Image Source: Getty Images

long term investors in Sainsbury’s (LSE: SBRY) stocks may tell the difference in supermarket returns this year after a difficult 2022.

The company’s share price has risen 15.5% since the beginning of January, which means it is now only down 6% in 12 months. In addition, dividend distributions that exceed the index cause the FTSE 100 Stocks an attractive option for passive income seekers.

If you had some extra cash, this is how you would invest in the UK supermarket chain for an annual return of £300.

dividend investment

As I write, Sainsbury’s share price stands at 260.10 pence. At today’s price, the dividend yield offered is 4.66%.

To aim for £300 in passive income per year, you would need to buy 2,500 shares. That would cost me a total of £6,502.50. I could expect just over £303 in dividends from my initial investment if I held the shares for a year.

Some caution is called for here, as several city analysts expect the dividend to fall to 11.5 pence per share next year. They anticipate that it will also not exceed 12 pence per share in 2025.

Dividend forecasts aren’t always correct, but it’s worth noting that yields can drop and distributions can be reduced or stopped at any time.

If the supermarket’s profitability comes under pressure as consumers tighten their budgets in the cost-of-living crisis, payments to shareholders could be cut.

However, with today’s performance, Sainsbury’s looks like a useful passive income generator to add to my stock market portfolio.

The outlook for Sainsbury’s shares

I think there are several reasons to be optimistic about the prospects for Sainsbury’s share price growth.

The company’s recent third-quarter business update revealed total retail sales growth of 5.3%. Encouragingly, the business delivered quarterly sales growth in all key areas, namely Groceries (+5.6%), General Merchandise (+4.6%) and Apparel (+1.3%).

The grocery industry is notoriously competitive. In that regard, it’s good to see Sainsbury’s outperforming its rivals on a number of metrics. Customer satisfaction is higher than in Tesco, Asda and Morrisons. In addition, Sainsbury’s outperforms the trio in speed of checkout and availability of colleagues.

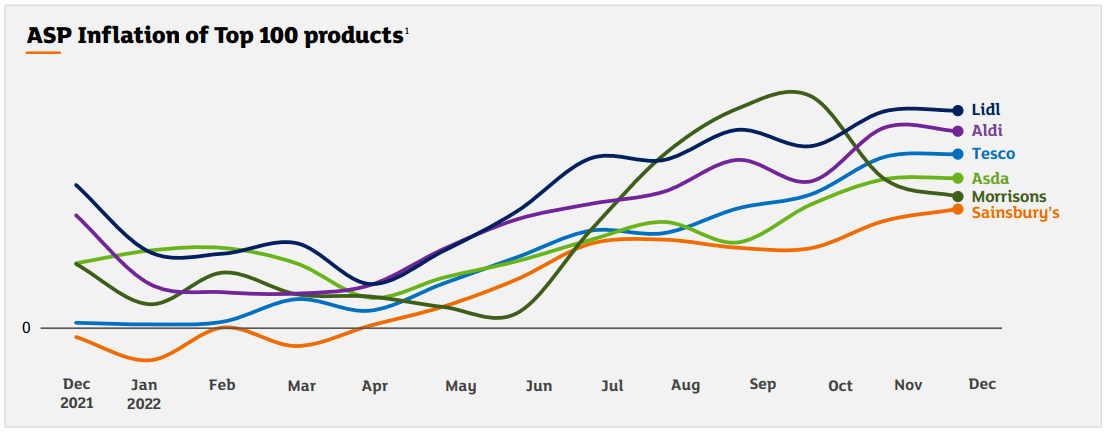

Fundamentally, inflation on the company’s top 100 products lags behind all major competitors. This includes British brands as well as low-price chains Aldi and Lidl.

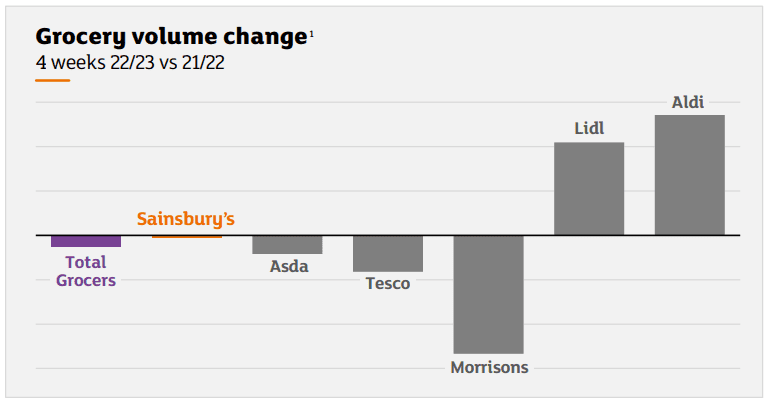

However, German challengers continue to enter the sector. In the four weeks leading up to Christmas, both Lidl and Aldi posted big increases in their grocery volumes, while Sainsbury’s stayed afloat.

Competition remains a risk for Sainsbury’s shares, as it forces the supermarket to cut its margins. So is the inflationary environment, which could continue to weigh on the company’s profitability. However, I think it has enough size and brand strength to weather a tough macro environment.

An interesting development is the recent news that Britain’s second largest wholesaler, Bestway, has taken a 4.47% stake in the business. A takeover could lift Sainsbury’s share price this year, although this is only a speculative possibility at the moment.

Despite some risks, Sainsbury’s shares currently look cheap to me. If I had some extra cash, the company would be on my buy list to aim for a regular passive income stream.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);