottom line

- Get better cash flow visibility and control

- Efficient resource allocation and improved budgeting

- Fast expense reimbursements

- A good employee experience

How do expense approvals work?

All companies have or need an expense approval process in place.

All expense approvals require prior authorization or approval after the expense has been incurred or a combination of both.

Pre-authorized expense process

Often used when an expense is higher than usual, like an expensive business trip to another country, companies ask employees to seek approval in advance.

The employee seeks authorization from the manager in advance and can spend on the go.

The benefits of such a pre-approved process are:

- Increased policy-compliance

- Reduced risk of non-reimbursements

- Smoother employee experience

- Better financial control

Any unplanned expenses that are not pre-authorized need to be approved and processed for reimbursement separately.

Post-expense approval process

In a typical post-expense approval process, an employee incurs an expense first and gets the approval later.

This is what the process usually looks like:

- Expense submission: The employee needs to first report the expense using an expense claim form or file an expense report.

- Expense reporting: The expense report must then be approved by the manager and verified by the finance department.

The employee must submit all the necessary proof or documents, such as receipts or invoices, for a policy compliance check and auditing purposes.

- Verification and approval: Once the expense is verified, the finance team approves the expense claim and initiates the reimbursement if required.

This entire process can take anywhere from a week to a month. In companies without a well-defined approval process, it can take longer and even months.

What is an expense report and how to create one on excel? | Nanonets

An expense report is a detailed list of business expenses incurred by an employee on behalf of the company. Read about how to create expense reports in Excel and how to automate the expense reporting process.

Different methods of expense tracking and approvals

Depending on the company’s guidelines, employees file expense claims using different methods:

Receipt collection

The traditional expense approval process requires employees to collect receipts. The finance department then verifies these expense receipts.

Tracking all such receipts is tedious for employees and finance teams both.

Receipt scanner mobile apps are replacing such old paper receipt collection processes. These apps allow employees to instantly upload receipts by scanning or clicking a photo and file expense claims.

Integrated expense software tools also allow employees to locate direct invoices or receipts from everyday tools like Gmail, Uber, and Credit Card transactions to create hassle-free reimbursement claims.

Expense reimbursement and the expense reimbursement process

Here’s everything you need to know about expense reimbursements, the expense reimbursement process, and the ways to tackle challenges with automation in 2024.

Per diem allowance

In some companies, employees are given a per diem allowance. The per diem rate is meant to cover everything and removes the need for receipt verification. If the employee breaches the expense cap, it must come out of their pocket.

By capping different expense categories, such allowances also increase policy compliance and help companies save costs for unexpected expenses.

Prepaid cards

While many companies opt for cashless reimbursements, prepaid cards have emerged as an excellent option for pre-authorized expense processing.

Prepaid cards are easy to load, track, and spend. They also have built-in compliance controls, and managers can customize spending limits for individual team members. These credit cards can be used for employee expense management, purchasing, and recurring vendor payments.

Prepaid cards are an innovative alternative to per diem allowances, as companies can exercise better control over them in real-time.

Corporate credit cards

Enterprises and companies provide corporate credit cards for employees who need to spend more. With customizable limits and controls, these company credit cards provide real-time spending visibility and empower employees with more financial freedom.

Comprehensive Guide to Credit Card Reconciliation

Simplify your business transactions with effective credit card reconciliation. Learn best practices and tools for better accuracy.

10 biggest challenges in the expense approval process and their solutions

The traditional post-expense approval process can be long and tedious. Let’s look at the common challenges and the steps to resolve them.

1. Endless delays in approvals

As multiple stakeholders need to authorize the expense claim, delays are common in expense approvals.

The managers wait until the end of the month to get an overall idea of the team’s spending and approve all expenses.

The finance team is overwhelmed with expense claims and has to chase down employees for required proof and documentation. Meanwhile, employees are left hanging, running for manager approval or waiting endlessly for reimbursements.

Solutions:

- Automate your approval workflow so that everyone is automatically sent timely reminders, notifications, or alerts to speed up the process.

- Even if you follow manual expense approvals, set proper timelines for all approvers – employees, managers, and the finance team.

