Image source: Rolls-Royce Holdings plc

He Rolls-Royce (LSE:RR) share price is up 179% in the last 12 months. But as engine flight hours recover to near their pre-pandemic levels, it may appear that the recovery is over.

I think that's a mistake. In my opinion, there are still other catalysts that can boost the company's profitability and help the stock rise even from this point.

Balance sheet

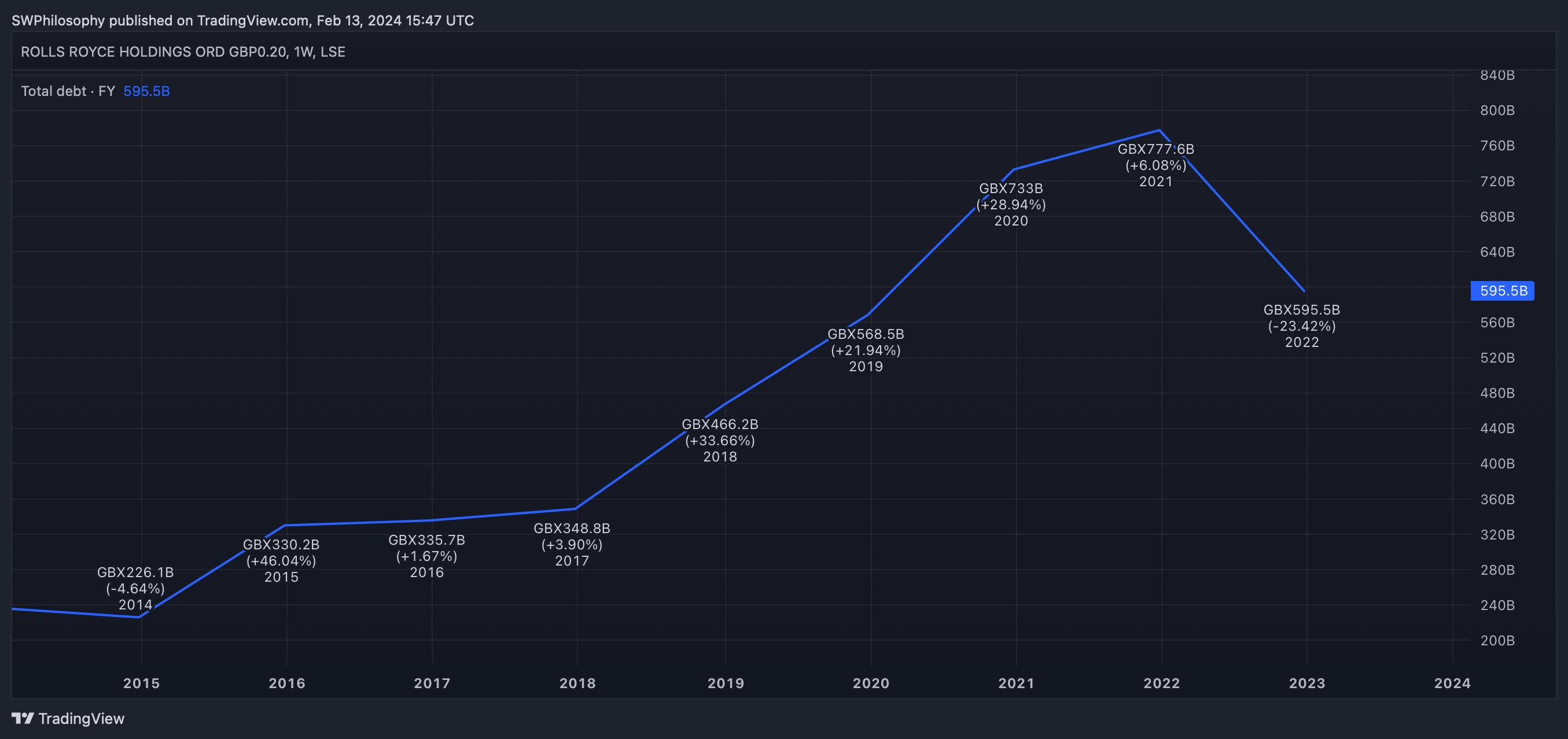

The first clear area of improvement I see for the business is its balance sheet. Rolls-Royce has just under £6bn in total debt, up from £3.5bn in 2018.

Rolls-Royce Total Debt

Created in TradingView

Much of this is due to the pandemic, where the company had to borrow cash to continue operating. But even with air travel almost fully recovered, the effects continue to weigh on the company's profit margins.

