Mireya Aceso/Getty Images Entertainment

The Industrial Select Sector (XLI) was once again in the green (+2.60%) for the week ending March 22, while the SPDR S&P 500 Trust ETF (SPY) also posted gains (+2.23%) amidst Federal Reserve maintenance Interest rates stable for the fifth consecutive match.

XLI was among 10 of the 11 S&P 500 sectors that ended the week in green. So far this year, XLI has skyrocketed +9.84%while SPY has risen +9.66%.

The top five gainers in the industrials sector (stocks with a market capitalization of more than $2 billion) gained more than +11% each this week. To date, 4 of these 5 stocks are in the green.

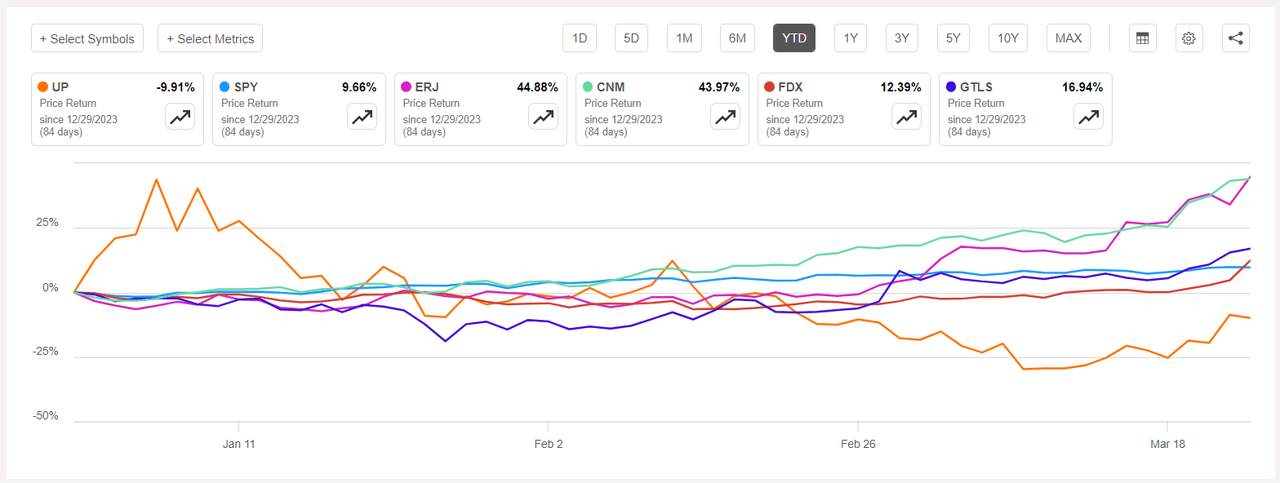

Wheels Up Experience (New York Stock Exchange: UP) +16.17%. The New York-based private aviation services provider saw its shares soar throughout the week, with the highest on Thursday. +13.41%. However, to date the stock has fallen. -9.91%the only one among this week's winners to be in the red during this period.

Embraer (ERJ) +14.57%. Shares of the Brazilian aircraft manufacturer rose the most on Friday +8.09%. Earlier this week, the company reported fourth-quarter results, noting that this year's aircraft deliveries and revenue would grow despite current impediments in its supply chain. THE LAST YEAR, +44.88%.

ERJ has an SA Quant rating, which takes into account factors such as momentum, profitability, and Strong Buy valuation, among others. The stock has a factor rating of C- for Profitability and B for Growth. The average rating by Wall Street analysts is Buy, with 5 out of 12 analysts labeling the stock a Strong Buy.

The chart below shows the year-to-date price-performance performance of the top five gainers and SPY:

Core and Main (CNM) +14.26%. Shares of the Saint Louis, Missouri-based company, which supplies water, sewer and fire protection products, rose. +7.50% on Tuesday after forecasting sales and profit growth for fiscal 2024. To date, +43.97%.

The SA Quant rating on CNM is Strong Buy with a score of A+ for Momentum and C- for Valuation. The average rating from Wall Street analysts is also positive, with a Buy rating, where 5 out of 11 analysts view the stock as a Strong Buy.

FedEx (FDX) +12.25%. The stock rose +7.35% on Friday following better-than-expected (Thursday post-market) results from the company's Express segment along with upbeat comments from leaders during the earnings conference call. THE LAST YEAR, +12.39%. FDX's SA Quant rating is Hold, which contrasts with the average Buy rating from Wall Street analysts.