2. Inaccurate expense reporting

Employees submit incorrect expense claims or expense reports without proper documentation, set processes, and proper guidelines. Misplaced, illegible, or damaged receipts are the most common culprits in Excel-based.

Some companies follow Excel-based expense reporting that involves manual data entry. This creates a library of spreadsheets that are prone to errors and lead to delays in expense report approvals.

Solutions:

- Go paperless and ensure efficient expense reporting with an OCR-enabled receipt scanning app that allows employees to capture and submit expenses.

- Ensure data extraction from the invoices/receipts is seamless to ensure the claim amount matches the expense.

- Train your employees with online resources that guide them to report expenses and file claims accurately.

10 Best Receipt Scanner Apps in 2024

We’ve found 10 receipt scanner apps that help you digitize receipts, extract relevant information, create expense reports and manage all your expenditure from one single app.

3. Manual expense verification

One in five expense reports submitted by employees contains errors that the finance team needs to correct manually. Already overwhelmed finance teams have to sift through each report line by line.

Such manual processes can cost businesses heavily.

Solutions:

- Use a tool that gives real-time visibility of expense claims filed by employees so the finance team doesn’t have to wait till the end of the month.

- Opt for an OCR-based expense verification tool that accurately captures, verifies, flags, or approves expense claims.

4. Long reimbursement cycles

Employees shouldn’t have to wait for weeks and months to get reimbursed.

Even if the manager approves the claim, the processing and reimbursement are further delayed, and months go by before the reimbursement hits the bank account.

Solutions:

- Make pre-approvals a standard norm by asking managers to authorize the spend in advance with a tailored budget.

- Set well-defined timelines for each department and approver, and ensure they are followed meticulously for everyone.

- Equip employees with corporate credit cards or prepaid cards to reduce the need for reimbursements.

5. Fraudulent claims

Expense claims are the most susceptible to fraud. The business suffers when the manual auditing fails to flag inflated claims or detect duplicate receipts.

Solutions:

- Have a precise expense categorization and enforce strict compliance with a well-defined expense policy.

- Keep a tab on recurring client gifts or client-related reimbursement claims.

- Compare spending patterns across individuals, teams, and departments. Have strict spending limits and per diem allowances in place for different categories.

- Check anomalies related to date, receipt ID, and price in receipts. Adopting an OCR-enabled expense tool can flag such instances early on.

- Don’t wait until the end of the year; perform surprise audits from time to time to catch and prevent fraud.

6. Infrequent expense claims

When employees send expense reports too late, it hampers the auditing process. Infrequent expense claims also make it difficult for companies to track employee spending.

The longer the time between each expense report submission, the longer the approval cycle.

Solutions:

- Have a fixed periodic expense reporting cycle—preferably biweekly or monthly expense reporting with quarterly auditing by the finance department.

7. No real-time expense visibility

Businesses rely on a steady cash flow to sustain operations.

A lack of real-time spend visibility hampers the budgeting process and particularly impacts small business owners.

Solutions:

- Make pre-approval the norm for some, if not all, expense categories. This will reduce volatility and help team leads better manage and utilize the budgets.

- Use expense software with an expense dashboard to track and manage all employee spending in one place.

8. Lack of compliance

When employees don’t understand the company’s reimbursement policy and guidelines, they submit incorrect expense claims and expense approvals get delayed.

Such unaware employees make out-of-pocket expenses and have their reimbursement claims rejected due to non-compliance.

Even with a well-defined expense policy, checking every expense for compliance can be extremely time-consuming and tedious for the finance team.

Solutions:

- Strictly implement an expense policy that outlines eligibility, expense categories, spending limits, documentation requirements, etc., in detail.

- Use built-in controls on your expense tool to increase compliance with spend limits or out-of-policy expense categories. For instance, your tool should be able to add a spend limit on meal allowances.

- Allow employees to remove or reduce personal expenses from receipts in expense claims.

For example, if an expense claim for a hotel stay on a business trip includes non-compliant expenses like laundry or alcohol for personal consumption, employees can be allowed to reduce the equivalent amount from the reimbursement claim.

