Streamlining your expense claim process isn’t just great for business efficiency and accuracy — it’s a game changer for your bottom line.

Think about it: faster reimbursements, accurate financial records, and easier compliance with company and tax laws. But it remains to be a painful exercise. According to this Global Business Travel Association report, processing an expense report for a single-night hotel stay costs an average of $58 and takes 20 minutes!

No matter how stellar your business model is or how great your sales numbers are, leaky expense claim processes can be a slow, silent killer for your finances. And if you’re a new or growing business, that’s a hit you can’t afford.

The good news is that automating your expense claim process can make it faster, more accurate, and less costly. If you want a quick, impactful boost to your finances, you should focus on this area.

This article will highlight how to automate and manage your expense claims better.

What is an expense claim?

An expense claim is a formal request raised by an employee to get reimbursed for expenses incurred on behalf of the company. These could be travel expenses, meals, office supplies, or any other costs that an employee has paid for out-of-pocket.

Different ways expense claims are generated

If your team member gets a traffic ticket while on a business trip, that’s not a business expense. But if they’ve treated a client to a fancy dinner or booked a hotel, then they can claim for that.

The IRS has a simple rule about what counts as a legit business expense. It has to be ordinary and necessary. Ordinary means it’s common in your line of work, and necessary means it’s helpful and suitable for your business.

Expense claims can come from various places, like travel, office supplies, or client relationship building.

Let’s break it down:

1. Travel expenses: Think airfare, hotels, rental cars, and gas when the employees are on the road for business.

2. Food and entertainment: This could include your sales team meeting potential clients for meals or grabbing tickets to a networking event.

3. Office expenses: Everything from your daily office supplies to the internet bill falls under this category.

4. Accommodation: Any costs for overnight stays, like hotel rooms or rented apartments, count here.

5. Unexpected related expenses: These include unforeseen costs shouldered by employees, like emergency repairs or legal fees, which are not part of the regular operations but are necessary for the business.

There are several ways that expense claims can be generated:

Receipts: The most traditional way, employees save their receipts from business-related purchases and submit them along with their expense claim reports.

Credit card statements: If the company provides a business credit card, expenses can be tracked directly from the card statement.

Mobile apps: Many businesses now use expense management apps that allow employees to snap a picture of their receipt and submit it instantly.

Per diem allowances: In some cases, businesses may provide a daily allowance for employees to cover their expenses. Any spending beyond this allowance would need to be claimed separately.

All these methods have pros and cons, and the best choice often depends on the size and needs of your business.

How businesses track and manage expense claims

Traditionally, companies have relied on manual processes for tracking and managing expense claims. This usually involves employees filling out paper expense reports, attaching physical receipts, and submitting them to their manager or a controller.

The manager then reviews and approves the claims. After that, the reports are forwarded to the accounting department for further processing. The accounting team enters the data into the accounting system, verifies the expenses, and issues reimbursements to the employees.

Sounds like a lot of work, doesn’t it? And it is. But that’s not even the worst part. Think about all the hassles and potential errors that could occur.

- Employees must keep track of all their receipts and submit them on time.

- Managers must review and approve each claim individually, wasting valuable time that could be better spent elsewhere.

- Fake or inflated claims can slip through, causing financial losses.

- Accounting errors can occur when manually entering data, leading to discrepancies in financial records.

- Delays in processing can lead to late reimbursements, causing employee dissatisfaction.

- The accounting team has to extract and categorize the data for tax purposes, which can be time-consuming and error-prone.

- Inaccurate data could hamper financial planning and budgeting, leading to poor business decisions.

With all these hurdles, it’s no surprise that many businesses are embracing automated expense management solutions. These tools streamline the entire process, from submission to approval to reimbursement. They can also integrate with your accounting system, making tracking and categorizing expenses easier.

Why should you consider automating your expense claim process?