Graphic Industries (GTLS) +11.66%. stocks rose further on Thursday +4.20%. Earlier in the week, UBS upgraded the stock to Buy from Neutral and, separately, the company received an order from Element Resources for a green hydrogen production facility in Lancaster, California.

The SA Quant rating and the average rating of Wall Street analysts, both on GTLS, are Buy. THE LAST YEAR, +16.94%.

This week's top five decliners among industrial stocks ($2 billion-plus market cap) lost more than -2% each. To date, 4 of these 5 stocks are in the red.

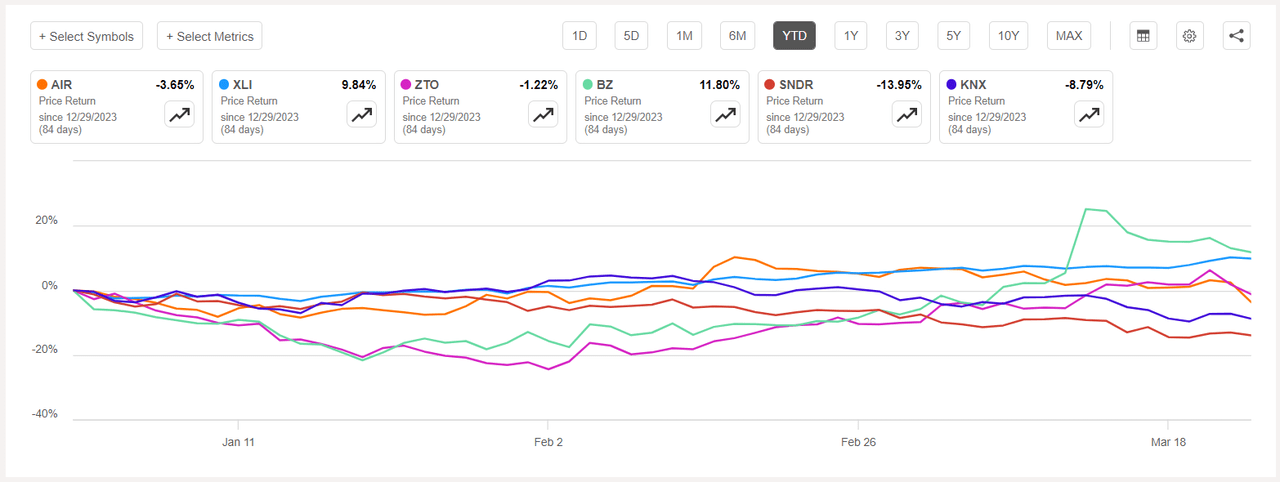

AA (New York Stock Exchange: AIR) -4.34%. The company, which provides products and services to the aviation markets, saw its shares fall -5.94% on Friday after its third quarter results were released on Thursday. THE LAST YEAR, -3.65%.

AIR's SA Quant Rating is Hold with a factor grade of C- for Profitability and C for Momentum. The average rating by Wall Street analysts differs and has a Strong Buy rating, with 4 out of 5 analysts viewing the stock as such.

ZTO Express (ZTO) -3.62%. Shares of Chinese logistics services provider rose +4.39% on Wednesday after fourth-quarter results beat estimates, however, it gave up earnings the next day as it fell -4.16%. THE LAST YEAR, -1.22%.

ZTO's SA Quant Rating is Hold with a score of B- for Growth and D+ for Momentum. The average Wall Street analyst rating disagrees and has a Strong Buy rating, with 15 out of 20 analysts labeling the stock as such.

The chart below shows the year-to-date price-performance performance of the top five decliners and XLI:

Kanzhun (BZ) -3.33%. Shares of the Chinese online recruiting platform pared gains made last week, when it was the biggest gainer, to be among the list of decliners this week. However, to date, the stock has gained +11.80% and it is the only one among the five that fell the most this week that is in the green for this period.

The SA Quant rating at BZ is Hold, with a factor rating of B+ for Profitability and A- for Growth. The average rating by Wall Street analysts differs and has a Strong Buy rating, with 13 out of 20 analysts labeling the stock as such.

National Schneider (SNDR) -2.88%. The transportation and logistics services provider recorded the biggest drop in its shares on Monday (-3.50%). THE LAST YEAR, -13.95%. SNDR's SA Quant rating is a Sell, which contrasts with the average Buy rating from Wall Street analysts.

Knight-Swift Transport (KNX) -2.88%. Shares of the Phoenix, Arizona-based company have fallen -8.79%, THE LAST YEAR. KNX's SA Quant rating is Hold, while the average rating by Wall Street analysts is Buy.

NEWSLETTER

NEWSLETTER