- Ensure your company policy is tax-compliant and updated periodically.

- Communicate your expense policy frequently to your employees.

Sample Employee Business Expense Policy Template

Use our Employee Business Expense Policy template to design an ideal expense policy ensuring financial control and compliance for your business.

9. Complex multi-level approval structure

Employees often need multiple approvals across different departments for costly expenses or expenses that fall under a specific category. This can dramatically delay the approval process.

Solutions:

- Establish a culture of accountability to ensure timely approvals. Ensure each stakeholder follows proper documentation to have a clear audit trail.

- Have a follow-up mechanism and deviation workflows to ensure your approval process doesn’t rely on just one or a few individuals.

- Automate all multi-level approvals with customizable workflow automation tools.

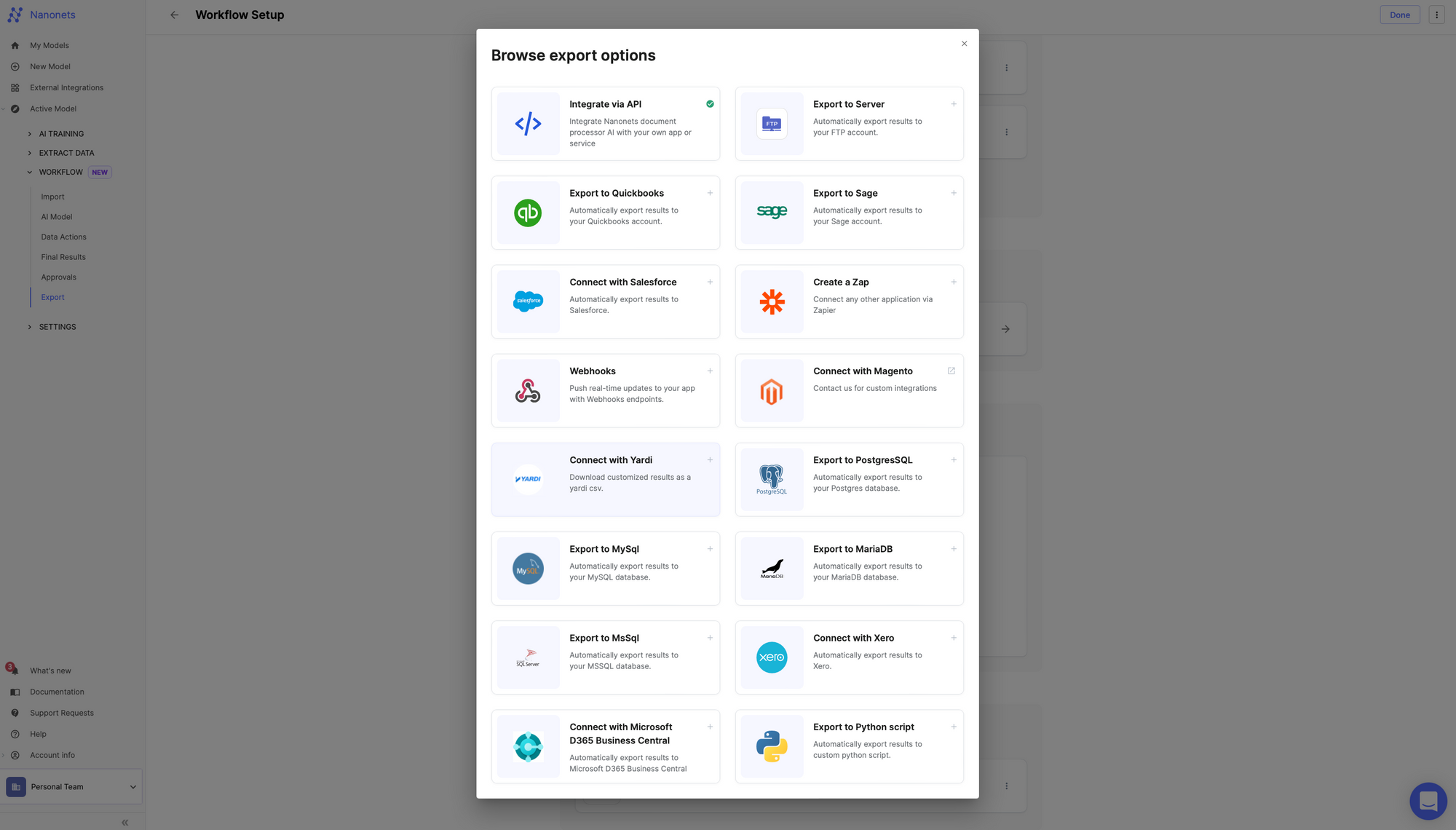

10. Lack of integration

Integrating your expense management tools with other finance and accounting software remains challenging for many companies.

Without properly implementing integration with all your pre-existing tools, automation can create more issues than solve them and soon become costly.

Solutions:

- Ensure your expense approval system is properly integrated into your core accounting and ERP software to work as a unified system.

- Prioritize interoperability and scalability while automating any workflow step with a new tool. The data flow and synchronization need to be seamless.

<h2 id="using-ai-to-streamline-expense-approval-process”>Using ai to streamline expense approval process

Finance departments have been using artificial intelligence for some time now, for example, in the form of OCR-based scanner apps.

Companies are rapidly adopting machine learning to train their models to spot fraudulent activities, train and adapt to new regulations, and become compliant.

In expense approvals, the use case for ai/ML is enormous. Let’s see how you can use some of these to streamline your approval process:

