B2B payment automation involves everything from the automation of capturing and processing invoices to making payments to vendors and reconciling those payments in your books. It allows your business to free up resources, reduce manual errors, and focus on more strategic tasks.

A 2018 report revealed that businesses in North America spend $187 billion annually on Accounts Payable (AP) processing, and labor accounts for over 90% of these costs. What if you could reduce these costs by 80% and increase the speed of processing invoices by up to 10 times? Sounds too good to be true?

With the right B2B payment automation software, it’s not. And the benefits are not limited to cost savings, accuracy, and efficiency — B2B payment automation can also improve supplier relationships, ensure compliance, avoid fines and penalties, and provide critical insights into cash flow and financial health.

B2B payment automation is a game-changer for businesses of all sizes. In this brief guide, we will walk you through the basics of B2B payment automation and how to implement AP automation in your business.

What is B2B payment automation?

B2B payment automation is a technology-driven process streamlining how businesses handle payments to suppliers, contractors, and other business partners.

So, rather than your team manually entering invoice data, checking for errors, initiating payments, and reconciling those payments in your financial system, these tasks are carried out by a solution like Nanonets.

This software streamlines the entire process with minimal human involvement, cutting down on time spent on these repetitive tasks and significantly decreasing the likelihood of mistakes and misunderstandings.

How can B2B payment automation streamline your workflow?

Investing in a B2B payment automation solution is a smart move for your business. Sometimes, it is hard to believe the transformative impact until you witness the changes in action.

So, let’s look at how these payment automation solutions automate different parts of the B2B payment process.

1. Invoice processing

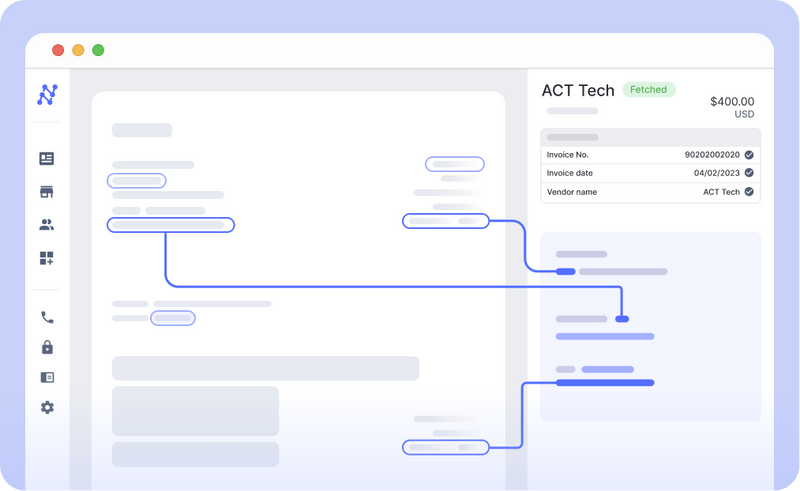

B2B payment automation solutions can capture and extract data from invoices and review them to ensure accuracy and completeness. It extracts vital data like invoice number, date, supplier name, and amount due and matches it with corresponding purchase orders and contracts.

If there is a mismatch, the software automatically flags the invoice for manual review. Your team can review it and route it back to the supplier for correction and resubmission in a matter of a few clicks.

This automated process dramatically reduces the time spent on manual data entry and review, leading to faster invoice processing times.