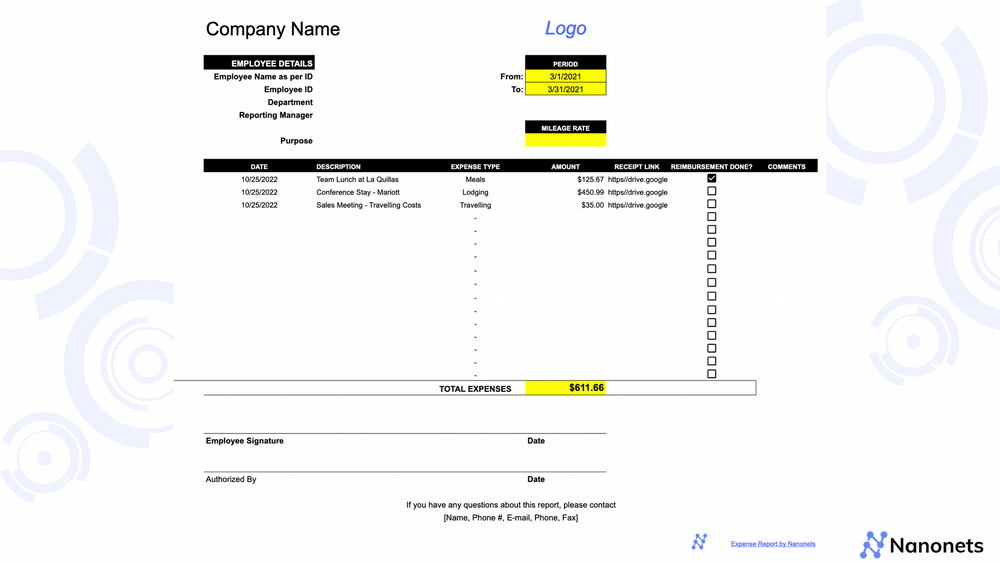

Picture this: an employee snaps a receipt and uploads it to an online platform. It automatically extracts the data, categorizes the expense, and submits the claim. The claim is then automatically routed to the appropriate manager for approval, followed by the accounting department for processing. The employee gets reimbursed, and the expense data is automatically recorded and categorized in the accounting system.

With an automation solution like Nanonets Expense Claim OCR, this is not a hypothetical scenario but a reality. You can eliminate the need for manual data entry, reduce the risk of errors, and speed up the entire expense claim process.

There are several reasons why you should consider automating your expense claim process:

1. Improves processing speed: Automation eliminates manual data entry, speeds up approval times, and ensures faster reimbursements. Your team can focus on more important tasks instead of getting bogged down with paperwork.

2. Cut down manual intervention: Since rules and workflows are set right at the beginning, managers and accounting teams don’t have to spend as much time reviewing and approving each claim. This reduces the risk of human error and ensures consistency in the process.

3. Reduces inaccuracies: Invalid data, duplicate entries, and fraudulent claims are flagged automatically and can be dealt with immediately. This ensures that your financial records are accurate, reliable, and compliant.

4. Enhances visibility: With automation, you get real-time visibility into your expenses. You can track spending trends, identify areas of high expenditure, and make informed decisions to control costs.

5. Ensures compliance: Automated systems can be programmed with your company’s expense policies and IRS regulations. This ensures all claims are compliant, reducing the risk of audits and penalties.

6. Simplifies reporting: Automated tools generate detailed reports, making it easier to analyze data and gain insights into your spending patterns. This can help in budgeting and financial planning.

7. Improves employee satisfaction: Employees don’t want to file hundreds of expense reports or wait weeks to get reimbursed. With an automated system, they can submit their expenses easily and get reimbursed quickly; no more chasing after approvals or worrying about lost receipts.

8. Environmentally friendly: No more printer and copier usage. By going digital, you’re reducing your carbon footprint and contributing to a more sustainable environment.

9. Scalable: As your business grows, so will your expenses. Unlike manual processing, automated systems can easily scale to accommodate more users and transactions, ensuring smooth operations as your company expands.

10. Saves money: Sure, there’s a price tag on automating your system, but consider this: No more expenses on paper, ink, and other sundries. No more paying for hours spent on tedious manual data entry and processing. Plus, improving accuracy and reducing duplicate and fraudulent claims can save you more money in the long term.

How to automate your expense claim process

Your business may have unique needs and requirements. A small business might only need an OCR tool to capture receipt data. The rest could be managed using a spreadsheet.

A mid-sized company, on the other hand, might need a more comprehensive solution. One that handles everything from data capture to approval workflows to integration with accounting software.

