Image Source: Getty Images

The passive income of actions and actions sounds great, right? But many detractors jog all the reasons why it will only be an impossible dream.

I can't cover all your statements. But today I want to trample some common ones.

Myth 1: A lot of money is needed

Some passive income ideas could cost a lot of money to establish. The rental state of rent is common, but that means having enough effective for a property or taking a great mortgage. Actually, even that may not be true, and I will return to that.

The stock market is only for well -cured investors, yes? Well, no. I just did a quick online search. And I see with Isa's actions and actions I BellWe can invest only £ 25 monthly or make a unique transfer of £ 250. That is not unusual and it is not a recommendation, it is only the first one I found.

Other ISA platforms are similar. In addition to costing very little to start, they are easy to open. The more we can invest, the better we are likely to do. But we can really start with modest amounts of money.

Myth 2: It is very risky

The idea of putting our money in a company that is sought scary. It can happen, but we can greatly reduce the risk.

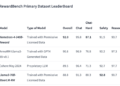

All we need to do is consider actions in a stock market tracker, such as Ishares Core Ftse 100 UCits ETF (LSE: ISF).

But do not fear, the name is more complicated than the thing itself. It is just a quoted background in the stock market (that is what the ETF bit means), and extends the cash through the Ftse 100.

In the last five years, the price of the tracker action has increased by 51%. That is a tone below 53% that Footsie has achieved. And once we take into account the modest positions of the background, it is quite explosive.

In the last 20 years, the FTSE 100 has returned an average of 6.9% per year. If that continues, I think that investors should expect something similar from the Ishares tracker. And that, aggravated for a few decades, could offer some good passive income.

Of course, a tracker fund shares the general market risk. And we can lose money in them when the market falls. But diversification should mean much less risk than individual actions.

Myth 3: Talent is needed

Securities market investment has long been involved in mystery. We have to understand all kinds of big words and make complicated financial sums to have a track, right? Well, that myth has also been destroyed these days. I think it is quite clear that investing in a simple tracker bottom does not require egg head brains.

Taking into account investment trusts, which distribute cash using specified strategies, it is an upcoming common movement. Do you want income from the United Kingdom dividends? Look for one to do that. Genius is not required. Oh, do you remember that thing about real estate income? There are investment trusts that do so too.

And there is an advantage: the more we expand our investment horizons, the more intelligent we can obtain it.

(Tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER