Image source: Getty Images

On the back of an aggressive rate hike cycle in 2022, lloyds Shares in (LSE:LLOY) are up 35% from October lows. In fact, the bank stock is already up 15% this year. However, its shares are still cheap, so it may still be worth buying.

interesting developments

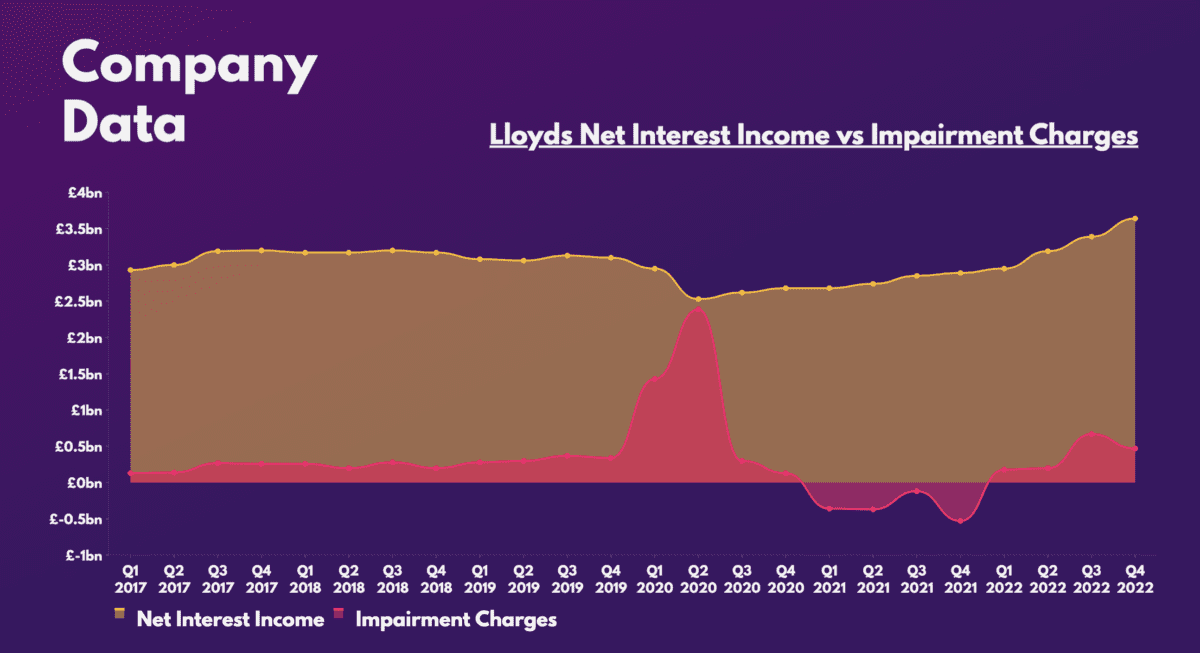

Lloyds reported its full-year results last month. Unfortunately, the numbers didn’t really impress. Net interest income (NII) saw a healthy improvement thanks to higher interest rates. This is the result of the company’s interest-bearing assets generating more income than the liabilities it has to pay. However, this was offset by higher impairment (bad debt) charges. As a result, Lloyds shares’ trajectory towards 60 pence has lost steam as net profit declined from a year earlier.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Interest margin (NII) | £13.17 billion | £11.16 billion | 18% |

| Net interest margin (MIN) | 2.94% | 2.54% | 0.4% |

| spoilage charges | £1.51 billion | -£1.39 billion | 209% |

| Net profit | £5.56 billion | £5.89 billion | -6% |

| Return on Tangible Equity (ROE) | 13.5% | 13.8% | -0.3% |

The perspective shared by Lloyds was not very good either. Compared to its other UK peers like barclays and NatWest, the Black Horse Bank disappointed with their guidance. It is forecasting a below-standard net interest margin (NIM) by 2023, with interest rates expected to peak very soon.

| Banks | 2022 YN | 2023 NIM Outlook |

|---|---|---|

| lloyds | 2.94% | >3.05% |

| barclays | 3.54% | >3.20% |

| NatWest | 2.85% | >3.20% |

However, the comparatively lower forecast NIM is also exacerbated by a number of other factors. The main one is that Lloyds has to share more of its NII with its clients, or risk undermining its strong liquidity. Furthermore, loan growth is very likely to slow due to the more difficult macroeconomic environment. This is not being helped by a declining property market, as Britain’s largest mortgage lender anticipates seeing lower loan income due to lower house prices.

