stocks may have posted most of their gains amid one of the longest pauses between Federal Reserve interest rate moves on record, leaving investors pinning hopes for a rebound in the second half on the strength of corporate earnings and earnings forecasts for the coming months.

The S&P 500 reversed some of its year-to-date gains in early April amid concerns that sticky inflation readings and a resilient labor market would prevent the Federal Reserve from meeting its three-quarter rate cut forecast. spot.

However, the index has largely recovered those declines in May, rising just over 3% to extend its year-to-date gain to 8.8%.

The S&P 500's last all-time closing high, recorded on March 20, pegged the benchmark index at 5,224.62 points, just 0.4% from its current level, suggesting a new record streak is on the way.

Better-than-expected corporate earnings, particularly from the so-called 7 tech heavyweights, have driven much of the recent advance, while a pullback in Treasury yields is tied to the Federal Reserve chair's confidence. , Jerome Powell, that rate increases are not on the table. soon has also helped.

With about 80% of the S&P 500 reporting March quarter earnings, collective earnings are forecast to rise 7.1% from a year ago to $466 billion. In the June quarter, it is estimated that they will grow 11.1% compared to the previous year, up to 496.6 billion dollars.

Meanwhile, last week's April jobs report offered what Wall Street calls a Goldilocks assessment of the world's largest economy that is typically tied to strong near-term stock performance.

Employers added 175,000 new jobs last month, a figure that showed enough of a slowdown from the upwardly revised 315,000 in March to quell fears of new wage pressures but still suggests solid hiring momentum into the summer. .

That helped 10-year Treasury yields, one of the most important valuation metrics on Wall Street, lose nearly 0.3 percentage points from their late April peak to trade at their current level of around 4.485%.

Bond Yields Are Declining

As an indicator of a risk-free borrowing rate, a lower 10-year yield is generally associated with higher asset prices (such as stocks and bonds), while higher yields generally add to downward pressures on the market.

“The Federal Reserve is now accepting that rates need to stay high longer given persistent inflation. It also rejected hikes,” BlackRock said in its weekly market commentary, led by Jean Boivin. “However, greater macroeconomic volatility makes it more difficult for markets and authorities to predict what lies ahead.”

“That's why we rely on new data, rather than policy signals from the Fed, to shape our view of the likely policy path,” he added.

Related: Jobs report may show red-hot market, which has defied Fed rate hikes, cooling

Meanwhile, rate traders now see the Federal Reserve in September carrying out the first of two likely rate cuts for 2024, bringing the Fed Funds benchmark level to between 5% and 5.25% as the economy slows and inflation cools.

