Image source: Getty Images

If I were starting out as an investor and only had a small sum at my disposal, I would consider FTSE 100-listed growth and participation in dividends tesco (LSE: TSCO).

It is the largest supermarket in the country. For every £1 British shoppers spend at big supermarket chains, 28p goes to Tesco, according to analysts Kantar.

Sainsbury's It is the second most popular supermarket in the UK, but costs just 15.2p in every £1. So there is a big gap between the winner and the runner-up here.

Strength… with risks

If I were just starting out, I would want to buy a stock that was in good shape. As I have gained more experience, I have become accustomed to targeting distressed companies in the hope that their stock will recover when they are resolved.

That's not a strategy for an absolute beginner. Tesco's share price is certainly not struggling. It has risen 27.83% in the last 12 months, easily beating the FTSE 100 average return of 11.36%. This isn't just a flash in the pan either. In five years, Tesco is up 45.81%.

Past performance is not a guide to the future. For Tesco's share price to continue rising, it will need to continue boosting sales and profits, and keep costs in check.

It faces a new challenge after yesterday's (October 30) autumn budget, which saw chancellor Rachel Reeves increase employers' national insurance contributions. This will hit Tesco harder than most as it now employs 326,000 people.

This stock appears to be good value for money.

Paying more NI will reduce the already razor-thin margins of 4.1%. Given the competitive nature of the UK grocery market, you may find it difficult to convey these to customers. On the other hand, rivals Sainsbury's, Asda, Morrisons, Aldi and Lidl also have large staff and are now facing exactly the same challenge.

I expect Tesco's revenue to rise as the cost of living crisis subsides. If interest rates start to fall, that should put money in buyers' pockets. But there are no guarantees that this optimistic scenario will succeed.

I wouldn't want to pay more for my first action. Despite its strong recent performance, Tesco shares are valued at a modest 14.71 times earnings. That's just below the FTSE 100's average price-to-earnings ratio of 15.4 times.

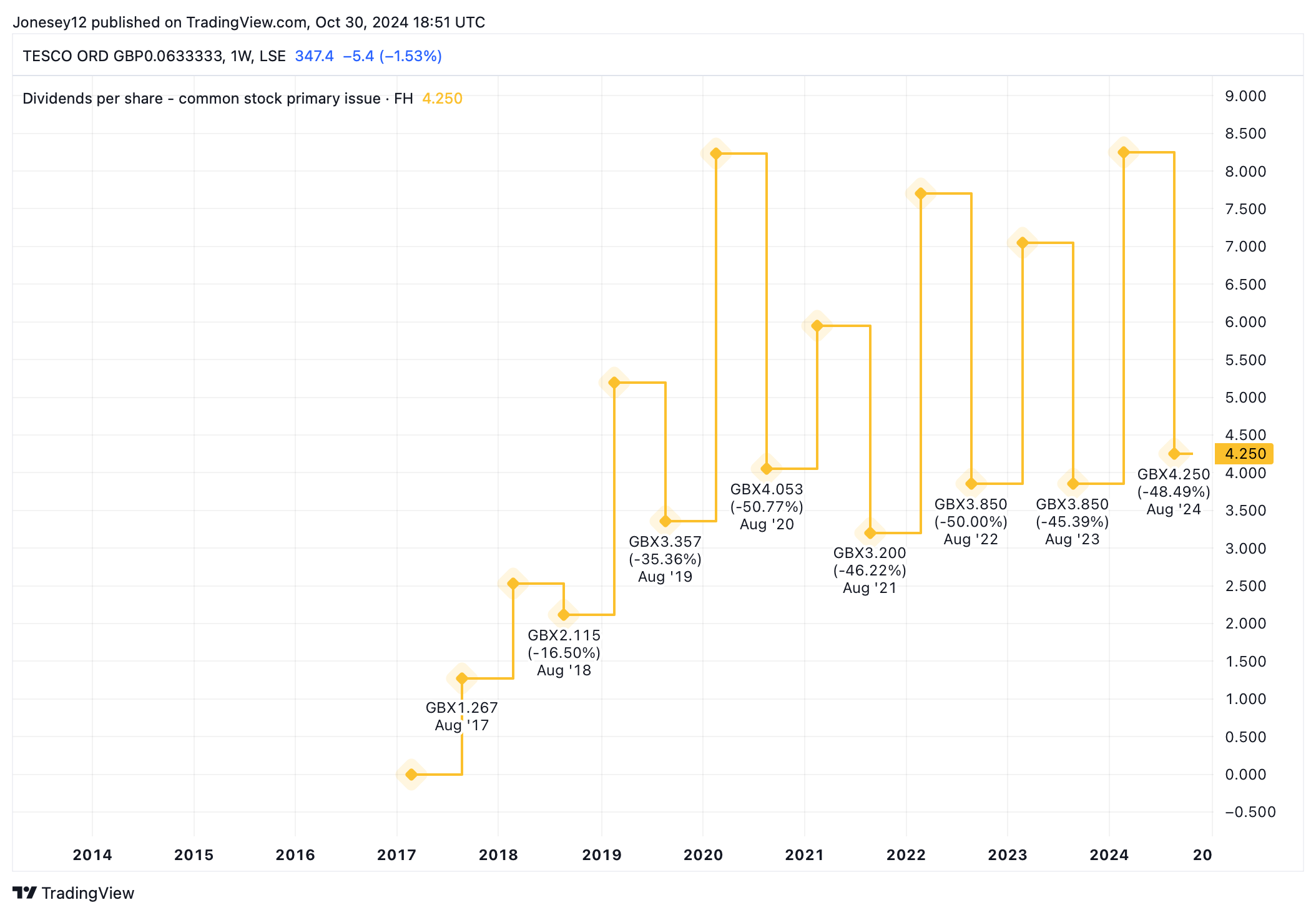

Tesco shares have a residual yield of 3.71%, a fraction above the index average of 3.5%. It is comfortably covered twice by earnings. When I look for a stock, I would like to see a good history of dividend growth. I admit that Tesco has been inconsistent lately, as this graph shows.

Chart by TradingView

I only buy stocks that I plan to hold for at least five years and ideally much longer. In that time, Tesco will inevitably suffer ups and downs. It has struggled before, especially under Philip Clarke, but bounced back after Dave Lewis replaced him in 2014. Tesco has shown a lot of resilience. And that's why it seems like a solid place to invest my hypothetical first £1,000.

NEWSLETTER

NEWSLETTER