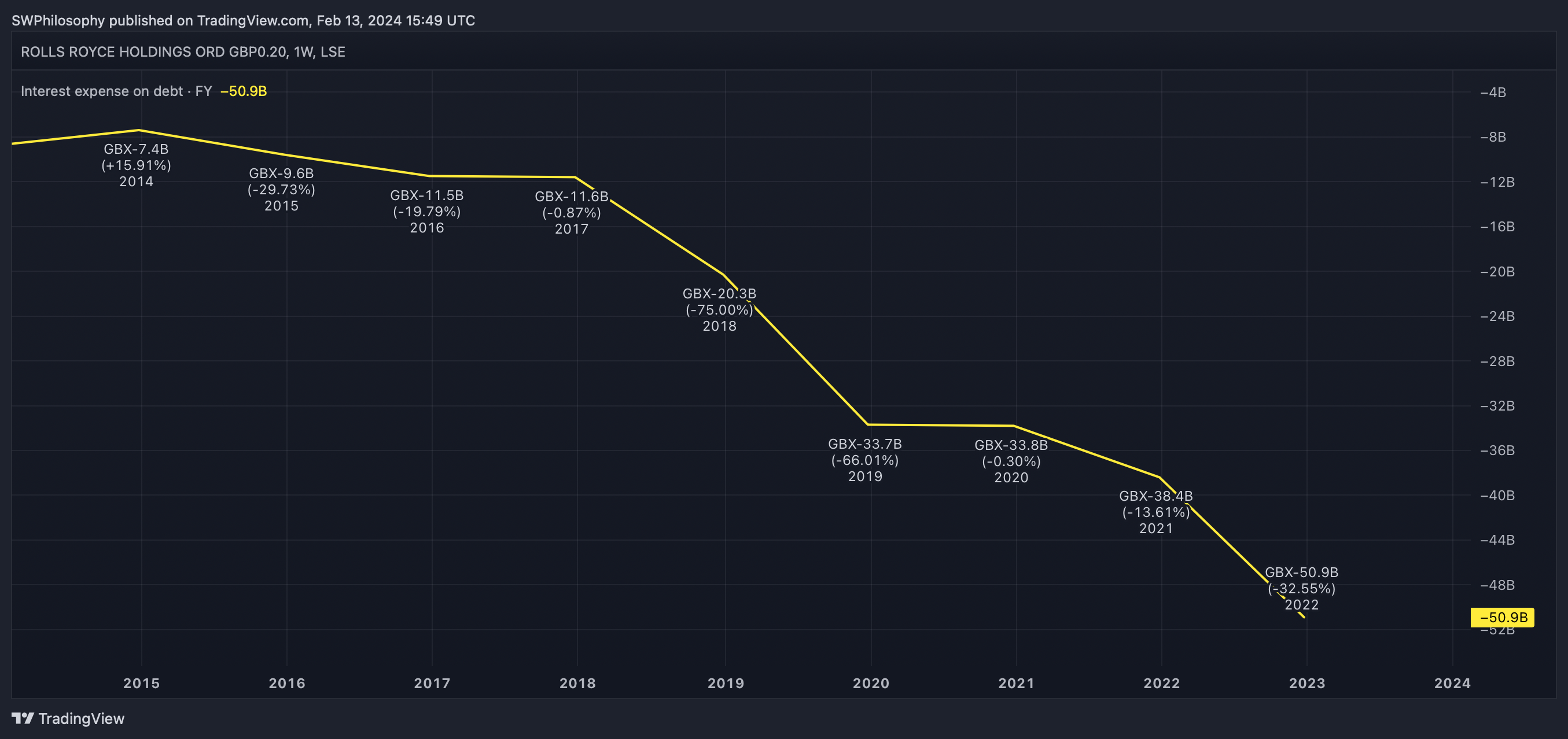

Rolls-Royce continues to pay more than double the interest than before Covid, as a result of much higher debt.

Rolls-Royce interest expense

Created in TradingView

In my opinion, this remains the stock's biggest risk. Demand may have recovered from the pandemic, but the company's bottom line has not.

Interest coverage

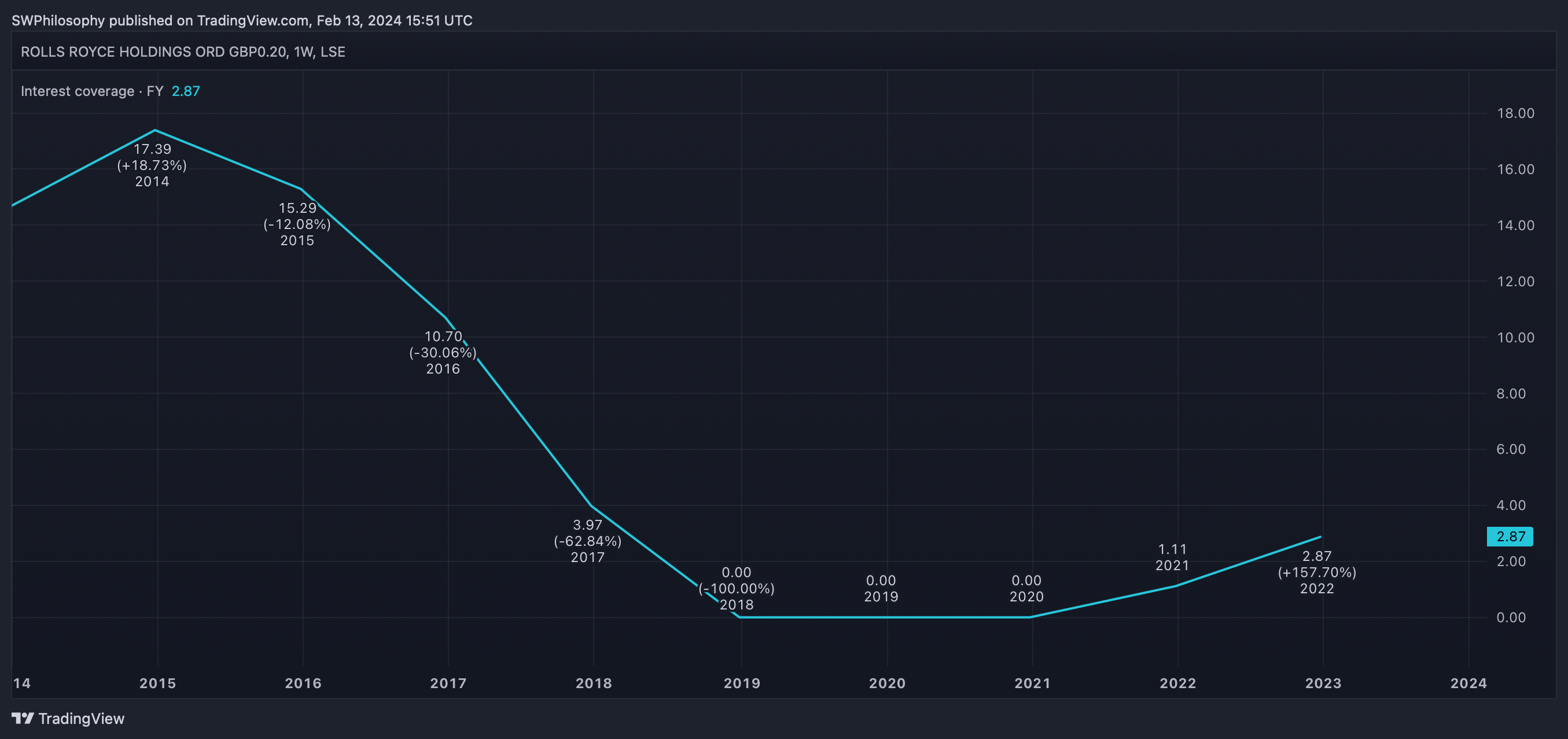

However, there are clear signs that Rolls-Royce is on the road to recovery. This can be seen in the interest coverage ratio, which measures a company's operating income against its interest expenses.

This figure fell below zero when the company was not generating profits in the Covid years. But it has started to improve and has reached 2.87, which implies that the company can cover its interest obligations.

Rolls-Royce interest cover

Created in TradingView

However, the most important thing is that there is still a way to go. An interest coverage ratio of 2.87 implies that 34% of operating income goes to interest, up from 3.97 (implying 25%) in 2017.

Reducing the company's debt levels should allow it to keep more of the cash it generates, rather than using it to make interest payments. And this should be positive for overall profitability.