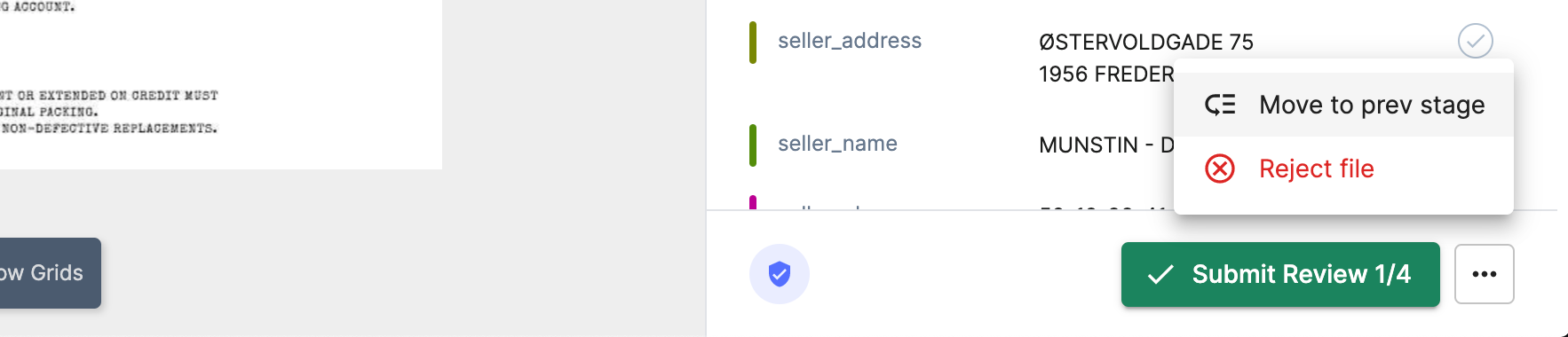

2. Approval workflows

Once the invoice is matched, it is automatically routed to the designated approver(s) for review and approval. The payment automation system sends reminders and escalations for overdue approvals, reducing the chances of delayed payments while increasing the chances of getting early payment discounts and better partner relationships.

Your partners will be able to track the status of their invoices in real-time, which reduces the number of queries your AP team has to deal with. This level of transparency fosters trust and improves your business relationships.

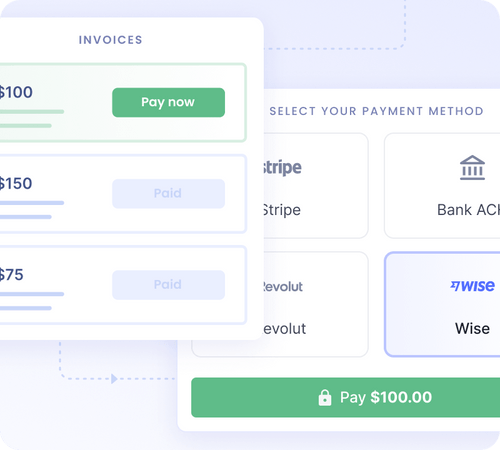

3. Payment execution

Payment automation software then initiates payments based on the approved invoices and payment terms. The software creates payment files for various payment methods like ACH, virtual cards, and checks and sends them to the bank or payment processor.

However, it is important to note that the effectiveness of payment automation depends on the quality of the software and how well it is integrated into your existing payment systems. As the processes vary from business to business, choosing automation solutions that can be customized to meet your specific needs is crucial.

Take Nanonets, for example. It can read invoices and purchase orders from various sources like email, scanned documents, digital files/images, and cloud storage — enabling you to go wholly touchless and match and reconcile expenses without manual intervention.