Marginal improvements?

That being said, there are some catalysts that could help push Lloyds’ share price higher. The first would be the continued decline in deficiencies. In second place, JP Morgan now forecasts that the UK will narrowly avoid a recession. This could boost the lender’s bottom line from credit releases in 2023. And if house prices don’t slump, Lloyds will be poised to benefit from any rise in the housing market over the medium term.

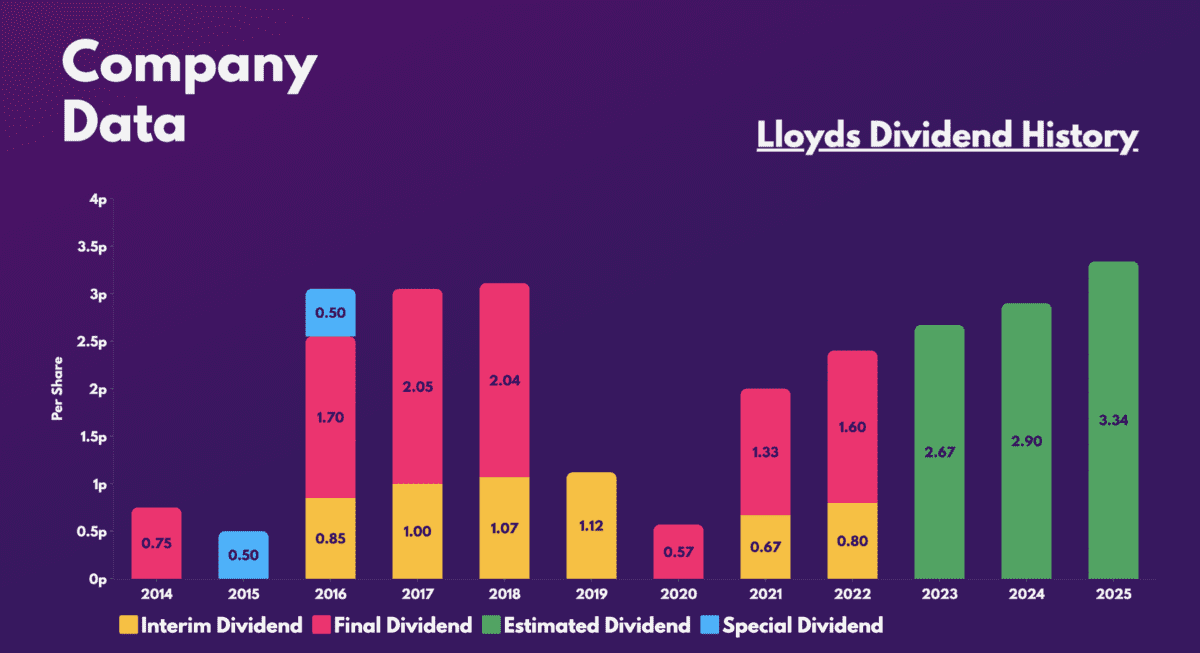

All of the following would not only result in a higher share price for Lloyds, but also a potentially higher dividend. This is because the group’s CET1 ratio (which compares a bank’s capital to its assets) is currently at 14.1%. This is comfortably above their target of 12.5%. Therefore, Lloyds plans to return excess capital to shareholders through share buybacks and dividends, starting with a £2bn buyback. As such, analysts project an increase in dividends over the next three years.

Are Lloyds shares a bargain?

So is Lloyds shares worth buying on that basis? Well, there are a number of things that suggest it. On the one hand, its solid balance sheet and liquidity insulates the FTSE 100 unconditional from any economic downturn. In addition, the conglomerate is geared towards better return on equity (ROTE) as well as tangible net assets per share in the coming years.

| Metrics | 2023 | 2024 | 2025 |

|---|---|---|---|

| Return on Tangible Equity (ROTE) | 13.5% | 14.1% | 14.9% |

| Tangible net assets per share | 52.7p | 58.0p | 60.1p |

More lucratively, Lloyds shares trade at relatively cheap current and future valuation multiples. It is therefore not surprising to see a number of investment banks, such as Barclays, UBSand German rating the stock a ‘buy’, with a 70p average price target. This presents a 37% advantage over current levels. For those reasons, I will be looking to increase my current holding in Lloyds.

| Metrics | lloyds | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.7 | 0.7 |

| Price-Earnings Ratio (P/E) | 6.9 | 10.0 |

| Forward price-earnings (FP/E) ratio | 7.6 | 8.6 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER