Mireya Aceso/Getty Images Entertainment

The Industrial Select Sector (XLI) and the SPDR S&P 500 Trust ETF (SPY) continued their winning streaks seen in recent weeks and closed the week ending December 22 higher. +0.10% and +0.92%respectively.

So far this year, XLI has won +15.19%while SPY has it shot itself +23.85%.

The top five gainers in the industrials sector (stocks with a market capitalization of more than $2 billion) gained more than +11% each this week. To date, 3 of these 5 stocks are in the green.

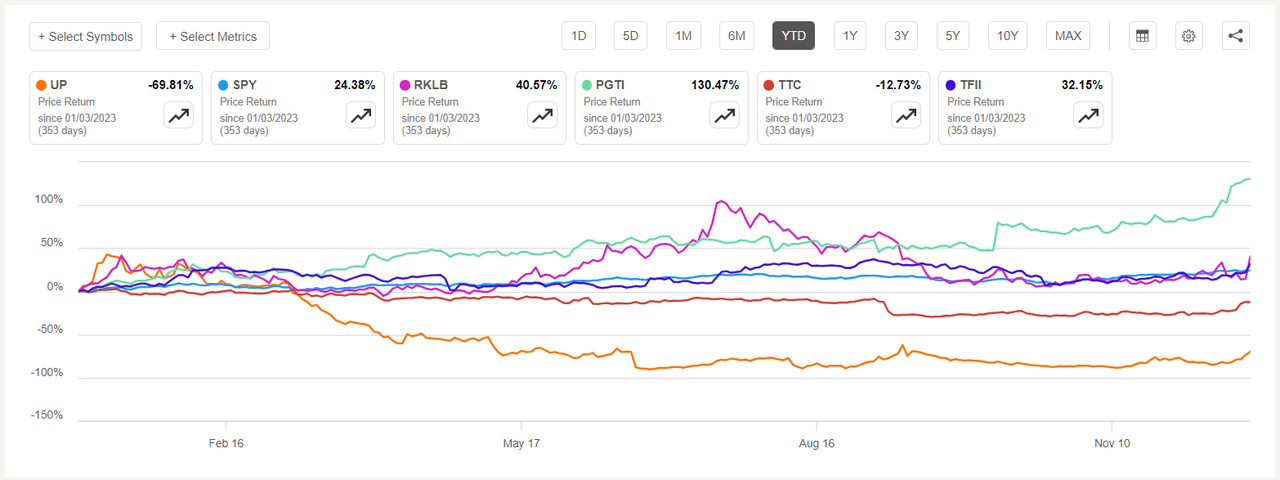

Wheels Up Experience (New York Stock Exchange: UP) +80.11%. The New York-based private aviation services provider saw its shares soar throughout the week, with the highest on Thursday. +22.77%. To date, however, the stock has plummeted. -69.22%, the most among this week's top five gainers for this period. Read – Warning: UP has a high risk of malfunctioning.

Wheels Up has an SA Quant Rating, which takes into account factors such as momentum, profitability, and strong-sell valuation, among others. The stock has a factor rating of F for Profitability and D+ for Growth. The average Wall Street analyst rating (1 analyst rating in this case) disagrees and has a Strong Buy rating.

US Rocket Laboratory (RKLB) +18%. stocks rose +22.80% Friday after the space company announced it had secured a $515 million contract with a U.S. government customer to manufacture and operate 18 space vehicles.

SA's Quantitative Rating on RKLB is Hold with a score of C for Momentum and C- for Valuation. The average rating of Wall Street analysts has a more positive view with a Buy rating, where 5 out of 9 analysts view the stock as a Strong Buy. THE LAST YEAR, +44.30%.

The chart below shows the year-to-date price-performance performance of the top five gainers and SPY:

PGT Innovations (PGTI) +13.60%. Shares of window and door maker rose +9.39% on Monday after Masonite (DOOR) said it will acquire PGT in a cash and stock deal worth $3 billion. Year to date, PGT stock is up +128.29%the most among this week's top five gainers for this period.

PGTI's SA Quant Rating is Strong Buy with a score of B+ for Growth and A+ for Momentum. The average rating of Wall Street analysts is also Positive and has a Buy rating, with 2 out of 3 analysts viewing the stock as a Strong Buy.

The Toro Company (TTC) +13.02%. Shares of lawn and landscaping equipment maker rose +8.94% on Wednesday after fourth-quarter results beat estimates. However, to date, the stock is in the red, -12.74%. SA's quantitative rating on TTC is Hold, as is the average rating of Wall Street analysts, Hold.

TFI International (TFII) +11.43%. Shares of the Canadian transportation company rose +8.08% on Friday after announcing it was acquiring transportation and logistics services provider Daseke (DSKE) in a deal that has an enterprise value of around $1.1 billion. TFII's SA Quant rating is Hold, which contrasts with the average Buy rating from Wall Street analysts. THE LAST YEAR, +32%.