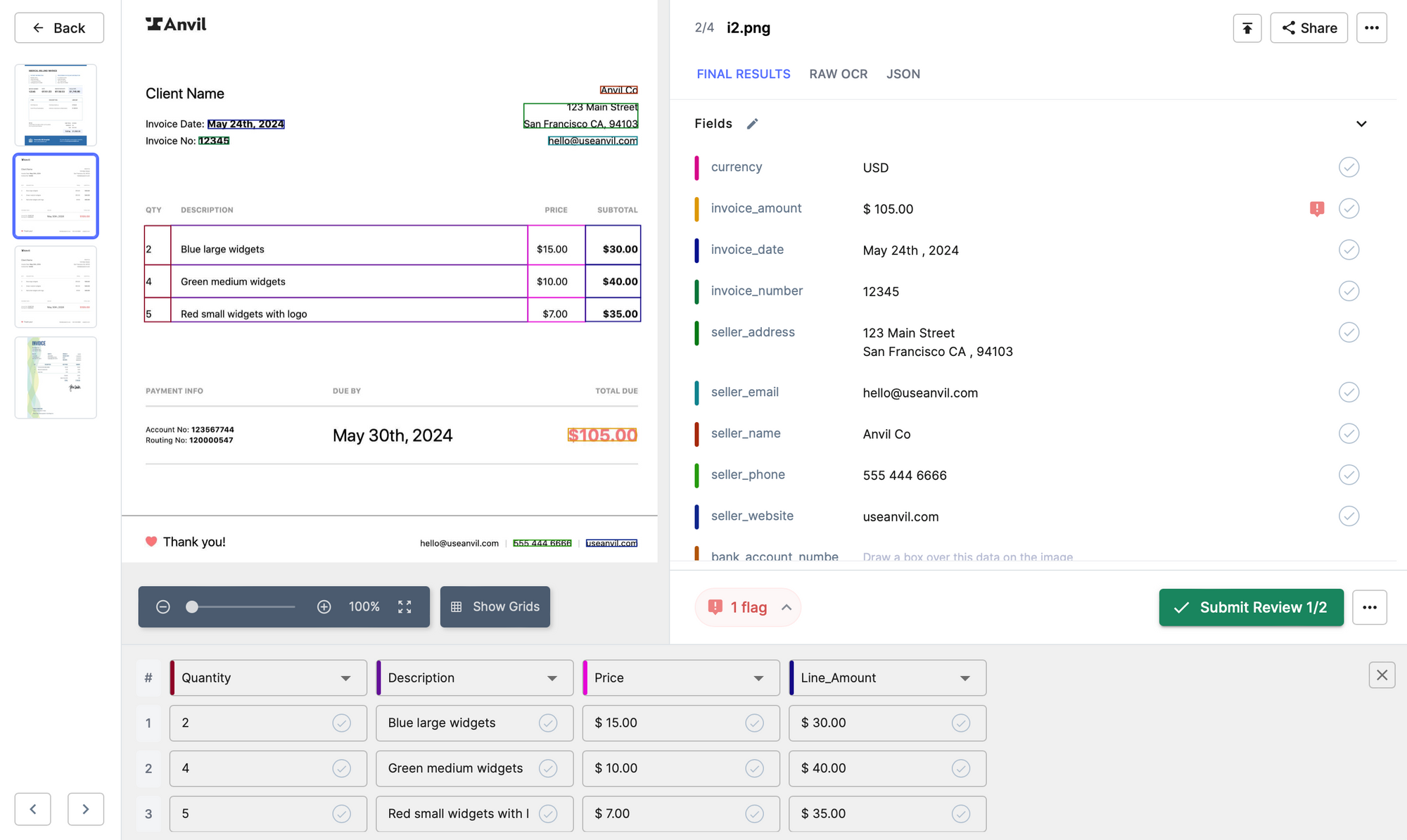

Employees can easily convert receipts and expense claims into readable data using a data extraction tool. Such tools simplify expense submission and verification by populating fields like amount, date, merchant/vendor data, expense category, etc.

Using these data extraction tools, expenses can be easily captured from emails, credit card transactions, or even paper receipts using receipt scanner apps.