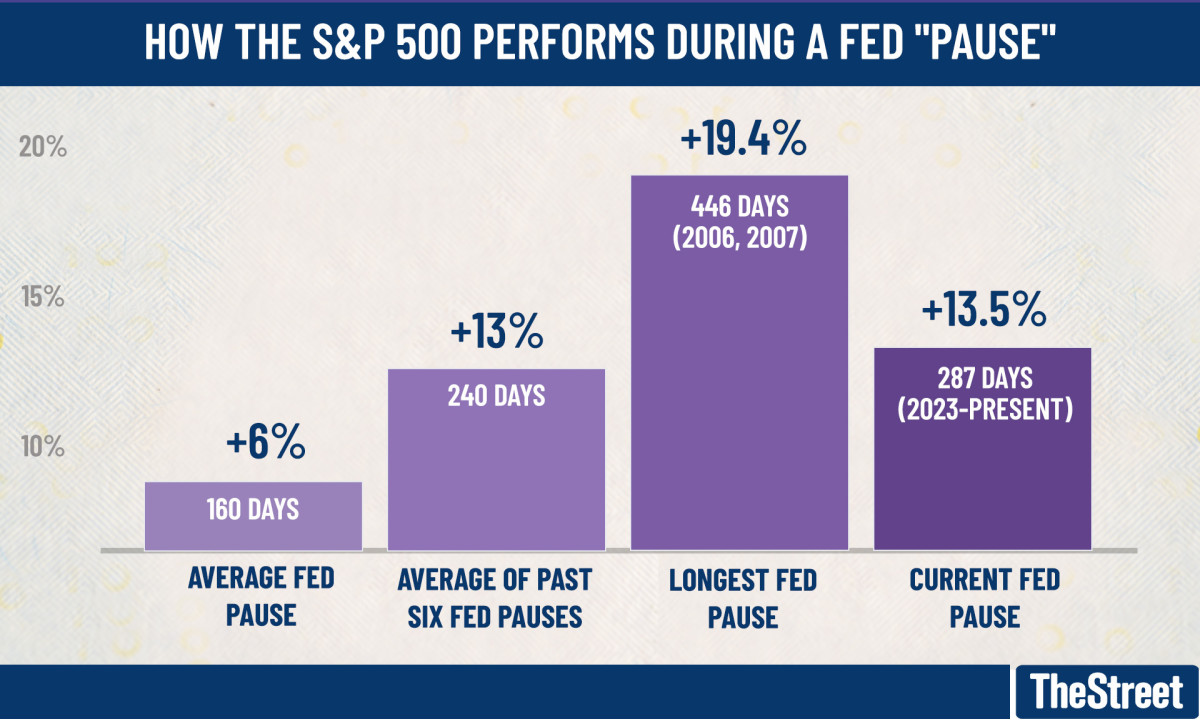

That would mark a gap of about 420 days from the Fed's previous rate hike, which was unveiled in July 2023 and would be the second-longest pause in Fed policy on record.

“Long pauses have historically been pretty good environments for stocks, and we're in one right now, even if they end this summer (which is far from certain),” said Jeff Buchbinder, chief equity strategist at LPL Financial.

stocks in the financial and energy sectors have generally outperformed their peers during a pause in Federal Reserve policy, rising an average of 16.9% and 15.1%, respectively, over the past six instances.

The pause that refreshes

Buchbinder also notes that the S&P 500's average gain during an average Fed pause is 6%, citing data collected over the past five decades.

However, longer pauses have produced better results: Buchbinder says the average gain over the last six political gaps, dating back to 1989, has been just over 13%.

We are already ahead of that.

The broadest benchmark of blue-chip U.S. stocks has gained more than 13.5% since the Federal Reserve raised rates in July last year, while the tech-heavy Nasdaq has gained 15.5%. 2%.

“It is important to remember, however, that monetary policy is only one factor that influences markets,” Buchbinder warned. “There are other key fundamentals, such as the economy, earnings and, in the long term, valuations.”

David Bahnsen, chief investment officer at Bahnsen Group in Newport Beach, California, agrees. He argues that the market's current gains are “driven more by 'fear of missing out' than by confidence in fundamentals” now that the Fed is deeply entrenched in a wait-and-see attitude.

“With no rate cuts possible until July, and probably not until September, and with the next earnings season two months away, there are no apparent catalysts to change the future direction of stocks beyond speculation,” he said.

This likely forces investors to focus on stock and sector valuations as drivers of near-term performance.

“Every category of context – macroeconomic, fiscal, monetary and geopolitical – cries out for a focus on value and quality right now,” Bahnsen said.

stocks are rich but earnings are improving

LSEG data pegs the S&P 500's trailing 12-month price-earnings multiple, a key Wall Street valuation metric, at 20.1 times, a level that's about 2 points above its recent five-year average. , but well below the maximum of 24.4 times. recorded in the summer of 1999.

But BlackRock's Boivin says that level shouldn't scare investors. He notes that he and his team are tactically overweight US stocks, thanks to strong earnings support and neutral long-term bond yields.

“Higher interest rates generally hurt U.S. stock valuations,” BlackRock's Boivin said. “Instead, strong first-quarter earnings have supported stocks even as high rates and lofty expectations raise the bar for what can keep markets optimistic.”

Related: The Federal Reserve faces a fine line between inflation hawks and slow growth realists

However, earnings will have to continue to improve if the Federal Reserve is willing to remain stagnant well into the year, or possibly beyond, while at the same time inflation remains as stubbornly sticky as it has been.

LSEG data pegs 2024 earnings growth at 10.4%, improving to 14% in 2025.

More economic analysis:

- Beware of 8% mortgage rates

- Hot inflation report hits stocks; this is what happens next

- Inflation report will disappoint markets (and the Federal Reserve)

That may not be too difficult to achieve if consumers continue to spend, argues Jason Pride, head of investment strategy and research at Glenmede. He says earnings improvements “should be a tailwind for most stock markets in 2024.”

“Despite the pessimism expressed in surveys, American consumers continue to spend their money at a healthy pace,” he said in a note written with the investment firm's vice president of investment strategy, Michael Reynolds.

“Consumption growth has outpaced personal income in four of the past five months, reflecting consumers' willingness to spend even if their incomes are not keeping up,” the pair said.

Related: A veteran fund manager picks his favorite stocks for 2024