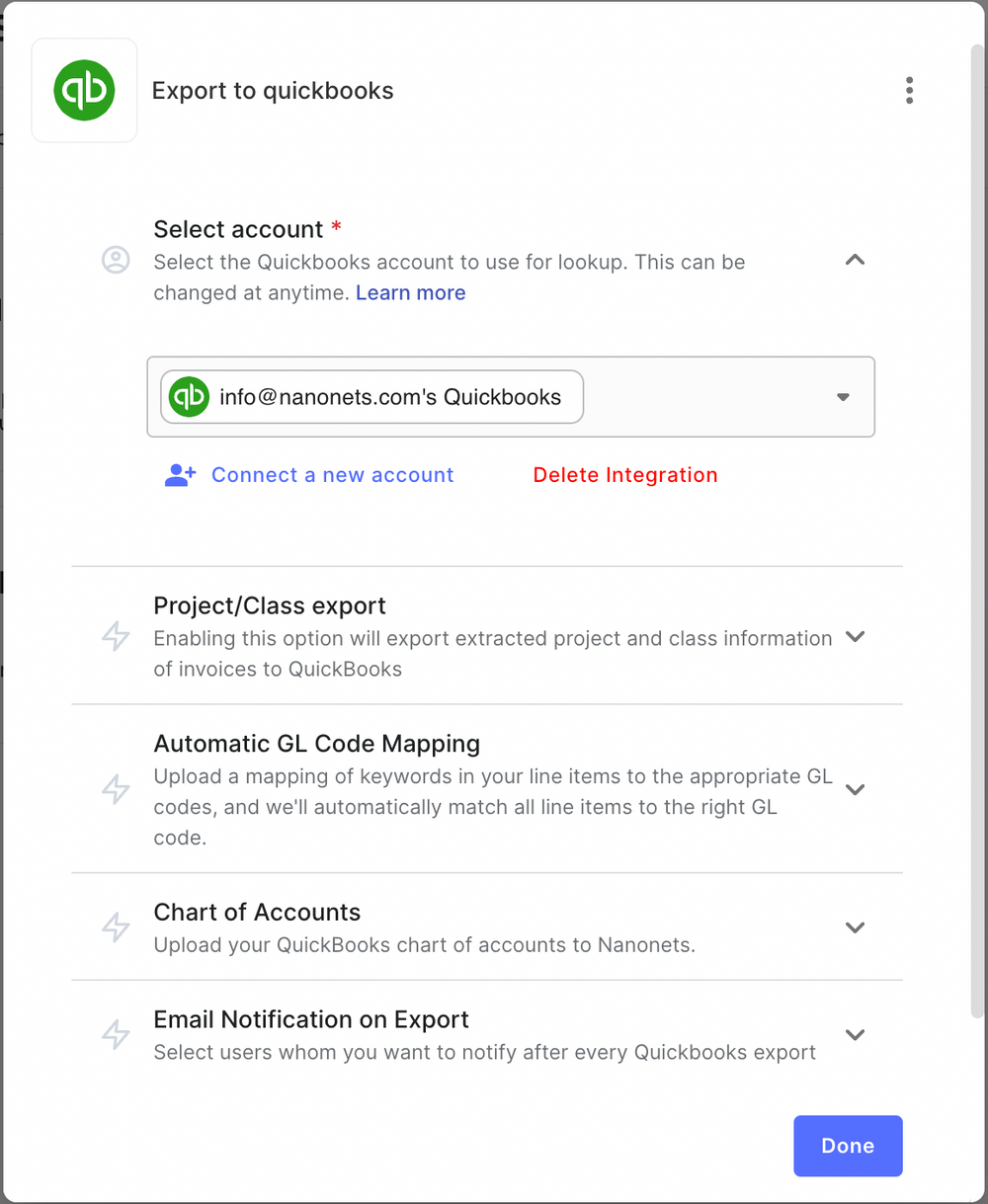

You can easily connect it with your existing accounting systems, including QuickBooks and Sage, so it doesn’t disrupt your current processes.

4. Payment reconciliation

Once the payments have been executed, the automation software will reconcile them. It will cross-reference the payments made with the approved invoices, ensuring that all payments are accurate and accounted for.

Any discrepancies will be immediately flagged, allowing your team to investigate and resolve them promptly. GL codes are automatically applied, enabling seamless integration with your accounting system and making the reconciliation process faster and more efficient.

5. Reporting and analytics

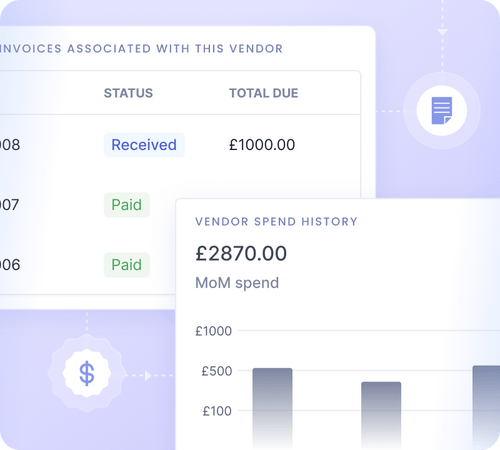

B2B payment automation software doesn’t just automate manual tasks; it also provides valuable insights into your business’s financial health. It generates comprehensive reports on your payment activities, showcasing trends, identifying bottlenecks, and highlighting opportunities for improvement.

