Image source: Getty Images

A common way to value stocks is to look at their price-to-earnings (P/E) ratio. As a general rule, the lower it is, the cheaper the stock, although there are a couple of important caveats to consider: Both the company's earnings and debt sustainability matter. Currently, a well-known FTSE 250 The stock sells for pennies and has a P/E ratio of just 8.

So is it a bargain that I should buy for my wallet?

Recognized consumer brand

The action in question is dr martens (LSE: DOCUMENTS).

With an iconic footwear brand, a large customer base and a unique place in the market, I think there are a lot of things to like about the business.

So why are FTSE 250 shares selling for pennies? (And why has it fallen 88% since it listed on the London Stock Exchange just three years ago?)

The answer lies in the company's weak performance lately.

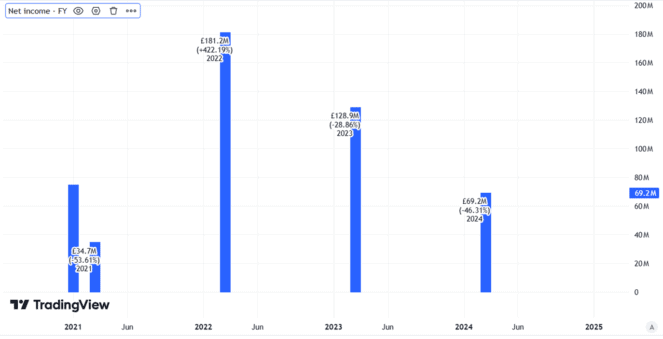

Take last year as an example. Revenue fell 12%. Profit after taxes plummeted 46%.

Created using TradingView

Meanwhile, net debt rose 24%. As I said above, debt is important when it comes to valuation, as its servicing and repayment can impact earnings.

Potential for change

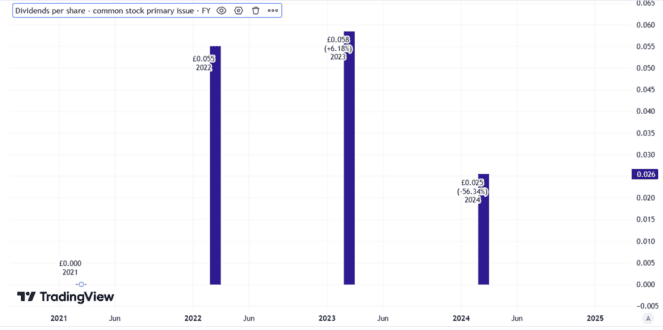

Still, although the company's after-tax profits fell sharply, it remained firmly in the black. It cut the dividend, but did not cancel it completely.

Created using TradingView

Weak demand from US consumers was seen as a key reason for last year's poor performance. But the company announced plans to address that, including increasing marketing spending in the crucial region.

The most recent update came in July, when the company said operations in its latest quarter had been in line with expectations. I think there will be a big test this month, when Dr. Martens announces his interim results.

If they contain positive news on sales and cost trends, I think the current share price could be a bargain.

However, the opposite could happen. If there are only weak signs of change (or none), the stock price may fall further. Dr Martens shoes are not cheap and US consumer spending remains quite weak.

I'm not going to buy

I'm not in a hurry to buy here. The huge drop in the company's share price since going public points to a number of factors that worry me, from net debt to the apparent fragility of the business model.

In the best case scenario, I think the business may start to show evidence of a turnaround and see the share price rise. But that change is unlikely to happen overnight. Therefore, I will probably have time to buy when the evidence of this comes, even if it means paying a higher price than today for the FTSE 250 share.

Meanwhile, the risks worry me. Dr Martens is a strong brand, but it is a company that has been facing significant challenges. Those can continue.

NEWSLETTER

NEWSLETTER