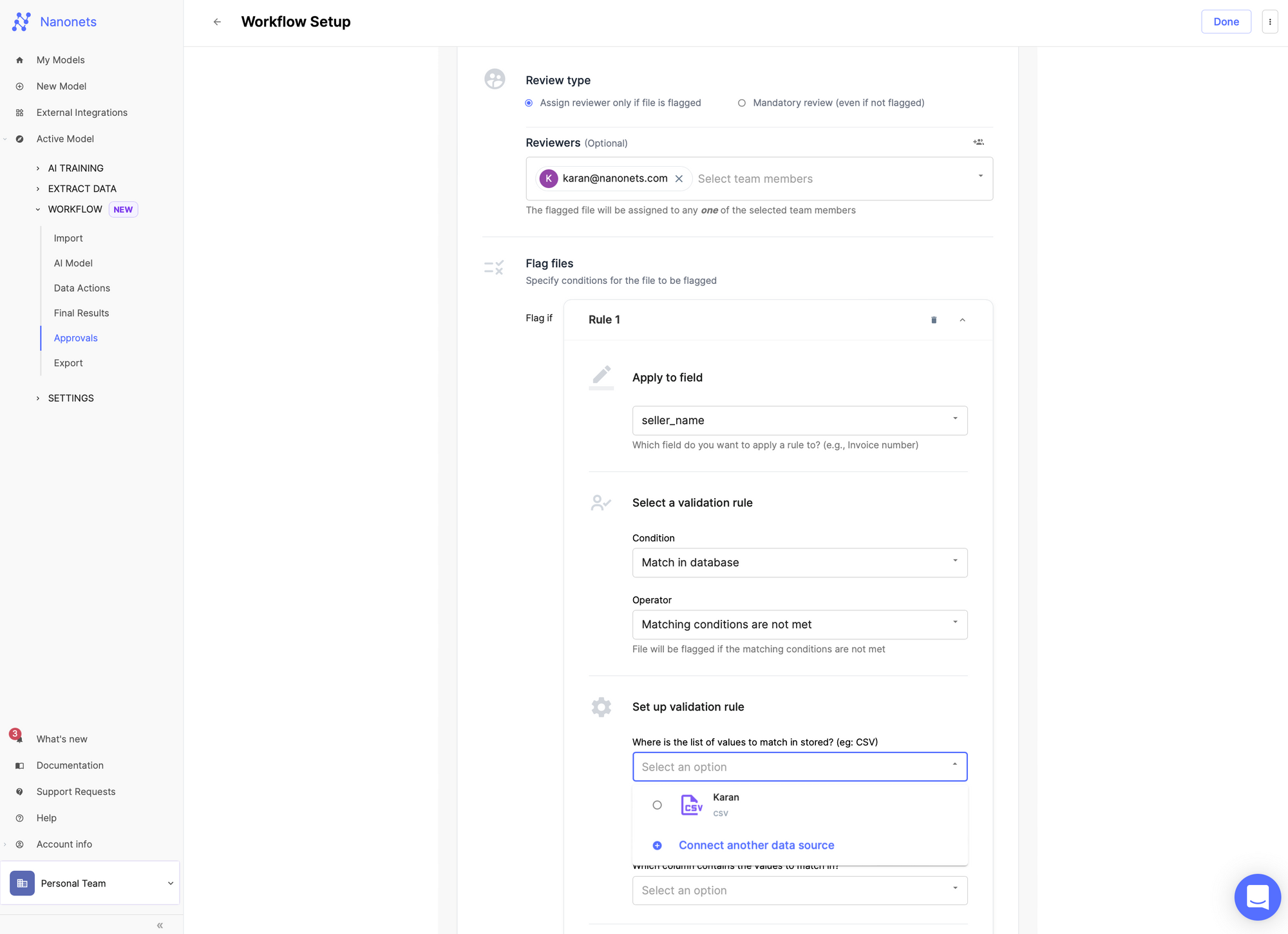

Approval workflow automation

With automated request submissions and workflows, employees can easily submit and approve spending requests asynchronously. These ai-driven workflows can automatically route and escalate claims to the correct approver based on customized approval levels.

Spend management system

A spend management system manages employee expenses and overall company spending. A platform that completely integrates with all pre-existing ERP tools can help you save costs, stay tax and policy-compliant, and manage spending effectively.

Such expense management software or spend management platforms come equipped with functionalities like instant expense reports, customizable dashboards, and real-time analytics that companies can customize.

How to automate expense approval workflows with Nanonets

Nanonets offers an intuitive and user-friendly interface for employees to submit spending requests, attach supporting documentation, and automate your approval process seamlessly.

Automated receipt capture

Employees snap photos of their receipts. Nanonets’ OCR technology instantly captures and digitizes the data.

Generate expense reports easily

The system automatically populates expense reports using the captured data and exports it into your software of choice.

Set up customized approval workflows

Configure your approval workflow and customize deviations as per your expense policy.

Managers receive instant notifications, moving the process along at the speed of an email. They can review reports more efficiently, aided by ai that flags anomalies or policy violations.

By implementing Nanonets, companies transform their expense approval workflow from a slow, manual process into a fast, automated, and nearly effortless system.

Final word

So there we have it, a whirlwind tour through the dynamic world of expense approvals.