This data-driven approach helps you to set more accurate budget forecasts, identify cost-saving opportunities, and make strategic decisions based on real-time financial data.

Why should you implement B2B payment automation?

So it can streamline your workflow. But how does that translate into tangible benefits for your business?

Here are some compelling reasons to consider implementing B2B payment automation:

1. Cost savings

A recent report revealed that almost 92% of businesses use checks for payments. With the median processing cost between $2.01 and $4, processing each check manually can be very expensive for companies.

Automated B2B payment processing can reduce the need for manual labor and paper-based processes, significantly reducing costs associated with printing, shipping, and storing paper checks.

2. Improved accuracy

Manual payment processing is prone to errors, leading to unexpected costs and delays. Duplicate payments, incorrect amounts, and missed deadlines are just a few examples of the inaccuracies that can occur with manual processing.

B2B payment automation can help eliminate these errors by automating tasks like data entry, matching payments with invoices, and identifying discrepancies.

In a recent survey, almost 62% of organizations cited increased efficiency as the top priority in payment automation and electronic payments.

3. Faster payment processing

With automated invoice processing, invoice approval workflows, and payment execution, the time it takes to process a B2B payment can be reduced from weeks to a few days or even hours.

Invoices can be approved from any location, and payment can be processed immediately, allowing faster turnaround times and improved cash flow.

4. Stronger supplier relationships

Late payments, disputes, and other payment-related issues can damage supplier relationships. B2B payment automation helps businesses avoid these issues by ensuring timely payments and accurate payment records.

This can help companies to foster stronger supplier relationships, leading to potential discounts, improved terms, and enhanced collaboration.

5. Scalability and growth

B2B payment automation enables organizations looking to scale their operations to do so more efficiently. As vendors and invoices pile up, manually processing them can be a bottleneck for growth.

Automated B2B payment processing helps businesses keep up with the volume of invoices and payments while reducing errors and increasing efficiency. Not only would this allow companies to plan their activities without worrying about delays in acquiring raw materials or critical supplies, but it also focuses on more strategic tasks that can drive growth and profitability.

6. Less susceptible to fraud

By automating vendor invoice processing, approval workflows, and payment execution, payment automation software can provide businesses with a comprehensive view of their payment activities, allowing them to identify any unusual transactions or activities.

Furthermore, B2B payment automation software can implement security measures like multi-factor authentication, user permission controls, and audit trails, providing businesses better protection against fraud.

7. Enhanced compliance

Creating audit trails manually can be difficult, especially when each partner has their own recording process and rules. This often leads to poorly maintained logs that can cause issues during audits or when following regulations. However, with payment automation, every transaction is recorded systematically and can be traced easily.

Moreover, the software can be programmed to comply with various international, national, or industry-specific regulations, reducing the risk of non-compliance. This simplifies audits and provides a structured way of handling compliance-related issues.

8. Better visibility and control

Automating your B2B payments gives you better visibility into your spending. A comprehensive view of your payment activities allows you to identify trends, spot inefficiencies, and make data-driven decisions. This can optimize your cash flow, manage your budget more effectively, and plan for future growth.

Additionally, automation provides you with greater control over your payments. You can set up approval workflows, automate reminders for upcoming payments, and receive alerts for unusual activity. This ensures you’re always in the loop and can intervene when necessary.

9. Increased employee productivity and better morale

Manual payment processing is not just time-consuming, but it also involves tedious tasks, which can be a drain on your employees’ productivity and morale. Automating B2B payments can free up your staff’s time to focus on more strategic tasks and initiatives that can contribute to the growth of your business.

Furthermore, they won’t have to chase after senior colleagues for invoice approvals, spend hours reconciling payments, or worry about misplacing important documents. Retaining and motivating employees becomes smoother when their skills and time are being used for meaningful work.

How to implement B2B payment automation in your organization to drive growth?

Embracing change can be challenging. Yet, successful integration of B2B payment automation in your business can revamp your business’s operations.

This shift saves time and money and enhances your rapport with suppliers. Sharpen your process, trim costs, and nurture partnerships — all in one go.