Share count

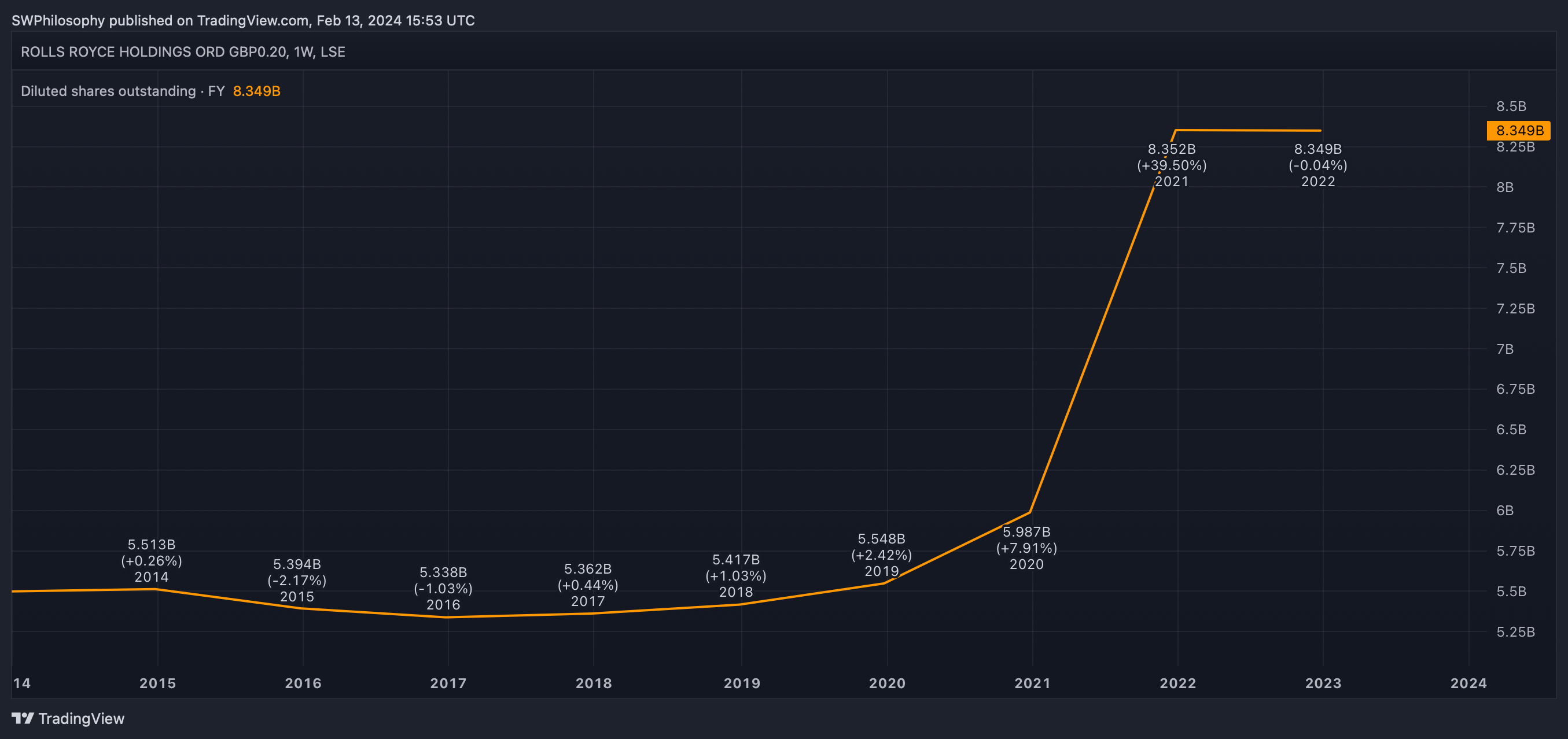

Another area where Rolls-Royce hasn't fully recovered is its share count. This increased from 5.33 billion to 8.35 billion.

Rolls-Royce shares outstanding

Created in TradingView

All things being equal, this reduces earnings per share. There's a big difference between having to divide profits between 5.33 billion shares and 8.35 billion.

However, if the company can use its excess cash to reduce its share count, earnings per share could get a boost. In my view, this is clearly an area where things can improve for shareholders.

A rising stock price could make this more challenging. But the thing is, the company has a clear path to further earnings per share growth.

Higher share price

Rolls-Royce shares currently trade at a price-to-earnings (P/E) ratio of around 15. In my opinion, that's particularly high, given the clear headroom for earnings growth I think the company has.

As the company reduces its debt, you would expect interest payments to decrease, causing profits to increase. From there, share buybacks could reduce the number of shares outstanding.

The Rolls-Royce share price has seen a big rally over the last year. But a look back at the company's history tells me it has a long way to go.

NEWSLETTER

NEWSLETTER