Implementing a well-defined expense approval process is essential for companies to maintain financial control, mitigate risks, and ensure responsible spending practices.

Using the solutions listed in this article can help you plug in the gaps in your expense management process and establish a robust framework for managing approvals.

Frequently Asked Questions (FAQs)

Q. Which expenses require approvals?

A. Typically all business expenses incurred by employees must be approved by their manager and the finance department. These expenses are usually categorized into travel, food and entertainment, office supplies, and miscellaneous expenses.

Here’s a whole list of expense categories to use.

Q. Who approves expenses in a company?

A. Depending on your company’s expense policy, the expenses must be approved by relevant approvers. Usually these include your manager and the finance department. Depending on other factors like certain expense categories or the amount of expense, the expense approvers can change and involve other people.

Q. What is the process of expense authorization?

A. The common process of expense authorization requires employees to save receipts or relevant proof of expenses and get them approved by managers and the finance department. In certain cases, managers also pre-approve expenses, and companies provide allowances or prepaid cards to incur expenses directly.

Q. How long should expense approval take?

A. Expense approvals can take anywhere from a few days to several weeks. If the process involves reimbursing the employee, the finance department will verify and approve the claim. This entire reimbursement process can take longer and usually goes upto a month.

Companies usually use ai tools to speed up the approval process and slash the approval cycle to a few days instead of weeks.