Here are a few tips to keep in mind when implementing payment automation within your organization:

1. Assess your current payment processes

From filing receipts to importing and consolidating data, figure out which aspects of your B2B payment processing are still manual. For example, email-based invoices are still being manually entered into your accounting system, or a certain vendor’s invoices are printed and mailed for approval.

Identifying these manual processes can help you determine which parts of your payment processing can be automated and what kind of payment automation solution would best fit your business.

2. Ensure there is minimal manual validation required

If your team has to manually validate each and every field, you’re not truly automating your payment processes. It could lead to invoices being cleared on the next business day, which resulted in an unwanted delay in operations.

Choose a B2B payment automation software that can reduce the time required to clear invoices to mere seconds. This way, your business can deliver a superior and trustworthy vendor experience.

3. Build a universally accessible knowledge base

Creating a knowledge base accessible to all the relevant team members can go a long way in ensuring the successful implementation of payment automation. It should contain detailed information on the B2B payment automation software you’ve chosen, how it works, user privileges, approval routing, and any policies or procedures that need to be followed.

This knowledge base should be updated regularly to reflect any changes in your payment automation processes to keep everyone on the same page.

4. Take compliance and security seriously

B2B payment automation involves sensitive financial data, making compliance and security paramount. Your B2B payment automation software should comply with relevant regulations and international standards such as PCI-DSS and ISO 27001, ensuring that your and your partners’ financial data is safe and secure.

In addition, you should implement appropriate security measures such as two-factor authentication, user permissions controls, and audit trails. You could also establish a dedicated team or hire a third-party auditor to monitor security and compliance.

5. Make sure B2B payment automation works well with your existing systems

Say you already use SAP’s enterprise resource planning (ERP) system to manage your business processes. You must ensure that the B2B payment automation solution you choose can integrate seamlessly with your current systems. This will help to streamline your workflow and avoid any potential issues or disruptions in your operations.

If the software doesn’t integrate well with your ERP system, your staff might have to manually transfer data between the systems, defeating the purpose of automation. Therefore, look for a solution that offers APIs or pre-built integrations with popular business software.

6. Train your team effectively

Automation boosts productivity, but only if your team can wield it effectively. So, your team must understand when to manually step in, recognize various alerts, know where data is stored, and troubleshoot typical issues.

This will help your team implement payment automation with purpose. It wouldn’t be seen as a shiny new tool but rather an integral part of the workflow. Regular training sessions, webinars, or workshops can be organized to familiarize the team with the software’s features, functions, and benefits.

7. Regularly review and update your workflows

Automation isn’t a set-and-forget solution. Regularly reassess your automated workflows to spot potential issues. These could range from practical problems, like software inaccurately reading scanned invoices, to strategic concerns, such as channel partners resisting digital invoicing.

Gather feedback from your team and stakeholders and critical metrics like error rates and processing times. Use these insights to make your payment automation system more efficient. Adjust and enhance your workflows to align with your evolving business needs. This way, your system stays effective, meeting your requirements over time.

Here’s a quick checklist to help you select the right B2B payment automation solution for your organization:

- Does it integrate well with your existing accounting and ERP systems — QuickBooks, Xero, SAP, Oracle, etc.?

- Does it come with AI capabilities for invoice data extraction and automated validation, and can it learn from manual inputs to enhance its accuracy over time?

- Does it support a wide range of payment methods — ACH, wire transfers, credit cards, checks, wallets, etc.?

- Does it offer features like dynamic discounting and supply chain financing?

- Does it support multicurrency payments and international transactions?

- Does it have robust security measures and compliance certifications?

- Does it allow you to customize the approval workflows based on your business needs? Does it have a scalable architecture that can grow with your business?

- Can you pay vendors directly from the platform without a third-party payment gateway?

- Does it have a user-friendly interface that your team can easily navigate and use?

- Does it offer real-time reporting and analytics to help you monitor and optimize your payment processes?

- Does it offer automation of recurring payments to save time and reduce errors?

- Does it support automatic reminders for pending payments and overdue invoices?

- Does it allow you to set user permissions and approval hierarchies based on your organizational structure?