Make sure you understand your requirements clearly before you think about automation.

Here’s a quick rundown of the steps you can follow to automate your expense claim process:

1. Identify your needs

Determine what you want to achieve with automation. This could be faster processing times, reduced errors, better compliance, or all of the above.

Also, consider factors such as:

- The size of your company

- Your expense policy

- The volume of expenses claims you handle

- The technical capabilities of your team

- Your budget

- Hurdles in the existing workflow

2. Evaluate available solutions

Research the market for available expense management solutions. Look for features that align with your needs:

- OCR for data capture and processing

- Rule-based approvals for faster processing

- AI-powered anomaly flagging

- Self-learning algorithms for categorizing expenses

- Integration with your accounting software

- On-the-go expense submission

- Customizable approval workflows

- Compliance checks and alerts

- Detailed reporting and analytics

3. Choose an expense management solution and implement it

Consider factors such as user-friendliness, training required, scalability, security measures, cost, and customer support while choosing a solution.

Narrow down your options. Request a demo or a trial period. This will give you hands-on experience with the software and help you determine whether it fits your business well.

Once you’ve found the right solution, you can implement it in your organization. This may involve:

- Training your employees

- Defining the eligible expenses, approvers, approval limits, and workflows

- Setting up the roles and system to comply with your expense policy and regulations

- Integrating it with your existing systems (accounting, payroll, HR, etc.)

4. Monitor and optimize the performance

Check the accuracy of data capture, approval times, and reimbursement times. Find out how often manual intervention is needed and whether the system correctly flags anomalies. Update the roles and rules as necessary.

Keep track of user feedback. Are your employees finding the system easy to use? Are they able to submit their expenses and get reimbursed quickly? You can use their feedback to make improvements.

Also, monitor the system’s impact on your bottom line. Are you saving time and money? Is the tool helping you control costs and reduce fraud?

How Nanonets can help automate your expense claim process

Expense claim processing gets a lot easier with Nanonets. You can automate the entire expense claim process, from receipt capture to expense approval and payment processing.

Here is a quick overview of how Nanonets can help:

1. Automate data capture: Employees can upload their receipts in bulk and have all the information automatically extracted and categorized. No worrying about formatting or manual data entry errors.

2. Centralize expense management: All the expense claim is stored in one place, making it easy to track, manage, pay, and audit. You can easily export the parsed data as CSV or Excel files for further analysis or reporting.

3. Work with an intelligent model: Our expense claim processing model learns from your actions over time. This helps improve the accuracy of data extraction and categorization, making the process more efficient over time.

4. Customize the workflows: You can set up approval workflows that align with your company’s policies. This ensures all expense claims go through the necessary checks and balances before approval.

5. Automatically flag anomalies: Identify unusual expense claims based on historical data and flag them for review. This helps in preventing fraud and maintaining compliance with company policies.

6. Integrate with existing systems: Seamlessly integrate with tools like Google Drive, Zapier, Xero, Sage, Gmail, QuickBooks, and more. Forget about endless data migration and enjoy a smooth transition.

7. Access real-time analytics: Get insights into your spending patterns, identify trends, and make data-driven decisions. Monitor your expense claims in real time and take prompt action when necessary.

8. Ensure compliance: With built-in compliance checks and alerts, you can ensure that all expense claims adhere to your company’s policies and regulations. Maintaining an audit trail becomes effortless, and you can avoid any potential legal issues.

Final thoughts

Managing expense claims is vital to any business. However, it is easy to lose track of expenses, especially when you’re chasing growth and expansion.

The good news is that automating the expense claim process helps. It not only saves you time and money but also keeps your operations running smoothly.

It reduces manual errors, ensures compliance, improves budgeting accuracy, and provides a clear view of your company’s spending. This isn’t just about cost control — it’s about making intelligent, informed business decisions.

Nanonets can support you in this journey by providing an intelligent, reliable, secure, and efficient solution for expense claim processing. Our platform is designed to adapt to your business needs, making the shift to automated expense management smooth and painless.

Schedule a demo with Nanonets today and let us help you streamline your expense management.

NEWSLETTER

NEWSLETTER