Image source: Getty Images

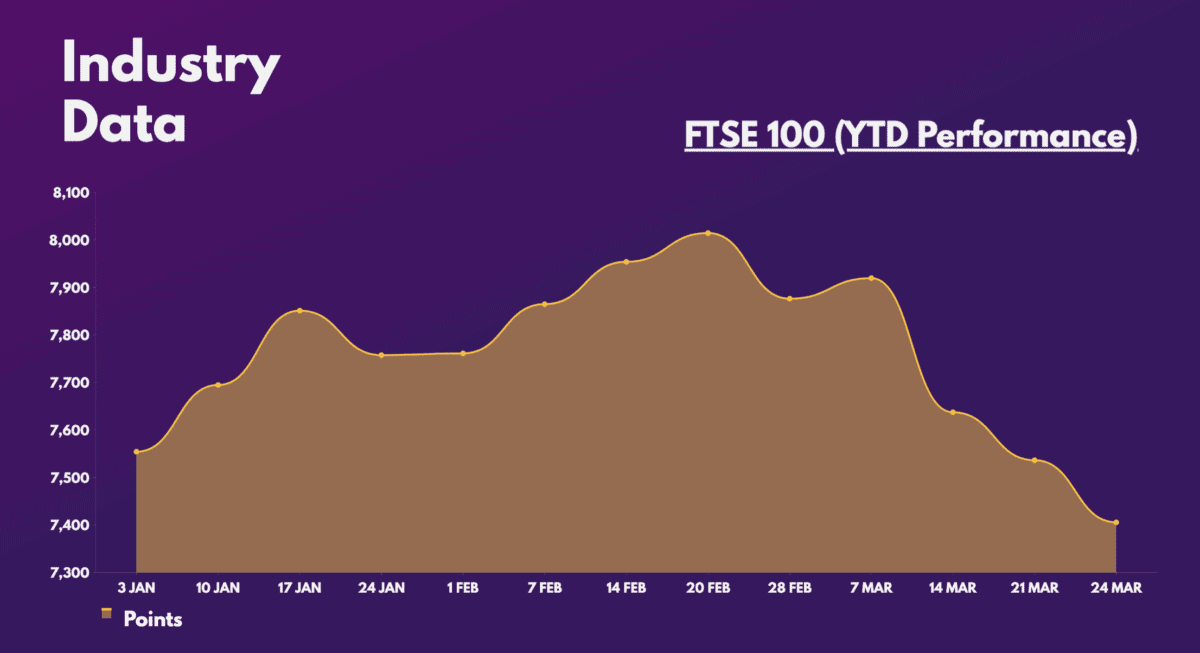

The UK’s main index finally did it: it reached an all-time high of 8,014 at the end of February. However, since then, a bout of fear around bank stocks, as well as weak industrial data, has caused to drop more than 600 points. With the headwinds increasing, can the FTSE 100 get it back to its highs?

Citi analysts aren’t too optimistic

analysts of citi They are not overly optimistic about the outlook for the FTSE 100 this year. The broker has now revised his prediction for the UK market to end the year at 7,600, from an initial 8,000. However, there are reasons for this.

The recent turmoil in the banking sector has sparked fears of contagion. Meanwhile, manufacturing activity has been contracting, made worse by China seeking to cap raw material prices. And with financials, industrials and materials accounting for 43.4% of the FTSE 100, it’s easy to see why optimism has waned.

| Sector | Weight in FTSE 100 |

|---|---|

| Consumer Staples | 17.9% |

| finance | 17.8% |

| Materials | 13.4% |

| industrial stocks | 12.2% |

| Health care | 11.7% |

| Energy | 9.5% |

| discretionary consumption | 6.9% |

| communications | 4.3% |

| Real estate | 1.4% |

| Technology | 1.4% |

Banking on a soft landing

So it’s not hard to see why the FTSE 100’s uptrend at the start of the year has reversed. Inflation remains high and new rate hikes by central banks are not ruled out. While this is normally good for banks, it could put more pressure on the already fragile banking system.

This has not been helped by a recent report published by S&P, which predicts that inflation will worsen in the UK. The credit agency anticipates that inflation will remain high at least until the end of the year, which may prompt further rate hikes.

By contrast, however, the Bank of England expects inflation to fall to around 2% by the end of the year. He also expects this to happen without the UK sinking into recession, due to consumer strength. The last retail sales data is evidence of this.

Should I keep buying FTSE 100 shares?

This all leads to the question of whether FTSE 100 shares are still worth buying if there is not much room for the index to grow. Well, Footsie may not hit 8,000 again in 2023, but that shouldn’t stop cheap stocks with great potential from rising this year.

After all, UK stocks, which are famously low in value, are now even cheaper. This is especially the case for bank stocks. Much stronger capital and cushions from UK banks make their current valuations very lucrative, which presents me with a buying opportunity.

| Metrics | lloyds | barclays | NatWest | HSBC | Santander | industrial average |

|---|---|---|---|---|---|---|

| Price-to-book (P/B) ratio | 0.6 | 0.3 | 0.7 | 0.7 | 0.6 | 0.7 |

| Price-Earnings Ratio (P/E) | 6.2 | 4.2 | 6.9 | 8.8 | 5.8 | 9.0 |

| Forward price-earnings (FP/E) ratio | 6.4 | 4.4 | 6.0 | 5.3 | 5.5 | 5.5 |

But if I don’t like that, I still have a range of other cheap FTSE 100 stocks to invest in, such as miners, retailers and even homebuilders. One of those actions that catches my attention is taylor wimpeywhich has a dividend yield of 8.2% and trades at large valuation multiples.

| Metrics | taylor wimpey | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.9 | 0.9 |

| Price-Sales Ratio (P/S) | 0.9 | 0.8 |

| Price-Earnings Ratio (P/E) | 6.3 | 9.8 |

| Forward price-to-sales ratio (FP/S) | 1.2 | 1.2 |

| Forward price-earnings (FP/E) ratio | 12.8 | 10.4 |

Either way, I am not too caught up in noise and short-term volatility. Rather, I’m more interested in investing in companies based on fundamentals and their future outlook, and the FTSE 100 has a lot of stocks for just that.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);