- Can it read and extract data from invoices with different formats, layouts, and languages?

- Does it raise alerts for any discrepancies or potential fraud detected in the payment process?

- Does it provide an audit trail for all transactions to ensure transparency and aid in compliance?

- Does it come at a cost that fits your budget without compromising your desired features?

What specific insights into financial health can B2B payment automation software provide?

Imagine using an Excel sheet to manage payments. Even if you forget about the hassle of all the manual data entry, the lack of real-time insights makes it challenging to make informed decisions quickly.

With B2B payment automation software, you can centralize all your financial data in one place and access real-time reports and analytics. It will give you real-time insights into the following:

- The discounts received from each vendor for early payments

- The average time taken to process invoices and payments

- The outstanding payments and overdue invoices

- The total spend by category, department, or vendor

- The cash flow forecast for the upcoming months

- The percentage of invoices that have discrepancies or potential fraud

- The overall cost of processing each invoice and payment

- The working capital optimization and how effectively it is being managed

- The efficiency of your approval workflows and any potential bottlenecks

- The percentage of payments made through different methods (ACH, wire transfers, credit cards, checks, wallets, etc.)

- The number of international transactions and the associated costs, and the impact of exchange rates on your multicurrency payments

- The budget utilization and any variances between the actual spend and the budgeted amount

This is not an exhaustive list but a glimpse into the insights you can get with the right automation software. Such data-driven insights can help you identify inefficiencies, cost-saving opportunities, and areas of improvement.

They can guide your strategic decisions, helping you negotiate better vendor terms, optimize your working capital, and improve your cash flow management.

How has B2B payment automation benefited businesses?

On paper, getting a B2B payment automation solution is a no-brainer. But you might still be wondering about its actual impact on businesses.

Here are some real-life stories of businesses that implemented Nanonets B2B payment automation and experienced significant improvements:

1. Ascend Properties’ AP team became 5x more efficient

This UK-based property management company saved 80% of its invoice processing costs using Nanonets. The AI-powered OCR technology of Nanonets enabled them to automate data extraction, approval routing, and upload to the CRM software process.

Ascend scaled from 2000 properties to 10,000 without increasing their AP team size. Moreover, from 5 full-time employees working on invoice processing, they were able to reduce it to only one part-timer, freeing up the other team members to focus on more strategic initiatives.

2. SaltPay achieved 99% time-saving on invoice processing

This London-based fintech company used Nanonets to automate its invoice extraction and approval process. Before switching to Nanonets, the SaltPay team spent significant time manually inputting invoice data into their SAP system.

Nanonets automated the data extraction process, validated the data against required conditions, and directly uploaded the data into the SAP system. SaltPay successfully improved the accuracy of its invoice processing and scaled its operations to serve clients from 26 countries.

3. ACM Services reduced manual invoice processing by 90%

ACM Services, a remediation contractor, turned to Nanonets to streamline their invoice extraction process. Before using Nanonets, they struggled with a cumbersome, manual process involving time-consuming data entry.

By integrating Nanonets into their workflow, they automated data capture and vendor-GL code matching, reducing manual invoice processing by 90%. The AP team was able to process all their invoices in a fraction of the previous time, reducing errors and increasing their overall productivity. The export to CSV option also made it easier for them to upload data into their accounting system.

To sum up, Nanonets’ AI-powered invoice management solution automates invoice processing with an accuracy rate of over 90%. Our solution can automatically extract invoice data from different formats, including scanned PDFs and images, and integrate with your existing accounting systems like Quickbooks, Xero, and SAP.

Nanonets is GDPR compliant and also provides enterprise-level security. It is scalable, easy to implement, and offers customizable approval workflows and detailed analytics to help you optimize your payment processes.

Final thoughts

No matter your industry, implementing payment automation can help streamline your payment processes and drive business growth. By reducing manual processes, improving efficiency, and strengthening supplier relationships, you can set your business up for success.

Always deploy a B2B payment automation software that fits your needs and your existing systems. Your finances and employees will indeed thank you. Remember, the goal is not just to automate but to automate intelligently.

NEWSLETTER

NEWSLETTER