This week's top five decliners among industrial stocks ($2 billion-plus market cap) lost more than -6% each. To date, only 1 of these 5 stocks is in the red.

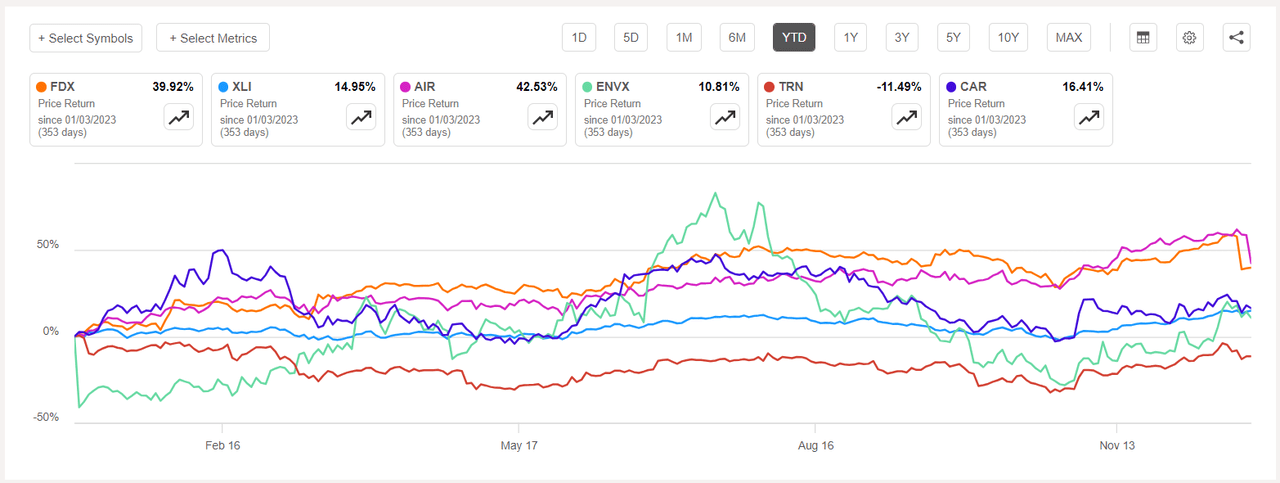

FedEx (New York Stock Exchange:FDX) -11.82%. the stock fell -12.05% Wednesday after second-quarter results (after market Tuesday) missed estimates and the company warned that revenue will continue to be pressured by volatile macroeconomic conditions. To date, however, shares have soared. +43.20%the most among this week's top five decliners for this period.

SA's Quantitative Rating on FDX is Hold with a Factor Grade of A+ for Profitability and B for Valuation. The rating differs from the average Buy rating by Wall Street analysts, where 17 out of 32 analysts view the stock as a Strong Buy.

AAR Corp. (AIR) -10.41%. stocks fell -10.20% Friday after the Wood Dale, Ill.-based company's second-quarter revenue fell short of estimates and the aircraft parts maker and service provider said it was acquiring Triumph's product support business. Group for 725 million dollars. THE LAST YEAR, +41.58%.

The SA Quant rating on AIR is Buy with a score of B+ for Growth and A- for Momentum. The average rating of Wall Street analysts is in line and has a Strong Buy rating, with 4 out of 5 analysts labeling the stock as such.

The chart below shows the year-to-date price-performance performance of the top five decliners and XLI:

Enovix (ENVX) -7.76%. Shares of the lithium-ion battery maker moved places from the list of winners it was on last week to be among the losers this week, and the stock fell further on Wednesday. -5.73%.

The SA Quant Rating on ENVX is Hold with a factor rating of D for Profitability and C for Growth. The rating is in stark contrast to the average Strong Buy rating from Wall Street analysts, where 10 out of 13 analysts view the stock as such. THE LAST YEAR, +7.96%.

Trinidad Industries (TRN) -6.99%. Shares of rail transportation product and service providers also fell the most on Wednesday -5.52%, just like the market in general. To date, shares have fallen -10.89%, the only one among the five that fell the most this week that is in the red during this period. TRN's SA Quant rating is Hold, while the average rating by Wall Street analysts is Buy.

Avis Quote (CAR) -6.26%. Shares of the car rental company plummeted on Wednesday (-5.42%). The company said in a regulatory filing that Chairman and CEO Joseph Ferraro sold 18,460 shares on Dec. 15, at a price ranging from $193.73 to $196.57, worth $3.6 million. . To date, the stock has gained +17.03%. Both SA's Quantitative Rating and the average rating from Wall Street analysts are Hold for CAR.

NEWSLETTER

NEWSLETTER